Europe’s Energy Crisis 2022: Lessons for Asia

10 May 2022 – by Viktor Tachev

Europe’s energy crisis in 2022 should be a wake-up call for Asia. The East can use Europe’s situation as a blueprint on what not to do. The region must ensure its energy self-sufficiency, reasonable energy costs, and stable supply when it comes to energy. While Asia is in danger of repeating Europe’s mistakes, there is time to pivot and focus on building a cleaner and more resilient energy system in line with global decarbonisation and energy transition efforts.

The Prerequisites for Energy Crisis in Europe 2022

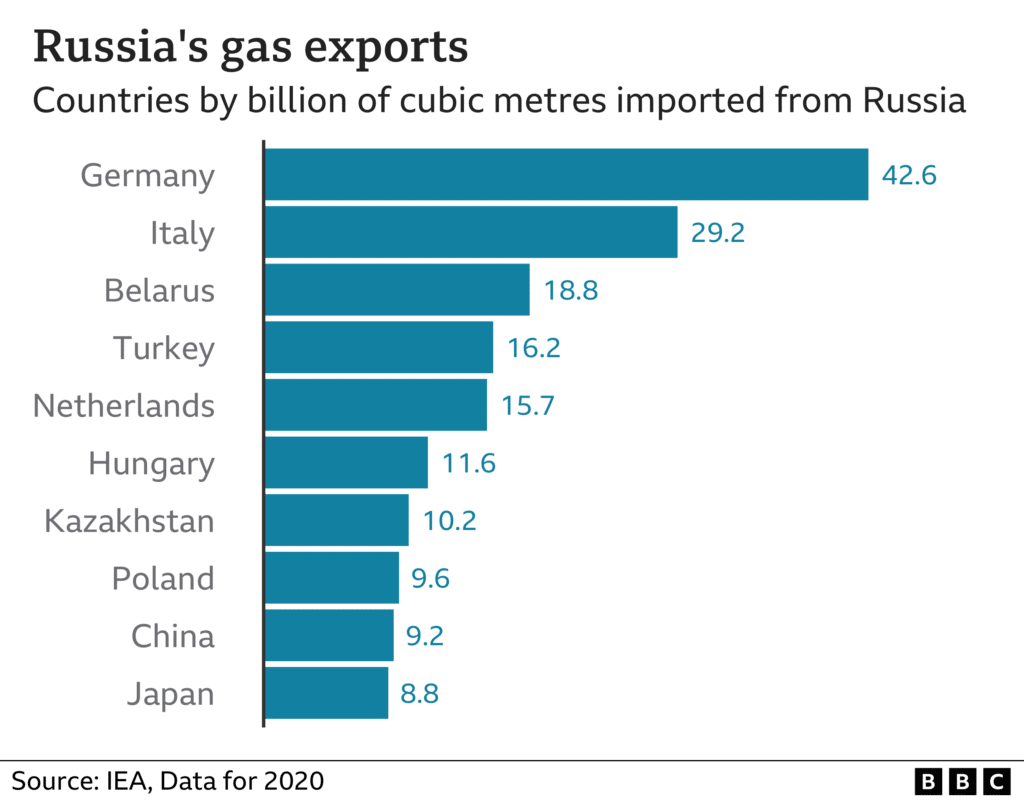

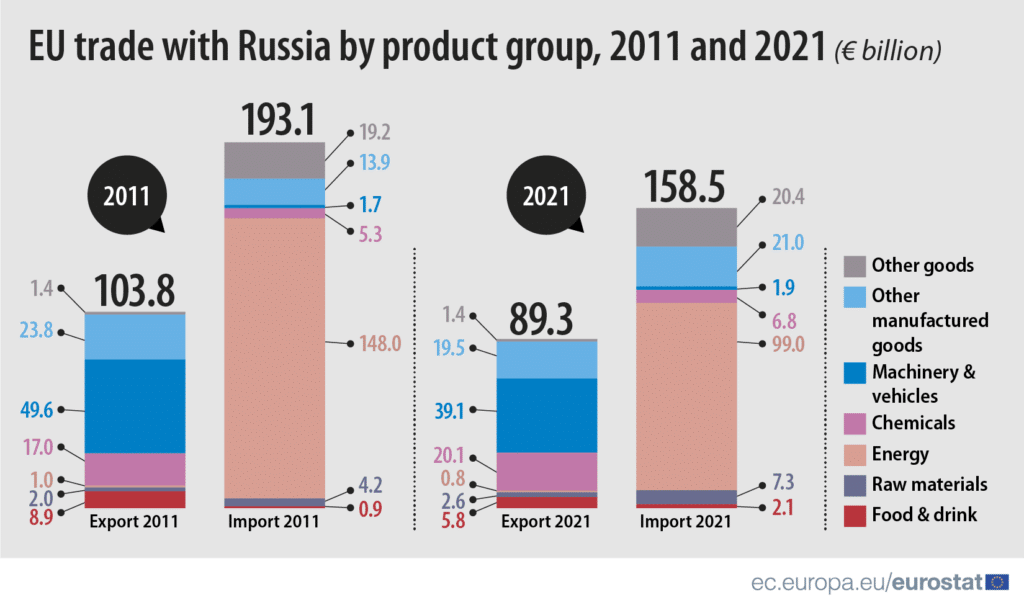

Russia has historically been and continues to be the largest natural gas supplier to the European Union. In 2020, Europe, including Turkey, imported 168 billion cubic meters (bcm) of pipeline gas and 17 bcm of liquefied natural gas (LNG) from Russia. In 2021, the European Union imported 142 bcm of pipeline natural gas and 14 bcm of LNG from Russia. Today, the EU depends on Russian gas for approximately 45% of its imports and around 40% of its gas consumption.

Russia also accounts for around 25% of the EU’s oil imports and 45% of the European Union’s coal imports.

Europe got itself into this trap over the years. This issue played a significant role during the gas disputes in 2006 and Russia’s 2014 invasion of Ukraine.

However, Europe is now exploring ways to reduce its energy dependence and cut its ties with Russia once and for all. This includes a plan to cut its reliance on Russian gas by two-thirds by the end of the year. Europe is also fast-forwarding plans to make itself independent of Russian fossil fuels by 2030.

What Asia Can Learn From European Energy Crisis in 2022

During the Russia-Ukraine war, many Asian leaders, including Japan and South Korea, heard the same request: to agree to divert LNG cargoes to Europe. This would help Europe to deal with the gas crunch.

Instead of repeating Europe’s mistakes, Asian leaders can use the painful experience of their Western counterparts to set the foundation for a cleaner, cheaper, more resilient and self-sufficient energy infrastructure and energy system.

