Vietnam’s Block B Gas Project – the Potential Impact on the Involved Parties

11 August 2022 – by Viktor Tachev Comments (0)

Vietnam’s Block B gas project raises risks for all parties involved – from developers and investors to the Vietnamese government. It reflects the power of the gas lobby, forcing a country with vast renewable energy potential to take a step back. As a result, Vietnam risks tarnishing the notable clean energy progress it has made in recent years, such as the latest PDP8 Vietnam draft.

Vietnam Block B Gas Project in a Nutshell

Block B, located in the Malay-Thổ Chu basin, is a USD 10 billion natural gas field and pipeline project. The leading investor in the project is Vietnam Gas Corporation JSC. The Japan Bank for International Cooperation (JBIC) also plans to take part in the project.

To date, Block B remains one of the country’s most significant natural gas exploitation sites. Upon launch, it will have more than 700 exploitation wells.

Vietnam’s Blocks B Project on Track for Sanction this Year

The project was first announced in 2016 but was suspended in early 2018. However, the project is now back on track for sanction in the fourth quarter of 2022. The entire chain of Block B-Ô Môn is intended to enter the construction phase in the second half of 2022. If everything goes according to schedule, the project will be completed in 2026.

The Block B Gas Project and Its Impact on the Involved Parties

According to the oil and gas group lobby, the Block B gas project will unleash many benefits other than increasing gas production. The lobby stated it would be “a growth engine for businesses in the country’s oil and gas value chain, strengthening the industry’s foundation and profit growth of oil and gas enterprises”.

As evident, the project will benefit mainly the oil and gas industry. However, the potential risks for the rest of the involved parties have yet to be discussed.

The Risks for Vietnam

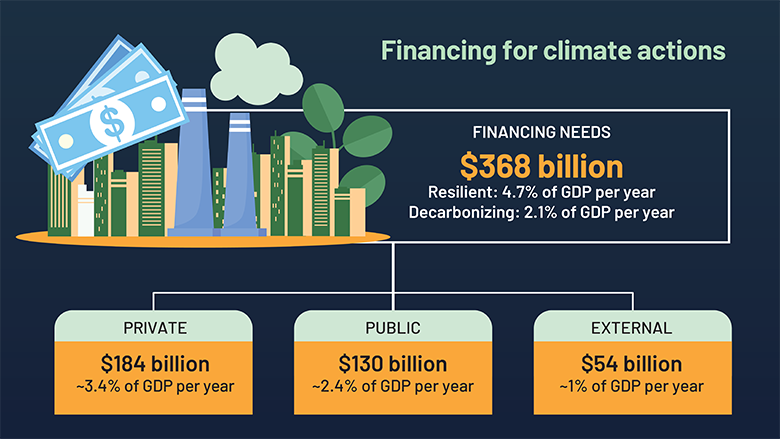

According to reports, the project’s massive bill will be added to the state budget over the project’s 20-year life from the upstream project and the gas pipeline. This comes at a time when the country is in glaring need of substantial clean energy investments. According to the World Bank, Vietnam will need about USD 64 billion to decarbonise its energy sector. Furthermore, the country faces a financing gap, requiring a combination of private, public and external funds to cover its needs and ensure energy security.

In that sense, investing in a natural gas project will consume massive capital that could otherwise go towards the country’s green energy transition. Furthermore, the Block B gas project will further slow the country’s decarbonisation and net-zero emissions goal by 2050.

