Renewable Energy Investments in Vietnam in 2024 – Asia’s Next Clean Energy Powerhouse

09 June 2024 – by Viktor Tachev Comments (0)

There are some great opportunities for renewable energy investments in Vietnam in 2024. Over the past decade, Vietnam’s electricity demand has more than doubled. Due to the country’s robust economic boom, population growth and heavy industrialisation and urbanisation, the trend is poised to continue.

While the country has increased its coal reliance to meet its growing energy needs, it has made significant progress in diversifying its energy mix, with a heavy focus on investing in renewable energy. As a result, the country is in a prime position for a swift clean energy transition, securing a sustainable future and attracting foreign investments in renewable energy.

Renewable Energy in Vietnam and Green Energy Progress in 2024

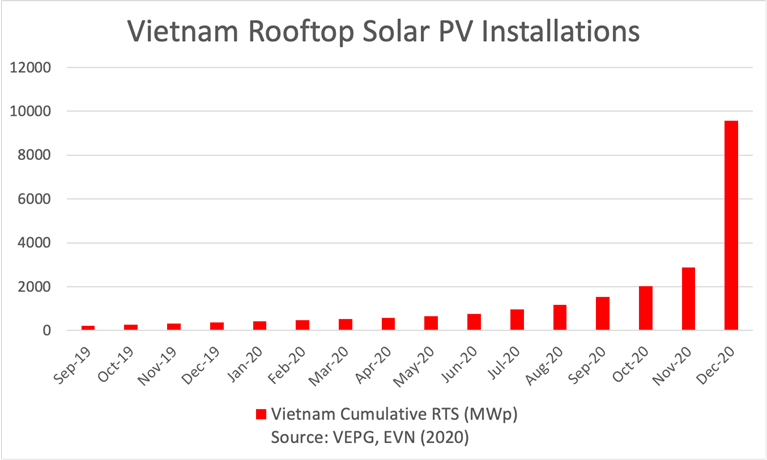

In 2014, the share of renewable energy in Vietnam was just 0.32%. In 2015, only 4 megawatts (MW) of installed solar capacity for power generation was available. However, within five years, investment in solar energy, for example, soared.

As of 2020, Vietnam had over 7.4 gigawatts (GW) of rooftop solar power connected to the national grid. These renewable energy numbers surpassed all expectations. It marked a 25-fold increase in installed capacity compared to 2019’s figures.

In 2021, the data showed that Vietnam now has 16.5 GW of solar power. This was accompanied by its green energy counterpart wind at 11.8 GW. A further 6.6 GW is expected in late 2021 or 2022. Ambitiously, the government plans to further bolster this by adding 12 GW of onshore and offshore wind by 2025.

Today, the country’s concentrated efforts and dedicated policies are why Vietnam is Asia’s next renewable energy powerhouse.

Between 2015 and 2023, solar and wind capacity grew tenfold to a 13% share in electricity generation. Paired with 29% hydropower, Vietnam is in a great position to decarbonise its economy. In fact, its per-capita emissions are already lower than the global average.

As per the official power plan (PDP8), the share of renewables, excluding hydropower, will top 31% by 2030. Wind power, with 18.5%, will be the main growth market. Offshore wind power, foreign investors’ key area of interest, will grow to 6 GW by 2030. By 2050, it will top 70 GW. Interestingly, solar power, which saw remarkable growth in 2020, will decline to just 8.5%. Hydropower’s share will also drop to 19.5% in 2030, down from 30% in 2020.

However, if the pledges of G7 countries for Vietnam’s JETP materialise, renewables’ share could reach 47% by 2030.The country’s concentrated efforts and dedicated policies are why Vietnam is Asia’s next renewable energy powerhouse.

How Does Vietnam Fare to Global Renewable Energy Leaders

Since signing the Paris Agreement in 2015, many countries have started actively working on their renewable energy programmes. Close to a decade later, clear leaders are emerging in the green energy race.

Vietnam’s Potential in the Renewable Energy Sector

According to the International Renewable Energy Agency (IRENA), in 2021, Vietnam ranked in the top 10 countries with the highest installed solar energy capacity. However, the exponential solar power expansion was halted due to grid issues. As a result, today, Vietnam is no longer in the top 10 countries of IRENA’s ranking.

However, its ambitious green energy goals, paired with the country’s JETP, now place it in a position to reclaim its crown as a regional and global leader in clean power deployment.

Its high solar PV potential has already enjoyed its fair share of investors’ interest and has started paying off.

Investments in wind power projects have tremendous potential too. Vietnam has one of the best wind resources in Southeast Asia, with an estimated potential of 311 GW.

In terms of solar power, Vietnam has the potential to reach 85 GW by 2030 and 214 GW by 2050.If Vietnam fixes its grid issues and gets back to its lightning pace of renewable energy expansion, it will further climb the rankings. This would mean it could potentially surpass countries like Korea in solar power capacity and get back into the top 10.

The State of Green Energy Investments Across Vietnam in 2024

The history of Vietnam’s renewable energy market and its strong fundamentals have turned it into a point of interest for global green energy investments and the country is expected to be a focal point for clean energy project financiers in the years ahead. This is primarily due to the wide variety of green energy opportunities like investing in solar energy projects in Vietnam.

