Solar Energy Investment is Expected to Overtake Oil Production For the First Time

21 June 2023 – by Viktor Tachev Comments (0)

The IEA’s 2023 Energy Investment report finds that the fossil fuel crisis has significantly boosted global clean energy investments. While it is clear that the renewable energy transition is well and truly underway, not all countries are progressing well. Developing Asia, in particular, can and must speed up its efforts.

The IEA Energy Investment Report 2023 in a Nutshell

The IEA finds that the global energy security issues caused by the Russia-Ukraine war and the post-COVID-19 recovery have ensured that renewable energy investments are extending their lead over fossil fuels.

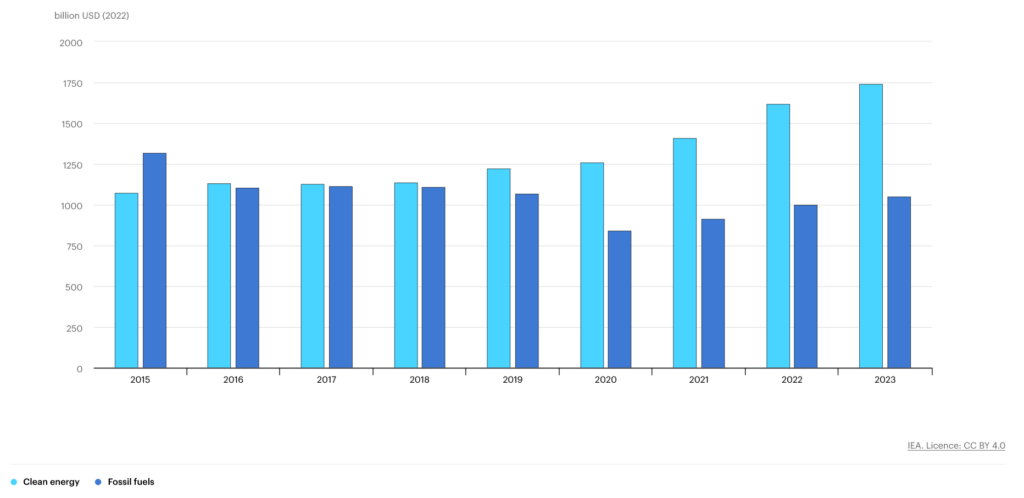

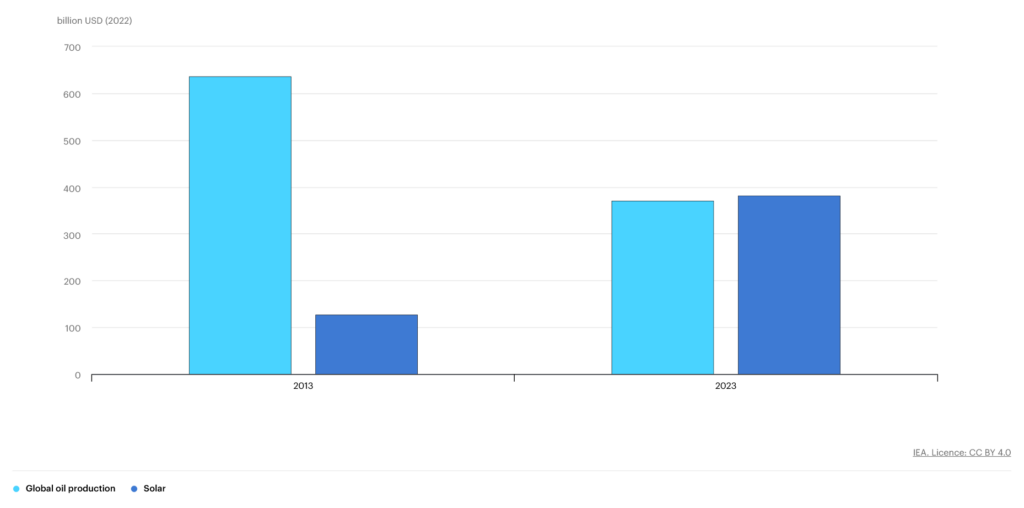

In 2023, global clean energy investment will top USD 1.7 trillion. For comparison, the total energy investments for this year are expected to reach USD 2.8 trillion. Remarkably, solar power will surpass oil production for the first time.

