Clean Energy Drove More Than a Third of China’s GDP Growth in 2025 [Op-Ed]

Photo: Shutterstock / ZCOOL HelloRF

11 February 2026 – by Lauri Myllyvirta and Belinda Schaepe

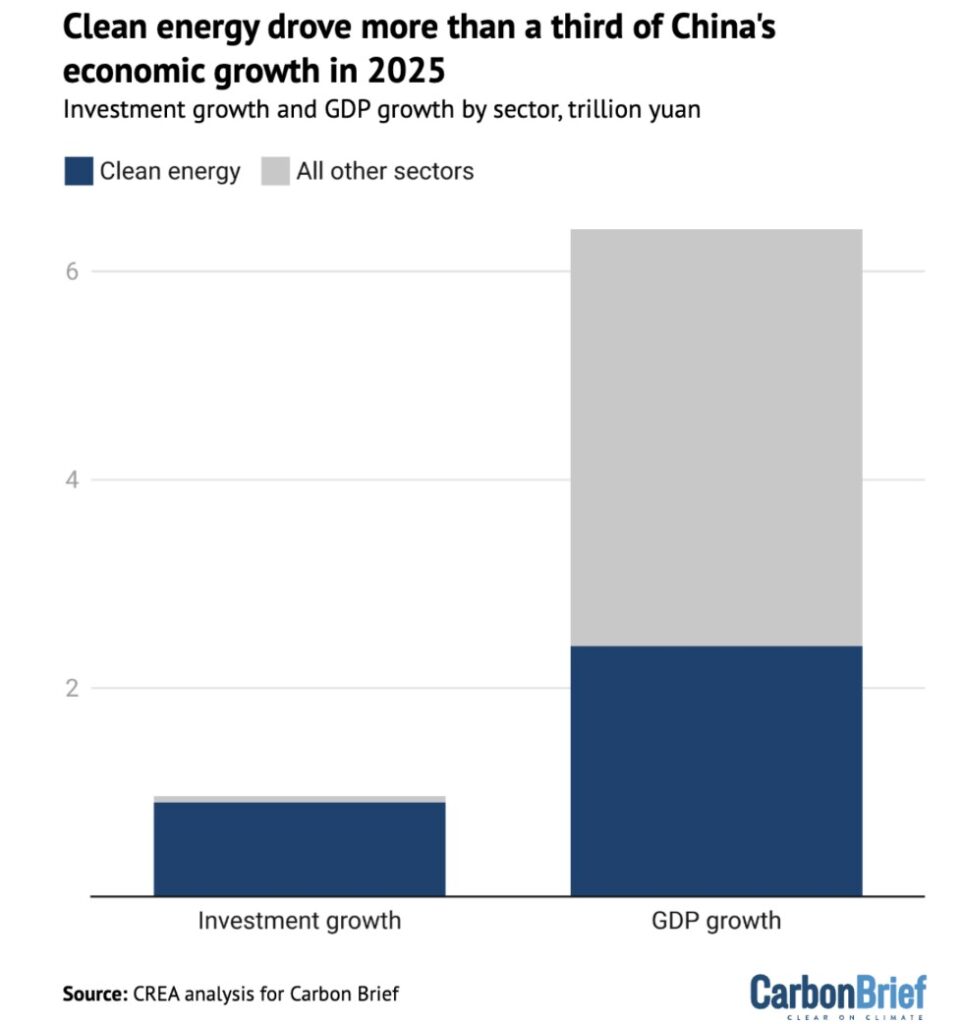

Solar power, electric vehicles (EVs) and other clean-energy technologies drove more than a third of the growth in China’s economy in 2025, and more than 90% of the rise in investment. Clean-energy sectors contributed a record 15.4tn yuan ($2.1tn) in 2025, some 11.4% of China’s gross domestic product (GDP) is comparable to that of Brazil and Canada.