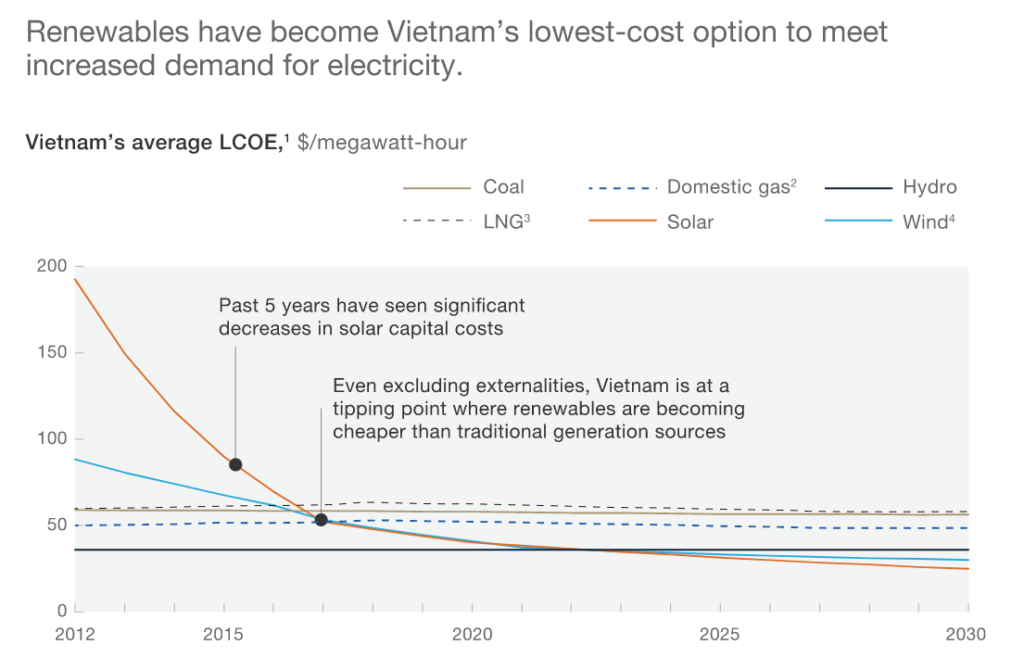

Vietnam’s gas expansion plans don’t make sense from an economic point of view, considering that solar – which the country has plenty of capacity for – is already the cheapest new energy source. This isn’t a one-off thing but a trend visible across Vietnam, China, India and Thailand. According to McKinsey, the price of renewables could continue to drop by up to 10% per year.

Proceeding with the gas plans will expose the country to a number of drawbacks typical for new gas infrastructure. These include stranded asset risk, environmental concerns, and more importantly – the risk of erasing the remarkable clean energy progress referred to in our previous article.

The Risks for Gas Developers and Investors

By the decade’s end, renewables will become the cheapest way to supply electricity across Asia. According to Carbon Tracker, new gas plant developers will have minimal time to build and start operating their infrastructure before finding it unable to compete with renewables.

This risk is even more glaring for gas projects in Vietnam. The reason is that the country has a technical potential for nearly 600 GW of wind power and an exemplary track record in solar capacity expansion.

Continuing to lean on fossil fuels in the current geopolitical situation can also be risky for project investors. For example, mine development and exploratory drilling projects are facing equipment shortages due to the reliance on Russian technology and the ongoing Russia-Ukraine war. Speaking to the Vietnam Investment Review, Tran Hong Nam, CEO of PetroVietnam Exploration Production Corporation, said that collaboration on developing oil and gas projects in the future might be extremely difficult.

The Risks for Japan and the Japanese Companies Involved

Earlier this year, the JBIC acquired an Environmental Impact Assessment and started to consider involvement in the Block B gas project. Mitsui Oil Exploration (MOECO) is also taking part in the project.

