Banking Indonesia Away From Coal [Op-Ed]

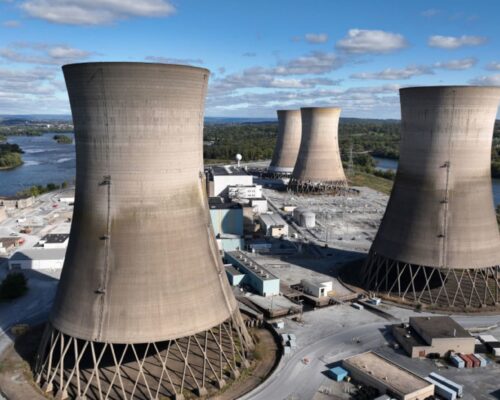

Photo: Shutterstock / Bramanyuro

06 October 2025 – by Anastasia Kriestella and Nabilla Gunawan

Over the last two decades, Indonesia has consistently demonstrated its commitment to playing a meaningful role in the fight against climate change. Indonesia once hosted a COP in Bali and has always been present in various UNFCCC processes. Indonesia has also indicated various plans to achieve Net Zero by 2060 or earlier, and, through its Enhanced Nationally Determined Contribution (ENDC), the country has pledged to cut its greenhouse gas emissions in line with the Paris Agreement.

However, translating commitments into concrete progress hinges on more than preparing policy documents. The financial sector, from commercial banks to institutional investors, also shapes how quickly and how just Indonesia’s energy transition will be. Subsequently, falling coal demands from China and India should be heeded as a wake-up call for Indonesia’s financiers. Clinging to fossil-heavy portfolios is no longer just environmentally risky – it threatens their balance sheets and Indonesia’s growth.

Declining Coal

Long regarded as dependable buyers of Indonesian coal, India and China have scaled back their purchases over the last few years as they diversify their energy mixes and ramp up domestic production. This shift should serve as a clear warning for Indonesia’s banking industry, as it has shaken the foundations of an industry that has bankrolled regional economies and delivered steady returns to lenders for decades.

The financial fallout can already be seen – major players such as Bumi Resources (BUMI), Golden Energy Mines (GEMS), and Indo Tambangraya Megah (ITMG) have all reported steep revenue drops tied to weaker coal prices and shrinking demand. For banks with significant exposure to these companies, the message is unavoidable: relying on coal as a cornerstone of profitability is becoming increasingly precarious.

This moment presents an opportunity and a test for the financial sector. By tightening environmental, social, and governance (ESG) standards, banks can manage risks from stranded assets and steer capital toward cleaner, more future-proof investments. On the other hand, failing to act could leave Indonesia’s financiers dangerously tethered to an industry whose long-term prospects are dimming fast.

Breaking the Cycle of Addiction

While several regional players like CIMB and Singapore’s DBS have begun cutting their exposure to coal, Indonesia’s largest banks are moving in the opposite direction. Mandiri, BNI, BRI, BCA, and Permata all increased lending to coal companies over the past two years, channelling roughly USD 2.7 billion in 2023 and a further USD 3.3 billion in 2024. This is a dramatic leap from about USD 560 million in 2021–2022, signalling a clear reluctance to pivot away from fossil-fuel financing.

This surge in lending raises uncomfortable questions about the credibility of domestic banks’ ESG pledges. At a time when their global peers are tightening coal policies, Indonesia’s financial heavyweights appear to double down on an industry facing mounting market, regulatory, and reputational risks.

Subsequently, the fact that Indonesia’s five biggest banks dominated new coal loans between 2023 and 2024 – as global lenders pulled back – should ring the alarm bells of regulators and bank boards alike. By refusing to align their portfolios with the country’s net-zero ambitions, these institutions risk undermining national climate goals and exposing themselves to stranded assets as the world’s energy mix shifts. Climate risk is already reshaping capital markets; without strict safeguards, these institutions face stranded assets, investor backlash, and mounting regulatory pressure.

Therefore, Indonesia’s banks need to scrutinise their own transition promises. Current ESG frameworks leave too much room for financing coal mines and power plants, undermining the credibility of their climate pledges.

Building Credible Transition Plans

A credible transition plan for financial institutions begins with clear, measurable targets and strict governance over coal exposure. The Network for Greening the Financial System’s technical principles guideline charts a pathway for phasing out financing of carbon-intensive assets backed by timelines, accountability mechanisms, and incentives to steer capital toward low-carbon growth.

China and India cutting their imports of Indonesian coal is a vivid reminder of how transition risks can erode fossil asset values almost overnight. Research by MSCI warns that default risks for Asia-Pacific banks could double within the next decade if they remain heavily tied to high-emitting industries. For Indonesian lenders, embedding rigorous climate safeguards into their lending strategies is no longer optional; it is a prerequisite for resilience in a decarbonising global economy.

However, it is important to internalise how public pledges mean little without binding rules. Take BRI, for example, despite announcing it would cap coal financing, the bank signed new coal loans in 2023 and 2024. Such contradictions show how voluntary statements without strict governance fail to curb exposure to high-carbon assets. Without enforceable lending standards, banks can and often continue funding projects that undermine their credibility and the country’s climate goals.

Domestic lenders still channel far more money into coal than renewables. Bank Mandiri alone has extended roughly USD 3.2 billion in coal credit since 2021, compared with only about USD 724 million for renewable energy. Where capital flows, priorities become clear. At the same time, Indonesia’s largest banks are betting on a future that is counter to the global transition, which is already reshaping markets.

More recently, the new minister of finance, Purbaya Yudhi Sadewa, announced a new policy to disburse Rp200 trillion (approximately USD 12,9 billion) for Indonesian state-owned banks. Mandiri, BRI, and BNI each received Rp55 trillion, BTN received Rp25 trillion, and BSI received Rp10 trillion. This fiscal policy was aimed at stimulating economic activities and boosting credit liquidity. Still, this push may further jeopardise Indonesia’s financial stability if the safeguards do not preclude fossil fuel funding.

Indonesia’s banks are running out of time. Every dollar that still flows to coal locks in higher financial risks and undermines the country’s climate goals. To stay competitive and safeguard their financial stability, lenders must send an unmistakable signal to their investors: financing the renewable future takes priority over propping up yesterday’s dirty energy.

Subsequently, the Indonesian government can also push for these reforms to increase investor interest in their sovereign wealth fund, Danantara. The OJK (Financial Services Authority) has included Indonesian state-owned banks in Danantara since the fund’s inception. Therefore, the OJK has a golden opportunity to modernise Indonesia’s banking safeguards regarding fossil fuel funding. Providing a clear signal to international investors that Indonesia’s financial sector is now up to date with global green investing trends will undoubtedly increase global investments in Danantara and Indonesian banks.

Anastasia Kriestella is the Outreach and Advocacy Associate of CERAH, and Nabilla Gunawan is a Researcher at Bersihkan Bankmu Coalition.

CERAH also known as Yayasan Indonesia Cerah, is an Indonesian non-profit organisation working to advance Indonesia’s energy transition policy agenda. CERAH combines deep energy sector knowledge, cutting-edge communications capacity, and a campaigner’s desire for change.

Bersihkan Bankmu (Clean Up Your Bank) Coalition is a coalition of civil society organisations (CSOs) that aims to accelerate the energy transition agenda in Indonesia through the sustainable finance sector.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.