San Miguel Corporation’s LNG Projects and their Implications for the Company and the Philippines

Photo by Leonardo Da

29 September 2022 – by Viktor Tachev Comments (0)

The San Miguel Corporation (SMC) and its LNG projects in the Philippines bear risks to both the company and the country. For SMC, the liquefied natural gas projects in development could be an impractical solution to the country’s power demand from a financial and reputational point of view. The environmental toll aside, the gas expansion also threatens to expose the Philippines to an increased energy security risk and a future of high electricity costs. On the other hand, renewable energy in the Philippines can be a much better option for corporate and national interests.

SMC’s LNG Projects and the Gas Expansion Plans in the Philippines

Due to the looming energy crisis, the Philippines is seeking reliable and stable energy. Under the influence of the oil and gas lobby and project developers, the government is actively considering gas infrastructure. Projections are for liquefied natural gas to account for 40% of the country’s energy mix by 2040, up from 22% in 2020.

Today, the Philippines has the second-largest planned gas expansion in Southeast Asia, with 29.9 GW in development. To accommodate the expected growth in LNG imports, it is also building a fleet of terminals. The first one was scheduled to go live by the end of 2022.

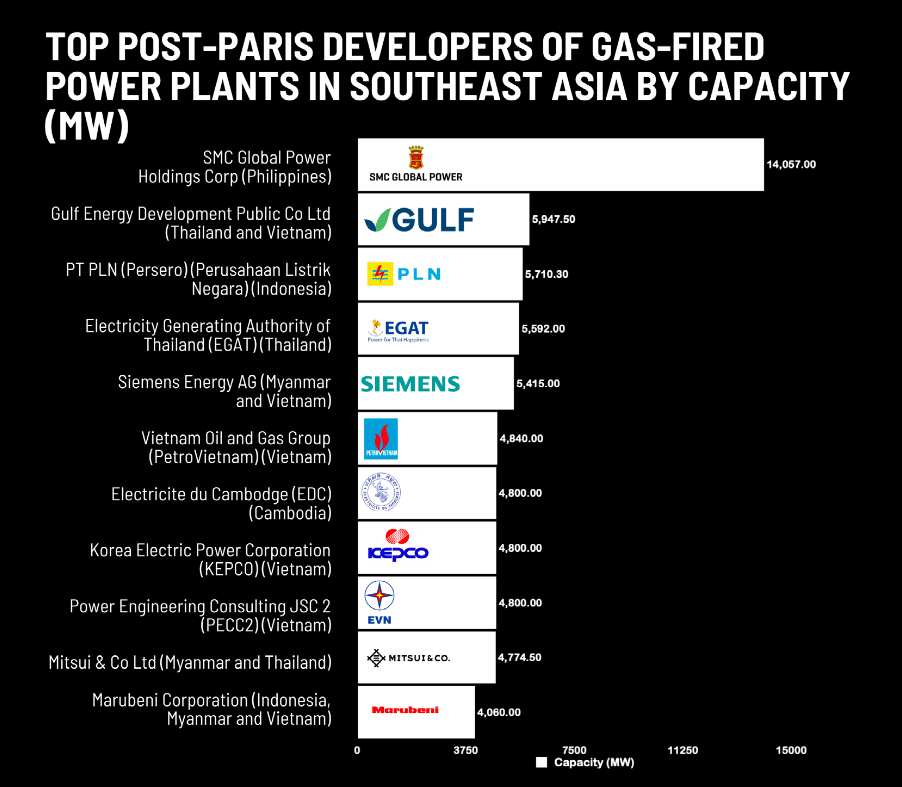

Many developers are pushing for gas expansion in the Philippines and the region. However, the most active is SMC Global Power Holdings Corp., the power arm of the conglomerate San Miguel Corp.

A report by CEED Philippines finds that SMC has 14.1 GW of proposed power generation projects, or half of all planned gas capacity expansion in the Philippines. Furthermore, the company is the leading gas infrastructure developer in the region.

The Implications of the Gas Expansion Plans for SMC

SMC is no stranger to the fossil fuel business. Beginning as the Philippines’ largest coal developer, it has now become the top fossil gas developer in the country. However, as CEED’s report points out, the obsession with fossil fuels isn’t only the fault of SMC’s board. Western banks with interests in the company also heavily support their use.

No matter who drives the gas expansion plans, such a road map risks causing many issues for SMC.

