Asia’s Proposed Coal Projects May Reverse Recent Declines, Significantly Increasing Methane Emissions [Op-Ed]

Photo: Shutterstock / AButyrin 22

18 August 2025 – by Dorothy Mei, Tiffany Means and Wynn Feng

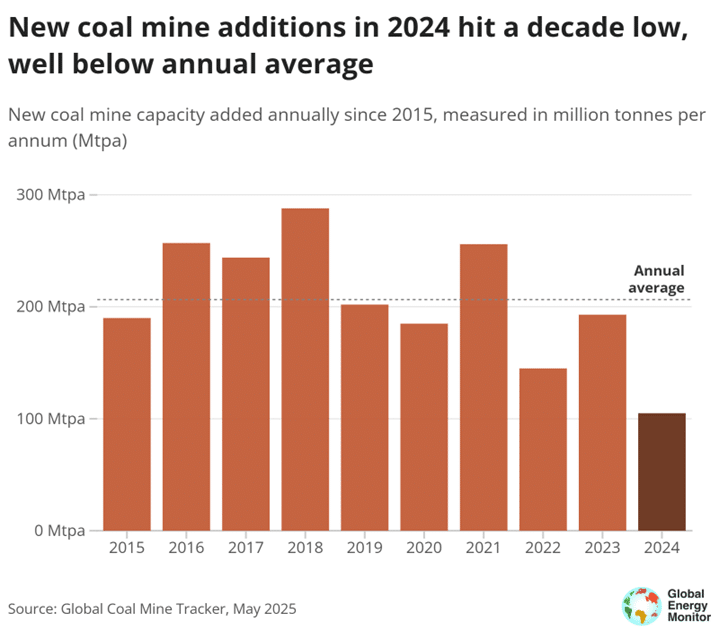

In 2024, the production capacity that came online at newly-operating mines hit its lowest level since at least 2015, the year the Paris Agreement was adopted. The 105 Mtpa increase was over 100 Mtpa below the 2015–2024 annual average of 206.5 Mtpa. This decline is primarily due to reduced additions in top coal-producing countries, India and China. However, this does not necessarily indicate a sustained slowdown in coal expansion plans in these countries. Instead, the slowdown likely reflects delays in expansion approvals, the inherently lengthy nature of coal mine development phases, and a potential easing of supply-demand pressure following the pandemic-fueled surge in capacity additions over the previous two years.

