Renewable Energy Challenges and Opportunities in Vietnam

06 May 2021 – by Viktor Tachev

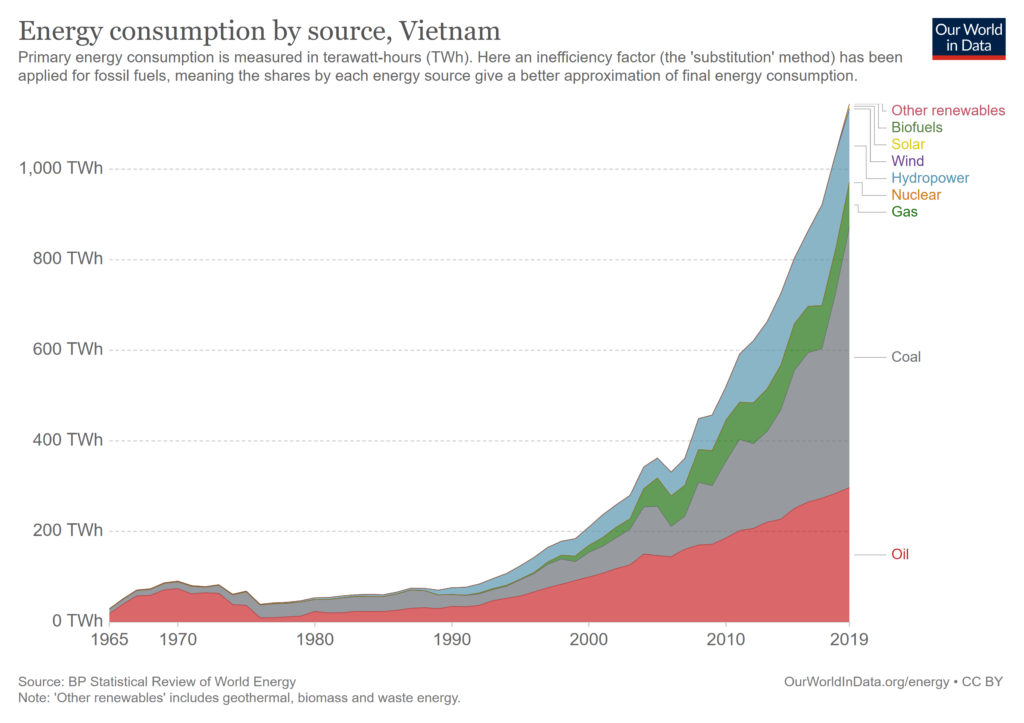

With a population soon to reach 100m and a booming economy, Vietnam’s energy needs are steadily growing. While the country is still overly reliant on fossil fuels, today, it is among the clean energy leaders. Although the journey to sustainability isn’t seamless due to the existing renewable energy challenges of the energy sector in Vietnam, the future is full of opportunities.

The Renewable Energy Challenges in Vietnam

Despite being on the right track for developing and using clean energy, Vietnam’s renewable energy sources still have a long way to go. And the first step is to solve the existing challenges:

Institutional barriers

Although new regulations were introduced to speed up renewables adoption in recent years, they leave a lot to be desired. Many of them are considered by experts to be overly detailed and impractical, further complicating the investment procedures.

Furthermore, institutions hesitate to fully unleash the ambitious PDP8 and boost the switch to renewables.

Financial challenges in the energy sector

Although the government tried to liberalize the policies and ease domestic and foreign investors entering the local renewable energy market, challenges remain. These include lack of clarity over future energy prices, insufficient capital and funding opportunities, un-bankable power purchasing agreements (PPA), and more.

Due to this, the private sector’s participation remains limited, which is another drawback for ensuring the country’s energy security.

Climate change and physical capacity issues

Vietnam is among the six most affected countries by climate change. The strong typhoons, riverine floodings, and drought, paired with the fact that the ocean level is projected to rise 75 centimeters by 2050, complicate the development and operation of the local energy grid.

Currently, Vietnam lacks the needed smart grid equipment and the capacity to manage supply and demand to speed up the renewables transition. In some parts of the country, the energy distribution network still isn’t reliable. These arguments are often used against deploying non-hydro renewable power from large projects. Furthermore, officials suggest that there isn’t a reliable storage system to integrate renewable energy development on a large scale.

Potential coal-to-gas switch

Despite Vietnam’s major renewable energy installation achievements, its coal consumption has grown 75% in the last five years. This rate is unmatched by any country in the world. Now, Vietnam plans to limit coal and shift to LNG. The PDP7 targeted a gas capacity of 129.5 GW by 2030. Achieving this will require importing up to 10 billion m3 in 2026 to 2035.

However, the truth is that replacing coal with LNG doesn’t make things better in terms of environmental impact. According to the Intergovernmental Panel on Climate Change (IPCC), methane’s warming effect is 87 times greater than CO2 over a 20-years period. Should Vietnam retain its plans, it will exacerbate the implications of its number one problem – climate change.

