Is Steel Bad For The Environment? A Look At Nippon Steel

Source: Reuters

03 June 2024 – by Eric Koons

Is steel bad for the environment? In its current state – yes.

Steel production is responsible for over 7% of global greenhouse gas emissions, accounting for 2.6 billion tonnes of CO2 emissions annually. This makes it one of the highest-emitting industrial sectors for energy use and a significant contributor to climate change.

As the world’s third-largest steel producer, Japan’s steel industry is a major influence on the industry’s global emissions. About 75% of Japanese steel production is dependent on coal-based blast furnaces.

Nippon Steel is a dominant force in the Japanese steel industry and is central to this issue. The company’s decarbonisation policies remain dubious, setting the industry on a subpar trajectory.

Nippon Steel: A Key Player in Japan’s Steel Industry

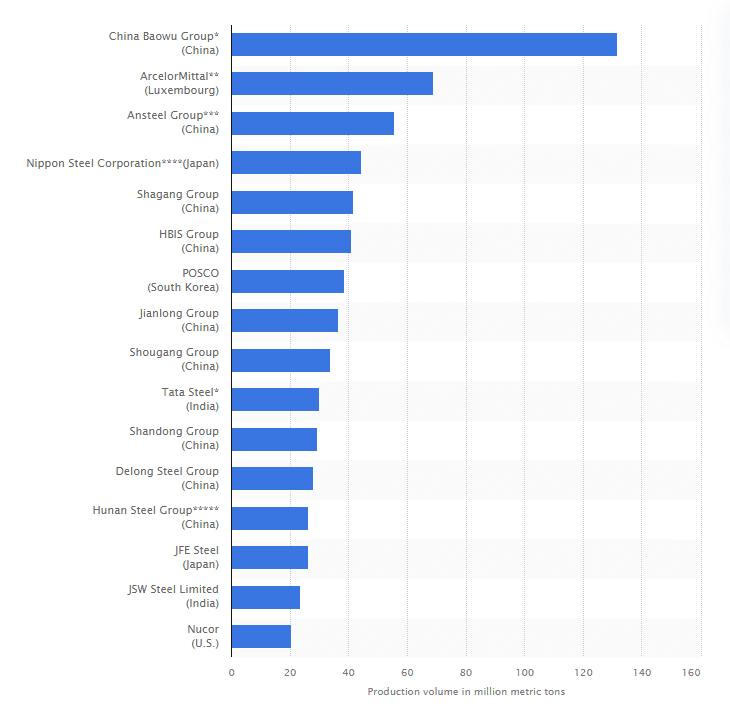

Nippon Steel is Japan’s largest steelmaker and the fourth largest in the world. The company accounts for around 40% of the country’s total steel production, with a crude steel production capacity of approximately 66 million tonnes. To support these operations, it employs approximately 100,000 people around the world.

Their operations, including those of their domestic subsidiaries, generated approximately 75 million tonnes of CO₂ emissions in 2022. This accounts for over 6.5% of Japan’s total emissions. As a result, the company has significant influence over both production practices and policy decisions.

Furthermore, Japan’s 2030 and 2050 decarbonisation goals are not feasible without a buy-in from Nippon Steel.

Nippon Steel’s Decarbonisation Strategy

Nippon Steel announced its Carbon Neutral Vision 2050 in 2021, which it highlighted as a medium and long-term priority. The goal is to be net-zero by 2050, with an interim 2030 goal of reducing emissions by 30% by 2030 compared to 2013 levels. This falls short of Japan’s Nationally Determined Contribution (NDC) of reducing emissions by 46% compared to 2013 levels by 2030. However, it aligns with the country’s 2050 net-zero target.

This gap in the 2030 target is a major red flag. The country’s 2030 goal is a stepping stone for its long-term 2050 plan. If Nippon Steel is a laggard in the interim goal, it will weigh down the country’s net-zero progress and potentially derail necessary national policies. Additionally, it will perpetuate a steel industry that is bad for the environment.

Progress on Decarbonisation

Another concern is Nippon Steel’s slow progress towards its already lacklustre 2030 goal. The company’s emissions are almost identical to those in 2020 and only slightly improved from 2021.

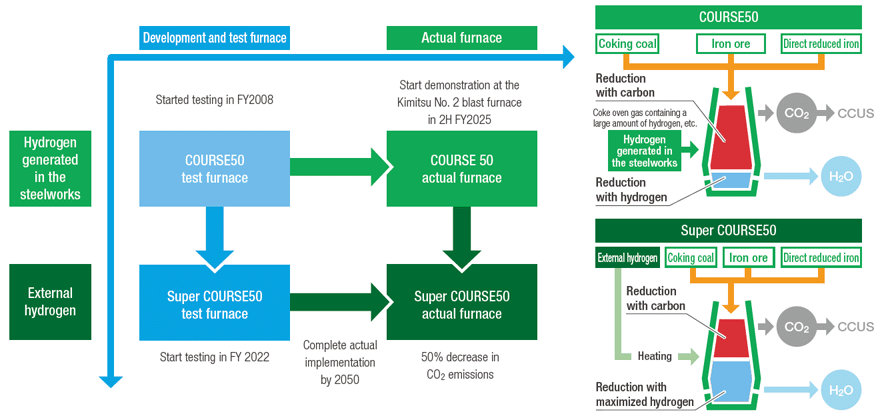

Although missions reductions for such a large fossil-fuel-dependent company take time, 2030 is in the near future. Its 2030 strategy focuses on reducing emissions in existing processes and implementing COURSE5O blast furnaces.

COURSE50 blast furnaces partially replace coal with hydrogen to reduce emissions. However, the technology has only been used in test furnaces and will not be demonstrated on a large blast furnace until 2025. If the approach is not successful, it will cripple the company’s near-term decarbonisation strategy and perpetuate steel production that is bad for the environment.

