APAC Stakeholders Must Accelerate Renewable Energy Adoption

03 February 2025 – by Viktor Tachev

As the climate crisis escalates, accelerating the fossil fuel phaseout and scaling up renewable energy adoption is becoming more urgent than ever, particularly in the Asia-Pacific (APAC) region. Home to over 60% of the world’s population and some of the fastest-growing and most energy-intensive economies, APAC’s energy choices will significantly impact global net-zero progress. Policymakers and businesses across the region have a crucial role, while individuals and communities must hold them accountable if the region is to get on track with the Paris Agreement.

Policymakers Have the Leading Role in Accelerating Renewable Energy Technologies Adoption

APAC is a picture-perfect example of how vital policymakers can be for the progress of the renewable energy transition.

For example, the Chinese government’s ambitious policies introduced in recent years have set the country on course to reach 1,500 GW of renewables in 2025, surpassing its 2030 target of 1,200 GW. Its CO2 emissions have either already peaked or will do so this year. The country also plans to gradually phase down coal use starting in 2026. Through its recently adopted clean energy plan, China will continue leapfrogging other markets in solar and wind power deployment, investments in grid expansion and modernisation and the development of EVs and emerging green technologies going forward.

Last year, the country connected the world’s largest solar farm to the grid, with 5 GW of installed capacity – enough to power Luxembourg for an entire year. It is now constructing another solar PV mega project, an 8 GW plant that should become operational in 2027.

Today, China is home to the world’s 10 top solar PV manufacturing equipment suppliers. The competition drives innovation, with companies like Longi and Jinko Solar continuously breaking solar panel efficiency milestones. At the same time, solar panel costs are dropping, having fallen nearly 90% in the last decade, largely due to Chinese companies’ efforts. Similar is the case with EVs, with BYD claiming the title of the biggest producer globally. The company is advancing clean transportation across the region by offering lower-priced options that have gone mainstream all across Asia.

In 2024, Indonesia, one of the world’s top coal superpowers, made probably the strongest energy transition commitment of the year. The president announced that the country will retire all coal and other fossil fuel plants by 2040.

Vietnam’s efforts to create one of the most enabling and supporting environments regarding green technology and renewable energy development in ASEAN has turned it into the green leader of Southeast Asia. The government is now working to complement its stellar track record in solar PV deployment by expanding the local rooftop solar market. As part of plans to equip half of the office buildings and homes with rooftop solar panels, in October 2024, the government issued rooftop solar power policy guidelines to stimulate self-produced and self-consumed solar energy and create favourable investment conditions to attract foreign capital.

However, APAC’s landscape also offers examples of policymakers increasingly prioritising gas investments and technologies intended to extend the life of fossil fuels. The IEA’s Southeast Asia Energy Outlook 2024 report projects that, based on today’s policy settings, Southeast Asia will account for 25% of global energy demand growth in the years up to 2035, second only to India. Clean energy sources such as wind, solar, bioenergy, and geothermal will meet around a third of that growth. Due to the continued reliance on fossil fuels, the region’s energy-related CO2 emissions will increase by 35% by 2050. As a result, the IEA warns that today’s policy settings leave Southeast Asia facing significant energy security risks – a consequence of the growing demand for natural gas in the region’s energy mix and the increased reliance on imports.

According to some experts, Japanese financing is a major reason South and Southeast Asia will remain hooked on fossil fuels. The country’s global gas empire undermines the efforts to tame the climate crisis but also risks adding to the pollution burden and diverting investment away from cleaner energy sources, Bloomberg says. In addition, under its GX strategy, the Japanese government has plans to support Southeast Asia’s expansion not only of gas infrastructure but also other fossil fuel-based technologies like carbon capture and storage and coal and ammonia co-firing.

All this comes at a time when solar and wind shares comprise just 4.4% of the ASEAN electricity mix. Furthermore, Southeast Asia attracts just 2% of global clean energy investment. To achieve the region’s announced energy and climate goals, which are still insufficient for a Paris Agreement-aligned scenario, investments must increase fivefold in 2035. Today, for every dollar invested in fossil fuels in the region, about 80 cents go to clean energy – far from the global ratio of nearly 2:1 in favour of clean energy.