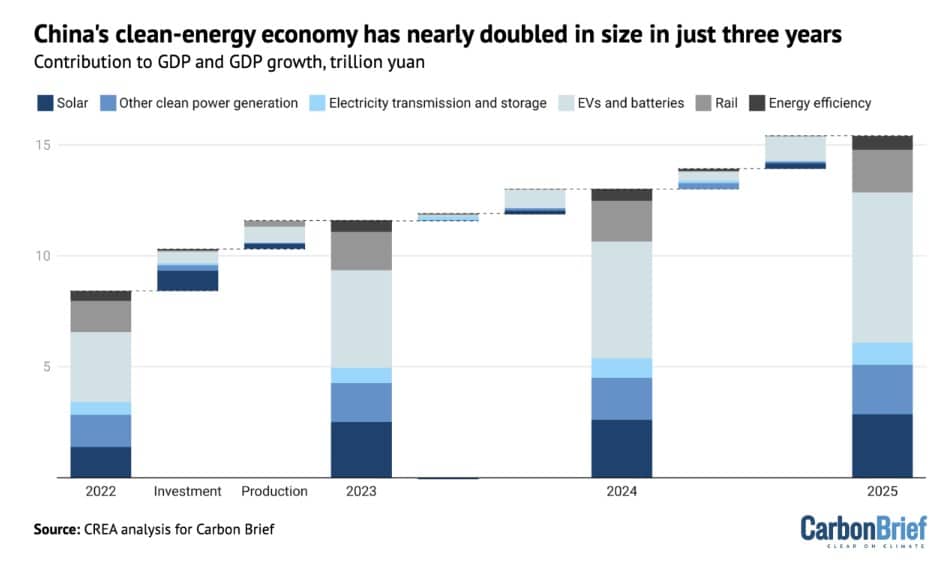

The new analysis for Carbon Brief, based on official figures, industry data and analyst reports, shows that China’s clean-energy sectors nearly doubled in real value between 2022-25 and – if they were a country – would now be the 8th-largest economy in the world.

Other key findings from the analysis include:

● Without clean-energy sectors, China would have missed its target for GDP growth of “around 5%”, expanding by 3.5% in 2025 instead of the reported 5.0%.

● Clean-energy industries are expanding much more quickly than China’s economy overall, with their annual growth rate accelerating from 12% in 2024 to 18% in 2025.

● The “new three” of EVs, batteries and solar continue to dominate the economic contribution of clean energy in China, generating two-thirds of the value added and attracting more than half of all investment in the sectors.

● China’s investments in clean energy reached 7.2tn yuan ($1.0tn) in 2025, roughly four times the still sizable $260bn put into fossil-fuel extraction and coal power.

● Exports of clean-energy technologies grew rapidly in 2025, but China’s domestic market still far exceeds the export market in value for Chinese firms.

These investments in clean-energy manufacturing represent a large bet on the energy transition in China and overseas, creating an incentive for the government and enterprises to keep the boom going.

However, there is uncertainty about what will happen this year and beyond, particularly for solar power, where growth has slowed in response to a new pricing system and where central government targets have been set far below the recent rate of expansion.

An ongoing slowdown could turn the sectors into a drag on GDP, while worsening industrial “overcapacity” and exacerbating trade tensions.

Yet, even if the central government targets in the next five-year plan are modest, those from local governments and state-owned enterprises could still drive significant growth in clean energy.

This article updates the analysis previously reported for 2023 and 2024.

Clean-energy Sectors Outperform Wider Economy

China’s clean-energy economy continues to grow far more quickly than the broader economy. This means that it is making an outsized contribution to annual economic growth.

The figure below shows that clean-energy technologies accounted for more than a third of China’s overall economic growth in 2025 and more than 90% of the net rise in investment.

In 2022, China’s clean-energy economy was estimated at 8.4 trillion yuan ($1.2tn trillion). By 2025, the sectors had nearly doubled in value to 15.4tn yuan ($2.1tn).

This is comparable to the output of the entire Brazilian or Canadian economy and positions the Chinese clean-energy industry as the 8th-largest economy in the world. Its value is roughly half that of India’s economy – the world’s fourth-largest – or of the US state of California.

