China’s Coal Imports Drop and the Imminent Effect on Coal Exporters

Photo by Tjunction Media

04 May 2022 – by Viktor Tachev

Major decarbonisation efforts will see China’s coal imports drop significantly. This will affect the economies of many coal-exporting countries that have, for years, relied on China to buy their coal. However, with rapid decarbonisation, the biggest energy consumer globally is now looking towards an independent and more resilient power system.

China and Its Critical Importance for the Global Coal Market

China is the world’s largest coal producer and consumer. Furthermore, the country is also the world’s leading coal importer.

In 2020 and 2021, China imported over 335 and 324 million metric tonnes of thermal coal, respectively. The amount imported in 2021 made up half of the total global coal imports.

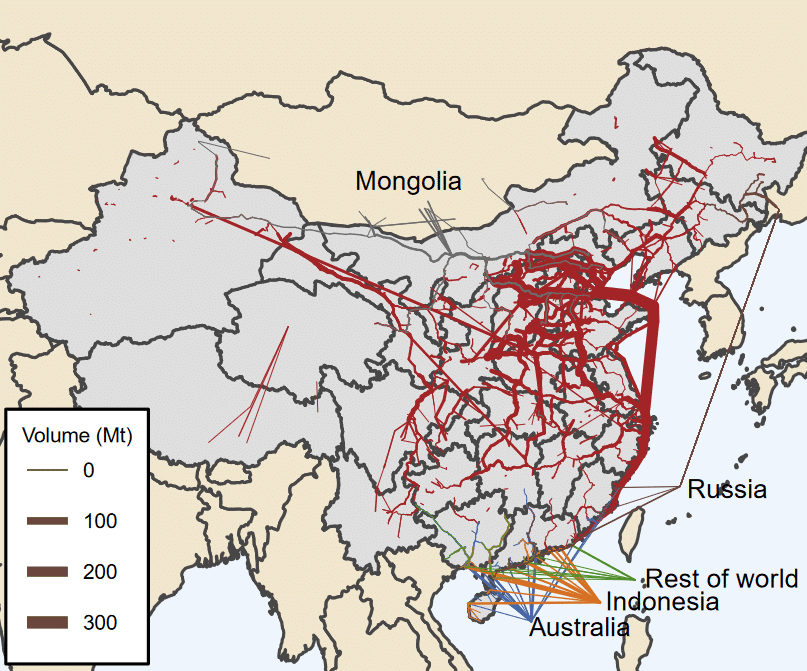

Where Does China Import Coal From?

Over 62% of coal imports of China come from Indonesia, with another 17% coming from Russia. Together, both countries account for close to 80% of coal China imports.

The rest comes from various countries, including Australia and the US. In 2021, the US had 15% of its coal exports shipped to China.

Coal No Longer the Focus: China’s Decarbonisation Strategy and the Effect on Coal-Exporting Countries

China aims to become net-zero by 2060 and is expected to reach the peak of its emissions by 2030. Meanwhile, the country is working on building a more independent and self-sufficient energy system. The combination of its decarbonisation commitments and its efforts towards boosting domestic energy security will inevitably lower the country’s coal consumption and imports.