Furthermore, there is the question of which type of hydrogen the blast furnace will use. Green hydrogen is the only low-carbon option, yet it accounts for less than 1% of total hydrogen production. The most accessible option is blue hydrogen, which produces 20% more emissions than coal. To enable the emissions reductions the COURSE50 reactors target, they will require green hydrogen, which depends on Japan rapidly scaling up its green hydrogen production.

This leaves Nippon Steel’s decarbonisation strategy dependent on several factors primarily out of their control.

Continued Investment in Coal

Another major concern is Nippon Steel’s continuing reliance on coal. While its 2030 and 2050 goals aim to reduce coal use with alternative production methods, the company’s actions do not align with this.

The company has publicly stated it is looking to invest in coking coal resources. In just the last year, it purchased a 20% stake in Canadian coal company Teck Resources for USD 1.34 billion and a portion of the mining interests at the Grosvenor Coal Mine in Australia for USD 57 million. This comes at a time when other Japanese investors are pulling out of coal mines in Australia.

These investments will prolong the company’s decarbonisation efforts and provide a runway for it to make a return on its coal investments. Furthermore, coal investments have a real threat of becoming stranded assets, which will weigh down the company’s future financial success.

Greenwashing Risk

These coal investments and a decarbonisation plan that hinges on untested technologies open the company up to greenwashing claims. First, the investments in coal do not align with the company’s decarbonisation goals. Additionally, the company has lobbied the Japanese government for USD 17 billion over the next few decades to help it decarbonise. Ongoing coal investments and government decarbonisation subsidies are at odds.

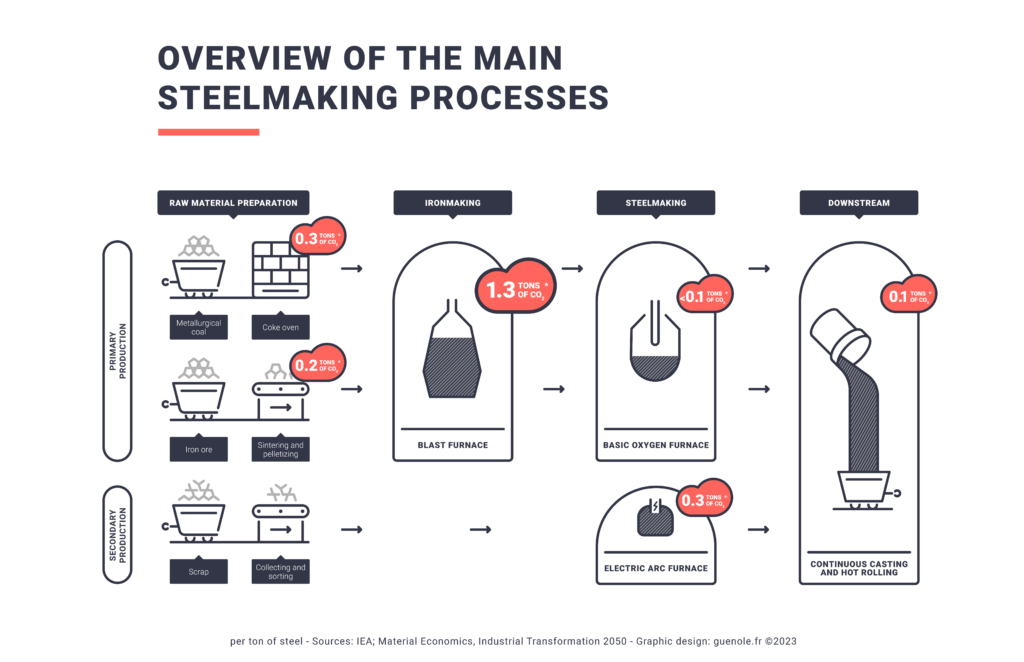

Second, the company’s decarbonisation plan hinges on unproven technologies. However, proven low-carbon steel production technologies – like electric arc furnaces (EAF) – are on the market. This raises the question of whether Nippon Steel’s innovative decarbonisation strategy is just a flashy distraction from making concrete progress, prolonging a steel industry that is bad for the environment.

Updating Nippon Steel’s Decarbonisation

To genuinely reduce its carbon footprint, Nippon Steel could adopt an alternative 2030 strategy. It should shift significant focus to proven technologies and practices, such as large-scale EAFs powered by renewable energy and the increased recycling of scrap steel.

While ongoing investment into developing COURSE50 reactors and hydrogen reduction is valuable, it should not be the primary pathway to decarbonisation. It should be a complementary approach that can be implemented when feasible.

Furthermore, the company should reallocate its investment in coal mines towards its decarbonisation efforts. This will provide added capital to expedite the low-carbon transition and help the company gain market share in green steel. Green steel is a lucrative market that is expanding faster than production, creating a supply gap – a prime investment opportunity.

Steel Sector and Government Collaboration Is Critical

Nippon Steel’s substantial influence over Japan’s steel industry underscores the importance of its role in the nation’s decarbonisation efforts and in developing a steel industry that is not bad for the environment. Despite its ambitions, the company’s reliance on coal and unproven technologies poses significant challenges and risks of greenwashing claims.

However, it’s not just Nippon Steel that needs to improve. Japan’s government is also important in the sector’s decarbonisation efforts. Policies to promote the development of renewable energy and green hydrogen are critical. If these low-carbon energy options are unavailable, the steel sector will not be able to decarbonise – even if it switches to EAFs.

The public and private sectors must work together to facilitate the steel industry’s decarbonisation. Further collaboration is necessary and will not be possible without realigning both decarbonisation strategies to a common target.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more