Stranded Fossil Fuel Assets: A Looming Burden

Source: Bloomberg

27 December 2021 – by Eric Koons

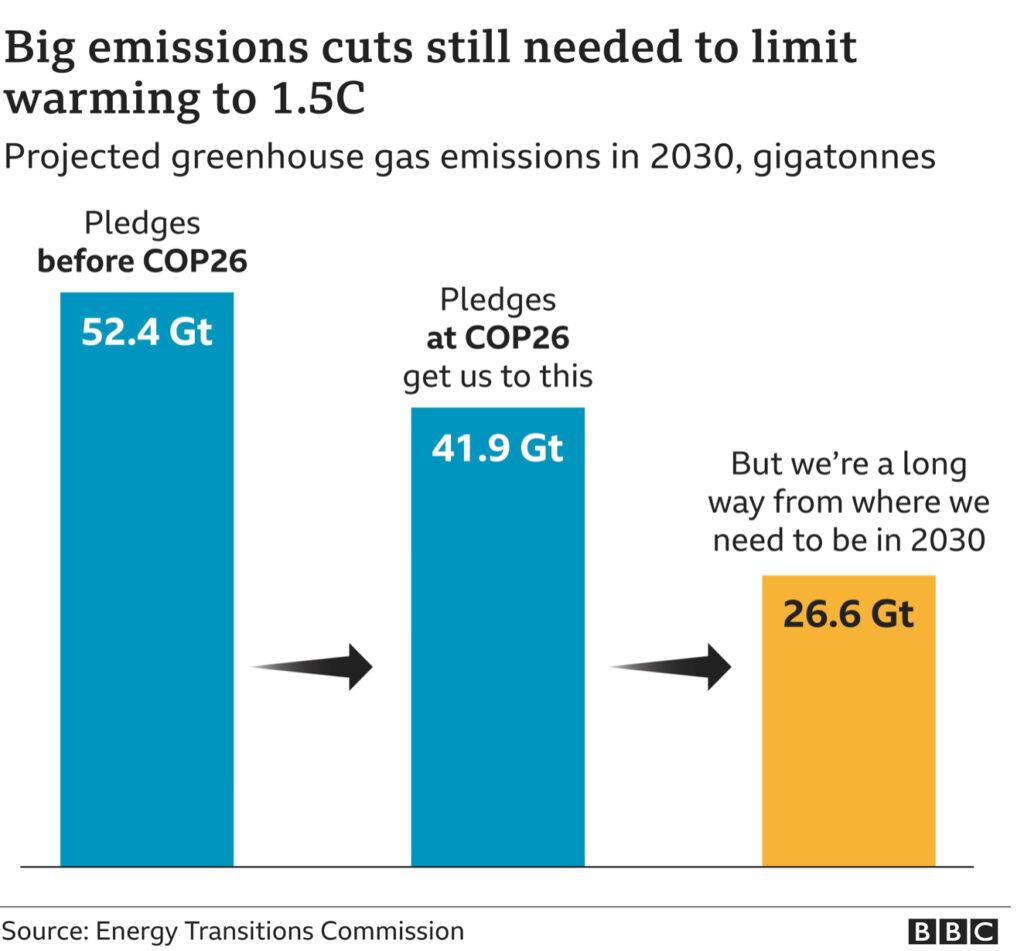

After heated debates, changes, and new goals, COP26 in Glasgow came to a close. Leaders, despite political differences, agreed that CO2 reduction targets need to be more robust by 2030. This ultimately led to the foundation of the Glasgow Climate Pact, which sets out a strategy to move beyond fossil fuels. The results of the pact, if carried out as envisioned, would mean phasing out fossil fuel subsidies and increasing funding for developing countries to switch to clean energy and adapt to climate change’s impacts. It’s a great step towards curbing greenhouse gas emissions, limiting global warming and fighting climate change.