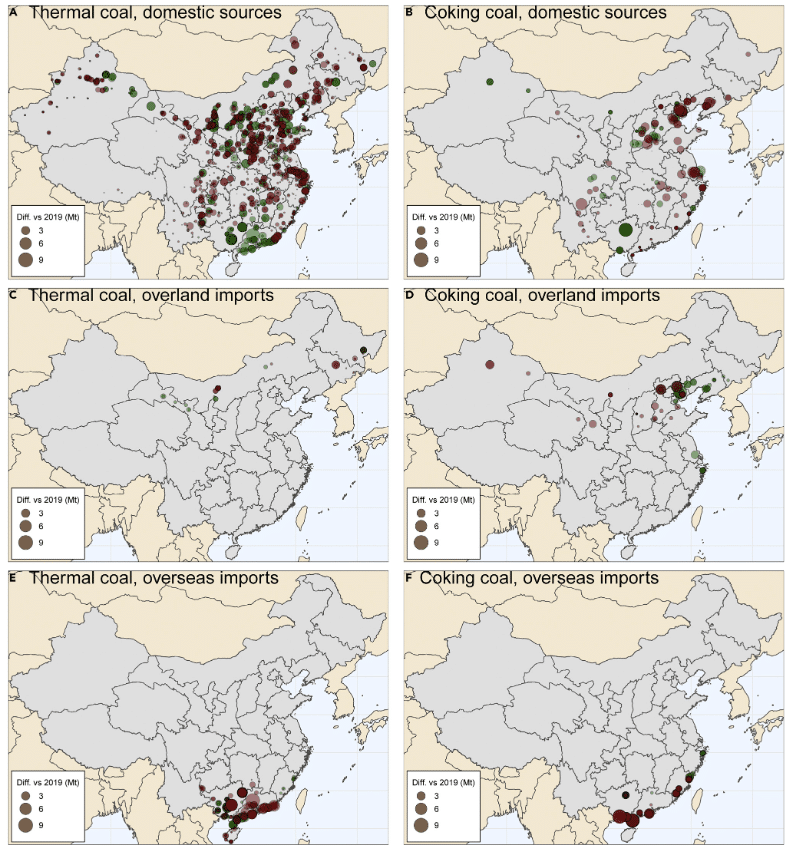

According to estimates from Australian National University (ANU), China’s coal imports will shrink by 49% by 2025. The fossil fuel exporting countries that will be most affected are Indonesia and Australia. China’s overseas thermal coal imports from both countries will drop to 130 Mt by 2025 from 185 Mt in 2019. Overseas coking coal imports, mainly from Australia, will fall from 34 Mt in 2019 to between 23 and 25 Mt by 2025.

China Coal Imports and Boosting Domestic Coal Production

To compensate, China is looking at overland coal imports from Mongolia. China’s government also plans to increase domestic coal output by 12 million tonnes per day. Furthermore, the 14th Five-Year Plan on Energy also aims to improve coal-related transport infrastructure.

Coking Coal Imports from Mongolia

Coking coal imports from Mongolia are projected to surge by 20 Mt by 2025. This shift has been in the works for a long time. In recent years, there has been an increase in investments in coal rail links between both countries and a notable expansion of the Mongolian coal mines.

The Economic Effect on Coal-exporting Countries

China’s coal imports have been a significant source of revenue for exporting countries in the Asia-Pacific region. The toll on some economies like Indonesia, China’s leading coal supplier, is likely to be excessive.

“As the world’s largest coal importer, any significant reduction in coal imports by China will have major ramifications across the global seaborne coal trade. China is the biggest export market for Indonesia – the world’s largest thermal coal exporter. Reduced coal imports by China will leave Indonesia seeking to compete even more strongly with exporters like Australia and South Africa in other markets,” says Simon Nicholas, Energy Finance Analyst, Institute for Energy Economics and Financial Analysis (IEEFA).

According to a technical paper by Boston University’s Global Development Policy Center, China’s coal phase-out policy might cause a 6% drop in Indonesia’s GDP by 2050.

However, loss of revenue is not the only looming risk over many coal-exporting countries. Many of them have made sufficient efforts to develop and expand their coal mine fleets. According to data from Global Energy Monitor, Australia has proposed 53 coal mining projects for coal supply, while Indonesia has proposed 12. Both countries each have five projects currently under construction. As China is actively progressing towards its net-zero goal, this expansion will accumulate a massive stranded-asset risk.

The Lessons to Learn

China’s pivot from coal has left exporters in limbo, and it exposes the risks of relying on a single major market. According to industry experts, coal-exporting countries will not be able to compensate for China’s absence by focusing on other markets.

“The long-term outlook for seaborne coal is one of inevitable decline. Potential growth markets for seaborne coal like Bangladesh, Pakistan and Vietnam look likely to be much smaller than coal exporters had hoped. When established coal importers like Japan, South Korea and especially China inevitably begin reducing imports, the seaborne coal trade will fall faster than overall global coal consumption,” explains Simon Nicholas.

However, coal-producing countries have a way out. But, it requires following China’s example and abandoning coal. China has established itself as a global renewable-energy powerhouse. The country accounts for about 40% of the global clean energy capacity growth between 2015 and 2020. Furthermore, it champions green technologies, including electric vehicles (EVs), batteries, wind turbines and solar power.

What’s more, the country is open to helping other Asian nations in their decarbonisation efforts. In September 2021, President Xi Jinping announced that China would step up its support for other developing countries in the development of green energy.

Major coal-producing countries have the time and the unique opportunity to repurpose their coal plants and coal-fired power plants into renewable ones. Companies have long been doing this, with great results. According to the World Economic Forum, alongside the social benefits, such a move also presents other advantages, including land space, interconnection lines, generators, synchronous condensers and substations. Finally, it will also result in massive economic benefits in the form of direct GDP gains.

The Drop in China’s Coal Imports Is an Opportunity

China’s decision to reduce its coal imports is a step in the right direction. It may just be the much-needed push that makes coal-producing and exporting countries reconsider their strategies. Moving towards renewable energy-dominated power systems is inevitable. The sooner coal exporters start moving towards their use, the better, especially for their economic prosperity, energy independence and long-term decarbonisation goals.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more