How Oil and Gas Companies Can Jump Aboard the Green Wagon

21 July 2021 – by Viktor Tachev Comments (0)

The COVID-19 pandemic had been a pivotal moment for the oil and gas companies worldwide. It gave organisations a chance to stop and reconsider their strategies and growth models. The much-needed reality check came at a moment when the world’s marching towards a net-zero economy. Oil and gas companies’ next move will determine how smoothly they will face the inevitable renewable energy switch. The next few years will prove successful for the most adaptable companies. The winners will be the ones, flexible enough to restructure and align their business models with the net-zero horizon ahead.

The Oil and Gas Industry at the Brink of the Renewable Energy Transition

Due to the pandemic and the global shutdown, 2020 saw a drop in global energy demand up to 30%. This was a critical moment that many oil and gas companies seized. They started planning more actively for when fossil fuels will no longer be the backbone of the global energy mix. While this moment might seem too far in the future, its breeze is starting to be felt today.

According to the Wall Street Journal, oil and gas companies in North America and Europe wrote down assets worth USD 145 billion (equivalent to 10% of their market value) during the first three quarters of 2020. In a further hit for the industry, Denmark announced it anticipates ending oil and gas production in the North Sea by 2050. It became the second country in Europe after France to set a date for banning oil and gas production.

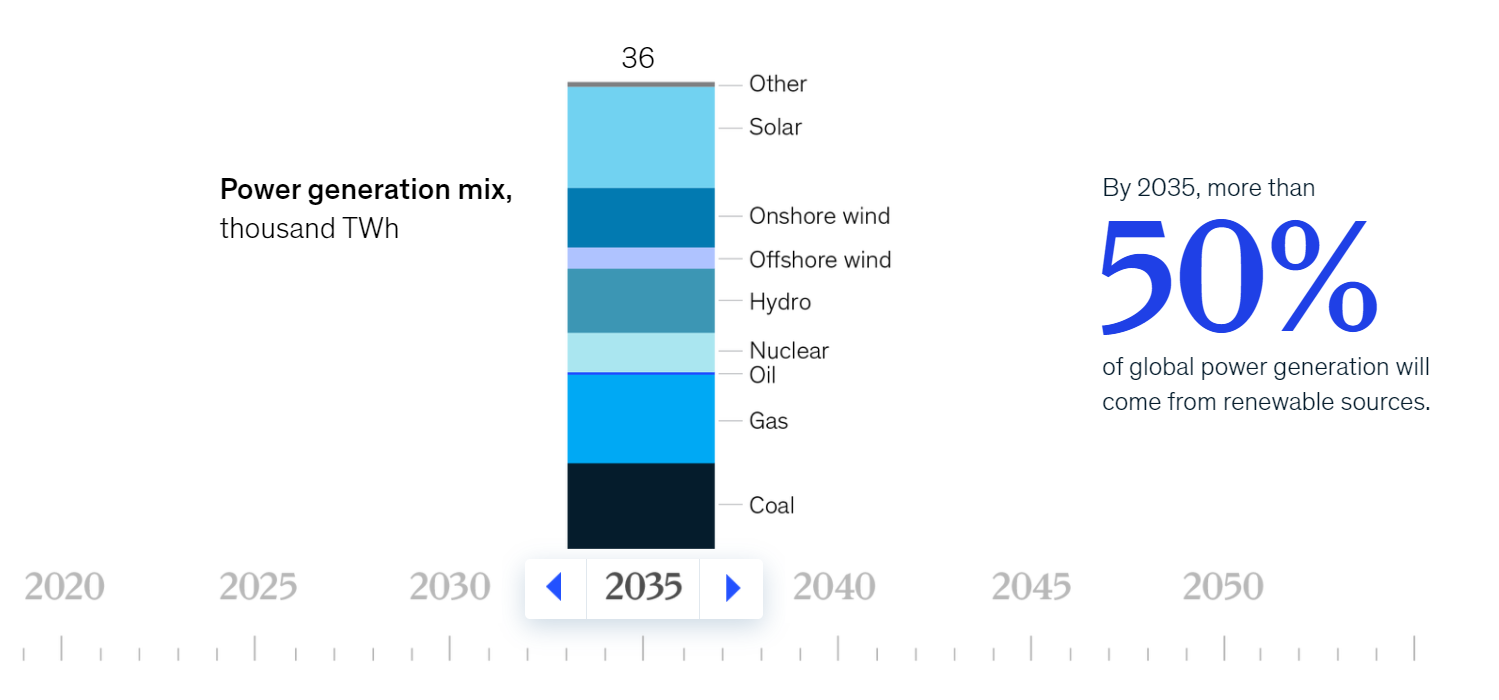

Furthermore, many governments made renewable energy investing a cornerstone in their post-pandemic recovery strategies. McKinsey estimates that, by 2035, 50% of the global power generation should be coming from renewables.

Crude Oil and Gas vs Renewables

Oil and gas companies shouldn’t look at renewables as the enemy, however. Clean energy is mostly a mirror that had exposed the inherent vulnerabilities of the fossil fuel industry. Oil and gas companies need to address them and reshape their operating models. Otherwise, the industry might face a major consolidation or even bankruptcies along the chain. To avoid that, McKinsey sees the process of steering a middle path toward becoming integrated energy players as the best step for players in the oil and gas market.