Stranded Fossil Fuel Assets lead Financial Crisis

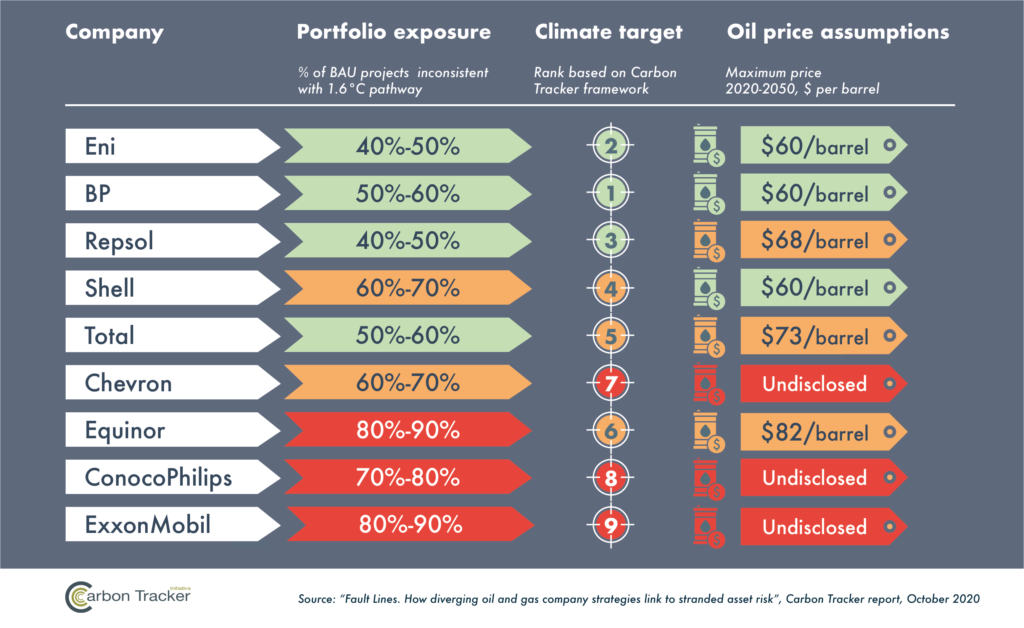

Both COP26 and the pact indicate a significant trend and interest away from fossil fuels and their associated infrastructure. This presents the fossil fuel industry and investors with a significant stranded asset risk, leading to a considerable loss in value and liquidity as countries shift toward clean energy. It can become a risk for the financial system and the global economy.

Risk for the Fossil Fuels Industry

The devaluation of fossil fuels poses a significant risk. These existing stranded fossil fuel assets need to be managed carefully, and banks should consider the risks before funding new fossil fuel projects. However, the good news is that the devaluation of fossil assets will likely take several years. This gives fossil fuel companies, banks and investors a window of opportunity to change their investment strategies.

Yet, even since the Paris Climate Agreement in 2015, the world’s 60 largest banks have pumped over USD 3.8 trillion into the fossil fuel industries. And specifically in Asia, a planned USD 379 billion expansion of gas infrastructure risks becoming stranded in the coming decades. If this trend doesn’t change, financial risks will continue to rise.

Stranded Assets are Already Impacting Oil and Gas Assets

While we assume stranded assets are a risk for the future, losses are already apparent. In June 2020, the British oil giant BP wrote off up to USD 17.5 billion from the value of its assets after cutting its long-term oil and gas price forecasts. According to the Financial Times, BP expects the pandemic to “hasten the shift away from fossil fuels”. This has been the company’s largest write-down since the Deepwater Horizon oil spill in 2010.

Furthermore, BP lowered its benchmark Brent oil price forecasts to an average of USD 55 per barrel until 2050, down by almost 30% from previous assumptions of USD 70. The company’s outlook is now the lowest among Europe’s top energy companies.

