Clean Coal vs Renewables: Economic Costs and Gains For Southeast Asia

11 December 2023 – by Viktor Tachev

Aside from fuelling the climate crisis by extending the life of fossil fuels, Japan’s clean coal technologies are unlikely to benefit Southeast Asia. By tapping into their own immense solar and wind power potential, Southeast Asian economies can embark on a cleaner, cheaper and more secure decarbonisation journey through renewables.

Japan’s Plans For GX Technology Expansion Across Asia

Through its Green Transformation Strategy (GX), Japan plans to mobilise USD 1.1 trillion in public and private financing over the next decade. The investment roadmap aims to transform the industry and speed up the decarbonisation progress domestically and regionally.

The strategy’s name suggests it will accelerate the clean energy transition. However, the proposed technologies within indicate the opposite.

While a significant share of financing under the package will be dedicated to renewables, the proposed targets are uninspiring. Furthermore, they come with a lot of room for interpretation. The strategy states that renewables deployment should be “based on 3E+S Principles” (energy security, economic efficiency, environmental considerations and safety). According to Influence Map, the strategy could be a potential stumbling block for clean fuels.

The GX strategy focuses primarily on LNG, ammonia co-firing at coal-fired power plants, hydrogen and carbon capture and storage (CCS). The common theme between all these solutions is that they will extend the life of fossil fuels. Furthermore, companies developing hydrogen and ammonia projects will receive more significant support than renewable energy businesses.

Japan aims to export its solutions, which experts have described as “false”, “a greenwashing exercise”, and “a way to legitimise coal in the eyes of financiers and lenders” to Southeast Asia. E3G notes that the Japanese government and some of its industry are doing this out of economic interest.

The technology promotion is taking place through high-level vehicles like the Asia Zero Emissions Community and the Asia Energy Transition Initiative.

Clean Coal and Hydrogen Versus Renewable Energy: An Economic Costs Breakdown

Japan plans to fund or assist the development of ammonia co-firing and hydrogen plants in India, Indonesia, Vietnam, the Philippines, Thailand and Singapore.

In their current form, Japan’s plans won’t decarbonise but, instead, will lock itself and other ASEAN countries’ economies into prolonged fossil fuel use. Ammonia and hydrogen as a power source remain largely untested with no practical application or commercialisation. According to estimates, these technologies might not be ready for application by 2035. Moreover, Kimiko Hirata, founder of Kiko Network and Climate Integrate, says that Japan hasn’t even explained the specifics of the GX to other countries in detail, which is why they might struggle to recognise the false solutions within.

However, aside from the delayed decarbonisation and sustained emissions, technologies like hydrogen, ammonia/coal co-firing and CCS will likely take a toll on the target markets’ economies.

Energy Dependence and Fuel Import Costs

At 13.7%, Japan has one of Asia’s lowest energy independence scores. It is far behind the countries it is trying to export its technologies to, including Thailand (48.4%), the Philippines (53.7%), Vietnam (62%) and Indonesia (100%).

According to BNEF, Japan spent USD 1.8 trillion on fossil fuel imports between 2010 and 2022 (over 3% of GDP). When it comes to ammonia and hydrogen, Japan would still have to rely on imports, resulting in more money leaving the country.

The country targets an ammonia-coal co-firing rate of more than 50% by 2030. Yet, the country’s Green Growth Strategy acknowledges that if Japan’s coal-fired plants used 20% ammonia for co-firing, they would need 20 million tonnes of supply annually. This equals the entire volume of ammonia currently traded on the world market.

Furthermore, while Japan can shelter high fuel import expenditures, Southeast Asia can’t. Many of these countries were already priced out of the energy markets during the fossil fuel price crisis and were left starving for power.

E3G notes that pursuing ammonia co-firing would require sourcing large amounts of fuel. The analysts warn that this will increase energy security risks and raise import dependency on future hydrogen and ammonia exporters such as Australia and countries in the Middle East.

For countries like Indonesia and Vietnam, which are planning to produce green ammonia domestically, E3G notes little value in using the energy source in the power sector. Using renewable electricity to produce hydrogen, converting it to ammonia and finally burning that ammonia to produce power is a costly, slow and inefficient way to improve self-sufficiency in energy, compared to using renewables directly to generate power.

Renewables, on the other hand, are helping countries cut energy costs. In 2022, solar power alone saved China, India, Japan, South Korea, Vietnam, the Philippines and Thailand USD 34 billion in coal and gas imports.