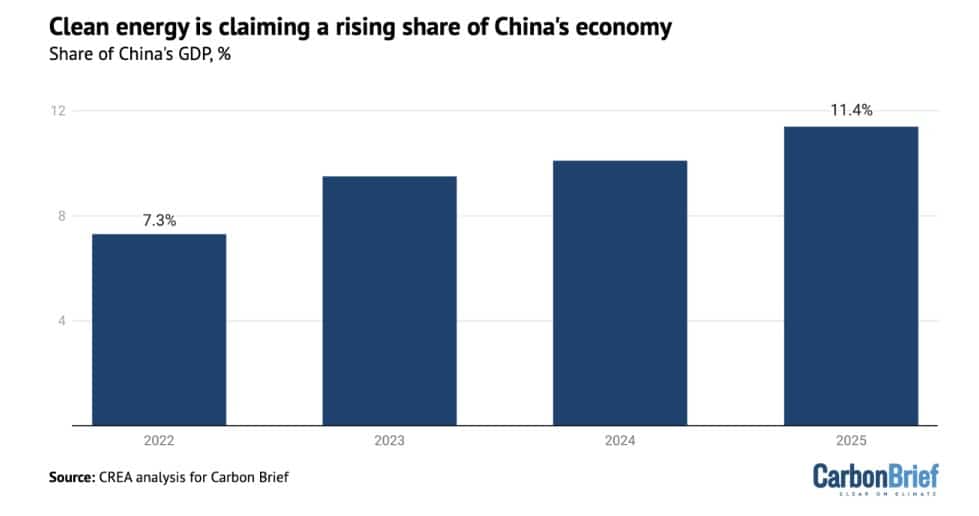

The outperformance of the clean-energy sectors means they are also claiming a rising share of China’s overall economy, as shown in the figure below.

This share has risen from 7.3% of China’s GDP in 2022 to 11.4% in 2025.

Without clean-energy sectors, China’s GDP would have expanded by 3.5% in 2025 instead of the reported 5.0%, missing the target of “around 5%” growth by a wide margin.

Clean energy thus made a crucial contribution during a challenging year, when promoting economic growth was the foremost aim for policymakers.

EVs and Batteries Were the Largest Drivers of GDP Growth

In 2024, EVs and solar were the largest growth drivers. In 2025, EVs and batteries accounted for 44% of the economic impact and more than half of the growth in the clean-energy industries. This was due to strong growth in both output and investment.

The contribution to nominal GDP growth – unadjusted for inflation – was even larger, as EV prices held up year-on-year while the economy as a whole suffered from deflation. Investment in battery manufacturing rebounded after a fall in 2024.

The major contribution of EVs and batteries is illustrated in the figure below, which shows both the overall size of the clean-energy economy and the sectors that contributed the most to year-over-year growth.

The next-largest subsector was clean-power generation, transmission, and storage, which accounted for 40% of GDP contributions and 30% of growth in 2025.

Within the electricity sector, the largest drivers were growth in investment in wind and solar power generation capacity, along with growth in power output from solar and wind, followed by exports of solar power equipment and materials.

Investment in solar-panel supply chains, a major growth driver in 2022-23, continued to fall for the second year. This was in line with the government’s efforts to rein in overcapacity and “irrational” price competition in the sector.

Finally, rail transportation accounted for 12% of the total economic output of the clean-energy sectors but saw relatively muted year-on-year growth, with revenue up 3% and investment up 6%.

Note that the International Energy Agency (IEA) world energy investment report projected that China invested $627bn in clean energy in 2025, against $257bn in fossil fuels.

For the same sectors as the IEA report, this analysis puts the value of clean-energy investment in 2025 at a significantly more conservative $430bn. The higher figures in this analysis overall are therefore the result of wider sectoral coverage.

Electric Vehicles and Batteries

EVs and vehicle batteries were again the largest contributors to China’s clean-energy economy in 2025, accounting for an estimated 44% of the overall value.

