Global Hydrogen Market: Size, Growth and Future

Liquid hydrogen fuel tank / Wikimedia Commons

23 May 2023 – by Eric Koons Comments (0)

Hydrogen is a versatile element with various applications in various industries. The hydrogen market is primarily focused on refining crude oil, producing ammonia fertilisers and processing metals. However, in recent years, an ongoing effort has been made to make it a viable renewable energy source.

Hydrogen Fuel Cells

In the future, green hydrogen has the potential to revolutionise the energy industry and transform the way we live. One of the most promising hydrogen applications is in the transportation sector, where it is an alternate fuel for vehicles. With hydrogen fuel cells, vehicles can run on electricity generated from renewable energy without the restrictions posed by batteries.

Hydrogen can also store energy from renewable sources, making it a crucial component of the transition to a low-carbon economy. We can create a sustainable and reliable non-fossil fuel energy system by producing hydrogen using renewable energy sources instead of fossil fuels like natural gas.

What Does the Hydrogen Market Look Like Today?

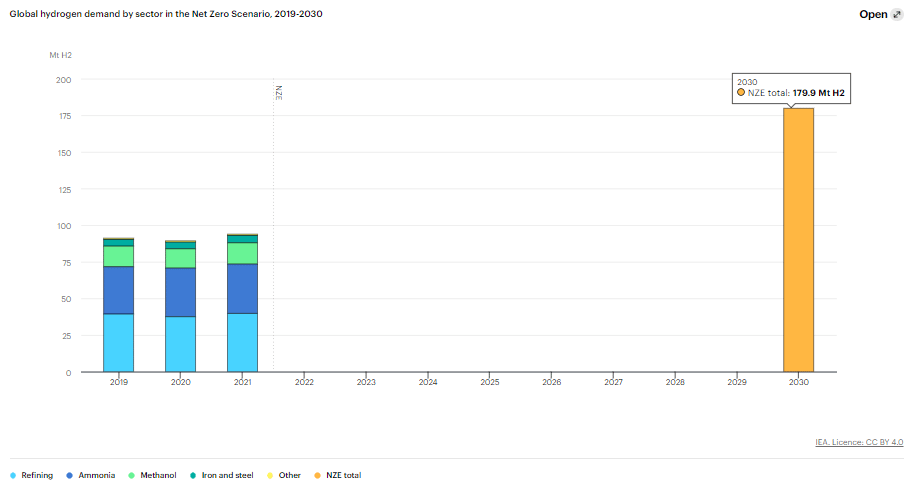

In 2022, the global hydrogen market was valued at USD 155.35 billion, and it is gaining momentum. During 2021 and 2022, nine countries unveiled national strategies for hydrogen, which will cover about 30% of global energy sector emissions. While most of the hydrogen produced is for the chemical and petrochemical sectors, hydrogen demand in new applications has also slowly grown.

This is reflected in the accelerating deployment of hydrogen fuel cell vehicles, like heavy-duty trucks in China. Additionally, there is progress in some critical new applications for hydrogen, such as the steel sector. New projects are growing quickly just a few years after the first large pilot project for using green hydrogen in steel production.

This growth will continue throughout the next decade. Grand View Research forecasts a compound annual growth rate of 9.3% from 2023 to 2030 for the industry. This will partly result from the rising demand for cleaner fuel from evolving national and international low-carbon regulations.

What Is the Biggest Hydrogen Market?

The Asia-Pacific region has emerged as the biggest hydrogen market in 2022. The region is home to some of the largest economies in the world – many of which are industrial hubs. The vast majority of hydrogen demand in the region is for petrochemicals.

However, the region is also a hotspot for hydrogen vehicles. China is the largest producer of hydrogen fuel cell trucks and cars. These vehicles are becoming increasingly popular among consumers and corporations looking for more viable low-carbon transportation options.

What Is the Future of the Global Hydrogen Generation Market?

Hydrogen is an efficient energy carrier for renewables and is critical in the transition towards a more sustainable and cleaner energy future.

