Over One-third of AZEC Agreements Support Fossil Fuels, Risking High Emissions and Future Costs for Southeast Asia

Photo: Shutterstock / VladSV

15 October 2024 – by Walter James Comments (0)

The Asia Zero Emission Community (AZEC) is the brainchild of former Japanese Prime Minister Fumio Kishida, who described it as “a framework designed to help Asia decarbonise together while continuing to promote the introduction of renewable energy and energy conservation.”

But a report by Zero Carbon Analytics, an international climate and energy research organization, shows that over one-third of agreements signed under the framework are related to fossil fuel technologies. This finding casts severe doubt on the claim that AZEC helps Asia decarbonize.

What is AZEC?

Launched by Japan in March 2023, AZEC is a diplomatic initiative with eleven Southeast Asian countries and Australia to advance cooperation in Asia towards carbon neutrality and a platform for joint investment to develop zero-emission technologies across the region.

Japan’s goal is to invest public funds it raises from its climate transition bonds to “create a huge new decarbonization market in Asia” to catalyze private funding from international investors. A host of Japan’s government-backed institutions will make the initial investments in energy projects. Japanese private-sector firms will also partner in many of the projects.

Over One-third of AZEC Agreements Promote Fossil Fuels

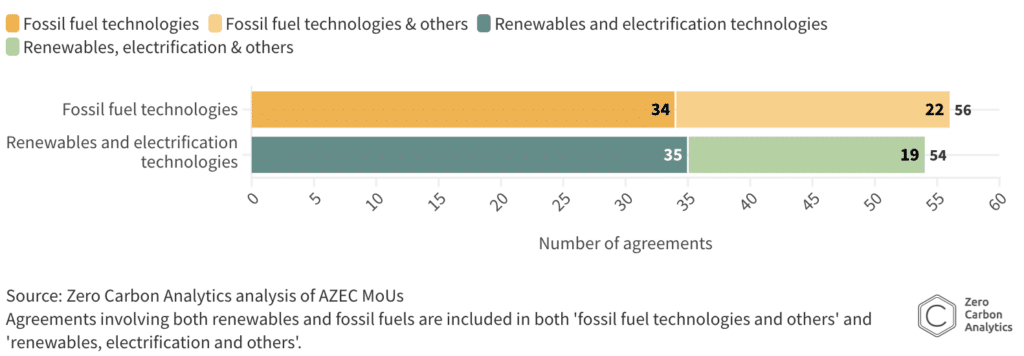

To date, 158 agreements, in the form of memoranda of understanding (MoUs), have been signed between the Japanese government or government-backed institutions and their AZEC member counterparts.

But according to Zero Carbon Analytics’ analysis, over one-third of those MoUs will promote fossil fuels or technologies that will prolong fossil fuels.

Of the 158 agreements, 56 MoUs (35%) advance fossil fuel technologies, including natural gas, liquefied natural gas (LNG), ammonia co-firing with fossil fuel power plants, ammonia and hydrogen produced with non-renewable energy sources, carbon capture, utilization and storage (CCS/CCUS), and e-fuels.

On the other hand, 54 agreements (34%) include renewables and electrification technologies, such as solar PV, wind, hydroelectric, geothermal, battery storage, electric vehicles, green hydrogen and ammonia, and waste management. Only 11 agreements (7%) include wind and/or solar.

Japan touts hydrogen, ammonia, and CCS as “decarbonization” technologies, and natural gas and LNG as “transition” fuels. It claims that these technologies will be able to meet the three overarching goals of energy policy in the region: carbon neutrality, energy security, and economic growth.

But Amy Kong, Zero Carbon Analytics Research Associate, challenges the view that they will contribute to Asia’s carbon neutrality or economic growth. She said in a statement that fossil-based technologies like “ammonia co-firing, CCS, grey and blue hydrogen, and LNG have much higher lifecycle emissions than solar and wind.”

“Relying on these technologies is a slower and more expensive path to decarbonisation for the region, and risks derailing national power sector emissions targets set out in the International Energy Agency’s 2050 net zero scenario,” Kong said.