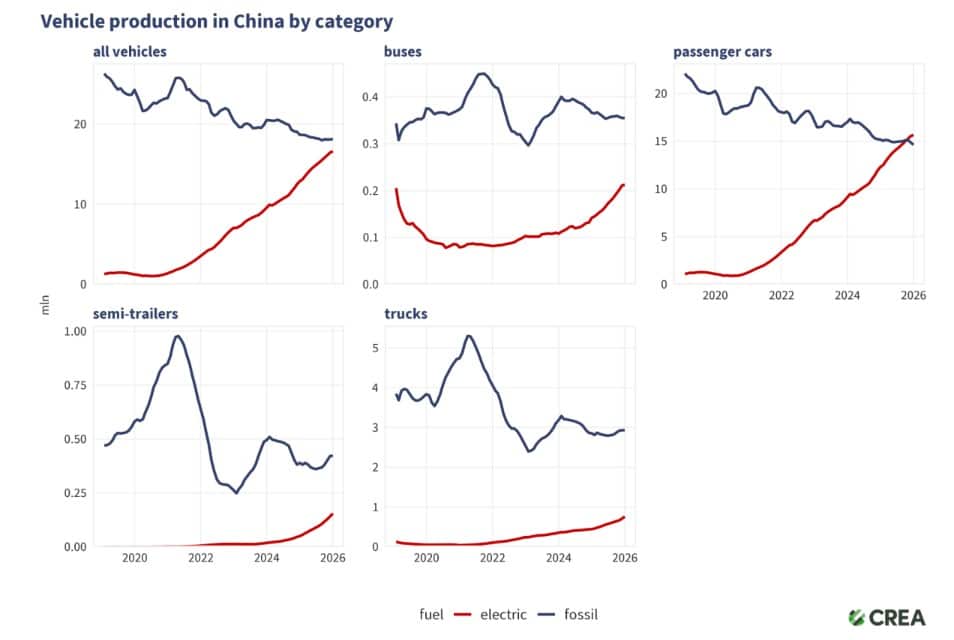

Of this total, the largest share of both total value and growth came from the production of battery EVs and plug-in hybrids, which expanded 29% year-on-year. This was followed by investment in EV manufacturing, which grew 18% after slower growth in 2024.

Investment in battery manufacturing also rebounded after a 2024 decline, driven by new battery technologies and strong demand from both domestic and international markets. Battery manufacturing investment grew by 35% year-on-year to 277bn yuan.

The share of electric vehicles (EVs) will have reached 12% of all vehicles on the road by the end of 2025, up from 9% a year earlier and less than 2% just five years ago.

The share of EVs in the sales of all new vehicles increased to 48%, from 41% in 2024, with passenger cars crossing the 50% threshold. In November, EV sales crossed the 60% mark in total sales, and they continue to drive overall automotive sales growth, as shown below.

Electric trucks experienced a breakthrough, with their market share rising from 8% in the first nine months of 2024 to 23% in the same period in 2025.

Policy support for EVs continues, for example, with a new policy that aims to double the charging infrastructure over the next three years.

Exports grew even faster than the domestic market, but the vast majority of EVs are still sold domestically. In 2025, China produced 16.6 million EVs, rising 29% year-on-year. While exports accounted for only 21% or 3.4m EVs, they grew by 86% year-on-year. The top export destinations for Chinese EVs were Western Europe, the Middle East, and Latin America.

The value of batteries exported also grew rapidly by 41% year-on-year, becoming the third-largest driver of GDP growth. Battery exports largely went to Western Europe, North America, and Southeast Asia.

In contrast with deflationary trends in the prices of many clean-energy technologies, average EV prices have held up in 2025, with a slight increase in the average price of new models after discounts. This also means the EV industry’s contribution to nominal GDP growth was even more significant, given that overall producer prices across the economy fell by 2.6%. Battery prices continued to drop.

Clean-power Generation

The solar power sector generated 19% of the total value of the clean-energy industries in 2025, adding 2.9tn yuan ($41bn) to the national economy.

Within this, investment in new solar power plants at 1.2tn yuan ($160bn) was the largest driver, followed by the value of solar technology exports and solar-generated power. Investment in manufacturing continued to fall after the wave of capacity additions in 2023, reaching 0.5tn yuan ($72bn), down 23% year-on-year.