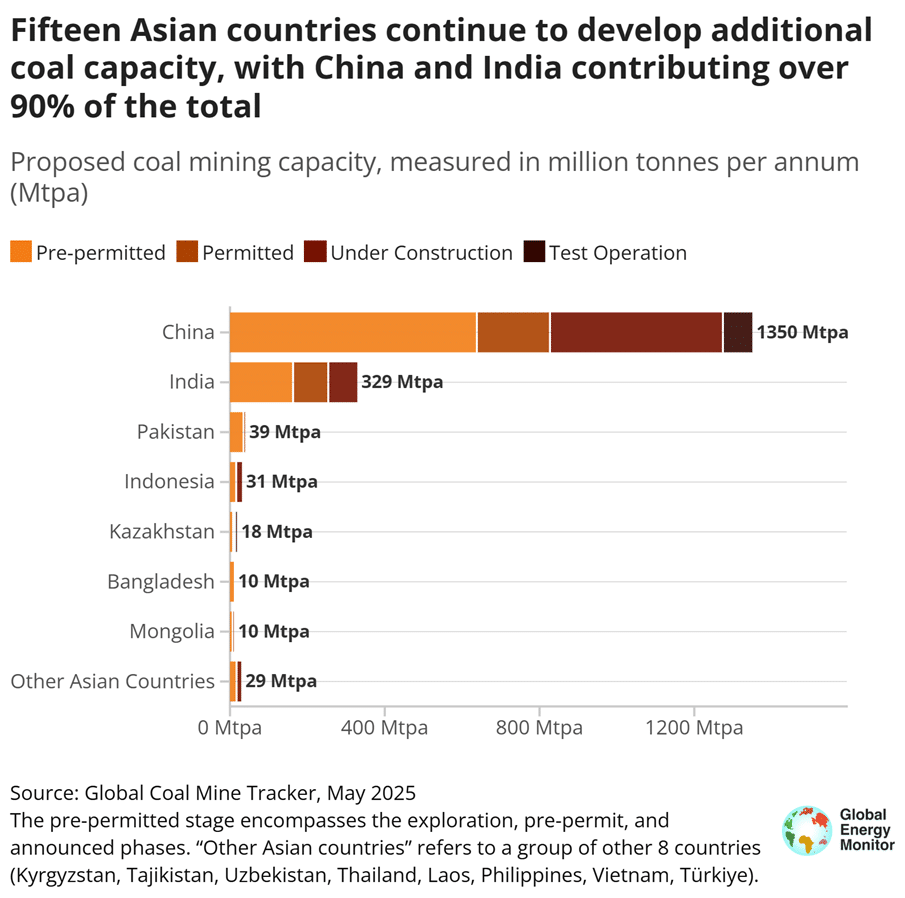

Given the substantial amount of proposed capacity still under development, the current downward trend may be at risk of reversing in the coming year. According to GEM’s latest coal mine data, at least 2,270 Mtpa of additional coal mining capacity remains at various stages of development. Nearly 80% (1,814 Mtpa) of this proposed capacity is located in Asia, with China and India accounting for over 90% of the region’s total.

China leads by a significant margin with 1,350 Mtpa of proposed coal capacity, predominantly in the country’s north and northwest regions. As of April 2025, China’s planned coal mine projects (including expansions) total 1,350 Mtpa, representing 60% of global proposed capacity. This amount surpasses Indonesia and Australia’s combined operating coal capacity, the world’s third- and fourth-largest coal producers. Over one-third (39%) of China’s proposed capacity is already under construction or in test operation. In comparison, 14% has been approved, and nearly half (47%) remain in the early planning or development stages.

China’s proposed coal projects continue to benefit from policy support. In 2024, China unveiled a plan to establish a coal capacity reserve system by 2027 to enhance energy security through a more flexible coal supply. This plan suggests further capacity expansion, involving approving new coal mines specifically for reserve purposes. By 2030, China aims to develop approximately 300 Mtpa of dispatchable reserve capacity. [1]

India ranks a distant second globally in proposed coal mining capacity, with 329 Mtpa currently under development, nearly half of which is being developed by state-owned Coal India. Of this, 163 Mtpa remains in the early planning stage, approximately 90 Mtpa has been permitted, and 75 Mtpa is already under construction.

India’s coal production reached a record 1,048 Mt in FY 2024–25 and is projected to rise further as the government seeks to boost domestic output, reduce import dependence, and enhance energy security. The government targets 1.3 billion tonnes of coal production by FY 2027 and 1.5 billion tonnes by 2030. To support this goal, India plans to open 100 new coal mines, adding 500 Mtpa in capacity by 2030. Over 80 Mtpa is expected to come online in FY 2025–26, suggesting already permitted or under-construction projects could be fast-tracked.

Pakistan ranks second in South Asia, after India, with approximately 38 Mtpa of coal mining capacity under development. Most of these proposed projects are tied to coal demand from the power sector. All currently proposed coal mines remain in the early planning phase.

Southeast Asia’s coal development pipeline is led by Indonesia, which currently has 15 Mtpa of coal mining capacity under construction and an additional 16 Mtpa in early-stage planning. About 94% of thermal coal is intended for domestic power generation and international markets. Additionally, more than 40 proposed coal mine projects remain very early and lack reported capacity data.