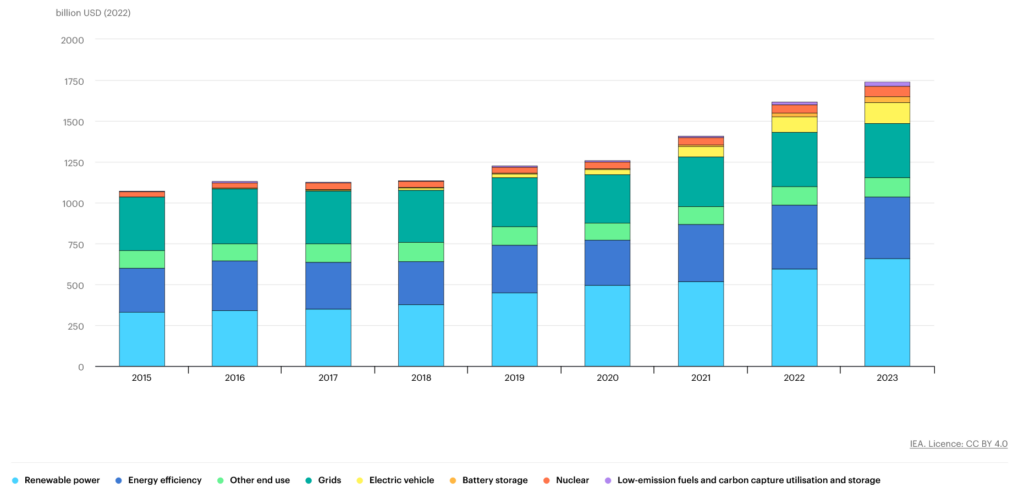

The investments will be diversified across various technologies, including renewable energy, nuclear power, EVs, grids, storage solutions, energy efficiency improvements and heat pumps.

Low-emission technologies, led by solar, will account for around 90% of the investments in global power generation. However, heat pump investments will also mark a staggering amount of growth, extending the double-digit annual growth trend that started in 2021. With EVs, the increase in sales will be over a third compared to 2022.

The yearly clean energy investment for 2021-2023 will jump by 24%, compared to 15% for fossil fuels. Today, for every US dollar invested in fossil fuels, USD 1.7 is invested in renewables. This has marked notable progress compared to five years ago when the ratio was 1:1.

Regarding the findings, the IEA’s Executive Director Fatih Birol said that clean energy is moving faster than many people realise.

Fossil Fuel Investments Aren’t Slowing Down as Much as They Should

In April, OPEC warned the IEA that its calls to stop oil investments were “undermining key oil investments”.

Meanwhile, fossil fuel investment doesn’t seem to be slowing down.

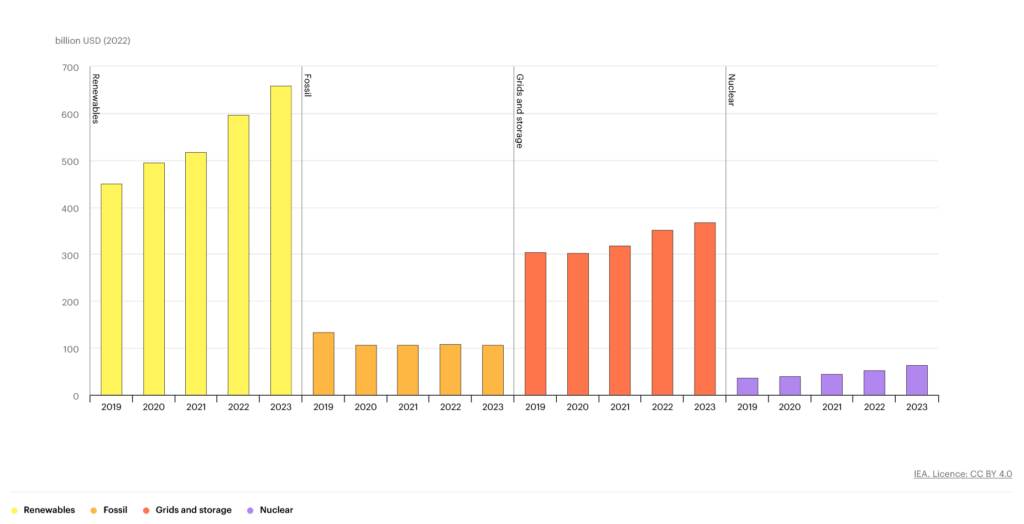

Globally, in 2023, a little over USD 1 trillion will go towards coal, oil and gas. Upstream oil and gas investments will rise by 7%.

