Solar Energy in Brazil: From Opportunity to a 55 GW Reality

Source: Monga Bay

09 July 2025 – by Eric Koons

Solar energy in Brazil surpassed the 55 GW milestone in March 2025, more than doubling its photovoltaic (PV) count in the last few years. That breakneck expansion is reshaping Brazil’s energy security, sharpening its industrial competitiveness and putting its 2030 climate pledges within reach.

Solar Energy in Brazil 2025

Brazil’s photovoltaic energy boom now rests on two complementary pillars.

Utility-scale Buildout and Flagship Solar Farms

Of the total, 17.6 GW comes from utility-scale solar farms clustered in high-irradiation states in the northeast. Developers win long-term power-purchase agreements (PPAs) through federal auctions or private offtake deals that routinely clear below USD 32.2 per MWh, derisking gigawatt-scale pipelines and drawing global capital.

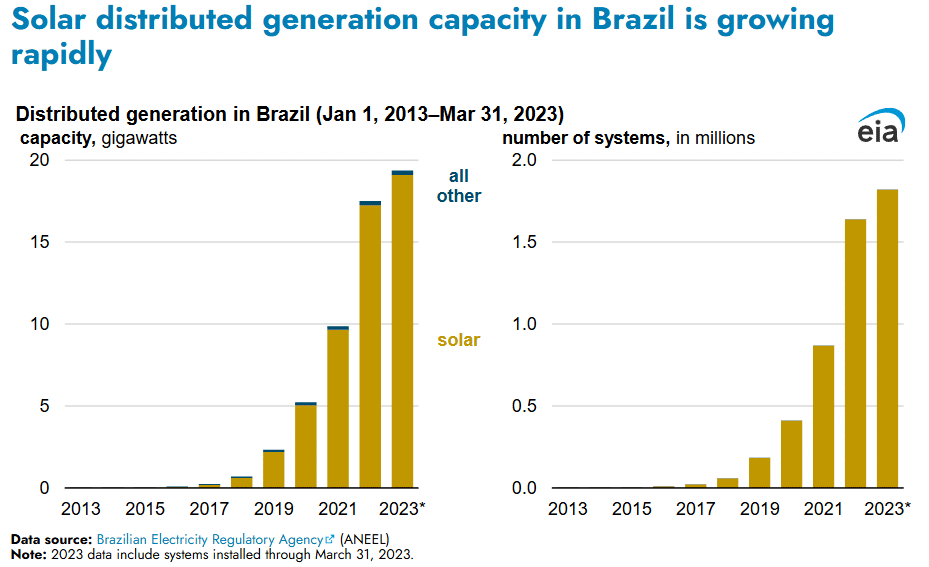

Distributed Generation Boom

The heavier lifting comes from rooftops and small ground-mounted arrays. Net-metering rules have locked in retail rate credits until 2045 for systems commissioned by January 2023, unleashing an army of prosumers. The result is 37.4 GW of distributed PV spread across over 2 million systems. This now accounts for two-thirds of annual solar additions.

Why Brazil Is a Solar Sweet Spot

Brazil enjoys a combination of a favourable natural environment and solar energy market design that keeps pushing costs down.

