What Lawmakers in the Philippines Can Do To Lower Power Prices

29 July 2025 – by Viktor Tachev

The Philippines’ energy sector faces crucial years ahead, with the government pressed to find solutions to the rapidly increasing power demand, persistently high electricity costs, energy security risks and growing emissions. At the same time, it has to accelerate efforts to protect frontline communities and the most vulnerable to the mounting weather extremes, which have turned the country into one of the most affected by the climate crisis in recent decades. Experts warn that the current plans for investing in new LNG infrastructure and scaling up imports won’t be the solution — in fact, they would worsen existing problems.

But the country’s massive clean power potential, solid renewable market fundamentals and solar’s progressively decreasing costs can help future-proof the Philippines’ economy, accelerate its decarbonisation journey and bring electricity costs down, all while helping protect nature and vulnerable communities. Realising those gains, however, requires pro-renewable energy lawmakers to enact legislative actions and introduce laws that promote investments in sustainable and affordable energy solutions and ensure equitable access to renewables. As a result, they can expect strengthened energy security, lower-priced electricity, and substantial economic and environmental benefits for Filipinos.

The Renewable Energy Laws and Regulations Empowering the Energy Transition in the Philippines

In recent years, the Philippines has made strides in improving its clean energy market fundamentals. The country’s push toward clean energy development began with the Renewable Energy Act of 2008. To achieve the goals laid out in the plan, the government has introduced a series of accompanying bills and follow-up policies such as Senate Bill Number (SBN) 1875 and related House Bill (HB) 9535 for the establishment of the Philippines Renewable Energy Corporation and HB 446 for protecting the rights of Indigenous peoples and communities affected by renewable energy development.

In 2022, the government acknowledged that the shift toward renewable energy “has been hampered by the lack of local government enthusiasm in renewable energy resources due to loss of livelihood and/or income, reduced collection in real property’ effects to native biodiversity and fisheries, raising the risk of tsunamis or storm surges, as well as health concerns from rising temperatures and vibration” and introduced various measures to accelerate deployment.

For example, SBN 532 states that “rooftop solar PV technology could be a valuable tool in achieving energy security, reducing electricity cost, improving supply reliability and promoting power grid independence” and also recognises the environmental benefits of clean power. The proposal prioritises key measures that would help accelerate the deployment of rooftop solar among residential, commercial, industrial and government end users, including requiring the Department of Energy, Energy Regulatory Commission, National Renewable Energy Board, Department of Interior and Local Government to standardise permits and licenses needed to install rooftop solar panels and address existing institutional barriers.

Furthermore, it urges the removal of the 100-kW cap on distributed generation to enable large electricity consumers, such as commercial establishments and industrial buildings, to take advantage of the net-metering program. The proposal also mandated the installation of rooftop solar panels on government buildings, with a 5% required increase every five years. The move was a part of a broad range of measures for demonstrating how the government can lead by example.

Furthermore, the Senate has introduced several bills intended to increase the amount of renewable energy used by government offices, buildings and authorities. For example, SBN 2137 proposes that government departments, bureaus, offices, agencies, local government units, and government-owned and controlled corporations source a minimum percentage (5%) of their electricity from renewable energy to reduce the government’s carbon footprint, improve air and water quality and cut energy costs. The minimum percentage should increase by at least 2% every three years. Tax credits and rebates, grants, low-interest loans, net metering and technical assistance are among the measures the government will rely on to support participants and achieve the target. In addition, SBN 446 mandates that all government offices meet at least 20% of their power needs with renewable energy.

There have also been measures on a local level to help communities lower their electricity bills. For example, with the BTA Bill 178, the Bangsamoro government tried to install solar energy systems in all socialised housing programs in the Bangsamoro Autonomous Region in Muslim Mindanao.

Over the years, ambitious policies, such as auctions, feed-in tariffs, net metering schemes, tax incentives and limited restrictions on foreign ownership, have dramatically improved the investment environment in the country. Among the key policy measures on that front was SBN 658 for promoting the adoption of solar technology and net-metering across end users. It allowed end users to participate in distributed power generation, enabling them to contribute to the electricity grid and consume electricity themselves, effectively generating savings on their electricity bills. However, the initiative enjoyed a low participation rate mainly due to the existing 100-kW cap for end-users and the cumbersome requirements for joining the program.