In 2025, China set another record for wind and solar capacity additions. The country installed a total of 315 GW of solar and 119 GW of wind capacity, adding more solar than the rest of the world combined and twice as much wind.

Clean energy accounted for 90% of investment in power generation, with solar alone covering 50% of that. As a result, non-fossil power made up 42% of total power generation, up from 39% in 2024.

However, a new pricing policy for solar and wind projects and modest capacity-growth targets have created uncertainty about whether the boom will continue.

Under the new policy, new clean power has to compete on price with existing coal power in markets that disadvantage it in key ways. At the same time, the electricity markets themselves are still being introduced and developed, creating investment uncertainty.

Investment in solar power generation increased year-on-year by 15%, but experienced a strong stop-and-go cycle. Developers rushed to finish projects ahead of the new pricing policy coming into force in June, and then again towards the end of the year to finalise projects before the end of the current 14th five-year plan.

Investment in the solar sector as a whole was stable year-on-year, with the decline in manufacturing capacity investment balanced by continued growth in power generation capacity additions. This helped shore up the utilisation of manufacturing plants, in line with the government’s aim to reduce “disorderly” price competition.

By late 2025, China’s solar manufacturing capacity reached an estimated 1,200GW per year, well ahead of global capacity additions of around 650GW. Manufacturers can now produce far more solar panels than the global market can absorb, leading to historically low profitability amid fierce competition.

China’s policymakers have sought to address the issue since mid-2024, warning against “involution”, passing regulations and convening a sector-wide meeting to put pressure on the industry. This is starting to yield results, with losses narrowing in the third quarter of 2025.

The volume of solar panels and components reached a record high in 2025, growing 19% year-on-year. In particular, exports of cells and wafers increased by 94% and 52%, respectively, while panel exports grew by only 4%.

This reflects the growing diversification of solar supply chains in the face of tariffs and with more countries around the world building out solar panel manufacturing capacity. The nominal value of exports fell by 8%, however, due to a decline in average prices and a shift to exporting upstream intermediate products rather than finished panels.

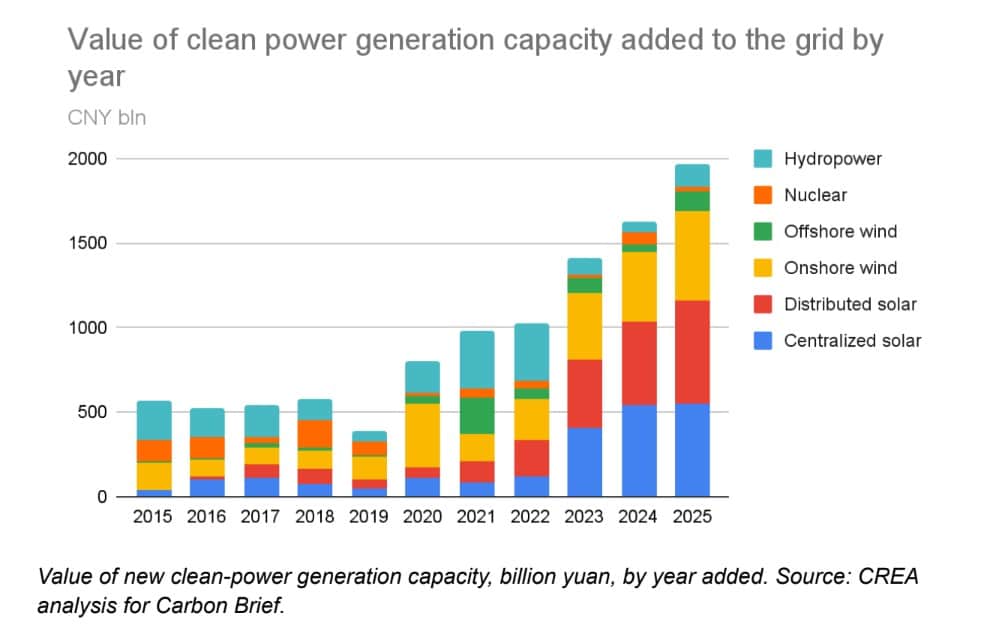

Hydropower, wind and nuclear were responsible for 15% of the total value of the clean-energy sectors in 2025, adding some 2.2 trillion yuan ($310bn) to China’s GDP in 2025.

