Oil Companies Post Record Profits in 2022 Amid Global Energy Crisis

22 November 2022 – by Eric Koons Comments (0)

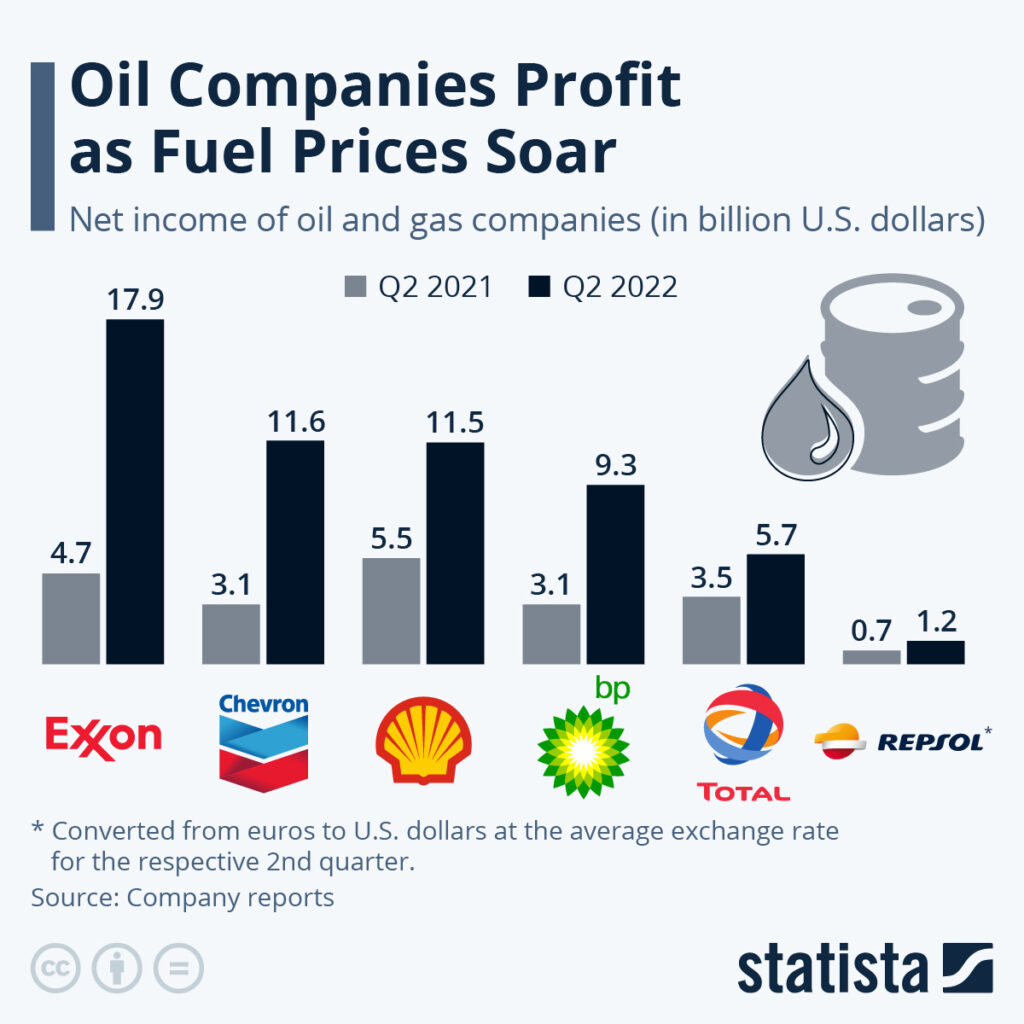

Major oil companies posting record profits in 2022 seemed an unlikely scenario just months ago. However, recent geopolitical developments combined with ongoing fossil fuel investments have made it a reality at a time when many economies are already struggling.

These concerns are highlighted by the ongoing war between Russia and Ukraine, OPEC 2022 decisions and global greenwashing practices. The massive profits are due to high oil prices, costing nations billions of dollars and forcing inflation rates to skyrocket.

How Did Oil Companies Make Record Profits?

The beginning of the pandemic in 2020 saw a significant decline in energy consumption. As vehicles, factories and economies halted, the price of oil dropped to negative values, and the world seemed to come to a standstill. Because of this, many big oil companies had to reduce oil and gas production.

Once governments lifted lockdown measures, people were mobile again and demand soared. During this period, fossil fuel use (and prices) skyrocketed. However, oil production capacity did not follow, and demand began to outpace supply.

