Renewable Energy in Indonesia – Current State, Opportunities and Challenges

09 June 2024 – by Viktor Tachev Comments (0)

The demand and potential for renewable energy in Indonesia is soaring. This is in large part due to Indonesia’s energy consumption growing at one of the fastest rates globally. Unsurprisingly, this is due to robust economic development, steady population growth and increasing urbanisation over the last decade.

However, Indonesia also remains deeply locked in fossil fuels. The country, which is the largest member of the Association of Southeast Asian Nations (ASEAN), is the sixth-biggest CO2 emitter globally, the world’s largest thermal coal exporter, and the third-largest coal producer. Additionally, it is Southeast Asia’s primary gas supplier and makes up a significant portion of global biofuel supply. Together, this makes Indonesia’s energy policy a vital factor in renewable energy trends and transition within the region.

The Growth of Renewable Energy in Indonesia 2024

Indonesian energy demand is expected to increase by 80%, while electricity demand triples between 2015 and 2030.

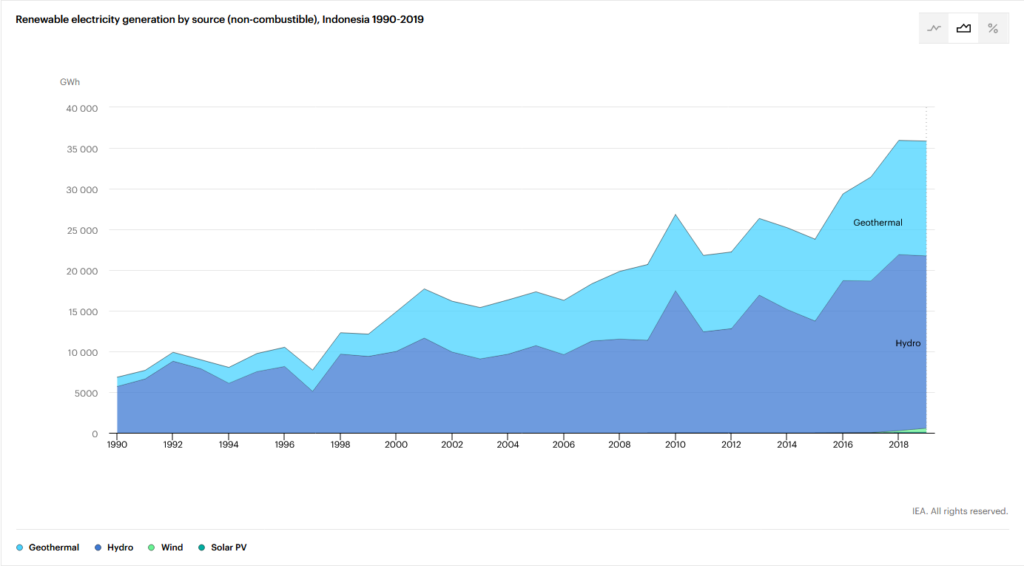

While fossil fuels account for around 80% of the country’s electricity generation, with coal holding a 61.55% share, clean energy’s contribution is also growing. Solar power capacity, for example, has increased by 800% over the past decade. Hydropower remains the largest clean energy source in Indonesia, with an 8% share in the country’s total energy mix. Indonesia also ranks second globally in terms of installed geothermal power capacity, only behind the USA. However, wind power deployment has remained relatively stagnant.

Indonesia’s consistent renewable energy additions over the years are a welcome sign that the country is progressing toward decarbonisation and a shift toward green energy.

However, the progress is far from what is needed to align with the Paris Agreement. Today, wind and solar power together account for just 0.2% of the country’s energy mix. This is far from the global average of 13%. Currently, the total share of all renewable energy sources, including geothermal, bioenergy, solar, wind, hydro and others, is just 14.5%.

Solar Energy Potential and Renewables in Indonesia

Indonesia is in the top five countries in the Asia-Pacific with significant renewable energy capacity. This is mainly sourced from hydropower and geothermal plants that make up 8% and 5%, respectively.

Indonesia’s plans for expanded deployment of clean energy sources are ambitious. Under the Just Energy Transition Partnership (JET-P), the government aims to reach at least 44% renewables in the power mix by 2030. This is an increase from the previous government policies, which intended to see 23% of the country’s energy supplied by modern renewables like solar by 2025. And by 2050, at least 31% were intended to come from modern renewable energy sources.