What Lies Ahead

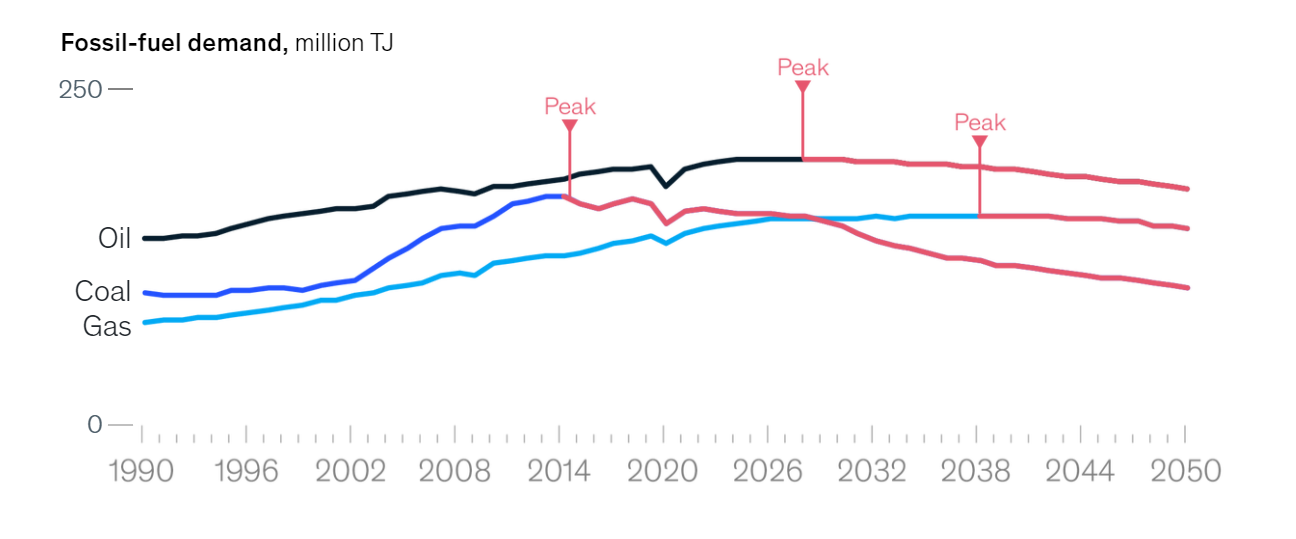

Currently, the public attention is focused on coal – the antipode of renewables. However, it had already peaked in some parts of the world. According to IEA’s Net-Zero By 2050 roadmap, the global demand would drop to just 1% of total energy use by 2050.

A gas industry without subsidies

Such a scenario leaves breathing space for the oil and gas industry. Yet, it is unrealistic to think that the demand would start going down only when we phase coal out entirely. Just the opposite, it is likely to follow the same path as coal and reach a plateau at near-peak levels before embracing a downward move. According to IEA, if the world wants to live up to its net-zero target, oil and gas demand should decline by 75% and 55%, respectively, come 2050.

For oil and gas companies, the middle of the century might seem too far in the future. However, the troubles might begin earlier if countries decide to put the brakes on fossil fuel subsidies and switch the capital inflow towards renewables.

Subsidies as a proxy for the industry’s outlook

Such a scenario is very realistic, given that the subsidies for clean energy in different countries in Asia are between 15 to 27 times less than those for fossil fuels. Considering that the investments in renewables are insufficient, countries might consider additional incentives like better subsidies to attract investors if they are too far behind their net-zero NDCs.

Subsidies aren’t the only way for governments to hit the fossil fuel industry, however. Ending funding is another strategy that is already being applied. In May 2021, the Asian Development Bank announced that it would stop financing coal projects. Public banks have also been doing this for a while. At some point, the oil and gas industry might have to face a similar faith.

Carbon Pricing Policies and the Oil and Gas Industry

Other steps like stricter carbon pricing policies can also be used to speed up the renewable energy transition at the expense of the fossil fuel industry.

Signs like these shouldn’t be the first reminder for oil and gas companies to start planning for the upcoming transitions. Instead, these should be the trigger to begin putting their plans into action.

The Best Moves for Oil and Gas Companies

McKinsey projects that the energy demand will return to pre-COVID levels in one to four years. However, it is likely that the return will present us with a new face of the energy mix, considering that renewables are becoming a cornerstone of governments’ recovery plans due to their economic and environmental benefits.

For now, however, fossil fuels subsidies represent a major stumbling block for the decarbonization strategies in Asia-Pacific. Due to this, ending government support and increasing the efforts in renewable energy backing is seen as one of the primary measures and most powerful tools for governments to advance on their net-zero strategies. As a result, oil and gas companies should start planning ex-ante, instead of post-factum, to ensure a swift net-zero transition.