Increased Reputational Risk

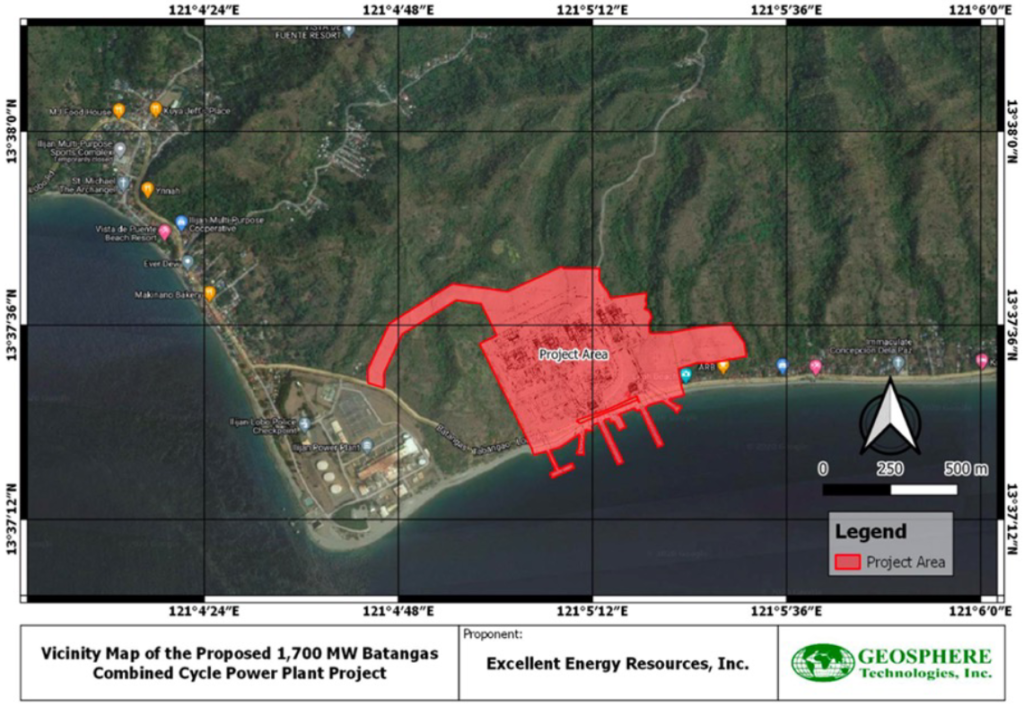

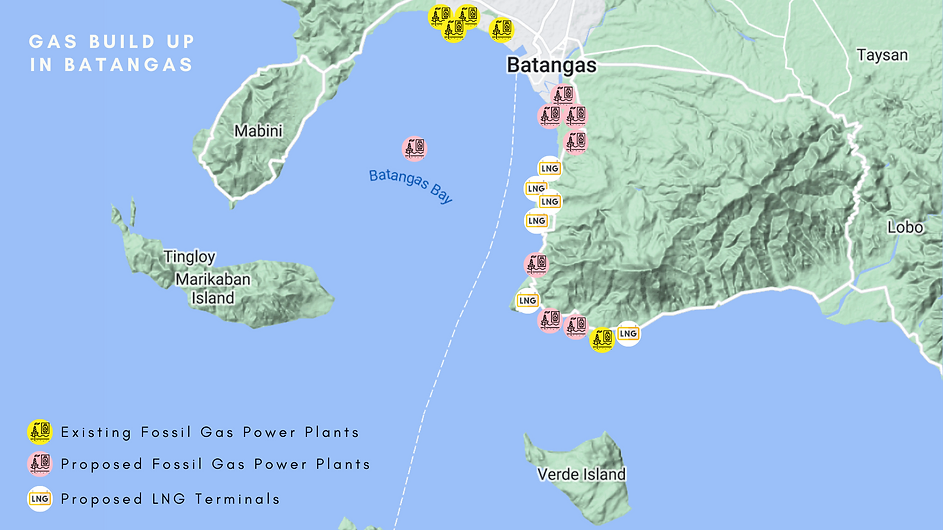

SMC faces public opposition against the 1.75 GW power plant in construction in Batangas from communities, organisations and environmentalists. Through a series of measures, including a fluvial demonstration, letters of protest, an online petition and legal complaints, activists are opposing this LNG power plant project (due to launch by the end of 2022) and see it as a threat to the marine corridor.

Batangas and the Verde Island Passage (VIP), in particular, provide food to over 2 million people. The VIP is also the centre of global shorefish biodiversity. It is home to 60% of all known shorefish species. In addition to fuelling the climate crisis, the groups claim that the projects threaten marine life and livelihoods. This claim is also backed by studies.

However, SMC’s 1.75 GW project isn’t the only one in the area. Batangas currently houses five of the six existing gas plants in the Philippines. Furthermore, eight of the 27 proposed new plants and seven of the nine planned terminals are going to be there. Public opposition to new gas projects is also growing in San Carlos city and other regions.