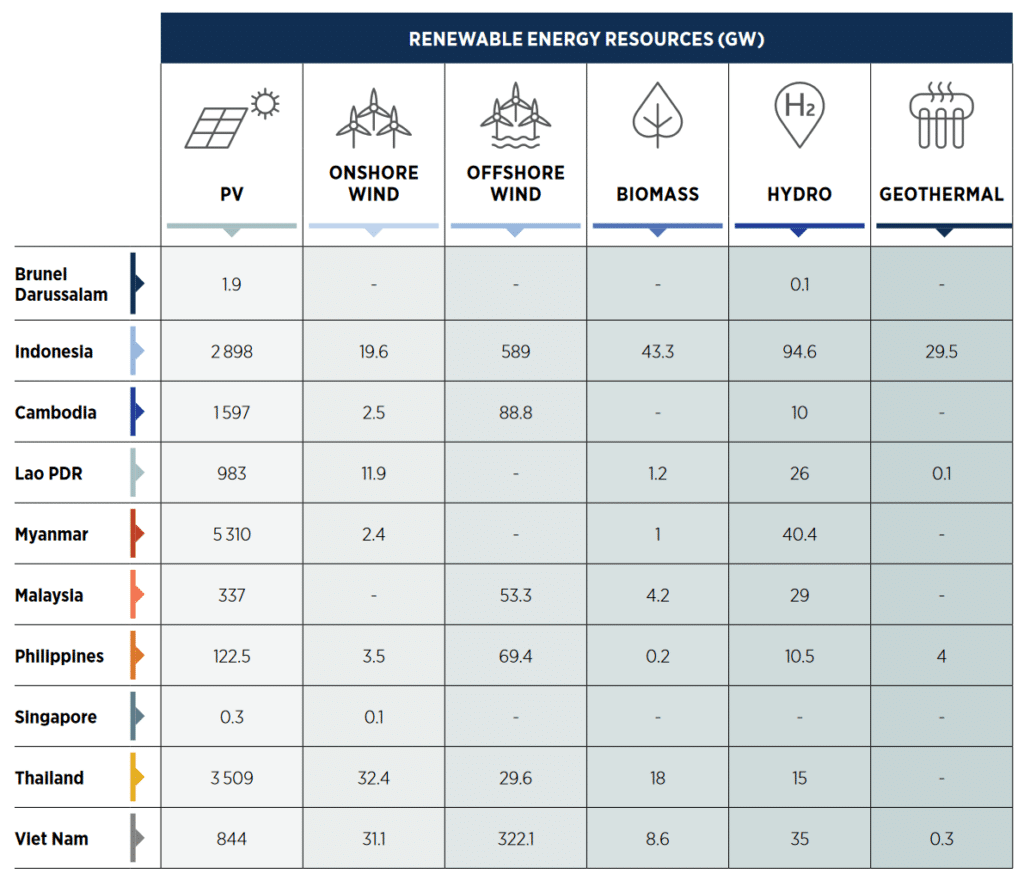

Furthermore, ASEAN countries share one key characteristic: the abundant, untapped technical potential for clean energy capacity. IRENA finds that the region can transition from just a 19% renewable energy share in 2018 to 65% by 2050 through renewables. Additionally, it could slash power sector emissions by 75% and reduce energy costs by USD 160 billion. Avoiding costs related to health and environmental damage caused by fossil fuels can accumulate savings of up to USD 1.5 trillion cumulatively by 2050.

Power Generation Costs

The World Coal Association recently underwent a rebranding. It now goes under FutureCoal, claiming to be a “Global Alliance for Sustainable Coal”. In one of the first interviews after the rebranding, the group’s CEO argued that investments in clean coal technologies for power generation would lower the cost of the energy transition, take less time to cut emissions and ensure a seamless electricity supply compared to renewables.

However, aside from Japanese officials promoting the “clean coal” idea and the fossil fuel industry, very few others share the same sentiment. Academics, politicians, analysts, and environmental groups opposed the feasibility, affordability, efficiency and environmental arguments of such technologies.

The IEA expects low-carbon ammonia for power generation to remain expensive up to 2030. It will sometimes be up to 30% more than regular energy market values.