How Are the Challenges Addressed

Opposite to many experts’ expectations, the EVN Power Corporation isn’t acting against the clean energy transition to protect its interests. Just the opposite, the organization is pushing hard to promote renewables in the energy sector through different initiatives, mainly in the solar power niche. With the right moves to upgrade Vietnam’s power grid, the country can reassure developers that their solar energy projects will not be curtailed.

The perception of Vietnam being an unfavourable soil for renewable energy investors is also changing. The country plans to shift from FiTs to auctions to ensure steady growth and further drive renewables price down.

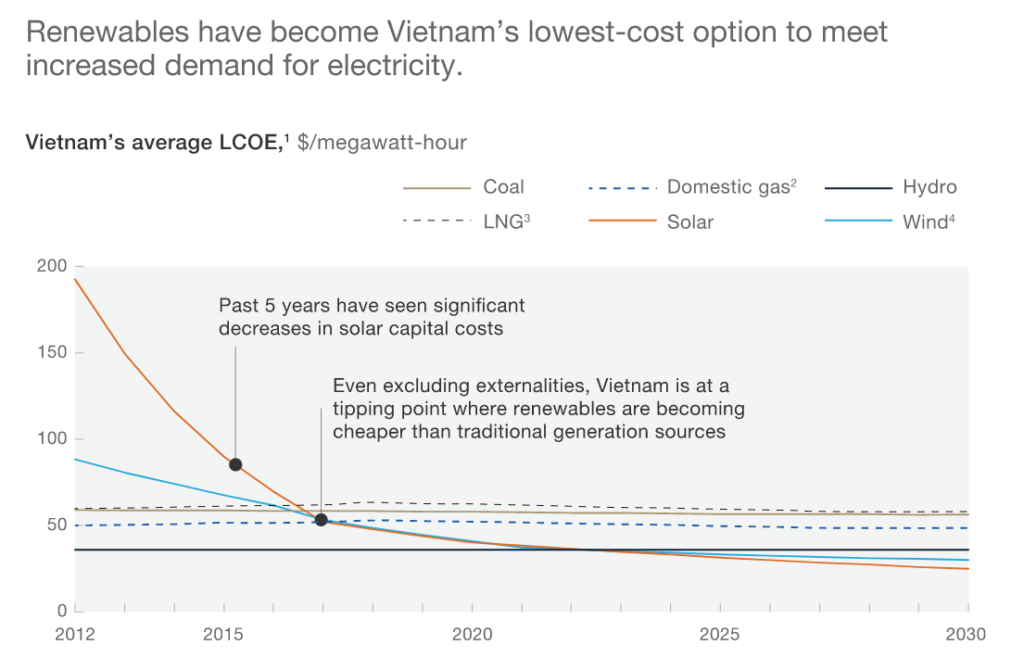

According to McKinsey, renewables have become the cheapest form of new power generation in the country on a levelized cost of electricity (LCOE) basis.

Officials also realize the need to ease policies and liberalize the renewable energy market to attract private sector investments. New Direct Power Purchase Agreements are in motion to allow energy producers to deal directly with end customers.

Renewable Energy Opportunities in Vietnam

The past decade turned Vietnam from an energy exporter to an energy importer, threatening its energy independence. However, the country’s plans are to change that by capitalizing on its renewable energy potential.

Rural areas, for example, have a significant potential for bioenergy (10b m3 per year), small hydropower (more than 4 GW), solar power (average daily radiation of 5kWh/m2 throughout the country), and wind power projects (500-1000 kWh/m2 per year).

