Gas Turbine Shortage in Vietnam and the Philippines

05 November 2025 – by Viktor Tachev

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) reveals that, aside from the financial and regulatory hurdles, the gas development plans of the Philippines and Vietnam are now threatened by a global gas turbine shortage. The extended delivery timelines, with up to seven to eight years of backlogs, paired with the higher infrastructure costs, have made LNG-to-power projects even less competitive compared to cheaper, domestically sourced renewable energy and storage. As a result, the viable solution for the energy systems of the two countries is evident — the question is whether the governments will take it.

Global Natural Gas Turbine Shortage Could Postpone Gas Projects in the Philippines and Vietnam Beyond 2030

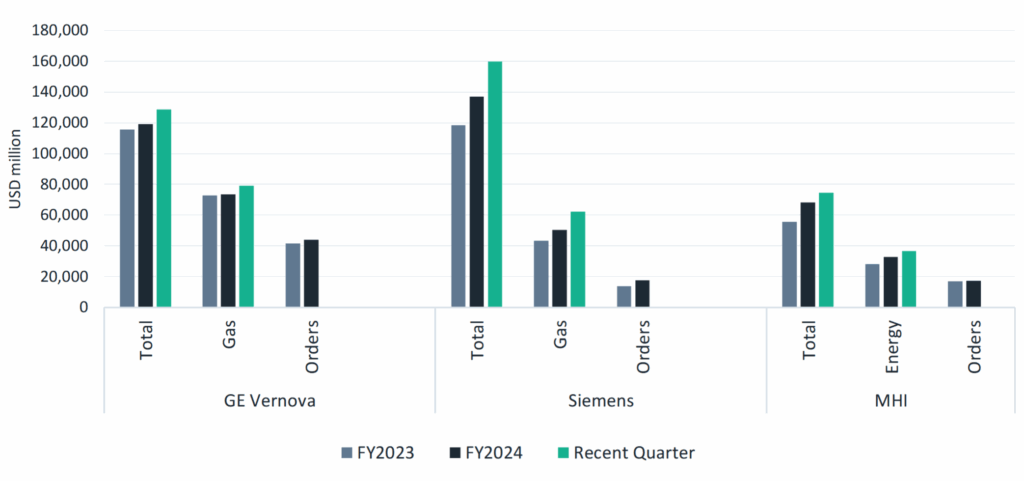

In a new report, Sam Reynolds, IEEFA’s research lead on LNG and gas for Asia, finds that the world’s largest gas turbine manufacturers, including GE Vernova, Siemens Energy and Mitsubishi Heavy Industries, face extensive production backlogs and are advising developers of new gas projects to plan for turbine procurement in seven or eight years. The expert also warns that it is unlikely that wait times or gas turbine costs will be reduced in the medium term, even if the world’s three leading manufacturers, which accounted for roughly 90% of the global market over the last decade, scale up manufacturing capacities.

The report also notes that recently, corporate financial results for the three manufacturers reveal a shift in growth prospects away from Asia and toward the US and the Middle East.

As a result, the looming production backlogs add to a lengthy list of challenges for LNG projects in Vietnam and the Philippines, with several already facing delays or even cancellations, causing power outages in major cities. Regulatory and bankability challenges also threaten projects and, according to Reynolds, are already delaying the gas and LNG development plans across the two countries.

Costs Also on the Rise

According to the report, the global gas turbine shortage not only threatens to delay LNG-to-power projects significantly but also substantially increases their costs.

Reynolds notes that turbine costs are increasing due to limited supply, reservation fees and rising component costs. For example, capital costs for gas turbines are found to have nearly tripled over the last two years, from USD 700–1,000 per kW to an estimated USD 2,400 per kW today. The analysis states that manufacturers are now also charging nonrefundable reservation fees to book turbine delivery in advance.

Furthermore, Reynolds warns that costs for gas turbine materials and components, including steel, aluminium, high-temperature coatings, labour and digital systems, are also on the rise. The same is true for other components of gas-fired power plants, including transformers and switchgear.

The Impact of the Global Gas Turbine Shortage on the Gas Expansion Plans of Vietnam and the Philippines

According to the report, for emerging Asian economies like Vietnam and the Philippines, where gas-to-power plans are already behind schedule and struggling to compete economically with coal and renewables, global turbine shortages present yet another obstacle to deployment.

Reynolds warns that Vietnam is likely to miss its 2030 targets for domestic gas and LNG-fired power capacity by a combined 25.2 GW. As per the Eighth Power Development Plan (PDP8), the government aims to build 22.5 GW of power capacity fueled by imported LNG by 2030, as well as up to 14.9 GW of capacity for domestically produced gas. However, IEEFA’s analysis finds that, as of September 2025, the country had just 1.6 GW of LNG-fired power capacity and 8.3 GW of capacity run on domestic gas, and expects that only two other projects are likely to have secured turbine reservations.