The IEA estimates that fossil fuel investments in 2023 will double the levels needed in 2030 in its net-zero emissions (NZE) by 2050 scenario. More importantly, coal investment will likely be six times the levels needed in 2023 to achieve the NZE scenario.

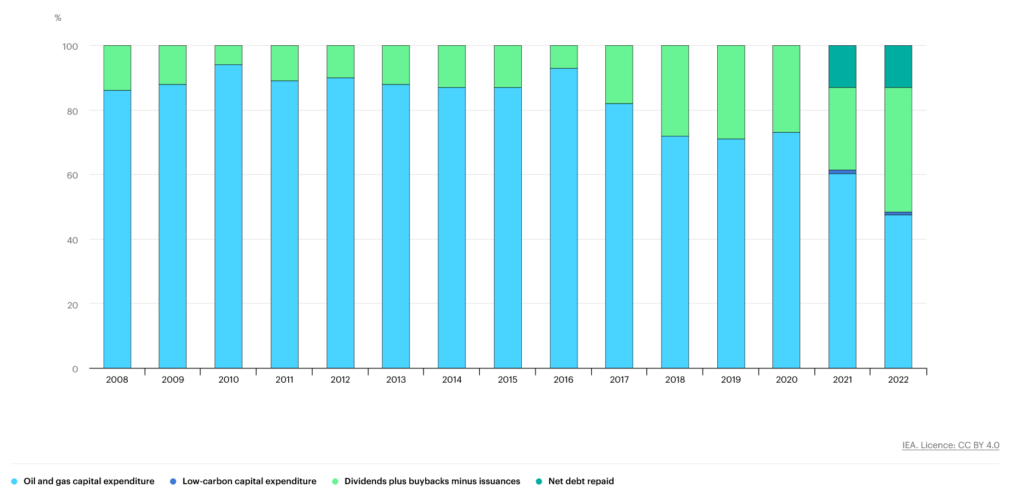

The agency also finds that the oil and gas industry continues to distribute profits instead of investing in decarbonisation. For reference, just 5% of its total upstream investments in 2022 went to clean electricity, renewable energy or carbon capture technologies.

The State of the Energy Investments in Asia

Over 2022, the Asia-Pacific region (excluding China) invested over USD 1 billion or 27% more than the previous year. In 2023, investments are likely to triple.