Future Coal Mine Methane Emissions from Asia

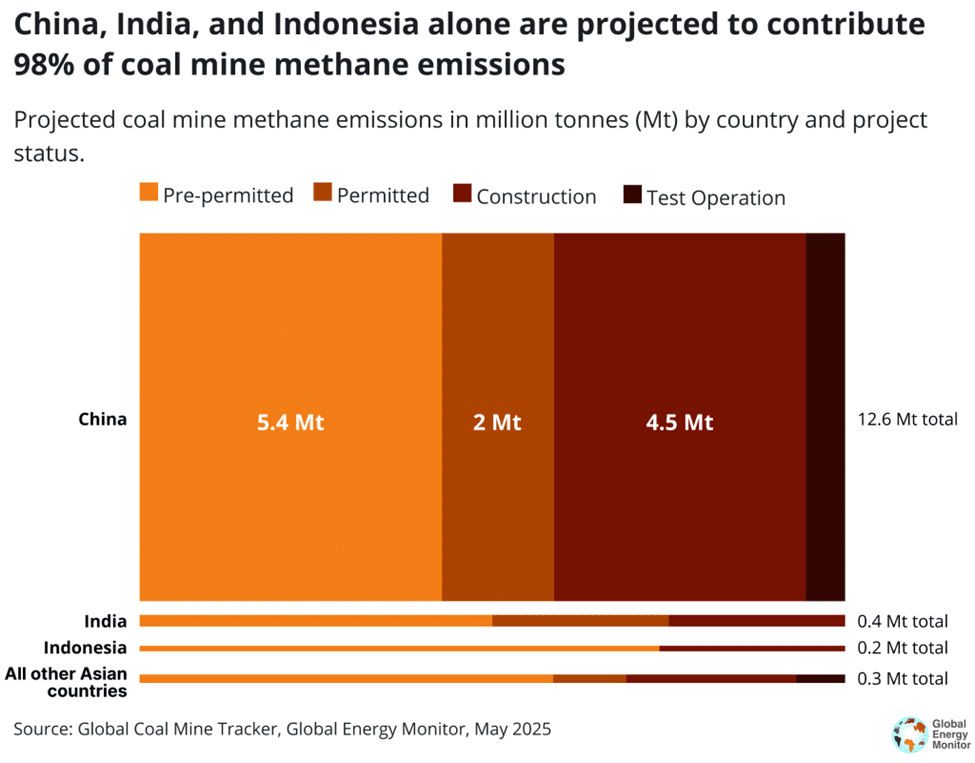

A projected 15.7 Mt of methane emissions per year could be released if all globally proposed coal mining projects are developed. [2] This is equivalent to roughly 1.3 billion tonnes of CO₂e using a 20-year Global Warming Potential — exceeding Japan’s total annual greenhouse gas emissions, which stood at 1.18 billion tonnes in 2022. Without robust abatement, emissions from new coal mines would compound the already significant methane emissions from existing mines.

Asia is projected to account for about 85% of emissions, with approximately 13.5 Mt of projected methane emissions, as the region contains the largest share of significant coal capacity. Nearly 98% of these emissions are concentrated in just three countries: China, India and Indonesia.

China is the largest projected source of global coal mine methane emissions, responsible for 80% of estimated emissions from proposed projects worldwide and 93% within Asia. The country has 456 proposed coal mines under development, totalling approximately 1,350 Mtpa in planned capacity. If fully realised, these projects could emit an additional 12.6 Mt of methane annually, according to GEM estimates. With nearly 40% of this capacity already under construction or in test operation, about 5 Mt of new emissions per year may be effectively locked in.

India ranks a distant second in projected methane emissions from proposed coal mining capacity in Asia, with an estimated 0.43 Mt of methane to be emitted annually, nearly 90% of which comes from identified thermal coal projects. However, as the government targets a significant increase in domestic coal production, especially from underground and metallurgical coal mines by 2030, methane emissions will likely rise further unless effective abatement measures are implemented.

Indonesia ranks third in Asia for projected methane emissions from proposed coal mining, with an estimated 0.2 Mt to be emitted annually. While this appears modest compared to China and India, the figure may be underestimated, as over 40 proposed projects in Indonesia are still in early stages and lack reported capacity data, making associated emissions difficult to estimate.

[1] Coal production reserve mines adopt a “base + reserve” dual-capacity system, with reserve capacity accounting for 20%–30% of total output. Under normal conditions, only base capacity operates, while reserve capacity can be quickly activated during emergencies.

[2] For further detail on estimating methane emissions from coal mines, visit GEM’s methodology wiki page.

For a full version of the report, please refer to this report link

To download the full GCMT dataset, please visit: https://globalenergymonitor.org/projects/global-coal-mine-tracker/download-data/

Dorothy Mei is the Project Manager for the Global Coal Mine Tracker at Global Energy Monitor. She has years of experience researching coal mining, coal mine methane and broader climate and energy issues.

Tiffany Means is a Senior Researcher for the Global Coal Mine Tracker at Global Energy Monitor. Her work focuses on tracking and improving data transparency on coal mine development and abandoned coal assets.

Wynn Feng is a Senior Global Coal Mine Tracker Researcher at Global Energy Monitor, specialising in China’s energy sector and has extensive experience in Chinese coal and steel research.

About Global Energy Monitor

Global Energy Monitor develops and shares information on fossil fuel projects in support of the worldwide movement for clean energy. Current projects include the Global Coal Plant Tracker, the Global Fossil Infrastructure Tracker, the Europe Gas Tracker, the CoalWire newsletter and the GEM wiki.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Energy Tracker Asia.