Climate Finance at COP27: All Talk and Lack of Action

Source: E&E News

15 November 2022 – by Eric Koons

One of the major themes at COP27 2022 is climate finance for developing nations. This was slated to be a focal point of this year’s meeting, as it has historically been a significant roadblock to meeting climate targets.

At COP15 in 2009, developed countries pledged to provide USD 100 billion a year in funding to developing nations. So far, this target has yet to be reached.

Additionally, a UN and COP26-backed report released days before the start of COP27 found that the USD 100 billion in funding is nowhere close enough to stop runaway climate change. The report highlighted that developing countries need USD 1 trillion annually in external climate financing and the same amount from their own funds by 2030.

The OECD found that developing nations received USD 83.3 billion from public and private sources in 2020. This is far less than the world needs.

A central discussion at COP27 is how to facilitate closing this investment gap with contributions from both the public and private sectors.

The Fossil Fuel Industry and Windfall Tax

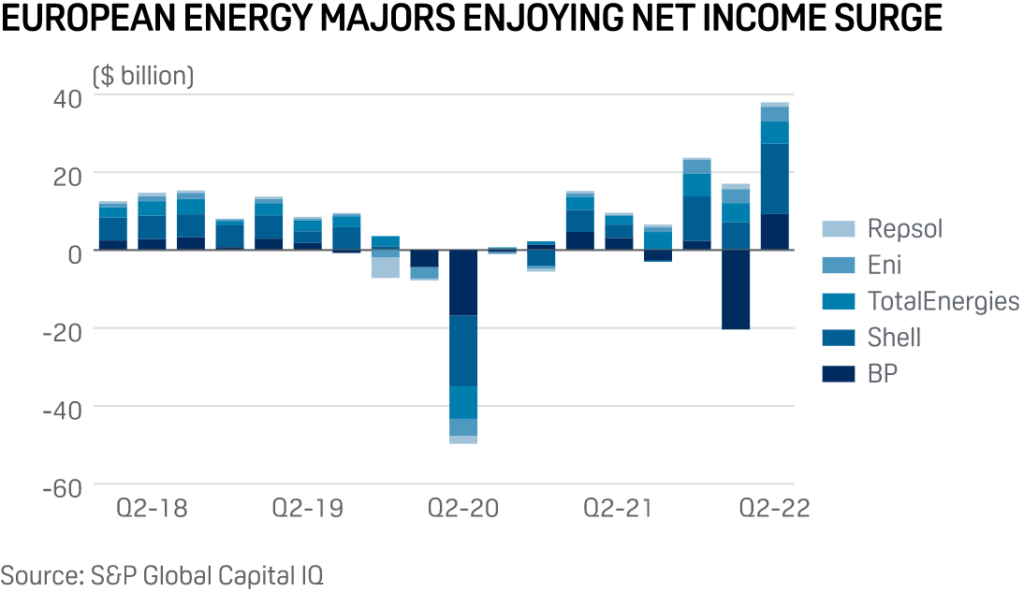

One climate finance option discussed at COP27 is implementing a “windfall tax” on fossil fuel companies. UN Secretary-General António Guterres put forward this idea in September after fossil fuel majors posted record profits in Q3 of 2022. He then reintroduced the idea on the first day of COP27 as a way to fund loss and damage benefits for developing nations.

Now, small island nations are championing the idea. These countries receive disproportionate impacts from climate change and are at the mercy of rising sea levels. The prime minister of Barbados highlighted this point, stating, “Profligate producers of fossil fuels have benefited from extortionate profits at the expense of human civilisation. While they are profiting, the planet is burning.” After this, Prime Minister of Barbados Mia Mottley called for a 10% tax on oil companies.

Development Banks and Debt Instruments

Climate financing through low-cost, long-term loans could be an impactful avenue for climate investment. This approach is an alternative to grants, which many developed nations and banks steer away from.

The UK’s export credit agency announced the inclusion of “Climate Resilient Debt Clauses” in its policies. These clauses will stop all debt payments for two years after a climate disaster impacts a borrowing nation. Similar policies by other lending agencies would help developing countries focus on rebuilding after disasters without the risk of default. Defaulting on loans hurts their borrowing capabilities in the future.

