Japan’s Natural Gas Dependence: A Liability For the G7

25 April 2023 – by Eric Koons

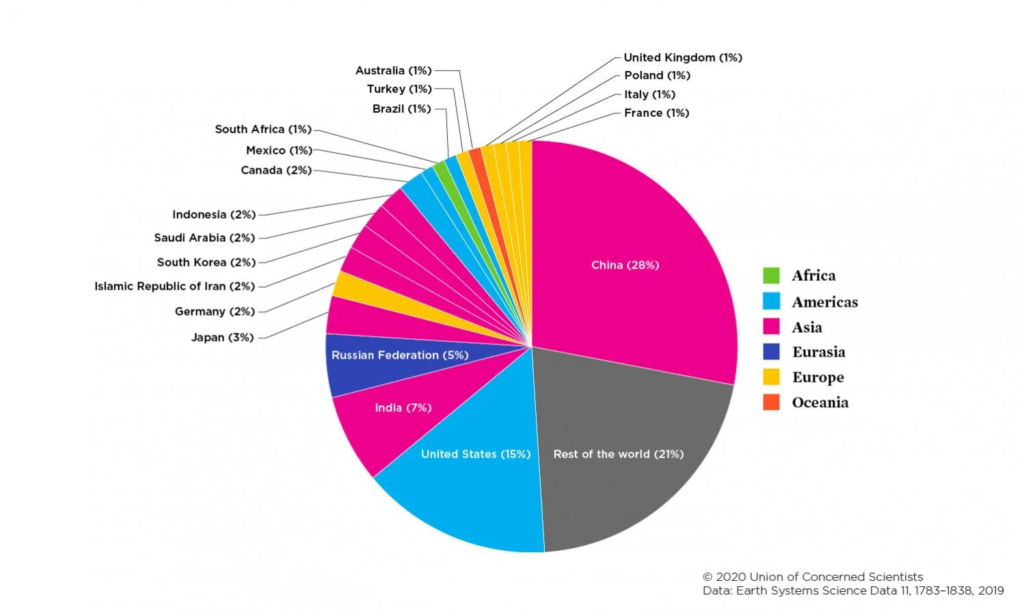

Japan is the seventh-largest consumer of natural gas, and as a resource-poor country, it relies on imports to satisfy these demands. 22% of global LNG imports go to Japan, making it the largest importer of natural gas. This high reliance on natural gas and other fossil fuels is the main reason the country also has the fifth-highest rate of CO2 emissions of a single country, accounting for over 2.5% of global emissions per year.

Japan’s gas use has steadily climbed since the 1980s and saw a significant spike in 2011. Following the Fukushima incident, Japan closed its 54 nuclear reactors. This immediately created a 30% energy gap, which was filled with fossil fuels. As of 2021, one-fifth of the country’s total energy and over one-third of its electricity came from natural gas.

As a member of the G7, Japan is balancing ending fossil fuel reliance with developing its needed low-carbon energy capacity. While most G7 nations have pledged to decarbonise the electricity sector by 2035, they are also considering supporting new natural gas investment – a priority for Japan. These two policies are incompatible, and further investment into natural gas will slow the energy transition.

Natural gas will undoubtedly be a major discussion point at this year’s G7 meeting in Japan.

How Does Japan Get Natural Gas?

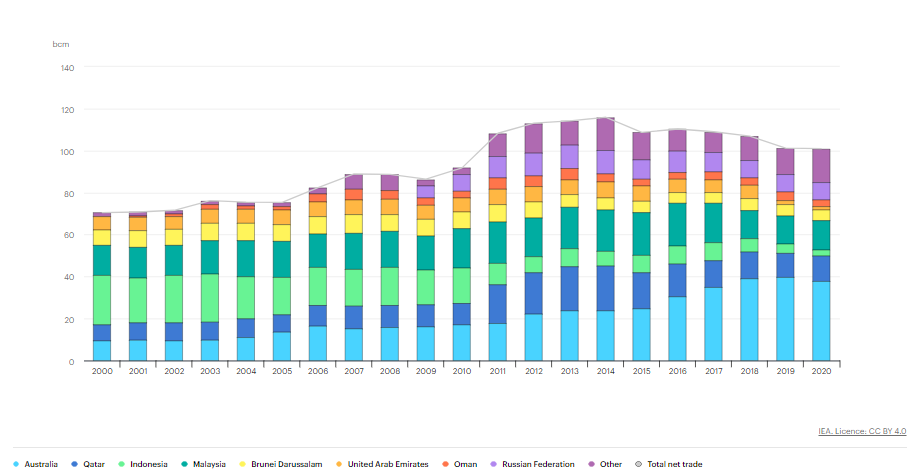

Natural gas accounts for 21% of Japan’s total energy consumption, and over 90% is imported. While natural gas imports peaked in 2014 following a steep rise after the Fukushima disaster, they have only slightly declined since.

As of 2022, Japan imported 71.99 million tonnes of natural gas, a 3.1% decline over the previous year. However, policy changes are only one of the drivers of this decline. It is mainly from higher energy prices. Japan’s total spending on natural gas imports increased by 97.5% between 2021 and 2022.