Yet, even the improved targets fail to capitalise on the vast untapped renewable energy potential of Indonesia. The country has the world’s largest geothermal energy reserves. Other green energy sources like solar and wind also remain underdeveloped. The 1.2 MW of installed wind power capacity is far from the 9.5 GW estimated potential. The same goes for solar. According to the Ministry of Energy and Mineral Resources, Indonesia has a solar power potential of around 207 GW, while other sources see it as up to 500 GW.

Capitalising on the Green Energy Potential of Indonesia is Crucial

The timing of how fast Indonesia can decarbonise cannot be more important. Indonesia is currently amongst the world’s largest carbon emitters. Furthermore, the country’s emissions are rising. Climate Action Tracker finds that the huge fleet of newly operating coal plants has skyrocketed Indonesia’s emissions by 21% in 2022. Worryingly, Indonesia’s coal capacity additions have been outpacing clean energy additions despite its goal of peaking emissions by 2030.

In that sense, capitalising on Indonesia’s renewable energy potential is essential. IRENA estimates that the transition will require USD 16 billion in investments per year.

The Advantages of Indonesia’s Renewable Energy Policy

While Indonesia’s clean energy transition is slow and stalling, the country has all the means for an accelerated growth. Currently, the country implements policies in 5/6 power policy categories tracked by Climatescope, including Renewable energy target, Renewable energy auction, Feed-in Tariff, Net Metering, Import tax incentives, and VAT incentives.

The pros of Indonesia’s progressive national energy policy are evident from every angle, including its economics, politics and a collective well-being perspective. By 2030, replacing fossil fuels with renewables will see savings of up to USD 1.7 billion per year. If air pollution costs are factored in, this rises between USD 15 to 50 billion. Additionally, when compared to current policies, a larger share of renewables will see a major cut in energy system costs.

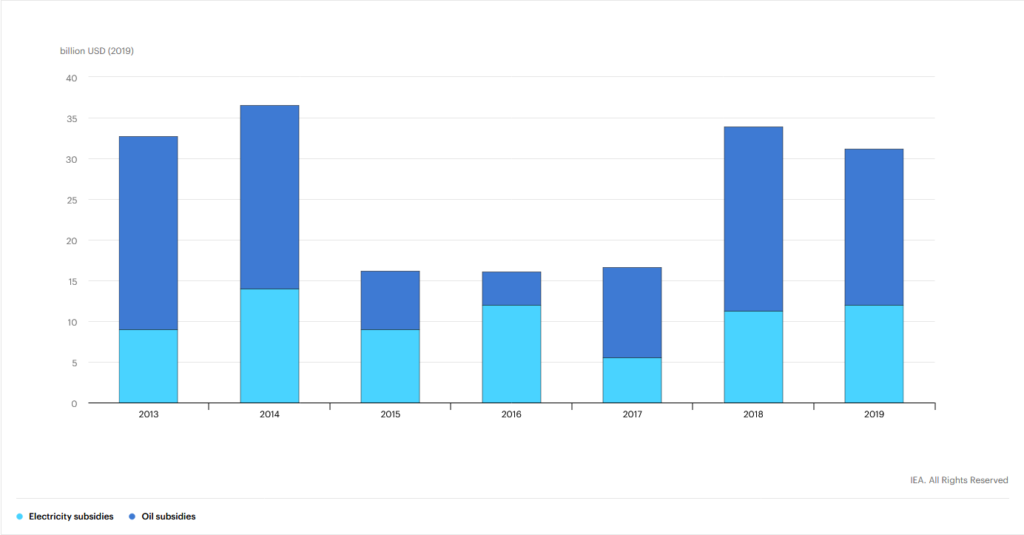

It will also ease the strain of fossil fuel subsidies on the state budget, which the country has been dealing with. In 2022, Indonesia, for example, budgeted USD 37.75 billion or 19.87% of its total 2022 expenditure budget for subsidies and compensation to keep most energy and fuel prices unchanged and to protect its population. According to the EU-ASEAN Business Council, this is twice Indonesia’s 2022 healthcare budget of USD 17.73 billion and four times its defence budget of USD 9.3 billion.

As an indirect advantage, renewables will also contribute to creating more jobs and empowering technological transfers. IRENA sees the increase in renewable energy jobs to skyrocket from 100,000 to 1.3 million by 2030. The main drivers of this exponential boom are expected to be solar panel production and electric vehicle manufacturing.