World’s Fossil Fuel Assets will lose Value

Moreover, according to research published in the journal Nature, almost half of the world’s fossil fuel assets could lose all value by 2036. This would render billions of dollars of assets worthless. As climate change policies gain strength, fossil fuel reserves will become unusable or stranded.

The Solution to Stranded Fossil Fuel Assets

Solutions for stranded fossil fuel assets boils down to increasing renewable energy capacity instead of fossil fuels. This move can be met in two ways: climate policy and funding renewable energy infrastructure.

Climate Policy

Long-term, consistent, and impactful climate action policy provides a set of guardrails for governments, banks, and private industry. These policies would align all stakeholders with reorganising industrial value chains, international trade, and geopolitics.

Renewable Energy Financing

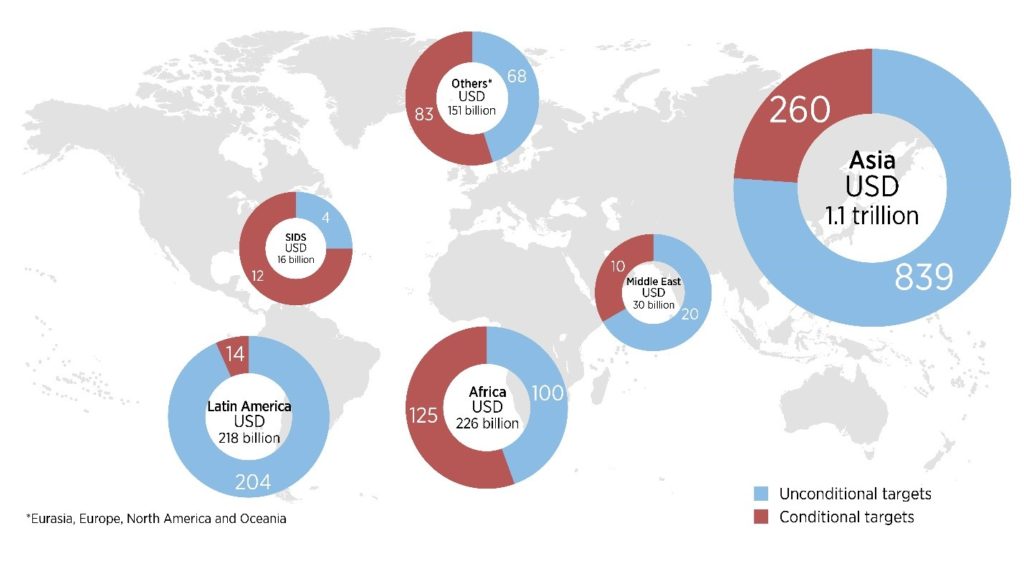

Funding remains the second major hurdle. According to the International Renewable Energy Agency (IRENA), the world requires USD 131 trillion of investments for the energy transition by 2050. This amount would be enough to meet the Paris Agreement goals. Yearly, the funding breaks down into around USD 4.4 trillion in renewable energy investments. This financing will need to come from the public and private sectors, with development banks playing a vital role.

In Asia, excluding China, these investments fall on major infrastructure lenders, like the Asian Development Bank (ADB) and Asian Infrastructure Investment Bank (AIIB). Luckily, these organisations have started to change their tune on fossil fuel financing in recent months. Both institutions announced policies to stop funding coal and oil projects potentially.

Furthermore, ADB invested over USD 1 billion into renewable energy projects in the Pacific from 2019 to 2021. And AIIB has been investing in renewable energy financing projects like the Asia Climate Bond Portfolio and the ESG Enhanced Credit Managed Portfolio. While this is a good start, it is only a beginning for Asia and the world.

COP26 in the Face of Stranded Assets

COP26 shows that global leaders understand climate risk and that consensus are necessary to progress with climate action. However, the lack of urgency in eliminating fossil fuel investments and consumption is alarming. Without changing investment approaches, the economic burden caused by billions of dollars of stranded fossil fuel assets will be crushing for one too many governments and institutions.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more