Decision-makers introduced several consecutive bills, including SBN 2138, SBN 485 and HB 170, to enhance the implementation of the net-metering program, streamline the permission process and encourage more end users to participate. The Philippines’ Department of Energy also issued a framework for energy storage systems (ESS) to support variable renewable energy integration. The ESS will be applied to serve a variety of functions in electricity management, including energy generation, peak shaving and ancillary services.

The Renewable Energy Laws and Regulatory Measures that Can Accelerate the Energy Transition

The renewable energy laws passed by the Philippines’ government to date have had a major impact. While in 2021 it ranked 30th among the most attractive emerging markets for renewable energy part of BloombergNEF’s Global Climatescope ranking, in 2024, it jumped to second place thanks to ambitious policies such as auctions, feed-in tariffs, net metering schemes, tax incentives and limited restrictions on foreign ownership.

However, BNEF and other experts are convinced there are many areas that the country can improve upon to strengthen its position and attract clean energy investments.

Improving Renewable Energy Access For Businesses and Households

Launched in 2021, the Green Energy Option Program (GEOP) is a voluntary mechanism allowing consumers to purchase electricity directly from renewable energy power plants rather than relying on the procurement choices of utilities. By granting electricity consumers the option to switch to 100% renewable energy without infrastructure costs, the program allows companies with an electricity demand of at least 100 kW to benefit from VAT zero-rated purchases of renewable energy, thereby reducing their exposure to rising fossil fuel costs and ensuring predictable and lower energy expenses.

The “Enabling the Renaissance of Renewable Energy in the Philippines” report by the Climate Reality Project finds that through participation in GEOP, companies have reduced their dependence on volatile fossil fuel prices and cut electricity generation costs by an average of 34%. Some businesses reported financial savings of up to 78%. Upon examining 36 GEOP members, the analysis finds that they have collectively saved PHP 71.7 million (USD 1.27 million). These opportunities are critical, particularly for small- and medium-sized enterprises, which are highly vulnerable to fluctuating operational costs.

The program has proved a major success also regarding allowing businesses to significantly reduce energy costs, minimise business disruptions, preserve jobs and prevent price hikes for their products and services.

Last but not least, the move has enabled the analysed businesses to slash their carbon emissions by an average of 79% and advance toward their net-zero goals. In total, since its introduction in 2021, GEOP has reduced the private sector’s emissions by at least 38.9 million kg of CO₂.

However, the GEOP isn’t flawless, and many companies still face barriers in joining the program, with the main ones being regional disparities in adoption and the limited renewable energy supply.

“During our information campaigns and other events, potential GEOP participants expressed difficulties in switching due to this scarcity,” explained Giancarlo Enriquez, energy program lead at The Climate Reality Project Philippines, in an interview for Energy Tracker Asia. “Additionally, some SMEs are excluded from the program because they don’t meet the current eligibility requirement of a 100-kW average monthly peak demand per electric meter.”

The Climate Reality Project notes that improvements in the accessibility and effectiveness of the GEOP and bringing existing barriers down can be achieved through targeted campaigns in underserved regions, improved infrastructure and stronger policy support.

Enriquez notes that adopting retail aggregation “would allow consumers to combine energy demand from multiple meters within a contiguous area to meet the current 100 kWh minimum peak demand threshold”. He says: “This could expand access and enable more SMEs to benefit from GEOP.”

“We also call for measures to increase the availability of renewable energy under GEOP. This could be achieved by revisiting the 100% replacement power requirement or by adopting ‘volume matching,’ enabling renewable energy suppliers to serve a broader base of customers more efficiently,” the expert adds.

Another crucial step is promoting innovative financing mechanisms that enable small- and medium-sized businesses and homeowners to access renewable energy.