Lesson #1: Avoid Liquefied Natural Gas Imports Dependency

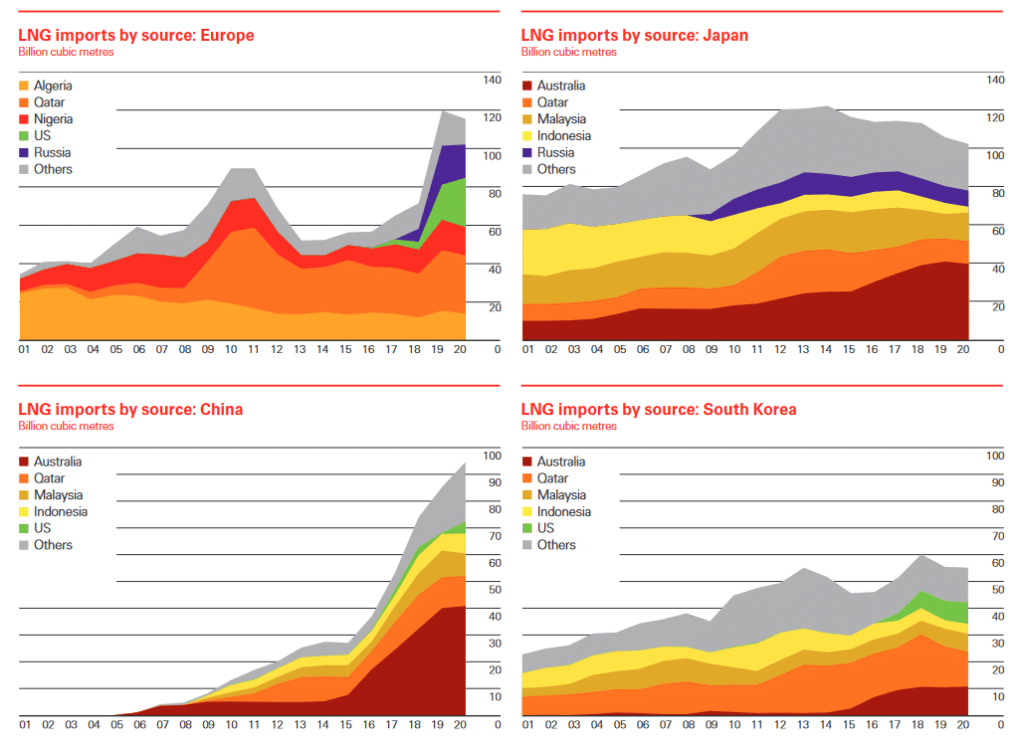

Russia aside, Europe also imports natural gas from Norway, Algeria, Qatar and other countries. Yet, this still failed to prevent the situation today. This shows how dependency on a single supplier for the majority of energy imports isn’t a reliable strategy. Major Asian LNG importers are still highly dependent on a single supplier, like Australia, despite their diversification efforts.