Nearly two-thirds of this (1.3tn yuan, $180bn) came from the value of hydropower, wind and nuclear power generation, with investment in new power generation projects contributing the rest.

Power generation grew 33% from solar, 13% from wind, 3% from hydropower and 8% from nuclear. Within power generation investment, solar remained the largest segment by value – as shown in the figure below – but wind-power generation projects were the largest contributor to growth, overtaking solar for the first time since 2020.

In particular, offshore wind power capacity investment rebounded as expected, doubling in 2025 after a sharp drop in 2024.

Investment in nuclear projects continued to grow but remains smaller in total terms, at 17bn yuan. Investment in conventional hydropower continued to decline by 7%.

Electricity Storage and Grids

Electricity transmission and storage accounted for 6% of the total value of the clean-energy sectors in 2025, amounting to 1.0 trillion yuan ($140bn).

The most valuable sub-segment was investment in power grids, which grew 6% in 2025 to $90bn. This was followed by investment in energy storage, including pumped hydropower, grid-connected battery storage and hydrogen production.

Investment in grid-connected batteries saw the largest year-on-year growth, increasing by 50%, while investments in electrolysers also grew by 30%. The transmission of clean power increased an estimated 13%, due to rapid growth in clean-power generation.

China’s total electricity storage capacity reached more than 213GW, with battery storage capacity crossing 145GW and pumped hydro storage at 69GW. Some 66GW of battery storage capacity was added in 2025, up 52% year-on-year and accounting for more than 40% of global capacity additions.

Notably, capacity additions accelerated in the second half of the year, with 43GW added, compared with 23GW in the first half.

The battery storage market initially slowed after the renewable power pricing policy, which banned storage mandates after May, but this was quickly replaced by a “market-driven boom”. Provincial electricity spot markets, time-of-day tariffs and increasing curtailment of solar power all improved the economics of adding storage.

By the end of 2025, China’s top five solar manufacturers had all entered the battery storage market, making a shift in industry strategy.

Investment in pumped hydropower continued to increase, with 15GW of new capacity permitted in the first half of 2025 alone and 3GW entering operation.

Railways

Rail transportation accounted for 12% of the GDP contribution of the clean-energy sectors, with revenue from passenger and freight rail the largest source of value. Most growth came from investment in rail infrastructure, which increased 6% year-on-year.

The electrification of transport is not limited to EVs, as rail passenger, freight, and investment volumes continued to grow. The total length of China’s high-speed railway network reached 50,000km in 2025, making up more than 70% of the global high-speed total.

Energy Efficiency

Investment in energy efficiency rebounded strongly in 2025. Measured by the aggregate turnover of large energy service companies (ESCOs), the market expanded by 17% year-on-year, returning to growth rates last seen during 2016-2020.

Total industry turnover has also recovered to its previous peak in 2021, signalling a clear turnaround after three years of weakness.

Industry projections now anticipate annual turnover reaching 1 trillion yuan by 2030, a target previously expected to be met by 2025.

China’s ESCO market has evolved into the world’s largest. Investment within China’s ESCO market remains heavily concentrated in the buildings sector, which accounts for around 50% of total activity. Industrial applications make up a further 21%, while energy supply, demand-side flexibility and energy storage together account for approximately 16%.

Implications of China’s Clean-energy Bet.

Ongoing investment of hundreds of billions of dollars into clean-energy manufacturing represents a gigantic economic and financial bet on a continuing global energy transition.

In addition to the domestic investment covered in this article, Chinese firms are making major investments in overseas manufacturing.

The clean-energy industries have played a crucial role in meeting China’s economic targets over the five years ending this year, accounting for an estimated 40%, 25% and 37% of total GDP growth in 2023, 2024 and 2025, respectively.

However, developments next year and beyond are unclear, particularly for solar power generation, as the new pricing system for renewable power generation is expected to lead to a short-term slowdown and create major uncertainty. At the same time, central government targets have been set far below current rates of clean-electricity additions.

