Japan’s LNG Investments in the US Gulf South: A Costly Miscalculation [Op-Ed]

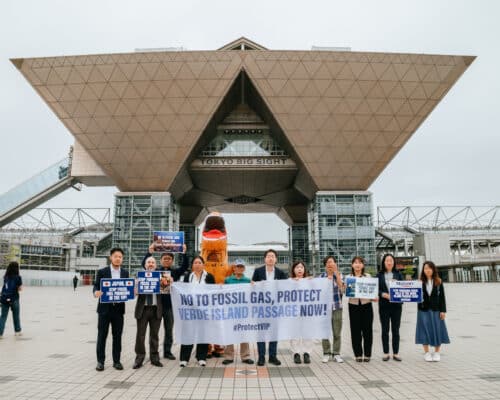

Photo by FoE Japan & Freeport Haven Project

30 January 2025 – by Manning Rollerson and Ayumi Fukakusa

As Japan positions itself as a clean energy leader in Asia, its financial institutions are making a strategic error that threatens its economic interests and climate commitments: doubling down on liquefied natural gas (LNG) infrastructure, especially along the United States Gulf South.

As environmental justice leaders from the US Gulf South travel to Tokyo to meet with Japanese financial institutions and policymakers this week, a recent Department of Energy analysis reveals that US LNG exports, far from serving as a “bridge fuel,” are actively competing with renewable energy adoption. More troublingly, a growing body of scientific evidence demonstrates that exported LNG is significantly worse for the climate than coal. Recent peer-reviewed research demonstrates that exported LNG has a 33% greater climate impact than coal when accounting for the entire supply chain.

This reality is visible through the specialised optical gas imaging cameras we use to monitor shale areas, including the Permian Basin – a vast oil and gas region that feeds directly into Gulf Coast export terminals through a sprawling network of pipelines and compressor stations. Japanese investments are enabling this massive buildout of connected methane gas infrastructure, from the wellheads in West Texas to the export facilities in the Gulf South. These cameras reveal constant intentional methane releases – not just mere leaks but designed venting of this gas, which is harming human health and worsening the climate crisis. At every step along this thousand-mile journey from the Permian to the Gulf Coast terminals, methane escapes into the atmosphere. With methane being 80 times more potent than carbon dioxide at warming our climate over 20 years, Japanese financiers stand out as the top backers of US LNG. The Japanese government is the largest public financier of US LNG. Japanese private banks MUFG, Mizuho and SMBC are the top 3 private financiers of US LNG, providing over $35 billion. Japanese institutions, such as the Nippon Export and Investment Insurance, are considering financing to expand the Cameron LNG export terminal. Some critical energy and climate-related policies, including the Strategic Energy Plan, are currently subject to public consultation in Japan, and the policy drafts emphasise LNG for “energy security.”

But, the financial risks for Japanese investors are mounting. Major insurers like Chubb are withdrawing coverage from LNG projects like Rio Grande LNG, while legal challenges to new export permits are gaining traction. While President Trump has ended the pause on LNG export approvals and declared an energy emergency, his administration’s approach also reflects concern that rushed permits will be overturned in court – a testament to the growing legal vulnerability of these projects. Combined with the frontline communities’ proven track record of successfully delaying terminals during Trump’s first term, these investments face significant obstacles and mounting community opposition regardless of who occupies the White House.

Beyond the financial and climate risks lies an even more immediate human cost. Residents face severe health impacts in communities like Freeport, Texas, where Japanese banks have financed major LNG terminals. Cancer clusters, respiratory disease and water contamination are enacted on predominantly low-income communities of colour – a pattern of environmental injustice that exposes project backers to serious reputational, legal and financial risks.

The response is clear. Japanese institutions must reassess their LNG investment strategy, acknowledging that these projects’ rising risks outweigh their diminishing returns. With renewable energy costs continuing to fall and global climate policies tightening, Japan’s financial sector can redirect capital toward renewable energy solutions that align with its economic interests and climate commitments while safeguarding human rights.

The alternative – continuing to bankroll infrastructure that harms vulnerable communities while accelerating climate change – is neither sustainable, defensible, nor sound investment. Japan’s global leadership in the clean energy transition hangs in the balance.

Manning Rollerson Jr III is a Freeport resident and the founder of the Freeport Haven project, a non-profit focused on housing and environmental justice. He is an outspoken activist fighting against local corruption and industrial pollution along the Gulf Coast, where the fossil fuel industry severely impacts people’s health and safety.

Ayumi Fukakusa is the Deputy Director of Friends of the Earth Japan, an environmental organisation that protects the environment and promotes social and environmental justice.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.