Starting with the USD 15.5 billion that the country will receive in the form of initial finance from the JETP, the government is also looking for ways to further ease and attract private investors to tap into the local market. For example, it actively promotes direct power purchase agreements to ease businesses in directly procuring power from renewable energy companies at competitive rates. Furthermore, it is actively working to make clean energy project development easier and more transparent. So far, Vietnam has implemented 4 out of the 6 power policy categories that Climatescope considers essential for attracting foreign investments, including Renewable energy targets, Renewable energy auctions, Feed-in Tariffs, Net Metering, Import tax incentives, and VAT incentives.

However, issues remain, mainly with the lack of needed ambition in Vietnam’s main energy plan, the PDP8. While it scaled down its earlier coal expansion plans and emphasised the integration of renewable energy, the government plans to strengthen its reliance on natural gas – both by investing into domestic power generation infrastructure and LNG import terminals. This contradicts IEA’s Net Zero Emissions Scenario and can potentially serve as a red flag to investors.

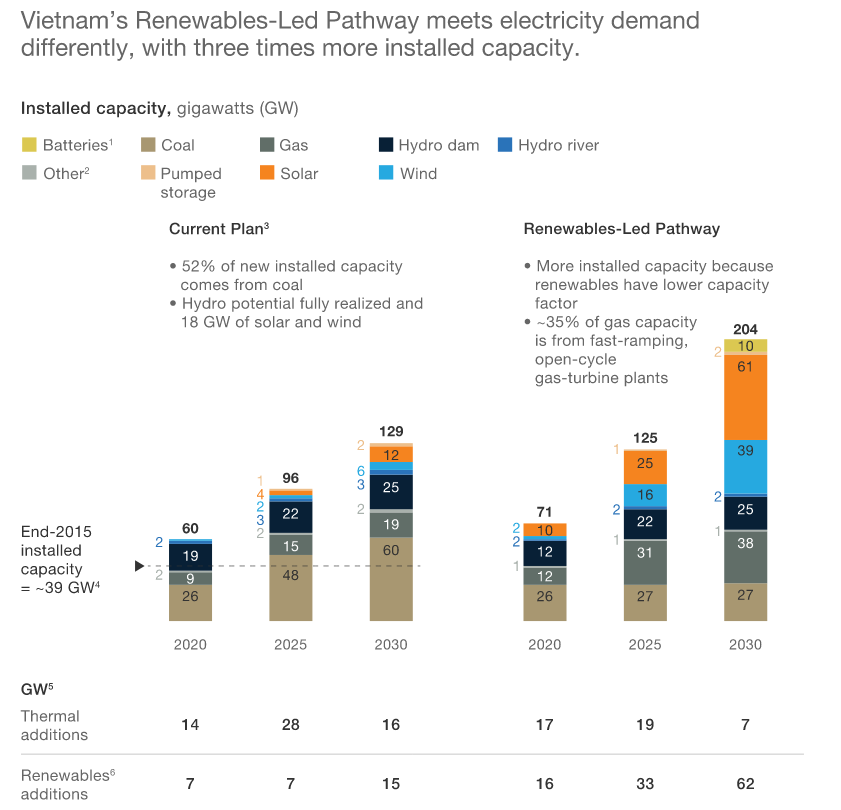

According to McKinsey, a renewables-led pathway could unlock several opportunities for Vietnam. This includes saving 10% in overall power costs, cutting down 1.1 giga-tonnes of greenhouse gas emissions and 0.6 mega-tonnes in particulate emissions. It would also see a 60% decrease in energy imports by 2030.

Growth Projections for Investments in Vietnam’s Renewable Energy

Investors have already recognised Vietnam’s commitment to renewable energy, the ambitious government targets, and relatively flexible terms and supportive policies for easing project financing as a welcome sign to capture what proves to be a lucrative market opportunity.

In fact, Vietnam is the 11th best-emerging market for clean energy investments globally.

According to a report by VietinbankSC, the value of the local renewables market will hit USD 714 billion and keep developing for at least 25 years. The bank finds that, between 2020 and 2030, the market for solar power will grow by 12.8%. Meanwhile, the market for wind power will soar by 34.2% annually.

While clean energy investments in the country have marked a major U-turn between 2017 and 2022, they are expected to get back to their growth phase once the JETP and the government’s policies kick off and the grid issues are addressed.

Future of Vietnam’s Renewable Energy Investments

Renewable energy in Vietnam is well on the way to becoming mainstream. As investments in solar and wind energy start growing again, so too will the country’s profile of a renewable energy leader in Asia and beyond.

There’s no denying Vietnam’s renewable energy potential. It has everything it needs to shift gears and swiftly move into making renewable energy the primary source of the country’s energy.

The fact that the government has acknowledged the country’s vast technical potential for clean energy development in the official energy plan, the PDP8, is a huge first step. Next, it should further improve its targets, which currently capture around 30% of Vietnam’s total potential, leaving huge room for the growth of clean energy technologies in the country. Furthermore, it has the ambition to become the region’s leading green energy exporter, with Singapore already planning to import clean electricity from Vietnam.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more