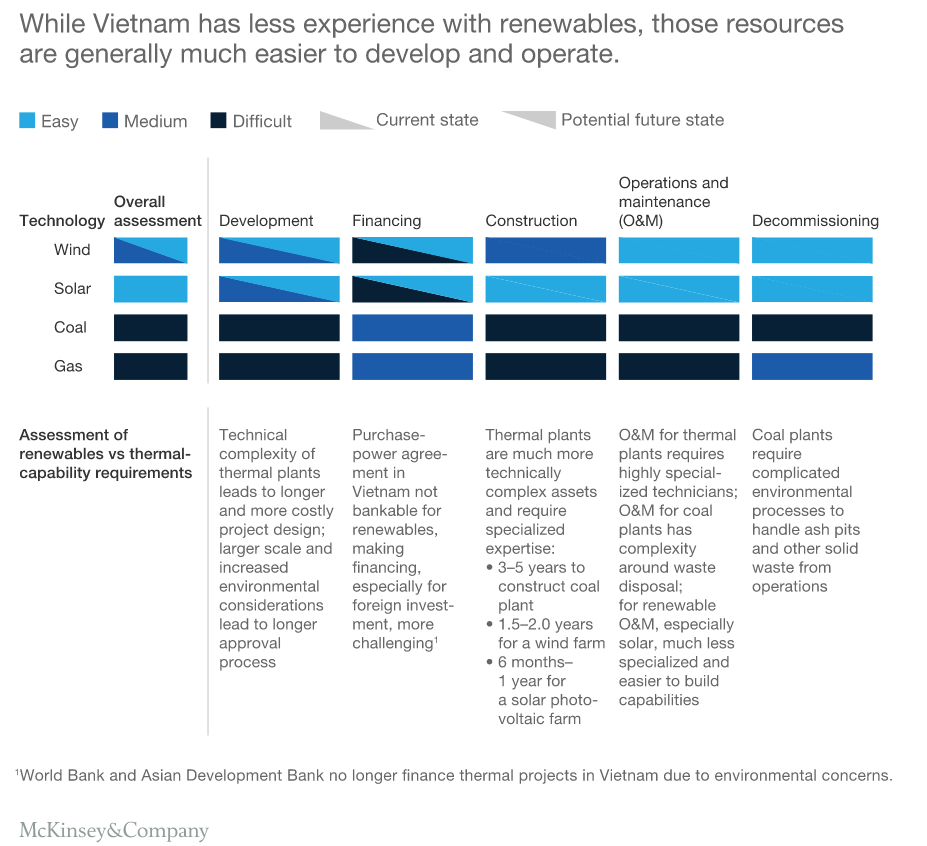

McKinsey’s analysis reveals that the renewable energy projects in the country are undisputedly the easiest to develop.

This presents investors with an opportunity to join Vietnam on its journey to bring back its energy independence by relying on heavier development of local renewable energy projects. Experts suggest investors can further benefit from the growing trend for large commercial and industrial companies to switch to solar power since they have good economic conditions and can grow sustainably in the long term.

The PDP8 draft submitted in February 2021 sets an ambitious target of having renewables (excluding hydropower) account for almost 30% of the total energy mix by 2030. It will also incentivize renewable energy development in all forms, meaning there is no turning back from clean energy. This will further increase the influx of local and foreign investments into Vietnam’s renewable energy industry and support economic growth from their energy supply.

The Results

The renewable energy shift is already taking place. In 2014, Vietnam had a total of 4 MW installed solar capacity for power generation. At the time, the share of renewables was just 0.32%. Today, it is close to 9.5 GW, with over 6 GW installed only in December 2020.

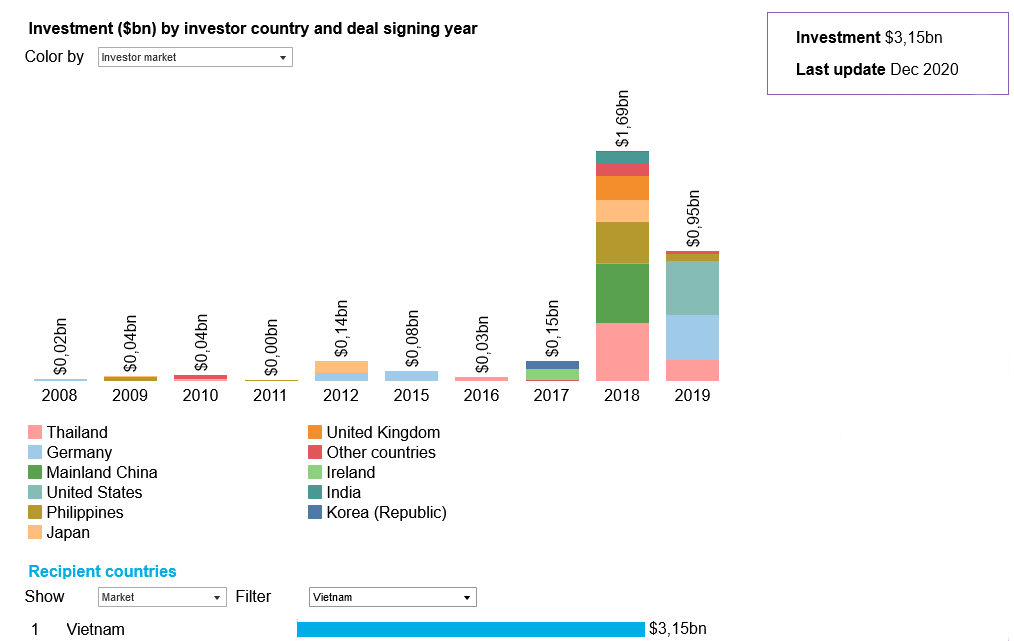

Currently, Vietnam is among the countries with the highest growth in investments in renewables.

Vietnam’s wind & solar power capacity

According to Bloomberg NEF, the country has enough installed capacity to become the third-largest solar energy market globally. McKinsey points out that investors in renewable energy projects in Vietnam have nothing to fear from. The capital costs have dropped 75% for solar power and 30% for wind projects during the past five years. Currently, these projects bear lower risk and are much easier and quicker to build. The potential in front of them, however, is unrivalled.

This shows that despite the challenges still present, Vietnam is marching towards leadership in clean energy and potentially a global renewable energy authority.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more