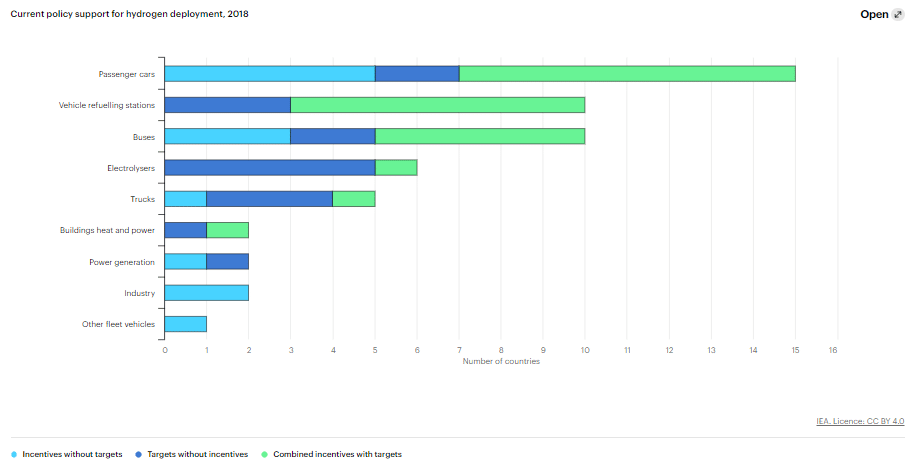

The International Energy Agency (IEA) produced a landmark report to explore the future development of the hydrogen market. The report finds unprecedented political and business momentum in the sector, with clean hydrogen championed by a growing number of policies and projects in different countries. The report concludes that now is the time to scale up green hydrogen production technologies and reduce the cost of hydrogen to generate widespread adoption.

Annual Hydrogen Production

Meanwhile, research done by the World Economic Forum (WEF) found that if all planned hydrogen projects come online, annual hydrogen production could reach 16-24 Mt by 2030. Green hydrogen production would make up 9-14 Mt and blue hydrogen 7-10 Mt. To support this, scaling up manufacturing capabilities could bring a 70% cost reduction to electrolyser production by 2030. Electrolyser cost is one of the main reasons green hydrogen is cost prohibitive.

However, the hydrogen market is still subject to significant uncertainties. These include demand, evolving and disjointed regulatory frameworks and a lack of established pipelines and shipping infrastructure as support.

The Potential for a Green Hydrogen Market

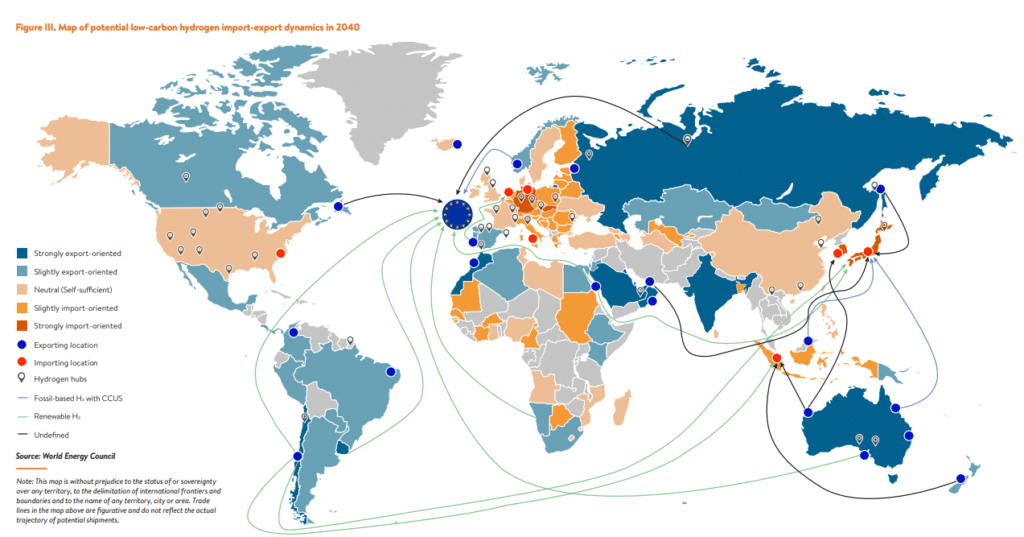

Consulting giant PwC assessed the cost to produce green hydrogen across different markets. Its analysis suggests that hydrogen demand will grow steadily until 2030 as various sectors adopt it. During this time, innovative partnerships will emerge across industries to facilitate hydrogen projects and reduce production costs by roughly 50% by 2030.

After 2030, hydrogen production costs will gradually decrease, with production costs in several regions expected to be around €1-1.5/kg. Production costs in regions with limited renewable energy resources, like Europe, Japan or South Korea, will be roughly €2/kg, so these markets will likely become net importers of green hydrogen.

The Business Case for Green Hydrogen

Expanding low-emissions energy technologies presents a significant opportunity for businesses and investors alike. Given the pressing need to reduce carbon emissions and mitigate the impacts of climate change, there is a growing demand for low-carbon energy solutions that can power homes, businesses and transportation systems.

This demand drives innovation and investment in various technologies, including solar, wind, geothermal and hydroelectric power. Expanding capacity and infrastructure for other low-carbon fuels, such as hydrogen and biofuels, will require significant capital spending, creating new opportunities for businesses and investors in these emerging sectors.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more