Coal Power Drops in China and India for First Time in 52 Years After Clean-energy Records [Op-Ed]

Photo: Shutterstock / dongfang

13 January 2026 – by Lauri Myllyvirta

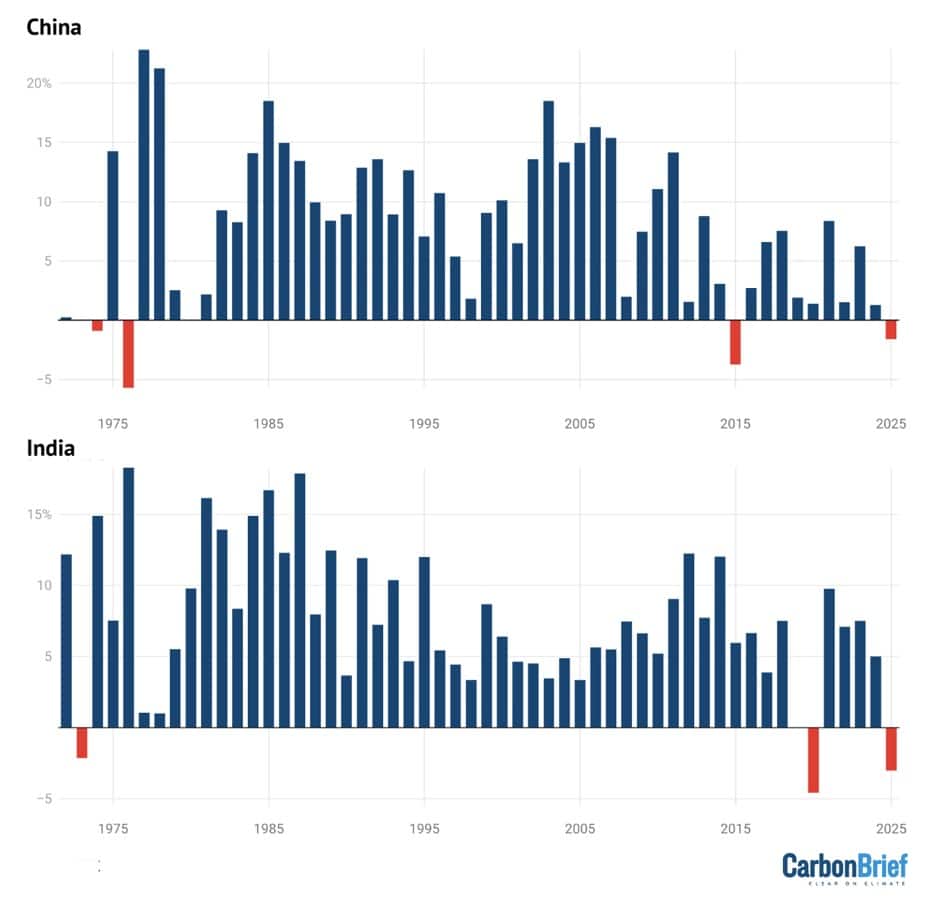

Coal power generation declined in both China and India in 2025, marking the first simultaneous drop in half a century, following each nation’s addition of record amounts of clean energy. The new analysis for Carbon Brief shows that electricity generation from coal in India fell by 3.0% year-on-year (57 terawatt-hours, TWh) and in China by 1.6% (58 TWh). The last time both countries registered a drop in coal power output was in 1973.

The fall in 2025 is a sign of things to come, as both countries added a record amount of new clean-power generation last year, which was more than sufficient to meet rising demand. Both countries now have the preconditions in place for peaking coal-fired power, provided China can sustain clean-energy growth and India meets its renewable energy targets.

These shifts have international implications, as the power sectors of these two countries accounted for 93% of the rise in global carbon dioxide (CO2) emissions from 2015 to 2024. While many challenges remain, the decline in their coal-power output marks a historic moment, which could help lead to a peak in global emissions.

