Solar Energy In Thailand: Policy Aspiration to Economic Engine

Source: Intelligent Living

22 May 2025 – by Eric Koons

Solar Energy in Thailand has jumped from a policy aspiration to an active economic strategy. Over the past decade, the kingdom has shifted from worrying about dwindling domestic gas reserves to determining how quickly it can expand its solar energy capacity. With power demand rising 2% a year and domestic fossil fuel resources declining, solar now sits at the intersection of energy security, trade competitiveness and rural development.

Thailand’s Solar Energy Landscape in 2025

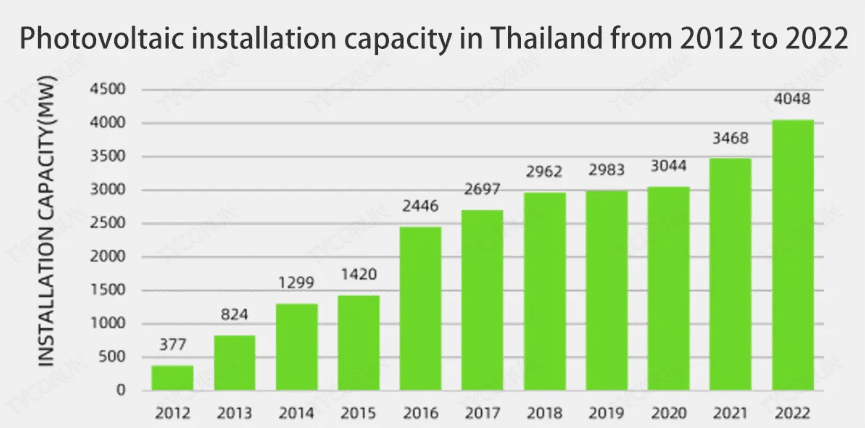

Thailand started 2024 with just under 5 GW of cumulative photovoltaic (PV) capacity and a compound annual solar growth rate of 20% since 2012. This accounted for 9% of the country’s installed electricity generation capacity. Flagship solar energy projects in Thailand are becoming increasingly innovative: the state utility, EGAT, is tendering a 24 MW floating solar array at Ubol Ratana Dam, the first phase of a 2.7 GW hydro-floating solar hybrid program that avoids land-use conflicts while boosting reservoir efficiency.

Policy momentum is catching up with engineering. The draft Alternative Energy Development Plan (AEDP 2024) raises the renewable capacity target to 51% by 2037. To broaden participation, the Energy Ministry has also approved a community-solar quota of 400 MW every year from 2025, creating a pipeline for municipalities, schools and cooperatives to sell power to the grid. Feed-in-tariff top-ups, direct corporate PPAs and a net-zero pledge for 2065 round out the policy mix and signal a long runway for investment.

Solar Energy Market

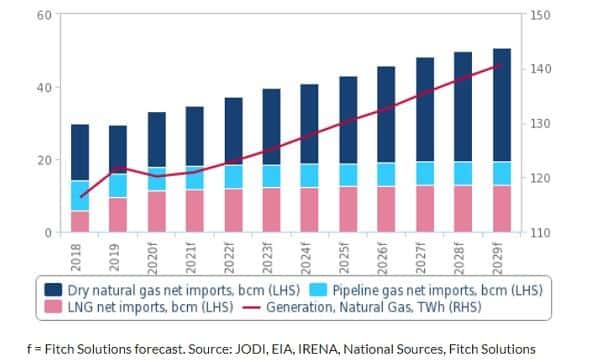

Cost, more than conviction, is driving the solar energy market in Thailand. During 2023, the levelised cost of utility-scale PV dropped 23%, making it 13% cheaper than coal. Meanwhile, Bangkok plans to import 1 million tonnes of U.S. LNG in 2026, carrying an estimated price tag of USD 500 million. This is part of a larger plan to import 15 million tonnes of LNG over the next 15 years.

While the LCOE of solar and LNG is currently comparable, the LCOE of solar is expected to decline by a further 27% by 2030, whereas fossil fuel plants will only decline by 5%. As a result, every incremental gigawatt of solar that displaces gas will trim the national import bill — an energy-security dividend with instant balance-of-payments benefits.

Investment is following the economics. In late 2024, the Asian Development Bank announced a USD 820 million loan package for a dozen solar-plus-storage projects across the country. Likewise, Thailand’s domestic PV cell and module manufacturing capacity is growing. Production capacity currently sits at 10 GW annually, with an export value of USD 4.3 billion.

Is Thailand Good for Solar?