Oil and Gas Companies Transitioning to Net-zero

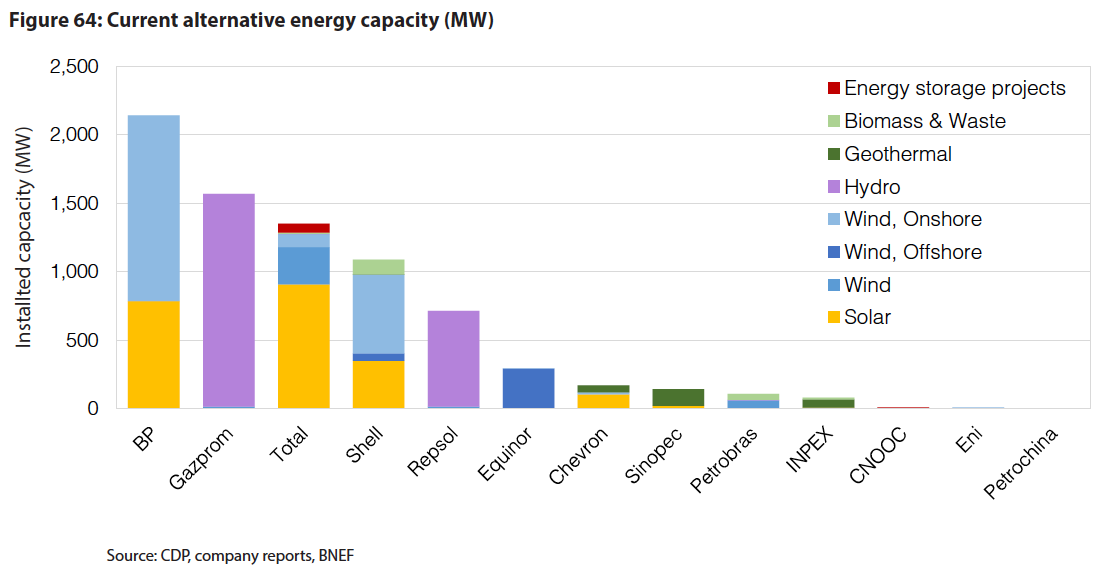

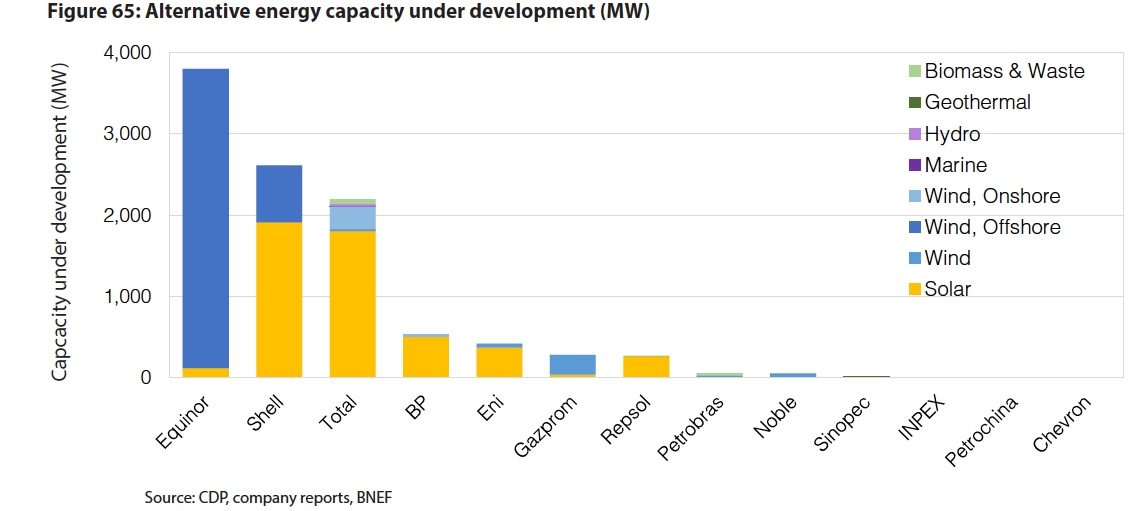

Some are already doing it. For instance, The Oil and Gas Climate Initiative has set aside USD 1 billion to back the low-carbon ecosystem switch. On a micro level, several oil and gas companies have set net-zero emissions targets and upped their efforts to decarbonize not only their operations but also their value chains. Such companies include Occidental Petroleum, China National Offshore Oil Corporation, ExxonMobil, BP, and more.

Renewable Energy Investments – Beyond Decarbonizing

The truth is there are promising signs in terms of renewable energy investments from oil and gas companies. However, most of their efforts concentrate on carbon-capture technologies or carbon credits for emission offsetting. According to McKinsey, the industry should be going well beyond decarbonizing their operations and focus on Scope 3 emissions. The consultancy estimates they hold over three-quarters of the sector’s emissions footprint and remain the dominant challenge.

To Conclude

Oil and gas companies should be looking to tailor their green approach based on their individual starting points and aspirations. What is more important, however, is that the industry, as a whole, understands that a focus on “what is essential: health, safety, and protection of the environment while providing the energy and vital products that society needs to support economic recovery” is what we need. Because understanding the problem is half of the solution.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more