Fossil-linked Energy Firms Have High Emissions and the Room for Denial is Shrinking

Shutterstock: Nicholas Ahonen

02 March 2023 – by Christina Ng

Investors can soon rely on improved, comparable and complete emissions data that are key to their investment decision-making.

The first set of globally aligned sustainability and climate-reporting standards is expected to be published in June 2023. The news was announced at the World Economic Forum in Davos in January 2023 by the Chairman of the International Financial Reporting Standards Foundation, Erkki Liikanen.

Chief among the new requirements is emissions reporting, including Scope 3.

This is a significant development. It brings all emitters and associated businesses into the spotlight and gives a holistic picture of how responsible any entity is for high-emitting activities and, thereby, that entity’s contribution to climate change.

With the inclusion of Scope 3 reporting, these entities will have little chance of ignoring their actual complicity in emissions. It would also facilitate discussions about their transition efforts and potentially minimise greenwashing.

This commentary focuses on companies in the energy value chain — including those in production, extraction, distribution and utilities — the higher-emitting sectors for most markets.

Steps Closer to Recognising Emissions on Paper

The global baseline standards have been developed under considerable support from the investment community — including the Net Zero Asset Owner Alliance, which represents more than US$10 trillion in assets — and the International Organization of Securities Commissions (IOSCO), which wields significant influence over global securities markets. The standards are a crucial building block that aligns with other important agendas like ESG ratings and the burgeoning US$5.8 trillion sustainable finance market.

The foundation’s International Sustainability Standards Board, in charge of developing the standards, is in the thick of deliberations to meet the June 2023 deadline.

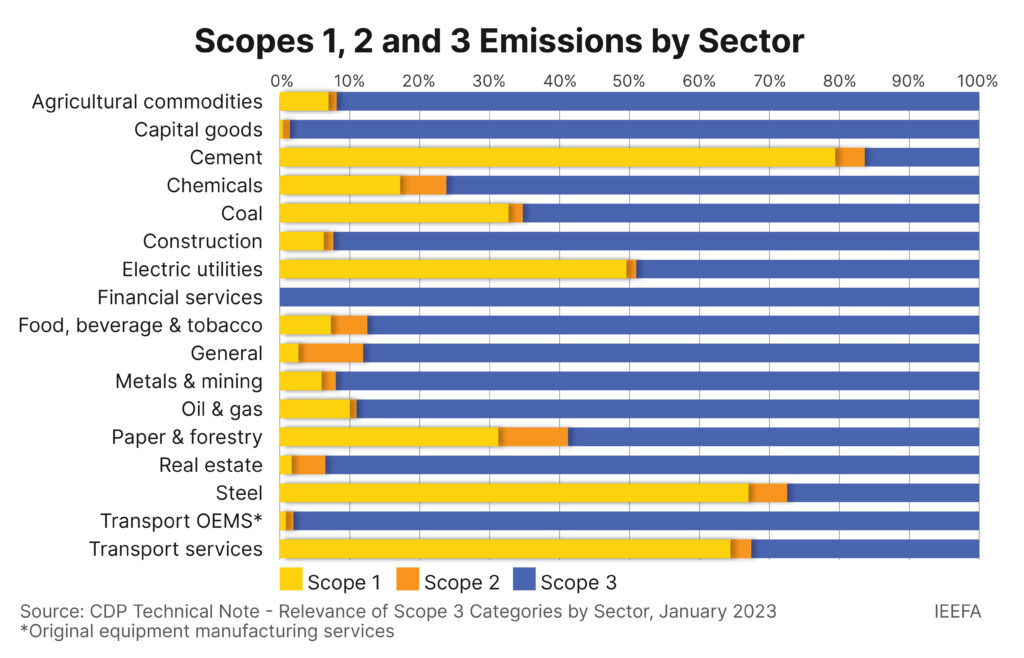

A key aspect of the standards is requiring emissions reporting across the value chain, which is categorised into three scopes as defined by the Greenhouse Gas Protocol Corporate Standard:

- Scope 1 constitutes emissions from sources owned or controlled by the company.

- Scope 2 represents indirect emissions from purchased energy input, such as electricity or heat, which are not generated directly by the company.

- Scope 3 represents all other emissions in the company’s value chain, including upstream (input) and downstream (output).

However, entities will receive an extra grace period of one year before Scope 3 reporting becomes mandatory, more than that allowed for scope 1 and 2 submissions.

The relief is a necessary compromise to provide entities with the time to get their emissions accounting processes in place. It also ensures that the requirement ultimately secures the support needed globally for adoption and aligns with the timelines of the United States’ and European Union’s respective proposals on Scope 3 reporting.

Despite the delay and ongoing debate, this development is considered significant given the dearth of comparable and consistent emissions reporting today — particularly on Scope 3.

Why Scope 3 Emission is Important

Scope 3 emission requires systemic thinking about the entire value chain of an entity’s operations and is usually the largest hidden category of emissions for most. In other words, it is a huge hidden risk to investors.

The immensity is mind-blowing: Scope 3 accounts for around 90% of total emissions from the oil and gas production sector and up to 70% from the coal sector. This is because of midstream and downstream activities, particularly in the distribution, final combustion and use of oil and gas products. Scope 3 emissions from power providers, where combustion happens, are around half the total emissions mainly derived from distribution systems and user consumption.

Because Scope 3 emissions have grown much faster than scopes 1 and 2, companies and their stakeholders are more exposed to rising hidden costs within the company’s value chain than they realise. This undermines their profitability and performance.

Long-term investors are therefore concerned about identifying companies that are connected and most exposed to emissions risk.

Such risk also applies to banks, asset managers and insurers in relation to their financed or facilitated emissions — another reporting requirement under the new standards. Financial institutions usually have far lower emissions from scopes 1 and 2; their products and services do not release gases, and the electricity used is controllable. However, their lending or investing decisions can result in clients supporting new or existing fossil-related projects that contribute significant greenhouse gases that harm the environment. Scope 3 emissions, therefore, reveal the institution’s impact on climate, its association with high-emitting activities, and its ability to influence emissions.

Using Emissions Data to Cut Through the Greenwash

Energy companies pledging to decarbonise their operations or claiming to offer “low-carbon” products usually refer to scopes 1 and 2 emissions only, leaving out much of their carbon footprint. This enables the company to appear more environmentally friendly than in reality.

For example, gas transmission companies in Europe market themselves as “low-carbon,” but when factoring in Scope 3 emissions associated with the final use of the transported gas, their actual emissions are at least 100 times greater than the total reported. Gas producers have also claimed to export “carbon-neutral liquefied natural gas” by buying carbon offsets or using carbon capture technology to “capture” the emissions generated from producing natural gas. However, up to 90% of emissions from producing oil and gas occur when the product is burned, and these are Scope 3 emissions left out of the picture.

The full scale of emissions from the cradle to the grave will be laid bare for all to see when Scope 3 reporting is mandated and improved, limiting the room for greenwashing. This can only lead to more meaningful investor decisions and robust discussions framed around transition plans, risks and opportunities.

What’s Next?

Ongoing refinements around Scope 3 measurement will continue to be debated and resolved.

The foundation has flagged its next task, which is to ensure global adoption of the standards. Market regulators will likely mandate the application of the standards, or they risk becoming irrelevant.

Energy companies and their stakeholders would be wise to implement robust decarbonisation plans and systems. IOSCO’s involvement suggests that companies will have to start moving quickly.

About IEEFA

The IEEFA conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.