The Bridgetown Agenda

On a similar theme, Prime Minister Mottley put forward an updated version of the “Bridgetown Agenda”. She originally introduced the proposal at COP26, but it didn’t gain much traction. However, this version appears to be gaining momentum, with France voicing its support for the proposal.

The Bridgetown Agenda aims to facilitate major reforms to how the World Bank, International Monetary Fund (IMF) and other multilateral development banks handle climate financing for developing nations. In short, it improves access to low-interest capital for developing countries.

Central to the agenda is the IMF’s development of a climate mitigation trust of USD 650 billion. This trust will allow nations to borrow money for climate action at very low interest rates. Research shows that this initial investment by the IMF will stimulate an additional USD 2 trillion in private investment. The agenda also calls for development banks to issue USD 1 trillion in low-interest loans for developing countries.

“Adopting these clauses in debt instruments is the single most impactful way of making the international financial system fitter for the new world of shocks and for international development.”

Mia Motley, Prime Minister of Barbados

The Private Sector Remains Silent

The private sector has been largely muted at COP27, particularly after the Glasgow Financial Alliance for Net Zero (GFANZ) has been faltering. As a result, several major governments are calling on the private sector to do more to support climate finance.

US Special Presidential Envoy for Climate John Kerry summed up this general sentiment during a talk at COP27. “Without it, no government has enough money to accelerate and support the process. We need everybody engaged in this,” said Kerry.

Meanwhile, the insurance industry has made several promising pledges. For example, 85 African insurance companies created the African Climate Risk Facility (ACRF). The ACRF will provide USD 14 billion in climate risk insurance across the continent. The initiative hopes to collect donor funds to offset premium costs for poor governments.

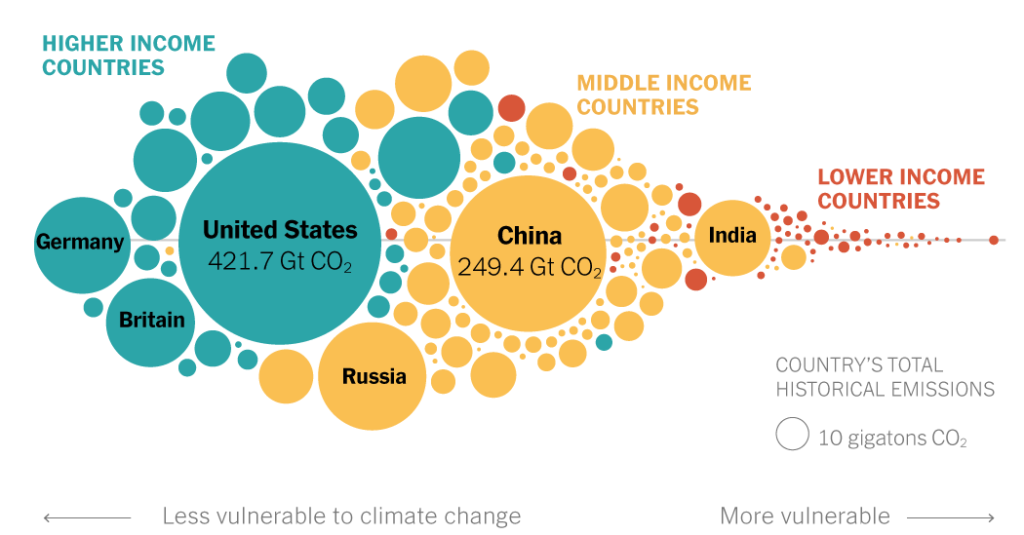

Africa only accounts for around 4% of global emissions, yet climate change will severely impact it.

Climate Funding Going Forward

While there has been a lot of discussion around climate finance at COP27, there has not been much concrete action. It is clear that developing nations need a significant amount of funding soon if the world is to keep warming below 1.5 degrees Celsius. Additionally, loss and damage funding for developing nations is critical for these countries to cope with the already inevitable climate impacts.

Developed nations need to step up and accept their role in funding the global energy transition. Not only have their past actions led to the current climate crisis, but their lack of meeting existing climate financing pledges continues to make climate mitigation harder.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more