The Russia-Ukraine War and Its Impact on Oil and Natural Gas Prices

Energy insecurity has fuelled oil demand in Europe, as Putin appeared to weaponise his natural gas supply lines. After several alleged breakdowns, the Russian president announced that the Nord Stream 1 would not continue to deliver natural gas to parts of Europe.

The European Union immediately imposed gas and energy-saving models, decreasing gas consumption to save fuel for the upcoming winter. For example, France restarted 27 nuclear reactors, and it is getting ready to supply energy both to its industry and the country of Germany.

As a result, the increased pressure on other OPEC countries to deliver more gas to Europe and the US further pushed demand and profit. That’s just one reason for high gas prices.

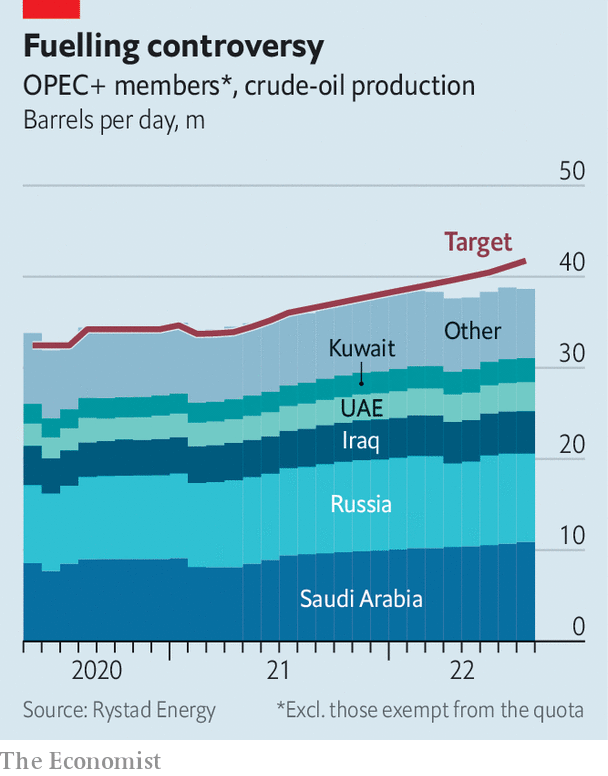

OPEC 2022 Oil Production Cuts

In response to these developments, the Organization of the Petroleum Exporting Countries (OPEC) held a meeting on October 5th. Despite global energy instability and rising oil prices, the 13 countries voted to further reduce oil extraction by 2 million barrels per day. This reduction will continue to reduce the already lacking supply and keep pushing up oil prices. The subsequent price increase would most likely impact the poorest nations first, as developed countries can rely on their existing reserves.

Continuing Investments in Fossil Fuels

In the meantime, the same oil companies, such as Exxon Mobil Corp., reporting huge profits continue to invest in oil exploration and infrastructure, despite claims that they are growing their low-carbon energy capabilities. Research has found that four of Europe’s largest oil companies only invested 5% of their profits in low-carbon alternatives and renewables. This is 10 times less than what these energy companies invested in fossil fuel development during the same period.

This continual investment in fossil fuels exacerbates the current crude oil price issues and creates long-term concerns. New investments in oil and gas have the potential of becoming stranded assets, which will weigh down these energy giants, potentially driving up energy costs further.