Renewable sources will also help Indonesia become more self-sufficient. It will ultimately reduce the demand for fossil fuels by approximately 10%. In other words, Indonesia would be able to reduce imports of petroleum products and coal.

The Challenges Facing Renewable Energy Trends and Transition

If Indonesia wants to meet its goals, investments in renewable energy will need to accelerate rapidly. However, it is not only a question of more investment. First, it is essential to consider where these investments are routed. This raises several crucial challenges facing the power sector and the end-use of energy in various areas of the economy.

For the power sector, the challenges include the highly-fragmented nature of Indonesia’s grid with operational issues within off-grid areas. This also includes financing opportunities for new projects currently limited by local banks and land acquisition issues.

From an energy consumption perspective several issues arise. The lack of adequate design standards for thermal and water heating in industrial buildings, limited awareness of the renewable energy potential, space limitations and a focus on liquid biofuels.

There is also the challenge of continuous fossil fuel subsidies. The International Energy Agency (IEA) states that to help support sustainable economic recovery, Indonesia must enhance its investment framework for renewables. This includes reforms that attract higher levels of private capital.

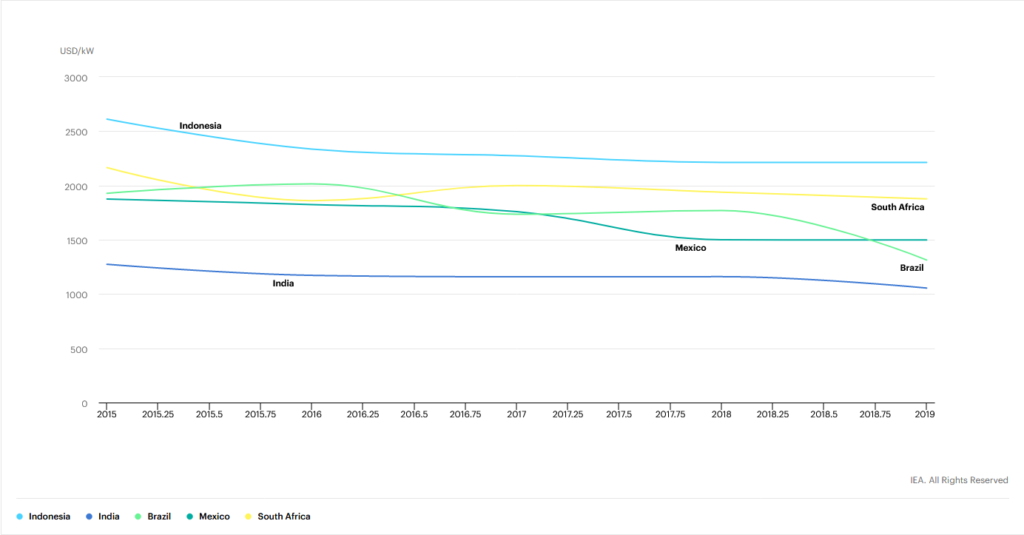

Another critical challenge is the relatively high costs. The average cost per megawatt of solar PV capacity in Indonesia in 2022 was 65% higher than in India. It was also 10% higher than its Southeast Asian neighbour, Thailand. However, this difference is now narrowing, considering the global trends in decreasing clean energy power costs and Indonesia’s progress in the past years. With the appropriate supportive policies, the country can unlock the major gains of the clean energy transition.

Collectively, this demonstrates the importance of a proactive national policy for Indonesia if it wants to achieve its goals. Fortunately, huge invests in renewable energy are already in the pipeline. The Indonesian government plans to build a new capital city relying on renewable energy for its electricity needs.

How Renewable Energy Transition Affects the Coal Industry

While the country has started decommissioning coal plants prematurely, overall, clean energy hasn’t had a massive impact on the domestic coal landscape in Indonesia, with the sector continuing to grow strong. However, considering Indonesia’s important role on the global coal stage, as the world moves away from the dirtiest fuel, the country’s exports will significantly shrink in the near term. By 2030, coal use will plateau and shrink thereafter because of renewable uptake. However, in the short-term, the most affected industry will be oil. For Indonesia, if current renewable energy trends are anything to go by, the shift to cleaner energy sources is a huge step in the right direction.

However, this step should be more ambitious. It is crucial that Indonesia rises to the occasion to meet the challenges of addressing climate change. Scientists warn that the country is among the most exposed to extreme weather events with climate disasters threatening around 180 million Indonesians living in coastal areas. So far, the government’s response has been slow or lacking.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more