Policies To Attract Investments and Capitalise on the Philippines Renewable Energy Potential

“To meet the rising demand driven by businesses transitioning away from fossil fuels, the Philippines must significantly accelerate investments in renewable energy,” notes Enriquez.

Although the Philippines aims for just 35% renewable electricity by 2030, which is below the global share of 60% the IEA Net Zero Emissions scenario recommends, the country has stable clean energy market fundamentals. It is also aiming at more ambitious targets and continues working to improve the administrative burden and slow bureaucratic processes, which can help ease clean energy adoption and project development. The Renewable Energy Law has set a good foundation. However, its coverage remains limited, providing policy support and incentives that benefit mostly utility-scale projects.

Furthermore, there are claims that the policy enacted by the Energy Regulatory Commission to support decentralised energy resources systems still maintains tedious permitting requirements and a pricing methodology for export power that is unfair to renewable energy owners. Overcoming the problem requires introducing more flexible permitting processes for micro-scale capacity (10kW and below) and encouraging financing and just pricing methodology for exported power.

Measures like these will help the country capitalise on its immense clean energy potential. Zero Carbon Analytics estimates that it is sufficient to meet its future electricity demand, enabling it to generate nearly 3,500 TWh of renewable power annually. In total, there is potential for up to 178 GW of offshore wind and 122 GW of solar PV.

Limiting LNG Import Dependence to Lower Electricity Costs

The government’s 2023 Philippines Energy Plan (PEP) foresees that the share of gas in the country’s energy mix will rise from 13.2% in 2022 to approximately 17% in 2050. The share of gas in electricity generation is also predicted to increase from 16% in 2022 to 24.2% in 2040 and nearly 35% in 2050. The majority of it would be met by imports.

This is crucial considering that power generation costs comprise a significant portion of the electricity bill in the Philippines, accounting for up to 56% for non-subsidised users and low-income households as of April 2025. Importantly, existing policies allow volatile and expensive LNG import costs to be directly passed on to end users, Filipino households and businesses.

“In the Philippines, power producers and distributors can shift the burden of global fossil fuel price fluctuations directly onto consumers through the automatic fuel pass-through provision in power contracts,” Enriquez explains. “LNG is a globally traded, price-volatile fuel, and every time global fossil fuel prices rise, it is the average household or local businesses that absorb the higher costs, not the companies profiting from fossil fuel imports.”

Historically, the Philippines has been dealing with some of the highest electricity rates in Asia, including between 25% and 87.5% higher than those in ASEAN neighbours. Between 2023 and 2025, it had the third-highest electricity price in Asia after Singapore and Japan.

Experts from Zero Carbon Analytics now warn that the new LNG import capacity projects will further exacerbate the problem, with the annual LNG import costs on course to triple between 2025 and 2029 to USD 1.12 billion per year. The 508% LNG import increase planned by the government between 2025 and 2029, alongside the required infrastructure, will cost a total of USD 5.4 billion, they warn. As a result, power generation costs could increase by 11-24%, leading to higher electricity bills for households and industrial consumers.

To alleviate the pressure of high electricity costs on Filipino businesses and households, the government should prioritise the development of indigenous renewable energy resources and reduce reliance on imported fuels such as coal and LNG. Another crucial measure is proceeding with the organisation of energy stakeholders’ forums and information sessions to increase the uptake of renewable energy.

Renewable Energy, Not LNG, Already the Cheapest Electricity Source in the Philippines

The government has recognised the importance of renewable energy for solving some of the most pressing problems in the Philippines, stating that it was “crucial to solving the issues of climate change, energy security and access to energy”. It has also described it as a “key component of the Philippines’ low-emission development strategy” and a tool for reducing the country’s “vulnerability to energy price spikes and supply disruptions”. It also states, “By supporting the development of renewable energy sources, the government can help create new jobs and stimulate economic growth.” Still, in 2024, the country relied on fossil fuels for 79% of its electricity, while the share of wind and solar was 3.8%, a quarter of the global average 15%.