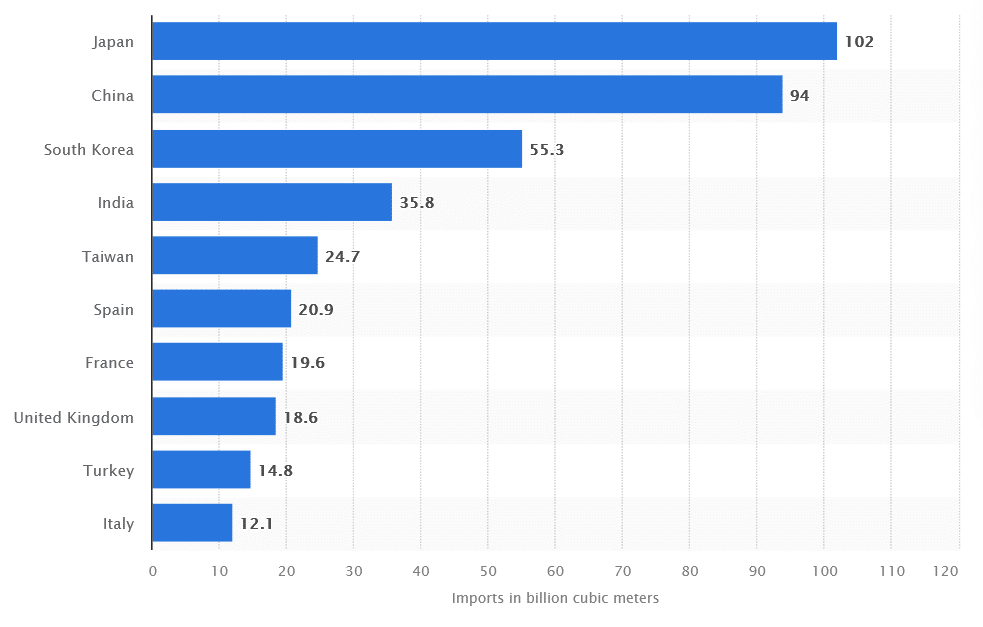

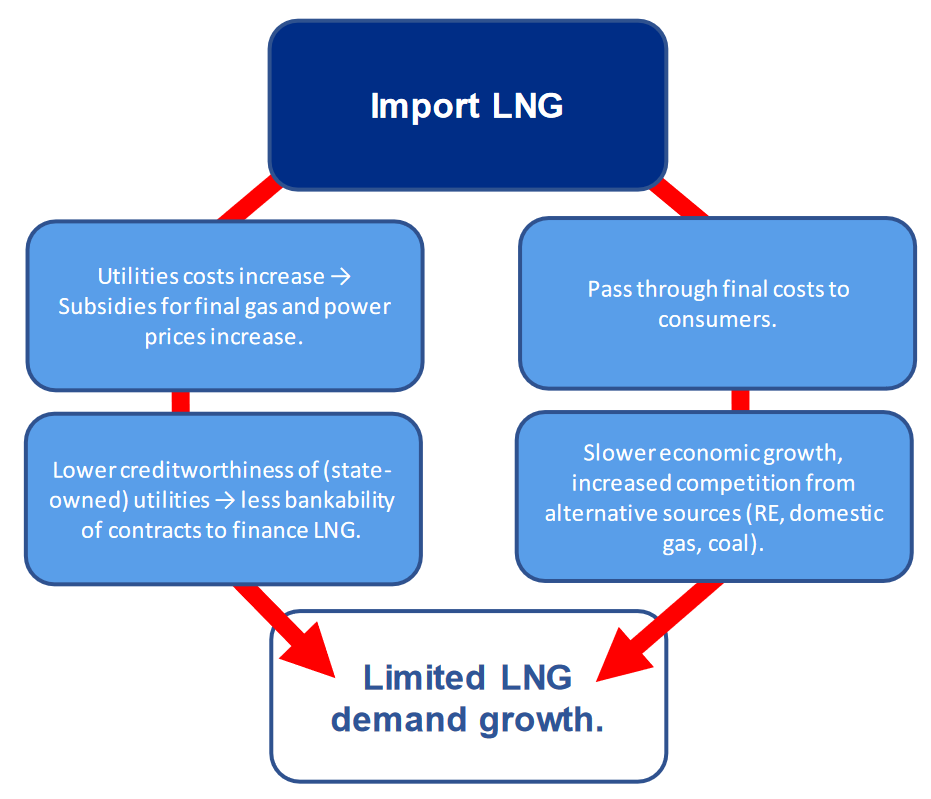

Europe got itself into its situation today by ignoring all the red flags throughout the years. The consequences of such badly planned energy policies should be ringing alarms across Asia. Asia could potentially be in a worse situation than Europe, considering that it relies on liquefied natural gas imports to an even greater extent. Asian countries top the charts as being among the world’s biggest LNG importers. The region is also the only one where natural gas consumption will increase over the next 20 years.

Lesson #2: Avoid Europe’s Mistake regarding Natural Gas Prices – Act Proactively, Not Reactively

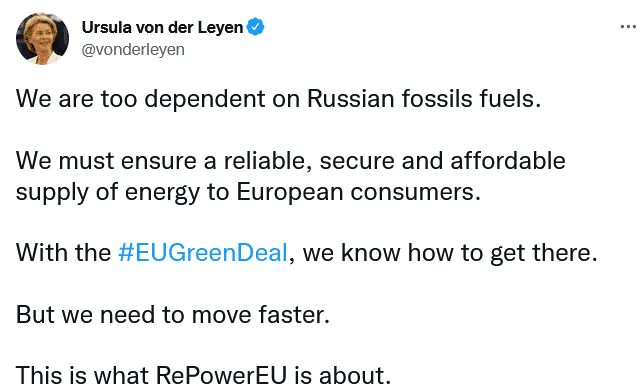

Ursula von der Leyen, president of the European Commission, said that Europe needs “to act now to mitigate the impact of rising energy prices.” However, this statement came a little too late, considering the soaring energy prices Europe has experienced in the past year. Between April 2020 and January 2021, European gas prices saw a 1,000% leap. Overall, LNG prices more than doubled from December 2020 to December 2021. Since Russia invaded Ukraine, the price of oil and gas has risen even higher.