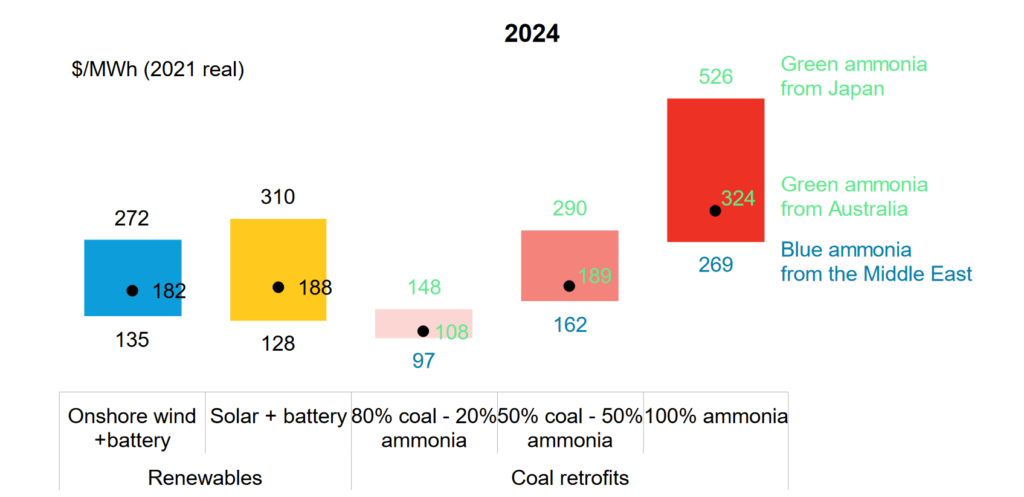

Bloomberg NEF warns that the only ammonia co-firing scheme cheaper than renewables today is 80% coal- 20% ammonia co-firing.

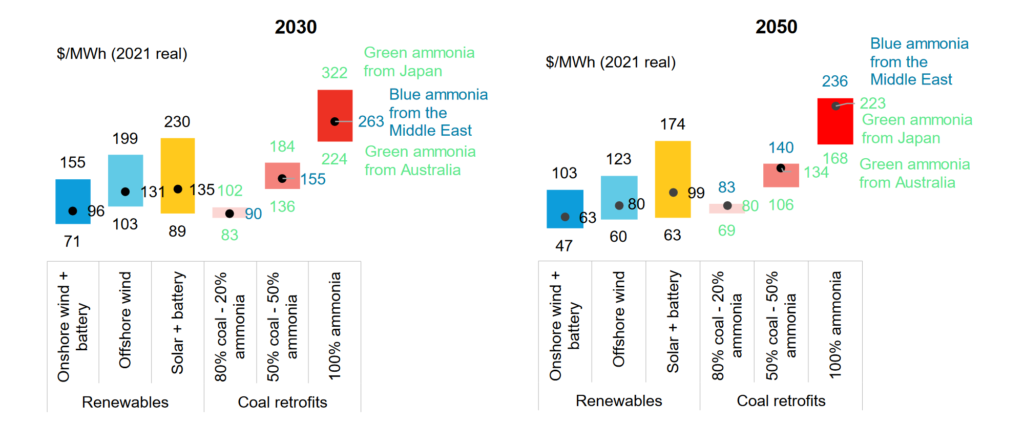

However, this won’t be the case by 2030 and 2050, when all renewable energy options will significantly outperform all ammonia co-firing schemes.

LCOE Comparison in 2030 and 2050, Source: BNEF

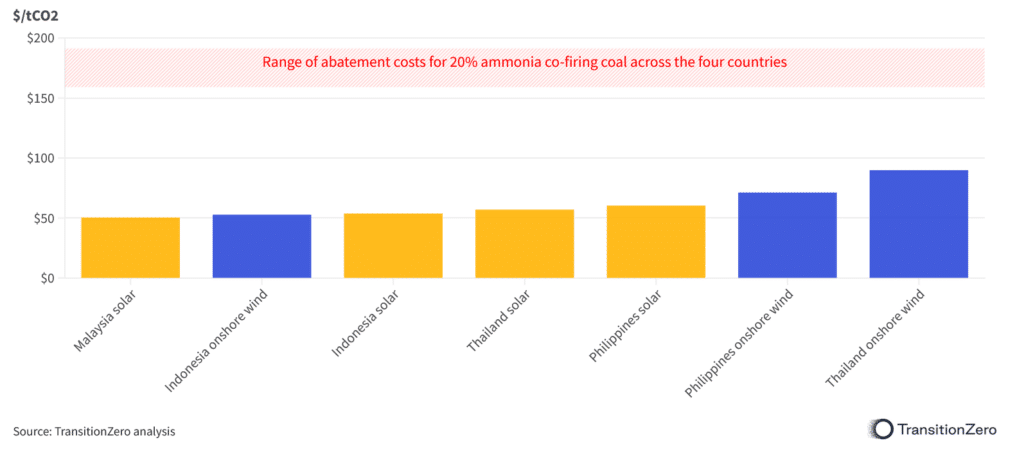

According to TransitionZero, Japan’s expensive and inefficient clean coal solutions will lead to significant cost increases in target markets. Even the cheapest form, the 20% ammonia co-firing scheme, can lead to four times higher abatement costs than solar and wind in the Philippines, Malaysia, Indonesia and Thailand.