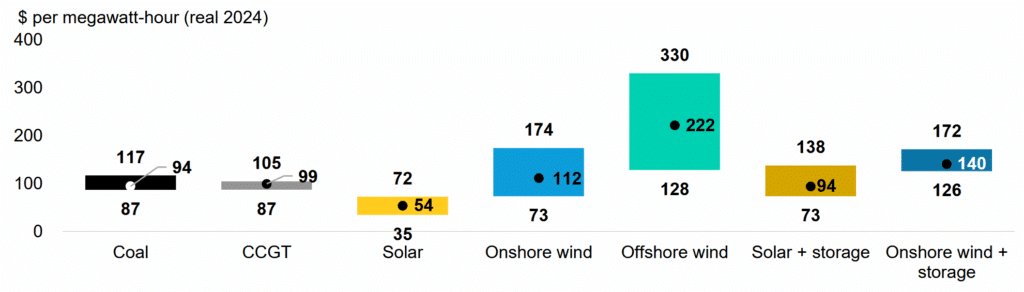

According to Bloomberg NEF, solar power has already established itself as an economically preferable option to meet the Philippines’ growing power demand while accelerating emissions reduction, with utility-scale solar being the cheapest source of bulk electricity generation in the country.

“Bloomberg NEF estimates the LCOE for new combined-cycle gas turbines in the Philippines to be almost twice the cost of solar. Unlike gas, renewables draw from domestic sources, offering more stable pricing,” notes Enriquez.

The Philippines has already experienced the cost-cutting advantages of solar power, which enabled it to save around USD 78 million in 2022, despite representing just 1.7% of its power generation.

Aside from the increased costs, prioritising LNG investments instead of renewables raises problems on several other fronts.

“This investment locks the Philippines into a fuel that is neither cheaper nor cleaner than renewable energy. LNG is not a true ‘transition’ fuel. Relying heavily on imported LNG exposes the country to price shocks, undermining efforts to build a more affordable and sustainable energy future,” Enriquez adds.

In particular, it will contribute to a projected 14 times increase in emissions, delaying the country’s decarbonisation. Furthermore, it will contradict the Natural Gas Industry Development Act, legislation that claims to support Indigenous energy development, signed into law in January 2025. In addition, new LNG import infrastructure has a lifespan of at least 20 years, which will not only undermine energy security for decades ahead, but also risk becoming stranded.

According to experts, the solutions are clear.

“To build a secure and sustainable energy system, the Philippines should avoid new LNG investments and begin planning for a phased transition away from gas. The government’s focus should be on accelerating renewable energy deployment, modernising the power grid and scaling up energy storage,” explains Enriquez.

These solutions can be low-hanging fruit, requiring simple measures like streamlining bureaucratic processes and enhancing existing policy frameworks. Aside from improving the accessibility and effectiveness of the GEOP, this would also help improve access to financing, which experts identify as a significant barrier to renewable energy adoption, especially for homeowners and MSMEs in the Philippines. Furthermore, easing the administrative burden and improving the renewable energy policy landscape to diversify funding sources and de-risk funding mechanisms can streamline the process of attracting new players in the energy sector and foster innovation.

The Next Moves of the Philippines’ Government Is Key to the Country’s Energy Future

Parliamentarians have a pivotal role to ensure the energy policy decisions in the country align with its climate commitments. They must display dedication to preserving nature and human rights (as per Article II, Section 16 of the 1987 Constitution) as well as the mission to deliver affordable, secure and clean energy for all. Key measures on that front would be limiting investments in LNG import infrastructure and deliveries and advocating for domestic energy resilience through building decentralised and community-owned renewable energy systems.

This would eliminate the risk of passing volatility to the end user and would preserve nature and protect Indigenous communities at risk from LNG infrastructure development plans, such as those in the Verde Island Passage. Last but not least, it would save millions in potential stranded asset infrastructure.

The new set of lawmakers in the House of Representatives and Senate should expedite work on pending renewable energy-related laws and ensure they don’t remain only on paper. Considering the country’s vast clean energy potential and the access to affordable solar, wind and battery technologies from China and the region, turning the Philippines into the clean energy powerhouse of Southeast Asia remains only a matter of reforms and political will.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more