Furthermore, many of the projects in the pipeline would require multiple gas turbines, which means the uncertainty around their completion is mounting. The gas projects are also facing bankability issues due to the lack of finalisation of PPAs and higher offtake requirements, with IEEFA citing an investor who stated that, without guaranteed cash flow, it was “nearly impossible to raise capital, especially with LNG price volatility”. According to the source, investing in these projects felt like “entering a trap”. As a result, at best, IEEFA expects Vietnam’s gas development plans to fall short of 2030 targets by 19.7 GW for LNG-fired power plants and 5.5 GW for domestic gas-to-power capacity.

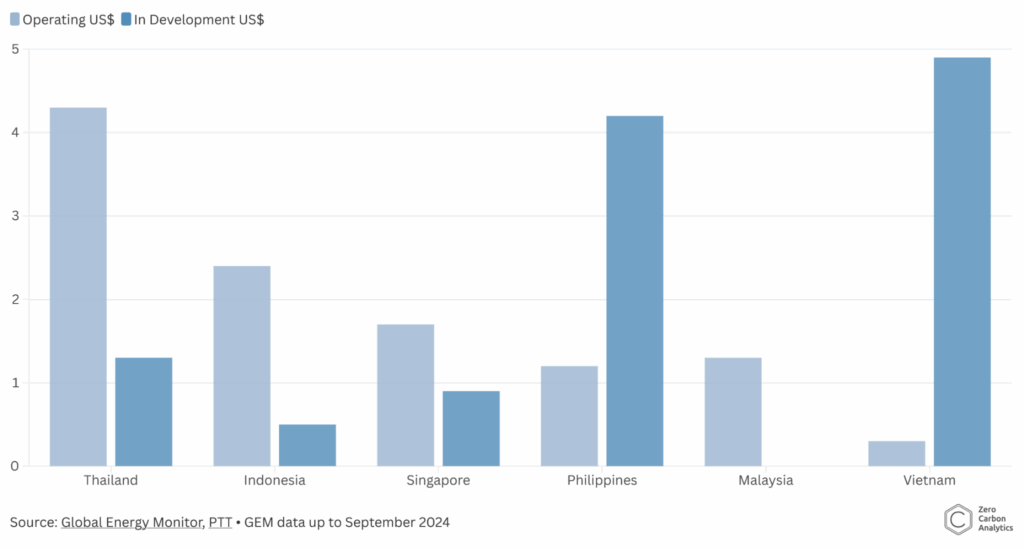

In the Philippines, the government’s plans for near-term gas-to-power capacity are more modest, and the IEEFA notes that new projects have recently struggled to secure long-term offtake commitments. In fact, the country currently has one LNG-to-power project expected to begin fully operating in 2025 and is unlikely to bring another LNG-fired power plant online this decade. Furthermore, all remaining projects, with a combined capacity of 10.7 GW, are in early development and are unlikely to have secured gas turbine orders. Meanwhile, IEEFA’s analysis finds that, similar to Vietnam, greenfield LNG-to-power projects in the Philippines have struggled to secure long-term offtake commitments with utilities that would underpin financing, presenting another challenge for the country’s LNG plans.

A Blessing in Disguise: The Gas Turbine Shortage Opens Up Huge Opportunities For Vietnam and the Philippines to Prioritise Renewables

According to Reynolds’ analysis, the two countries can try to overcome disruptions to their gas expansion plans by diversifying turbine suppliers and opting for smaller, less efficient gas turbines. However, these moves are accompanied by uncertainty, technical and operational challenges.

As a result, the most effective measure to address projected delays in LNG-to-power projects in both countries is to expand low-cost renewables and storage, thereby reducing the need for LNG in the long term. Aside from the cost, energy security and decarbonisation benefits, such a shift would also help countries capitalise on shorter and more precise timelines. For example, while the timelines for solar and wind project development are typically around 1 year, LNG projects can take three to four years, even before factoring in ongoing turbine shortages and other contractual and regulatory delays, Reynolds notes. The Philippines is a case in point. While LNG-to-power projects were proposed as early as 2003, the country’s first import terminal wasn’t live until 2023.