Abatement Costs (USD per tonne of avoided CO2), Source: TransitionZero

E3G comes to a similar conclusion. According to estimates, shifting from conventional coal power to 20% co-firing with the cheapest form of ammonia, grey, would double costs. Grey and green ammonia cost four and 15 times as much as coal, respectively.

The case with carbon capture and storage is similar. It remains an expensive technology that hasn’t been proven on a large scale.

According to TransitionZero, the slow development and application of CCS in the power sector may ultimately result in a case of being too little, too late. By the time the technology becomes cost-competitive over unabated fossil fuels, it will be outshone by renewables.

At the same time, renewables are the cheapest power option in much of Southeast Asia. Paired with ever-decreasing technology costs, short time-to-market and the stable transmission networks already existing in many ASEAN countries, renewables give governments a cheap and quick sustainable solution that will cement their energy independence and empower their growing economies.

Energy Efficiency Rates

Experts describe ammonia as a highly inefficient energy source, as it is accompanied by significant energy losses at each step of its production process.

For example, between 20% and 30% is lost in the initial production of hydrogen. Another 5-20% is wasted in ammonia production. Up to 10% is lost in liquefaction and transportation. However, the most significant loss is at the point of combustion since thermal coal plants can convert 40% of their fuel into electricity.

In the end, TransitionZero notes that between 18% and 32% of ammonia’s original energy content becomes electricity. A CSIRO study finds that the cycle efficiency of ammonia is just between 11% and 19%.

With renewable energy, the losses are virtually zero, with the technology’s efficiency continuously increasing.

Infrastructure Lifespan

Renewables, in their various forms, are the fuels of the future. Their use is limited only by the natural resources they rely on. Where there is wind, sun and water, there will be energy.

On the other hand, ammonia co-firing schemes will become stranded assets alongside coal in the short term and have to close before their effective lifespan ends. The reason is that none of the ammonia co-firing solutions aligns with the IEA’s trajectories for net zero by 2050.

Subsidies

The Japanese government is heavily subsidising ammonia co-firing projects to make them appear economically feasible. Southeast Asian countries that end up pursuing the technology are likely to have to do the same.

A 2018 study estimated ASEAN’s yearly fossil fuel subsidies at USD 35 billion, compared to just USD 7 billion invested in fossil fuels. The trend was similar in 2021 as well, when ASEAN nations allocated a considerable amount of their GDP to costly fossil fuel subsidies.

The situation got more severe when the energy crisis struck in full force. In 2022, Indonesia, for example, had to budget USD 37.75 billion or 19.87% of its total 2022 expenditure budget for subsidies and compensation to keep most energy and fuel prices unchanged and to protect its population. According to the EU-ASEAN Business Council, this is twice Indonesia’s 2022 healthcare budget of USD 17.73 billion and four times its defence budget of USD 9.3 billion.

The IEA warns that fossil fuel subsidies are rarely well-targeted to protect vulnerable groups. As a result, their main function is to keep the polluting industry alive.

On the other hand, even without subsidies, renewables have been cheaper than any fossil fuel power option for years. By pursuing a renewable energy-led pathway, ASEAN countries can cut the excessive fossil fuel subsidy bill from their state budgets – a change over half Southeast Asians reportedly want.

Southeast Asian Countries Need Their Own Solutions

The circumstances of Japan and Southeast Asian countries are entirely different. Japan is the world’s third-largest economy globally and can afford to bear high fossil fuel import costs. Unlike Southeast Asia, it doesn’t have the same clean energy potential. Furthermore, Japan’s plans don’t indicate a willingness to improve its energy dependence nor speed up the transition to cleaner sources. According to critics, Japan’s sole motivation behind its ammonia co-firing and hydrogen plans is to protect the vested interests of the strong fossil fuel lobby in the country.

“They are fully aware that they are losers in this shift,” shares Kimiko Hirata. “So, they are really big on protecting the status quo and vested interests as long as possible,” she adds.

Adopting Japan’s questionable technologies will be a “costly strategic misstep” for Southeast Asia, as TransitionZero puts it. Instead, the analysts advocate for investments in renewables so that the nations remain in line with their climate targets and avoid stranded assets.

ASEAN countries need decarbonisation solutions tailored to their individual circumstances. Technologies promoted by Japan that have been proven expensive and inefficient in its domestic market won’t speed up the decarbonisation journey. They will impede it instead.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more