Moreover, the energy market is dominated by long-term contracts, meaning that even if EU buyers are willing to pay high energy prices, they aren’t guaranteed to be able to make purchases.

The situation is similar to what Asia faces. Asia will represent 60% of global gas demand growth over the next three decades, with the most significant increase expected in emerging markets across South and Southeast Asia. At the same time, clean energy sources and renewable energy generation will become cheaper than natural gas in most Asian countries in the next five years. Yet, many Asian countries are locked into 20 to 25-year-long LNG contracts. This can prove costly in every sense – from the countries having to bear excessively high energy costs to experiencing slow progress towards decarbonisation and the lack of a reliable energy supply due to the inability to hold suppliers accountable.

Lesson #3: Focus on Renewable Energy Development

Europe realised it was too dependent on Russian fossil fuels, but it was too late.

Asia has the unique opportunity of learning from Europe’s mistakes. The continent won’t have to learn the hard way. For Asia, pursuing renewables and leaving fossil fuels in the past makes sense from every point of view. And Europe has already proven it.

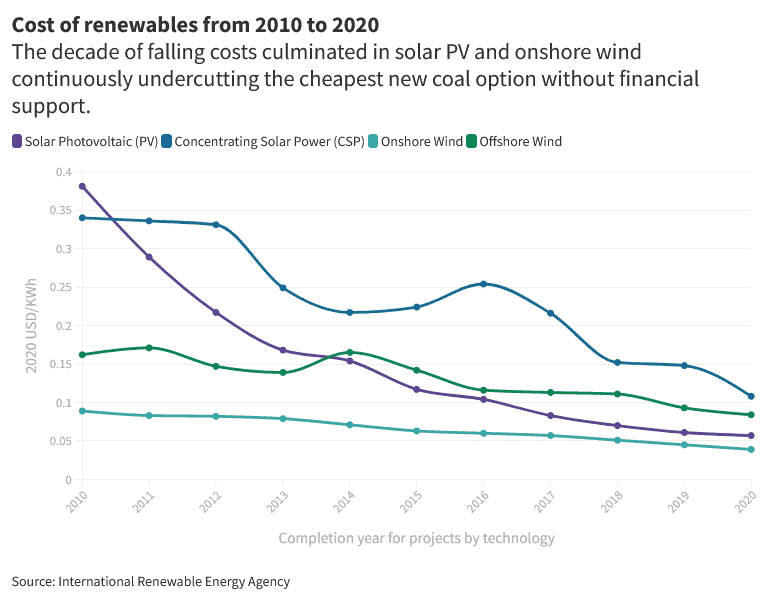

Wind and solar now represent the cheapest forms of electricity in most of the world, and in the near term, the cost of running coal and gas-fired power plants for electricity generation will be greater than those of building solar and wind farms. Furthermore, a massive rollout of domestically produced energy, like renewables, won’t only reduce import dependency but also cut carbon emissions.

Asia’s Next Move Will Be Crucial to not Get Caught in Europe’s Energy Crisis 2022

Asia risks facing a self-inflicted energy crisis. Europe’s energy woes are a glaring example of the potential consequences. Its case epitomises all the drawbacks of fossil fuel dependency. It highlights everything that could go wrong when overly reliant on imports. Asia holds its future in its own hands.

Europe and Asia represent 94% of global natural gas imports, accounting for one-third of global gas consumption. Both continents are in the same boat. However, Asia is in the unique situation to avoid repeating Europe’s mistakes.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more