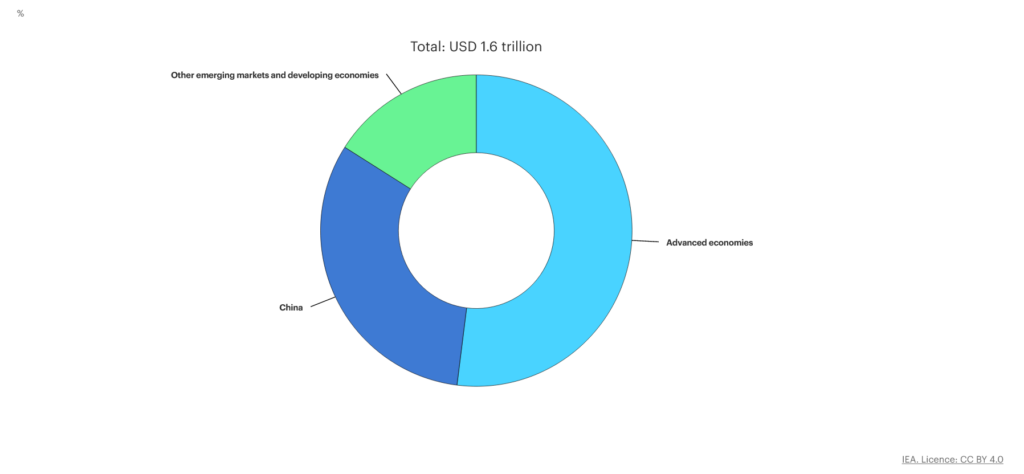

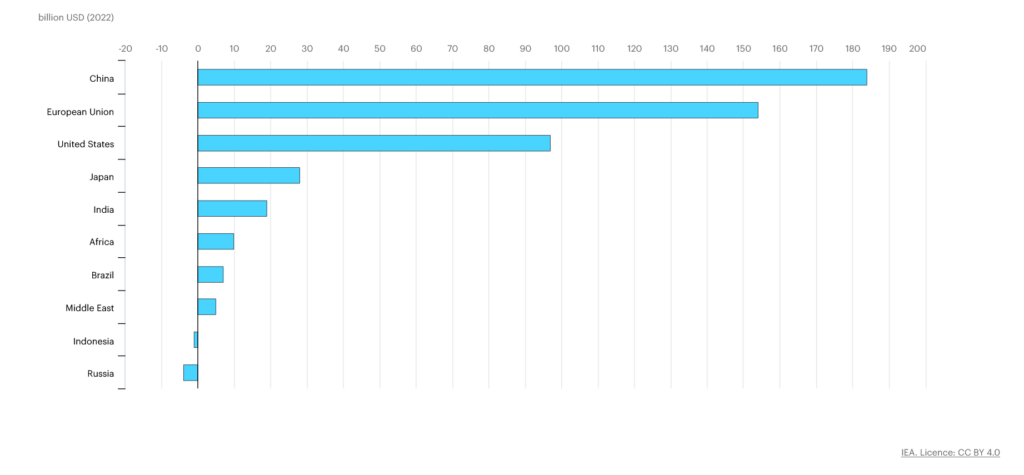

Over 90% of the expected increase in clean energy investments in 2023 will come from developed economies and China.

In 2022, clean energy investment was the lowest in emerging and developing economies. The main reasons include lack of regulatory certainty, weak market design fundamentals, unreliable grids, high cost of capital and more.

As a result, the agency sees a real risk of new dividing lines in global energy if developing nations don’t catch up.

Positive Signs For Clean Energy Development From All Over Asia

Many Asian countries are seeing traction on the regulatory front to ease low-carbon energy investments. For example, countries like India, Japan, Malaysia and Singapore are pushing ahead with ambitious sustainable finance-related regulations addressing lending, disclosures and stewardship practices.

Indonesia and Vietnam have already announced their JETPs. The partnerships aim to accelerate the retirement of coal power plants and enhance clean energy development.

Thailand has introduced legislation for clean energy procurement, introducing FiTs for distribution companies.

The Philippines aims to achieve 35% renewable electricity generation by the decade’s end. For 2040, it targets 50%.

South Korea aims to achieve 31% clean energy power generation by 2036, up from just 7.5% in 2021.

In India, the clean energy transition is also in full force. In 2022, solar power investments boomed while sales of EVs tripled. The country moves ahead with the expansion of its Production-Linked Incentive scheme. India will target 40 GW of solar PV manufacturing capacity in the next three years.

India also has ambitious targets for battery storage. Under the National Programme on Advanced Chemistry Cell (ACC) Battery Storage, the government plans to provide over USD 2 billion in support for the battery industry.

Fossil Fuel Investment in Asia: Momentum Is Changing

According to the IEA, coal investment globally jumped to USD 135 billion and is likely to top USD 150 billion in 2023. More importantly, 90% of it has come from the Asia-Pacific region and China and India, in particular. Most of the investment in those countries has gone to production expansion and new coal mine development.

However, developing nations across Southeast Asia are willing to move away from coal. Indonesia, a leading coal exporter, hasn’t had any new coal FIDs in 2022, in line with its net-zero pledge and JETP targets. Vietnam’s final PDP8 also doesn’t include any new coal capacity.

Furthermore, across most of Asia (China excluded), gas-fired power investments dropped by over 60%.

Lessons For Asia

The IEA notes that the mass increase in clean energy technology investments results from the fact that most countries have already realised the drawbacks of fossil fuels. Affordability and energy security concerns are strengthening the momentum for investments in renewables.

The IEA’s report urges the international community to help drive increased investments in lower-income nations. According to the agency, this might help compensate for the lack of participation of the private sector in those countries.

However, the international community can only do so much. Asian countries should reshape their energy policies to open the door for private sector investments. Furthermore, they should design energy plans that restrict the reliance on fossil fuel imports and cut investments in coal or gas infrastructure, as well as questionable technologies like ammonia co-firing schemes.

Instead, they should prioritise the cheaper, cleaner and more secure alternatives, like solar and wind, for which most developing nations have massive yet untapped potential.

Fortunately, many countries are already moving in that direction. Furthermore, the JETPs of Indonesia and Vietnam showcase that developing nations won’t be left alone in the journey towards decarbonisation. The crucial next step is to scale these efforts and do it as quickly as possible to avoid the looming energy security and financial risks of fossil fuels.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more