At the same time, SMC’s website is all about sustainability. The company calls itself “sustainability champions” and claims to have “gone well beyond mitigating the problems of climate change”. It stands behind its core value, “malasakit,” described as the “unique Filipino value of helping others without being prodded and without expecting anything in return”. SMC even claims to be doing better for the environment by taking direct action to help the cities, waters and forests in the Philippines.

Stranded Asset and Financial Risk

Carbon Tracker warns new gas plant developers of having minimal time to build and start operating their units before their assets become uncompetitive with renewables. Analysts consider getting an LNG import project up and running in the Philippines an even more challenging task.

The Institute of Energy Economics and Financial Analysis (IEEFA) finds that the stranded asset risk of LNG-to-power infrastructure in the Philippines is USD 14 billion. IEEFA sees a relatively low feasible investment in new LNG infrastructure in the country. This reflects the broader risk of the region’s planned LNG and gas infrastructure not going ahead.

However, if it does, it risks exacerbating the problem of the high energy costs in the country. The IEEFA notes that, currently, cargoes flow to buyers willing to pay the highest prices. From March 2021 through March 2022, the Asian spot price for LNG jumped by over 15 times the price. Experts expect prices to remain high until at least 2026 after significant new supply capacity comes online.

Currently, Filipinos pay some of the highest electricity prices in Southeast Asia. The country’s current model directly passes price changes to end-users who must bear the high volatility. This also puts the corporate sector at a competitive disadvantage to businesses from countries with lower energy costs.

After winning a power supply contract in February 2021, the San Miguel subsidiary Excellent Energy Resources Inc. promised electricity from its LNG plant due to launch in March 2023 at a price that is a third of the actual cost of producing power from the fuel cost alone. Sam Reynolds from IEEFA notes that, unless the company has already secured access to low-cost LNG, it will probably fail to meet its commitment. He urges EERI to bear the cost alone in such a scenario instead of passing it to the people.

A Future of Uncertainty

San Miguel Corporation doesn’t need to look far to see the impacts of fossil fuel price volatility. In August, SMC Global Power said it suffered combined losses of P15 billion from its two power plants, including its LNG plant in Ilijan, Batangas, due to “skyrocketing global coal prices and unilateral natural gas supply restrictions from Malampaya”. SMC, along with Manila Electric Company (Meralco), has an ongoing petition at the Energy Regulatory Commission (ERC) to be allowed to charge higher for electricity – a move that will pass the burden to consumers.

Pushing ahead with the gas expansion risks a future of energy instability, unreliable supplies and increased geopolitical risk. Europe’s situation in light of the Russia–Ukraine war is a prime example of this. The conflict has been wreaking havoc on the natural gas market since March. Meanwhile, its implications will likely continue even after it ends. The IEEFA now says the growing global energy crisis will likely hinder LNG plans in the Philippines. Asian LNG projects under development in the Philippines, Thailand and Vietnam are now facing the issue of securing the supply for planned projects at competitive levels.

This comes on top of the already unstable fossil fuel stage, which has caused widespread project cancellations and postponements. The Philippines’ first LNG import terminal, scheduled to go live by the end of 2022, is now delayed for Q3 2023. The Pagbilao LNG facility, which had to be online in 2011, now targets commercial operation by 2024.

Renewables: The Alternative SMC Should Consider

Instead of gas, SMC and its financial backers can invest in developing renewable energy capacity to safeguard its financial interests, ease the country’s decarbonisation and ensure lower energy costs.

Yet, this doesn’t seem to be on the agenda for SMC. Despite committing to investing in up to 10 GW of new renewable energy developments, the company doesn’t have a net-zero pledge so far. While SMC acknowledges the benefits of clean power technologies, it continues to advocate for gas expansion, despite the potential threat to the company and the nation’s goals.

According to the World Economic Forum, citing numbers from the International Renewable Energy Agency (IRENA), every dollar invested in the clean energy transition generates three to eight times the return. These figures can be even greater for the Philippines – a country with an abundant yet mostly untapped clean energy potential. Furthermore, switching from coal to clean energy is now cheaper than switching to gas. New solar and onshore wind power in some parts of Asia are either already or will soon become cheaper overall investments than new gas units by 2025. According to McKinsey, the price of renewables can even continue dropping by up to 10% per year. This will again highlight the risk of gas infrastructure in the Philippines becoming stranded. This is especially important as electricity consumers are encouraged to choose their suppliers.

Analysts are growing confident that the window of opportunity for LNG projects is closing quickly due to the country’s accelerating shift toward renewable energy alternatives. With that said, SMC’s management has one clear pathway going forward. However, considering what is at stake for the company and the Philippines, the future is in its hands.