Investment in solar-power generation and solar manufacturing declined in the second half of the year. In contrast, investment in generation clocked growth for the whole year, showing the risk to the industries under the current power market set-ups that favour coal-fired power.

The reduction in the prices of clean-energy technology has been so dramatic that when the prices for GDP statistics are updated, the sectors’ contribution to real GDP – adjusted for inflation or, in this case, deflation – will be revised down.

Nevertheless, the key economic role of the industry creates a strong motivation to keep the clean-energy boom going. A slowdown in the domestic market could also undermine efforts to stem overcapacity and inflame trade tensions by increasing pressure on exports to absorb supply.

A recent CREA survey of experts working on climate and energy issues in China found that the majority believe that economic and geopolitical challenges will make the “dual carbon” goals – and with that, clean-energy industries – only more important.

Local governments and state-owned enterprises will also influence the sector’s outlook. Their previous five-year plans played a key role in creating the gigantic wind and solar power “bases” that substantially exceeded the central government’s level of ambition.

Provincial governments also have considerable leeway in implementing the new electricity markets and contracting systems for renewable power generation. The new five-year plans, to be published this year, will therefore be of major importance.

About the Data

Reported investment expenditure and sales revenue have been used where available. When this is not available, estimates are based on physical volumes – gigawatts of capacity installed, number of vehicles sold, and unit costs or prices.

The contribution to real growth is tracked by adjusting for inflation using 2022-2023 prices. All calculations and data sources are given in a worksheet.

Estimates include the contribution of clean-energy technologies to the demand for upstream inputs such as metals and chemicals.

This approach shows the contribution of the clean-energy sectors to driving economic activity, including outside the sectors themselves. It is appropriate for estimating how much lower economic growth would have been without these sectors’ growth.

Double counting is avoided by only including non-overlapping points in value chains. For example, the value of EV production and investment in battery storage of electricity is included, but not the value of battery production for the domestic market, which is predominantly an input to these activities.

Similarly, the value of solar panels produced for the domestic market is not included, as it is part of the value of solar power-generating capacity installed in China. However, the value of solar panels and battery exports is included.

In 2025, there was a major divergence between two different measures of investment. The first, fixed asset investment, reportedly fell by 3.8%, the first drop in 35 years. In contrast, gross capital formation grew at the slowest pace in that period, but still inched up by 2%.

This analysis uses gross capital formation as the measure of investment, as it is the data point used for GDP accounting. However, the analysis cannot account for inventory changes, so the estimate of clean-energy investment is based on fixed asset investment in the sectors.

The analysis does not explicitly account for the diminishing role of imports in producing clean-energy goods and services. This means that the results slightly overstate the contribution to GDP but understate the contribution to growth.

For example, one of the most important import dependencies that China has is for advanced computing chips for EVs. The value of the chips in a typical EV is $1,000, and China’s import dependency for these chips is 90%, suggesting that imported chips account for less than 3% of the value of EV production.

The estimates are likely to be conservative in some key respects. For example, Bloomberg New Energy Finance estimates “investment in the energy transition” in China in 2024 at $800bn. This estimate covers a nearly identical list of sectors to ours, but excludes manufacturing – the comparable number from our data is $600bn.

China’s National Bureau of Statistics says that the total value generated by automobile production and sales in 2023 was 11 trillion yuan. The estimate in this analysis for EV sales in 2023 is 2.3 trillion yuan, or 20% of the industry’s total value, even though EVs already accounted for 31% of vehicle production, and average EV selling prices were slightly higher than those of internal combustion engine vehicles.

This analysis is by Lauri Myllyvirta, lead analyst at Centre for Research on Energy and Clean Air (CREA) and Belinda Schaepe, China policy analyst at CREA.

CREA is an independent research organisation using scientific data, research and evidence to support the efforts of governments, companies and campaigning organisations worldwide in their efforts to move towards clean energy and clean air. CREA is headquartered in Finland, with 30 staff members across Asia, Europe, and North America.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.