Without policy intervention and a definitive U-turn toward renewables, Southeast Asia risks locking itself into a future of energy insecurity, high power costs, increased pollution and economic pressure. Bangladesh and Pakistan have already felt that first-hand and are actively working to pivot away from fossil fuels through ambitious policies, such as the 10-year tax break package for renewable energy projects introduced in Bangladesh in November 2024.

Aside from introducing financial incentives such as subsidies, tax breaks and feed-in tariffs to increase the viability of clean energy projects, APAC governments should take the opportunity for the 2025 NDC updates, pledging to take on more ambitious clean energy targets to bring transparency and attract private capital holders.

Corporations Have a Huge Role to Play to Reduce Reliance on Fossil Fuels

While government policies are integral, they can fall short of advancing the clean energy transition without help from the private sector. Crucial on that front would be reducing support for fossil fuels and scaling up investments in clean energy. For example, reports reveal that the lobby around Japanese gas companies plays an important role in the natural gas expansion plans across Southeast Asia. Bloomberg also sees them as integral to driving the demand growth in the region.

However, the fossil fuel lobby can only do so much if corporations remain committed to their efforts to advance the clean energy transition and decarbonise operations. Businesses have a pivotal role in scaling clean energy adoption, and companies that prioritise sustainability will not only reduce their environmental impact but also gain competitive advantages by appealing to eco-conscious consumers and investors. Furthermore, by implementing energy efficiency measures, companies can reduce energy consumption and operational costs. Through energy audits and retrofitting initiatives, industrial players in Malaysia have managed to achieve substantial progress on this.

Furthermore, corporations can leverage their influence to advocate for cleaner energy policies through initiatives like the RE100. For example, climate-concerned businesses in Japan have set initiatives like the Japan Climate Leaders’ Partnership to urge the government to advance its decarbonisation progress and introduce more ambitious policy targets.

The Financial Sector as a Driver For Change

According to analysts, when climate change was at the front of the political agenda a few years back, banks boasted their commitments to act on climate. However, with Donald Trump back in office and the momentum swinging in the other direction, acting on climate has become less important for banks. As a result, at the start of 2025, some of the biggest lenders globally, including JP Morgan, Citigroup, Bank of America, Morgan Stanley, Wells Fargo, Goldman Sachs and more, withdrew from the UN-sponsored net-zero banking alliance. Many of those listed were among the initiative’s founding members. Four leading Canadian banks also quit the NZBA.

At the time of writing, there hasn’t been a similar exodus of Asian banks. However, they remain among the biggest financiers of fossil fuels, with Japanese banks pouring billions into fossil fuel expansion across the region. Asian investors also remain big supporters of maintaining the status quo.

While the withdrawal of major US banks from the NZBA can negatively affect the already limited pool of climate finance and potentially increase borrowing costs, especially for countries with JETPs like Indonesia and Vietnam, it also opens up an opportunity for Asian financiers to step up and fill in the gap.

Over the past year, there have been cases of high-profile investors and insurance companies opting against the reputational and financial risks associated with fossil fuel projects by withdrawing their involvement. A case in point is the Barossa gas project in the Commonwealth waters near Australia, which lost significant foreign support due to viability and environmental concerns despite efforts by government officials to convince Korean and Japanese stakeholders to continue backing the plans.