Domestic Production

Domestic production is extremely low, at just 2.2% of total consumption. While this is partly because the country has minimal natural gas fields, many available gas fields remain undeveloped.

Japan is promoting domestic gas production as part of a move to become more energy independent. This includes partially funding the development of one of the country’s largest gas fields, which has a capacity of 2.8 billion cubic metres of natural gas. Once online, it will provide 1.2% of Japan’s total natural gas demand.

However, even with these projects, imports of natural gas will remain central to the country’s energy grid.

Japan’s LNG Import Statistics

Australia is the largest LNG exporter to Japan, which has been steadily gaining its share over the last decade. In 2022, Australia supplied Japan with 43% of its total natural gas demand, an increase of 15% from 2021. This total value of over USD 19 billion accounts for 37.9% of Australia’s entire LNG exports. This dependence raises questions for both countries, which are vulnerable to declining production or demand.

Qatar, Malaysia, the USA and Russia account for most of the remaining LNG imports.

Japan’s Liquefied Natural Gas Terminals and Infrastructure

Japan has developed a network of 37 LNG receiving terminals to receive gas imports that connect to a gas network of 261,167 km of pipelines. However, the gas network remains relatively fragmented, as regional utilities and gas companies own most pipelines. There is no single transmission system operator, like many other countries have.

The current countrywide LNG storage capacity is 18 million cubic metres, enough to supply the country for 36 days.

Why Are Gas Prices High in Japan?

Considering that Japan has very low domestic natural gas production and no direct pipelines to import gas, the price of gas has never truly been low. Instead, it depends highly on the global LNG market, which is sensitive to many factors like supply and geopolitical events.

This is becoming a significant concern, as Japan’s gas import prices are reaching record levels, driving up consumer electricity prices in what some consider an ongoing energy crisis.

Supply Failing To Keep Up with Demand

The main reason for the recent gas price spike is supply and demand.

First, global access to natural gas has been dropping due to the Russia-Ukraine war. Russia is the world’s second-largest natural gas producer, and in 2022, production fell by around 12%. This drove up LNG prices to record levels in 2022.

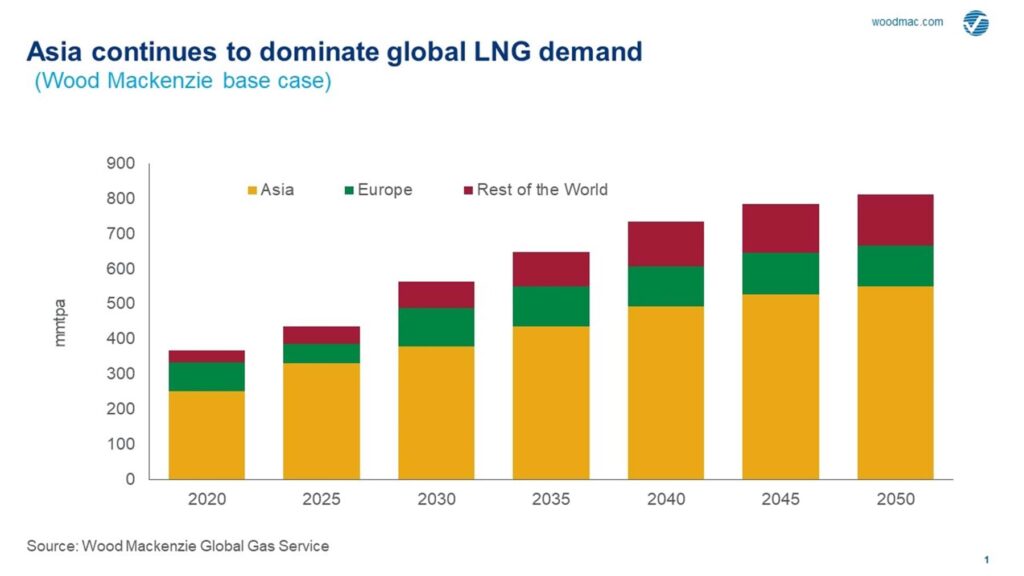

Second, Japan bought gas during the summer of 2022 to prepare for the winter demand surge. This exacerbated the already high prices by further limiting global LNG supplies. Meanwhile, demand for LNG throughout Asia has steadily increased. Additionally, demand in Asia will further outstrip supply as economic activity recovers in China and the country reduces its COVID-19 restrictions. Some estimates have put China’s demand growth at 35% during 2023.

Japanese Energy Independence

Japan has historically struggled with energy, as it has limited domestic fossil fuel resources. As a result, the country has become highly dependent on energy imports, which make it vulnerable to market prices and can cause it to become a potential liability for allied nations. This is highlighted by the Russia-Ukraine war, during which G7 nations drastically reduced LNG imports from Russia. Yet, Japan was unable to follow its peers because it could not fill the subsequent energy gap.

However, this can be a different case moving forward, particularly as renewables have become cost-competitive with fossil fuels. Japan has the third highest offshore wind and geothermal energy potential as an island nation. Government support to develop these renewable energy resources will help Japan build energy independence and a resilient, renewable-powered grid.

This article is available in the Japanese language on Energy Tracker Japan.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more