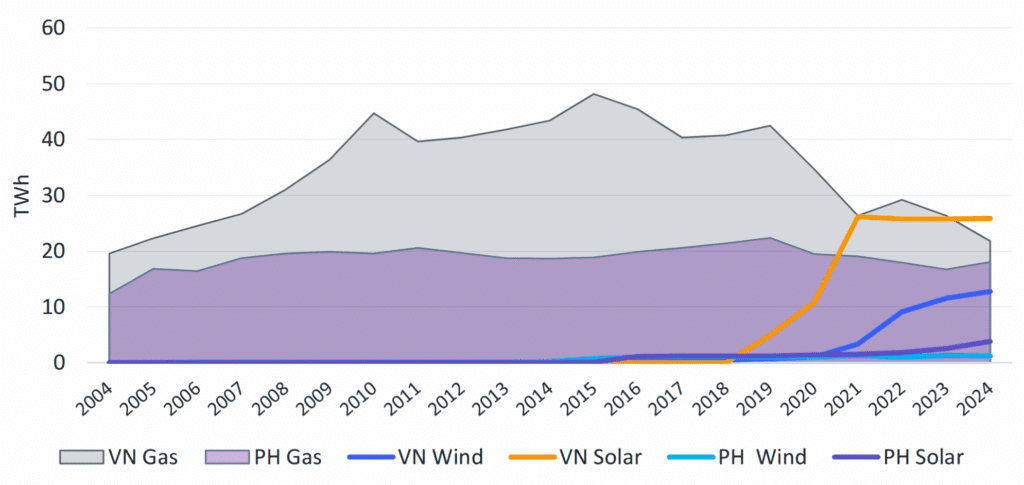

Vietnam is no stranger to deploying renewables en masse. Between 2018 and 2023, the country’s wind and solar capacity spiked from virtually zero to over 21 GW, driven by a generous feed-in tariff (FIT) regime, making it Southeast Asia’s largest solar producer. At the same time, gas generation has fallen 55% since 2015, and both domestic gas production and demand have declined. Looking ahead, the country’s revised PDP8 increased its 2030 solar targets sixfold, with the plan now aiming for renewables (excluding large-scale hydropower) to provide up to 75% of electricity generation by 2050.

IEEFA’s report notes that gas-fired power generation has also declined in the Philippines since 2015, with the falling domestic production forcing a shift to more expensive LNG imports. At the same time, renewable generation has grown more slowly than in Vietnam, but Reynolds sees signs of rapid potential growth in the near term. This year alone, the government awarded 9.4 GW of renewable energy contracts, with projects expected to come online from 2026. Furthermore, the country is currently constructing a 3.5 GW solar-plus-storage project, the largest in the world.

The fact that battery storage prices have fallen by almost 75% since 2017 also opens vast opportunities for Vietnam and the Philippines to transition to cleaner and more self-sufficient energy systems. Through its PDP8, Vietnam aims to take advantage of that, as the country has increased its battery storage deployment targets from an initial 300 MW to between 10,000 MW and 16,300 MW by 2030.

The Philippines is also moving in that direction, with the country recently launching its first hybrid solar plant, a 197 MW solar array with a 320 MWh battery storage system. Moreover, the country’s fourth green energy auction, held this year, set a 1.1 GW target for solar-plus-storage capacity for the first time. Current plans indicate that the Philippines will deploy around 2 GW of battery storage projects over the next three years.

Uncertainty Around Gas-fired Power Plants Paves the Way For Accelerating the Energy Transition in Vietnam and the Philippines

The LNG industry often cites Southeast Asia’s power sector as a major global demand driver. This has, indeed, been the case for several years in a row.

In the case of the Philippines, Zero Carbon Analytics expects annual LNG import costs to triple from 2025 to 2029, reaching USD 3.9 billion over that period. Paired with the construction of expensive new facilities, they could increase power generation costs in the country by 11-24%, resulting in higher electricity bills for households and industrial consumers. Businesses in the Philippines are already struggling with higher operational expenses, while the market design has allowed utilities to pass on fossil fuel price volatility directly to consumers, such as households.

However, Southeast Asian countries have started dragging their feet and are increasingly reconsidering their gas expansion plans, with reports revealing that the gas power development pipeline remains stuck in the planning phase, with only around 6% of the announced power projects across the region currently under construction.

Vietnam and the Philippines have felt firsthand the risks of excessive reliance on fossil fuel imports. Following the 2022 energy crisis, they found themselves exposed to extreme volatility and unaffordable fuel prices, ultimately losing bidding wars on global markets and seeing deliveries rerouted to wealthier nations. The gas turbine manufacturing issues identified by IEEFA’s Sam Reynolds now present yet another challenge to rapid LNG demand growth forecasts for key Asian economies, ultimately putting them in a similar situation. This time around, though, emerging Asian economies are losing another battle with wealthier markets — one for gas turbines.

Renewables, once again, promise a way out. The LCOE for a new utility-scale solar project in the Philippines currently ranges from USD 35-72 per MWh, compared to USD 87-105 per MWh for a combined gas-cycle turbine. According to BloombergNEF, solar paired with storage is already cheaper than gas, with the price gap on course to widen by 2030. Even onshore wind, which remains more expensive than coal and gas in 2025, will be cheaper than both by 2028. Solar is also more affordable than natural gas in Vietnam.

According to Reynolds, with every year passing by, countries like the Philippines and Vietnam will feel they need less and less LNG in the long run. In that sense, strengthening their energy systems with more affordable, secure and cleaner power sources has emerged as the only viable strategy to avoid dealing with uncertainty and to be at the mercy of third parties.

Fortunately, the Philippines and Vietnam have everything needed to shield their economies and consumers from high fossil fuel prices and project costs — from vast clean energy potential and solid renewable market fundamentals to access to affordable solar, wind and battery technologies from China. Whether they utilise the abundant options available remains a question of political will.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more