Double Drop

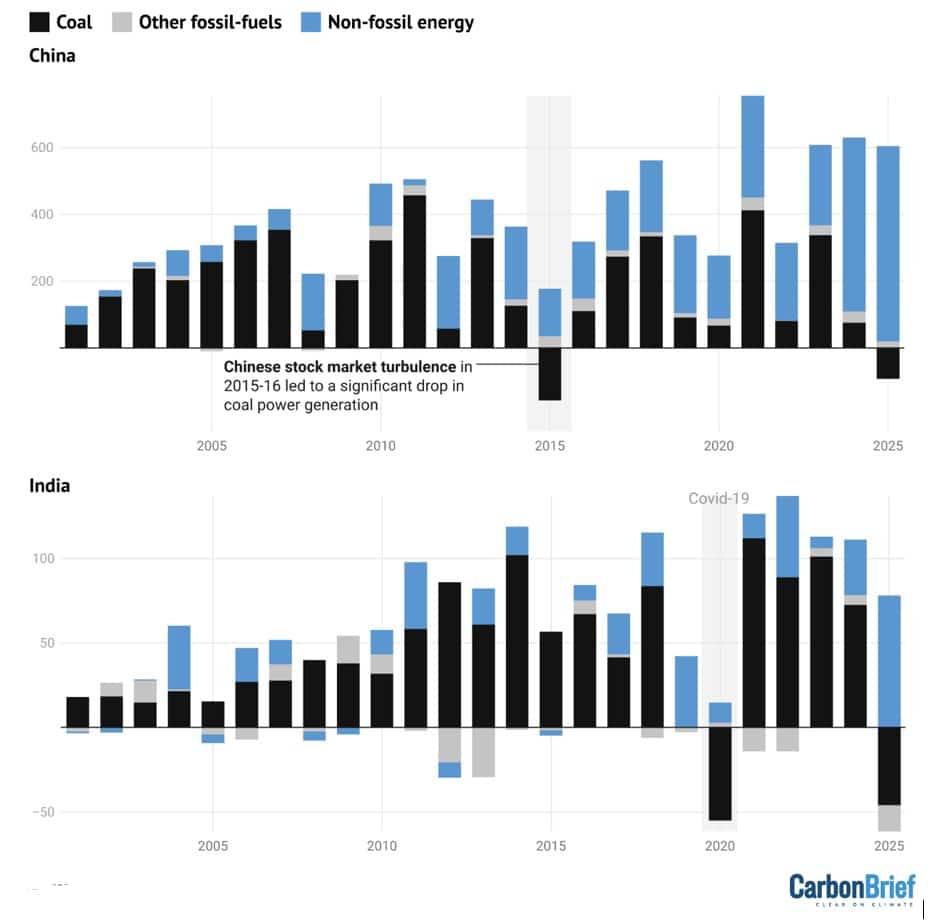

The new analysis shows that power generation from coal fell by 1.6% in China and by 3.0% in India in 2025, as non-fossil energy sources grew quickly enough in both countries to cover electricity consumption growth. This is illustrated in the figure below.

China achieved this feat even as electricity demand continued to grow at a rapid rate of 5% year-on-year. In India, the decline in coal production was due to record clean-energy growth, combined with slower demand growth resulting from mild weather and a longer-term slowdown.

The simultaneous decline in coal power in both countries in 2025 marks the first such decline since 1973, when the oil crisis rocked the world. Both China and India experienced weak power demand growth that year, accompanied by increases in power generation from alternative sources – hydro and nuclear in India’s case, and oil in China’s case.

China’s recent growth in clean-energy generation, if sustained, is already sufficient to peak coal power. Similarly, India’s clean-energy targets, if met, will enable a peak in coal use before 2030, even if electricity demand growth accelerates again. In 2025, China is expected to have added more than 300 gigawatts (GW) of solar power and 100 GW of wind power, both new records for China and, therefore, for any country.

Power generation from solar and wind increased by 450TWh in the first 11 months of the year, and nuclear power delivered another 35TWh. This put the growth of non-fossil power generation, excluding hydropower, squarely above the 460TWh increase in demand. Growth in clean-power generation has outpaced demand growth, and as a result, power-sector coal use and CO2 emissions have been declining since early 2024.

Coal use outside the power sector is also falling, primarily driven by a decline in the output of steel, cement, and other construction materials, the largest coal-consuming sectors after power. In India’s case, the decline in coal-fired power in 2025 was a result of accelerated clean-energy growth, a longer-term slowdown in power demand growth, and milder weather, which led to a reduction in power demand for air conditioning.

Faster clean-energy growth contributed 44% of the reduction in coal and gas use, compared to the trend in 2019-24, while milder weather contributed 36% and slower underlying demand growth contributed 20%. This is the first time that clean-energy growth has played a significant role in driving down India’s coal-fired power generation, as shown below.