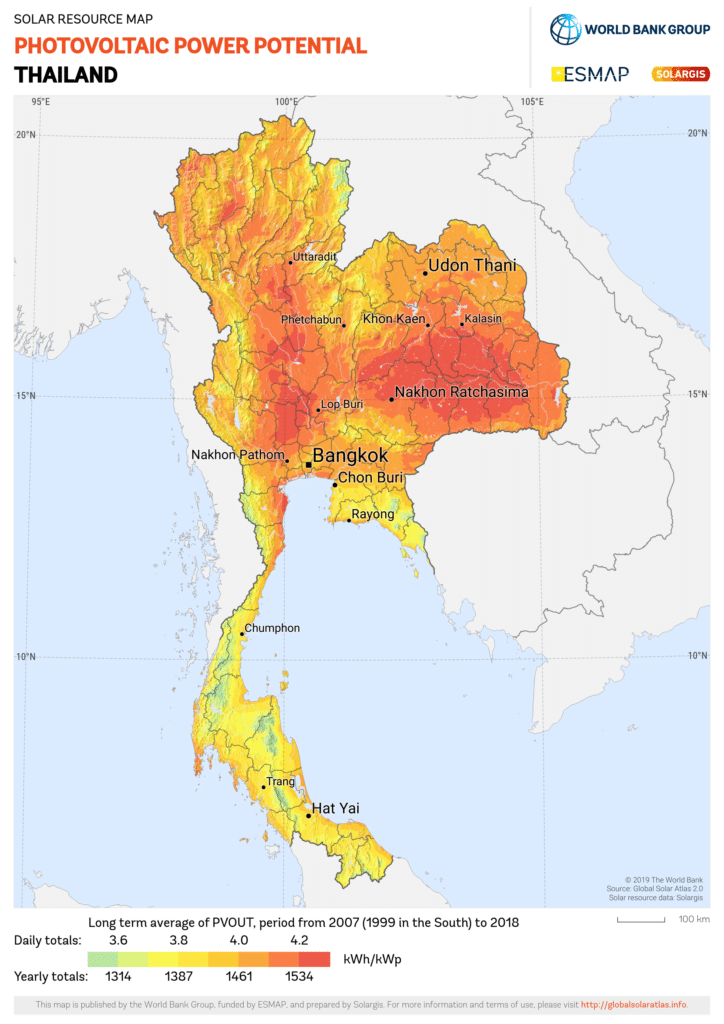

Resource data indicates a positive outlook. The World Bank’s Global Solar Atlas records average daily irradiation exceeding 4 kWh per square meter across the central plains and northeast plateau. This gives the country a total potential solar capacity greater than 300 GW, which requires less than 2% of the country’s land area to achieve. Rooftops are another growing opportunity, with capacity anticipated to reach 9 GW by 2037.

Land constraints are a potential concern, but also solvable. EGAT plans to develop the world’s largest network of floating solar systems. This removes the need for ground-mounted acreage, while agrivoltaics are a viable option to produce power during non-growing seasons for rice, boosting farm income even as solar panels feed the grid. Together, these hybrid models underscore how solar energy in Thailand can expand without crowding food or forests.

Economic Outcomes to 2030

One of the primary hurdles to solar energy development in Thailand is its current energy grid. The grid faces load balancing and storage issues that struggle to handle the intermittency of renewables. The government’s answer is storage: the existing Power Development Plan (PDP) targets adding 10 GW of battery energy-storage systems (BESS) by 2030. While this is a good start, it is estimated that the country will need to add three to four times more battery storage to meet its clean energy goals.

On the financial side, Thailand will need to mobilise USD 22 billion for renewable energy projects and an additional USD 28 billion for energy efficiency improvements between 2022 and 2037 to meet its clean energy targets. This is at odds with the country’s long-term subsidies on gasoline, diesel and natural gas. Reducing these subsidies in favour of renewable energy investments is critical for the country’s energy transition.

To support this, the government recently issued its inaugural sustainability-linked bond totalling USD 865 million in investments towards the goal of reducing greenhouse gas emissions by 30% and supporting the purchase of 440,000 zero-emission vehicles per year by 2030.

Future of Solar Power in Thailand

Solar energy in Thailand has crossed the line from a promise to a profitable imperative. Costs of renewable energy sources are now lower than those of coal and competitive with gas, with capacity growing at a rate of 20% annually. Policy signals, from 400 MW of community-solar quotas to a 51% renewable goal, are lining up behind the technology.

The remaining roadblocks are technical and financial, rather than geographic: a smarter grid, large-scale batteries and a shift away from LNG growth. If Thailand can get those pieces right in the next two years, it can conceivably double solar’s share again by 2030, saving billions on imported fuel, creating tens of thousands of skilled jobs and cementing its position as a resilient, low-carbon manufacturing base.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more