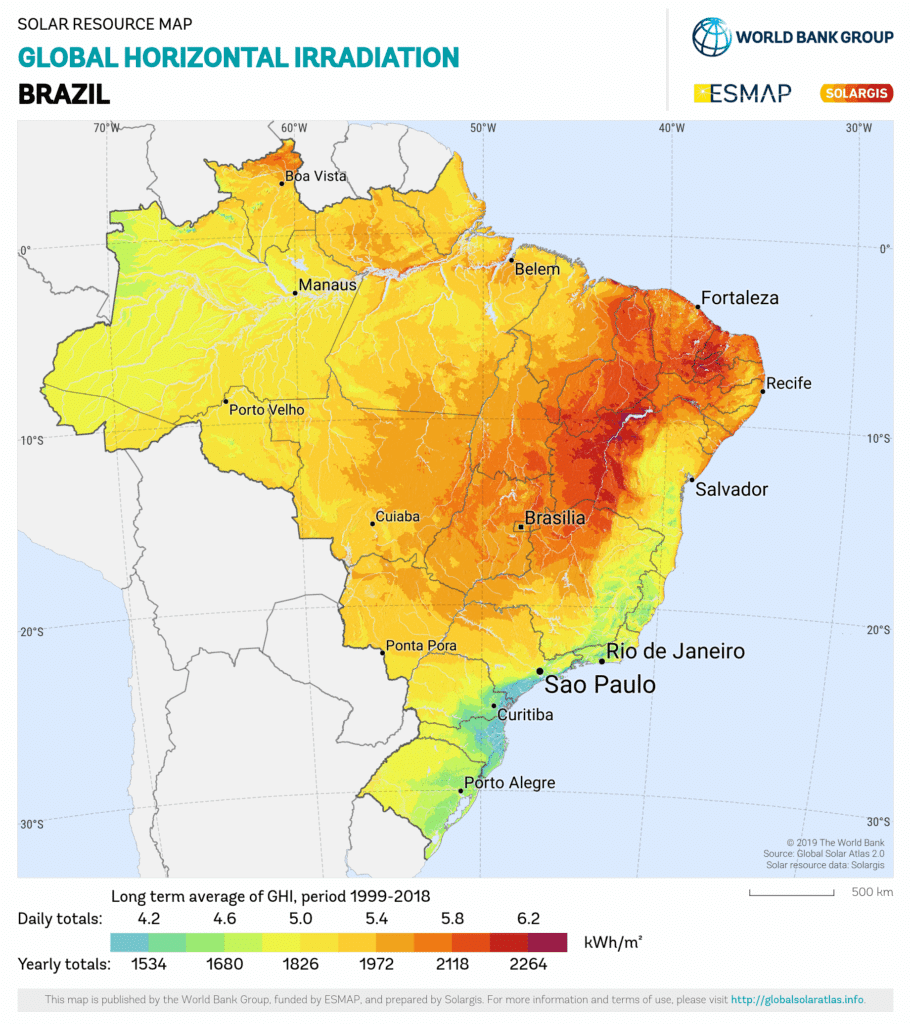

World-class Solar Resource and Geography

Brazil experiences a global horizontal irradiation (GHI) of 5.0 to 6.2 kWh per m² a day across almost the entire country. The absolute peak, around 6.5 kWh per m² a day is logged in the semi-arid interiors of Bahia, Piauí and Ceará, putting parts of Brazil on par with Australia’s outback.

Much of this high-irradiance land is on broad, gently sloping plateaus in the northeast that already host 230- and 500-kV transmission backbones built for hydroelectric and wind power. Additionally, developers continue to expand the transmission infrastructure throughout the region.

Low Power Generation Costs

Ready grid access and minimal civil work translate into low electricity generation costs. Brazil’s most recent federal auctions closed utility-scale PV contracts at just USD 32.2 per MWh in 2022. This represents a significant decline, down from USD 86.7 per MWh in 2014. Corporate power-purchase agreements go lower still. Canadian Solar’s 190 MWp Gameleira project in Ceará locked in a 20-year agreement of USD 22 per MWh. This underscores why Brazil now hosts multiple parks exceeding 300 MW across Bahia, Piauí and Minas Gerais.

Government Incentives, Policy and Economics

Three overlapping policy tracks are propelling solar energy in Brazil from a niche to a mainstream market. First, legislation guarantees net-metering credits for systems until 2045. This provides rooftop solar panels and community solar investors with more than two decades of stability.

Second, utility-scale developers rely on Brazil’s solar contract auctions, which provide very favourable rates. Complementing those tenders, the government has reduced import duties on crucial solar modules and inverters. This incentivises solar investors to build in the country.