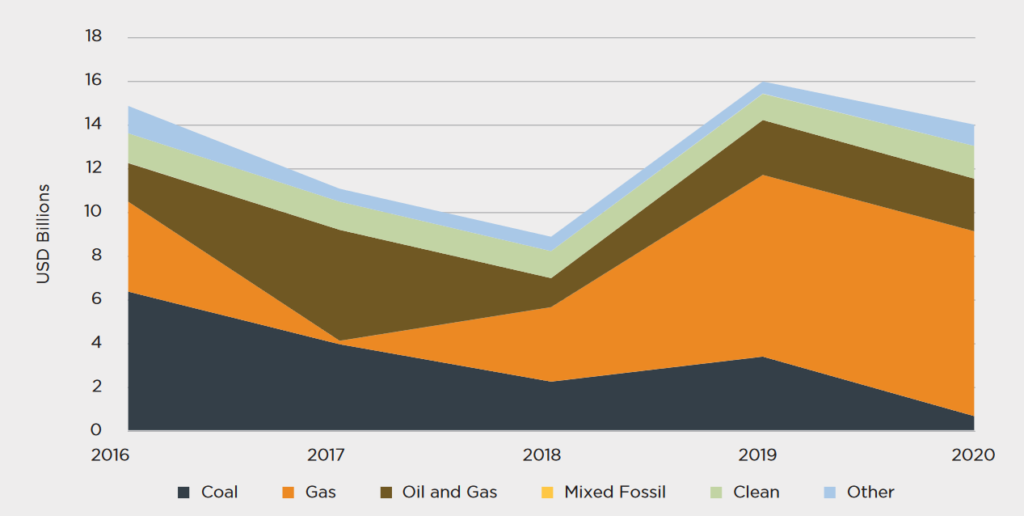

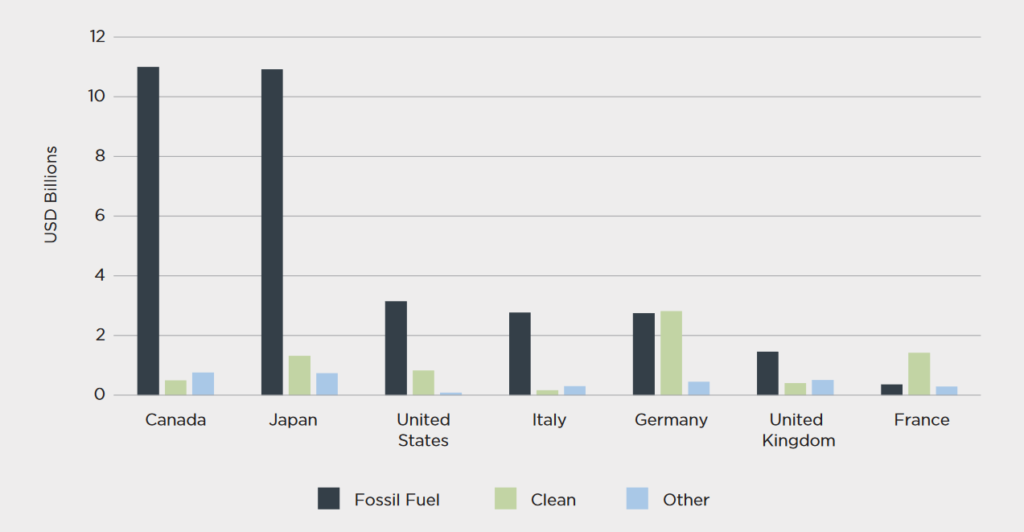

The interest in the Block B gas project isn’t surprising. Under its Asia Energy Transition Initiative, Japan is driving the expansion of gas infrastructure in Asia, spending billions of dollars on new fossil fuel developments yearly.

It remains unclear whether JBIC will push ahead with support for the Block B gas project. However, if it decides to do so, it will signify that Japan’s commitment to end overseas fossil fuel financing by the end of 2022 is just an empty promise. The Japanese government remains committed to public support for upstream oil and gas projects, despite its G7 pledge.

However, this will entrench the Japanese government deeper into dirty and risky gas infrastructure projects in Asia. The country risks bearing a large stranded asset risk and threatening its own economy and energy security. It will also undermine the energy and climate security of Asian countries. This is a notable problem, considering that many of the countries with the highest climate risk are in the South and Southeast Asia regions.

On the other hand, by fulfilling its G7 commitment, Japan can shift USD 33 billion each year from fossil fuels to clean energy and speed up the net-zero transition in the region.

Towards a Future of Unpredictability

Vietnam’s gas obsession is a combination of internal policies and external pressure. Regarding the former, the country’s current plan includes a substantial gas capacity expansion. The country’s PDP8 aims to increase the gas demand for power generation by up to 23% in 2030, from 12% currently.

Regarding the latter, there has long been an agenda to paint liquefied natural gas (LNG) as a fuel aligned with a net-zero economy. Recent research over public statements from the gas lobby in Japan and South Korea regarding Vietnam has found that in 2019, only 11% of the statements in favour of LNG used the “low carbon” argument. After COP26 and Vietnam’s goal for net zero by 2050, the percentage rose to 85%.

However, in recent events, highly-volatile LNG prices have given the Vietnam government second thoughts regarding the 23 new liquefied natural gas-fired power plants proposed in the PDP8. There are also concerns about financial institutions refusing to fund LNG after 2025. According to analysts, project delays and cancellations are at risk if the record-high prices continue.

All this means that the idea of gas being Vietnam’s much-needed solution is starting to lose ground. If companies like JBIC proceed with their support of the Block B gas project, they will be exposing themselves to widespread risks. And in a world where net-zero is the only viable path, these risks are abundant.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more