India added 35 GW of solar, 6 GW of wind, and 3.5 GW of hydropower in the first 11 months of 2025, with renewable energy capacity additions increasing by 44% year-on-year. Power generation from non-fossil sources increased by 71 TWh, led by solar at 33 TWh, while total generation increased by 21 TWh, also contributing to a decline in power generation from coal and gas.

The increase in clean power, however, is below the average demand growth recorded from 2019 to 2024, at 85 TWh per year, as well as below the projection for 2026-2030. This means that clean-energy growth would need to accelerate for coal power to see a structural peak and decline in output, rather than a short-term blip.

Meeting the government’s target for 500GW of non-fossil power capacity by 2030, set by India’s prime minister Narendra Modi in 2021, requires just such an acceleration.

Historic Moment

While the accelerated growth of clean energy in China and India has upended the outlook for their coal use, locking in declines would depend on meeting a series of challenges.

First, the power grids would need to be operated more flexibly to accommodate the increasing share of renewable energy. This would mean updating outdated power market structures, which were built to serve coal-fired power plants, in both China and India. Second, both countries have continued to add new coal-fired power capacity. In the short term, this is leading to a decline in capacity utilisation – the number of hours each coal unit can operate – as power generation from coal decreases.

(Both China and India have been adding new coal-power capacity in response to increases in peak electricity demand. This includes rising demand for air conditioning, in part resulting from extreme heat driven by the historical emissions that have caused climate change.)

If under-construction and permitted coal-power projects are completed, they would increase coal-power capacity by 28% in China and 23% in India. Without marked growth in power generation from coal, the utilisation of this capacity would fall significantly, causing financial distress for generators and adding costs for power users.

In the longer term, new coal-power capacity additions would need to be substantially slowed down, and retirements accelerated to make space for further expansion of clean energy in the power system. Despite these challenges ahead, the decline in coal power and the record increase in clean energy in China and India mark a historic moment.

Power generation in these two countries accounted for more than 90% of the increase in global CO2 emissions from all sources between 2015 and 2024 – with 78% from China and 16% from India – making their power sectors key to peaking global emissions.

About the Data

- China’s coal-fired power generation until November 2025 is calculated from monthly data on the capacity and utilisation of coal-fired power plants from the China Electricity Council (CEC), accessed through Wind Financial Terminal.

- For December, year-on-year growth is based on a weekly survey of power generation at China’s coal plants by CEC, with data up to 25 December. This data closely predicts CEC numbers for the full month.

- Other power generation and capacity data are derived from CEC and National Bureau of Statistics data, following the methodology of CREA’s monthly snapshot of energy and emissions trends in China.

- For India, the analysis utilises daily power generation data and monthly capacity data from the Central Electricity Authority, which are accessed through a dashboard published by the government think tank NITI Aayog.

- The role of coal-fired power in China and India in driving global CO2 emissions is calculated using the International Energy Agency (IEA) World Energy Balances up to 2023, with default CO2 emission factors from the Intergovernmental Panel on Climate Change.

- To extend the calculation to 2024, the year-on-year growth of coal-fired power generation in China and India is sourced from the above, and the growth of global fossil-fuel CO2 emissions is taken from the Energy Institute’s Statistical Review of World Energy.

- The time series of coal-fired power generation since 1971, used to establish that the previous drop in both countries occurred in 1973, was obtained from the IEA World Energy Balances. This dataset uses fiscal years ending in March for India. Calendar-year data was available starting from 2000, based on Ember’s yearly electricity data.

Analysis for Carbon Brief by Lauri Myllyvira, reproduced with permission.

Lauri Myllyvirta is the co-founder and lead analyst of the Centre for Research on Energy and Clean Air, as well as a senior fellow at the Asia Society Policy Institute. He has more than a decade of experience as an energy analyst, tracking, advising, and producing research that influences and monitors energy, air quality, and emissions issues, and is one of the most widely cited commentators on China’s energy and CO2 trends.

CREA is an independent research organisation using scientific data, research and evidence to support the efforts of governments, companies and campaigning organisations worldwide in their efforts to move towards clean energy and clean air. CREA is headquartered in Finland, with 30 staff members across Asia, Europe, and North America.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.