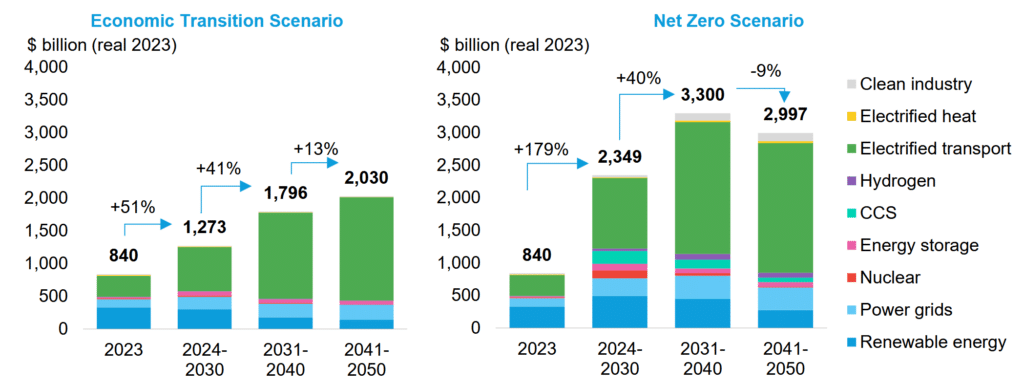

In total, to stay on track with the Paris Agreement, BloombergNEF estimates that Asia-Pacific countries would need USD 88.7 trillion in investments. This is the total capital needed from all stakeholders, including companies, financial institutions, governments and consumers. Furthermore, the figures are just 20% higher compared to an Economic Transition Scenario (BNEF’s base case scenario). Meanwhile, the falling costs of low-carbon solutions, such as EVs and clean power, and new policy commitments will help close the spending gap between the two scenarios.

However, the experts estimate that clean energy investments in the region will have to increase significantly in the coming years. For example, the investments in the period 2024–2030 should be triple the 2023 levels to align with the Paris Agreement’s goals.

Grassroots Measures and Individuals’ Contributions to Renewable Energy Adoption Also Crucial

Recent research by the University of Sydney found a trend across the Australian energy sector to shift the responsibility for the climate crisis to consumers. By creating a myth that individual action is enough to address climate change, it tried to reduce pressure on industry and government to take action. According to the researchers, the intentional pressure and overwhelming responsibility placed on individuals risked making them feel helpless and disengaged by the lack of progress.

Instead of shifting the responsibility and placing an unrealistic burden on the individual, corporations and governments should lead by example by implementing more comprehensive environmental policies and advancing a structural change.

Individual efforts can also make a positive difference, mainly as part of joint initiatives such as pressuring companies and governments to advance their decarbonisation efforts. For example, last year, Youth 4 Climate Action took South Korea’s leadership to court over its unambitious climate policies. The Constitutional Court of Korea found the country’s current climate measures insufficient for safeguarding citizens’ rights, particularly those of younger generations, who will bear the brunt of the effects of climate change. The ruling was the first of its kind in Asia and could set a powerful example for the rest of the region. The verdict now requires the government to set legally binding emission reduction targets for 2031-2049 by February 2026.

Another case demonstrating the power of communities was the Sumba Iconic Island initiative in Indonesia, which transformed the remote island into a model for 100% renewable energy. By installing solar panels, wind turbines and micro-hydro plants, the project substantially improved energy access for underserved communities.

Individual action, including more sustainable consumer choices and energy efficiency measures, can also make a difference. An example of this is participating in demand response programs like those in South Korea.

NDC Updates as a Way For APAC Countries to Accelerate Renewable Energy Adoption and Reduce Greenhouse Gas Emissions

APAC stakeholders are well-positioned to lead the global clean energy transition. However, doing so requires a top-to-bottom approach where governments lead through ambitious and transparent policies, followed by action from corporations and financial industry stakeholders.

The NDC updates due this year offer the prime opportunity for APAC states to establish themselves as the leaders of the global clean energy transition. According to BloombergNEF, Asian countries should show more ambition in the new NDCs and improve their targets’ transparency and credibility. Furthermore, the experts warn governments that in order to accelerate their energy transitions, they should prioritise proven green technologies that are ready for deployment and give less focus to solutions that are expensive, not available at scale or have limited decarbonisation efficiency.

These developments should be backed by efforts to bridge the financial gap by scaling up innovative financing mechanisms, providing more grant financing than loans that burden economies and helping vulnerable communities mitigate the high upfront costs of climate change adaptation efforts.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more