Third, Brazil has a robust financial system supporting solar energy and wind power development. Public lender BNDES is one of the world’s largest development banks and has financed roughly 70% of all renewable energy projects since 2000. Private money is also piling in. The 152 MW Gameleira project secured a 20-year corporate PPA at just USD 22 per MWh, showing that market-based offtake can now undercut even record-low auction tariffs.

Solar Energy Market Outlook and Investment Pipeline

Brazil’s solar story is still on the upward swing.

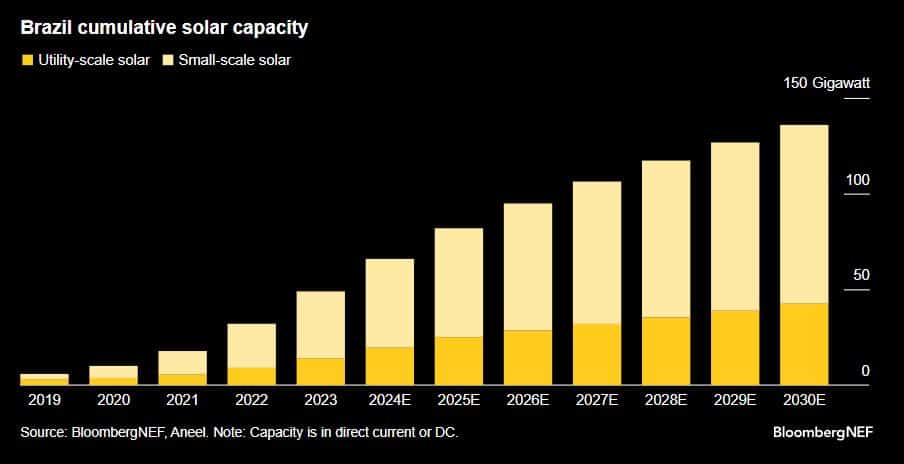

Solar Photovoltaic Energy Capacity Trajectory to 2030

Joint modelling by the energy-planning agency EPE and the industry body Absolar predicts that cumulative PV capacity will reach 90-108 GW by 2029. On the high-growth track, solar could overtake hydropower to become Brazil’s second-largest power source by 2032, a remarkable diversification for a grid historically dominated by big dams.

Source: Bloomberg NEF

Financing Trends and Industrial Spillovers

The sector pulled in around USD 2.4 billion in fresh investment during 2024, lifting the post-2012 tally to USD 35 billion. Job creation in the renewable energy sector is also booming, with 1.6 million solar-energy jobs, and one-third of them generated just since January 2024.

Rapid PV uptake is also catalysing a nascent battery market. Brazil installed 269 MWh of new storage in 2024, pushing cumulative capacity to 685 MWh and prompting a 2025 auction dedicated to battery assets.

Solar’s Role in Brazil’s Renewable Energy Goals

Thanks largely to hydro, wind and now solar, 88.2% of Brazil’s electricity already comes from renewables — wind and solar alone delivered 24% in 2024. This gives Brazil the lowest per capita emissions among all G20 countries.

This momentum aligns with the nation’s updated nationally determined contribution, which targets a 50% reduction in greenhouse gas emissions by 2030 and economy-wide net-zero emissions by 2050. Furthermore, the country’s National Energy and Climate Plan targets renewable sources accounting for 85% of the energy mix by 2030.

Scaling PV is crucial to achieving all of these goals and is a significant focus for the country’s energy growth over the coming decade.

Bright Horizons For Brazil’s Solar Future and Energy Transition

Solar energy in Brazil has advanced from promising to pivotal in less than a decade. It is slashing carbon, stabilising a hydro-tilted grid and building entire value chains, from glass and polysilicon to batteries and green hydrogen pilots.

However, realising a 100 GW solar system before 2030 will hinge on continued transmission buildouts and rapid local manufacturing scale-up. Clear those hurdles, and Brazil’s solar power engine can continue to deliver cheaper electricity, resilient communities and a commanding lead in Latin America’s clean energy race.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more