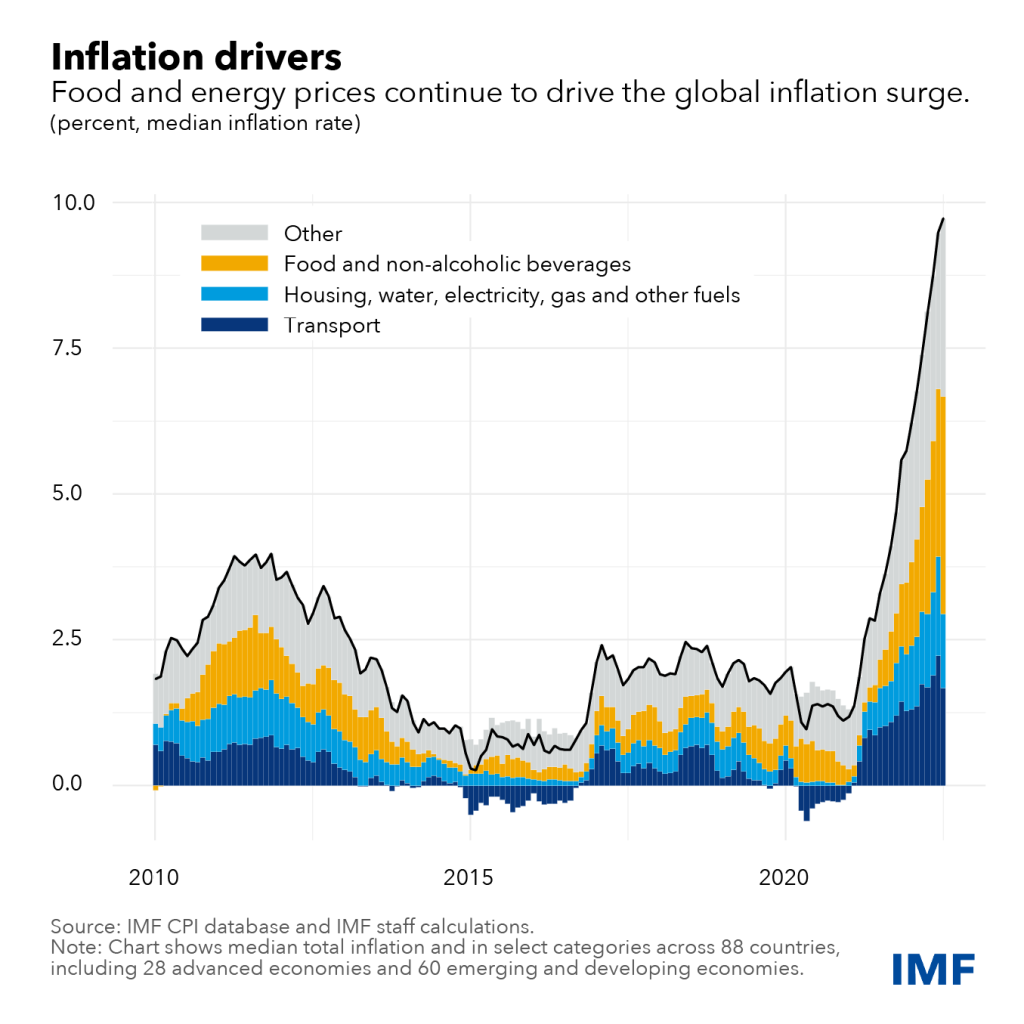

The Gas and Oil Industry Is Driving Inflation

In addition to recording record breaking profits in 2022, oil companies and their actions are fuelling the current spike in global inflation. It has long been established that oil prices directly correlate to inflation rates because gas and fuel are necessary to transport goods in our globalised world. Increased gasoline prices and transportation costs are typically passed onto the consumer, which, therefore, raises prices.

Currently, the average global inflation rate is 8.6%, which is the highest level since 1981. High inflation is historically associated with an impending recession, which can impact health, the environment and well-being worldwide. For example, recessions typically cause a rise in death rates, which can disproportionately impact developing countries.

There is an argument that the actions of oil giants, in fuelling their record profits, are increasing inflation. These actions have the potential to lead to a recession, which directly affects millions of people’s well-being.

For the good of everyone, it is clear that this trend can’t continue, and oil companies can’t continue to have record profits like in 2022.

Solutions to Reduce Oil Prices

There are multiple solutions to help solve the energy crisis. A simple parting with fossil fuels is an unlikely scenario in the immediate term, despite alternative technologies being available. However, a gradual long-term shift from fossil fuels to renewables is almost inevitable. Currently, there are several options.

Oil Profits Windfall Tax

With oil giants breaking the 11-figure roof in relation to their quarterly dividend, something had to be done. In response, Antonio Guterres, the UN Secretary-General, has proposed introducing a windfall tax on these profits. In his proposal, companies that increase their historic windfall profits thanks to the energy crisis will share their profits to help reduce climate change impacts in the poorest nations.

Decreasing Fossil Fuel Subsidies

At the same time, decreasing fossil fuel subsidies will reduce profitability for gas and oil companies while driving up prices. The immediate shock of higher oil prices is tough to accept, especially for consumers. However, it will provide the long-term benefit of cheaper and more reliable renewable energy, with a more resilient energy grid.

Increasing Renewable Energy Subsidies

Increasing renewable subsidies, or extending the deadlines for existing ones, will further advance the energy transition. The US’ Solar Investment Tax Credit is an excellent example of how to stimulate both residential and commercial renewable investment. Similar programs worldwide will lead to the further decentralisation of energy production while increasing green technology adoption and energy independence.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more