Numerous non-governmental organizations have raised concerns that AZEC primarily promotes fossil-based technologies. Hanna Hakko, Senior Associate of think tank E3G, argued that Japan’s promotion of fossil-based technologies in Southeast Asia “risks exacerbating energy security and stranded asset risks in the region.”

Japan’s push for ammonia co-firing has also been criticized by other governments, most prominently by Canadian, UK, and German ministers during the 2023 G7 meeting.

Japan’s fossil fuel investments through AZEC are inconsistent with the Group of Seven agreement that Japan joined in 2022 to stop overseas fossil fuel financing and its COP28 pledge to help triple global renewable energy capacity. They also lack a justification – the world already has enough oil and gas projects planned to meet global energy demand forecasts by 2050.

CCS, Ammonia and LNG Are Environmentally and Economically Detrimental

Japan’s promotion of ammonia co-firing, CCS/CCUS, and natural gas and LNG is detrimental from both a climate mitigation and economic perspectives.

Zero Carbon Analytics’ analysis shows that 22 of the 158 MoUs signed under AZEC include ammonia and ammonia co-firing. About 80% of global ammonia use is in fertiliser production, and in 2020, 99% of global ammonia production relied on fossil fuels.

Japan has signed agreements with AZEC partners in Thailand, Indonesia, Malaysia and the Philippines to test ammonia co-firing as part of its vision to make these coal plants “zero emission” by 2050. Yet an ammonia co-firing ratio below 50% will release more carbon than a gas-fired power plant. Even the co-firing rate of 20% that Japanese firms are currently testing is not aligned with the IEA’s 2030 power sector emissions trajectories for Southeast Asian countries. Producing and shipping ammonia will also be highly energy inefficient and retrofitting existing coal plants with co-firing infrastructure will raise energy bills for consumers in Southeast Asia.

CCS and CCUS are included in 23 MoUs and projects are already being planned to export CO2 from Japan to be stored in Australia, Malaysia and Indonesia. CCS has overwhelmingly been used by the fossil fuel industry to increase oil and gas extraction, and some of the AZEC agreements are no different. What’s more, CO2 capture rates often undershoot industry promises. There is also potential for CO2 leakage, releasing the captured carbon back into the atmosphere. Relying on CCS could therefore use up 30% of the remaining global carbon budget. A heavy reliance on CCS to achieve net-zero by 2050 could cost USD 30 trillion more than a pathway prioritizing renewables, electrification and energy efficiency.

Natural gas and LNG are featured in 17 AZEC agreements. Japan positions gas as a lower-emission fuel that can help coal-dependent countries in Southeast Asia curb their emissions. But methane, the primary molecule in natural gas and LNG, is the second-largest contributor to climate warming after CO2. In fact, a recent study has shown that methane leaks throughout the LNG supply chain renders the global warming potential of this fuel worse than coal.

Economically, a shift from coal to LNG, instead of renewables, exposes importing countries to price volatility. Between January 2021 and August 2024, about one-third of Southeast Asia’s LNG imports were the spot market, where LNG is bought and sold for immediate delivery. During the 2022 energy crisis triggered by Russia’s invasion of Ukraine, the average price of LNG in Asia became twice as high as the annual average price for 2021.

These fossil fuel-based technologies may also risk worsening the fiscal positions of developing economies in Southeast Asia. Ayumi Fukakusa, Campaigner and Deputy Executive Director of Friends of the Earth Japan, told Energy Tracker Asia that “most of the ‘support’ made by the Japanese government in the past, especially for energy projects, are through loans.”

Renewable energy, on the other hand, is cheaper and can enhance the region’s energy security by reducing its exposure to price volatility. The cost of electricity from utility-scale solar PV in Asia declined significantly over the last few years, while the costs of coal and gas generation increased. According to Wood Mackenzie, renewables were 13% cheaper than conventional coal in Asia in 2023 and are expected to be 32% cheaper by 2030.

AZEC is in Line with Japan’s Historical Role in the Region

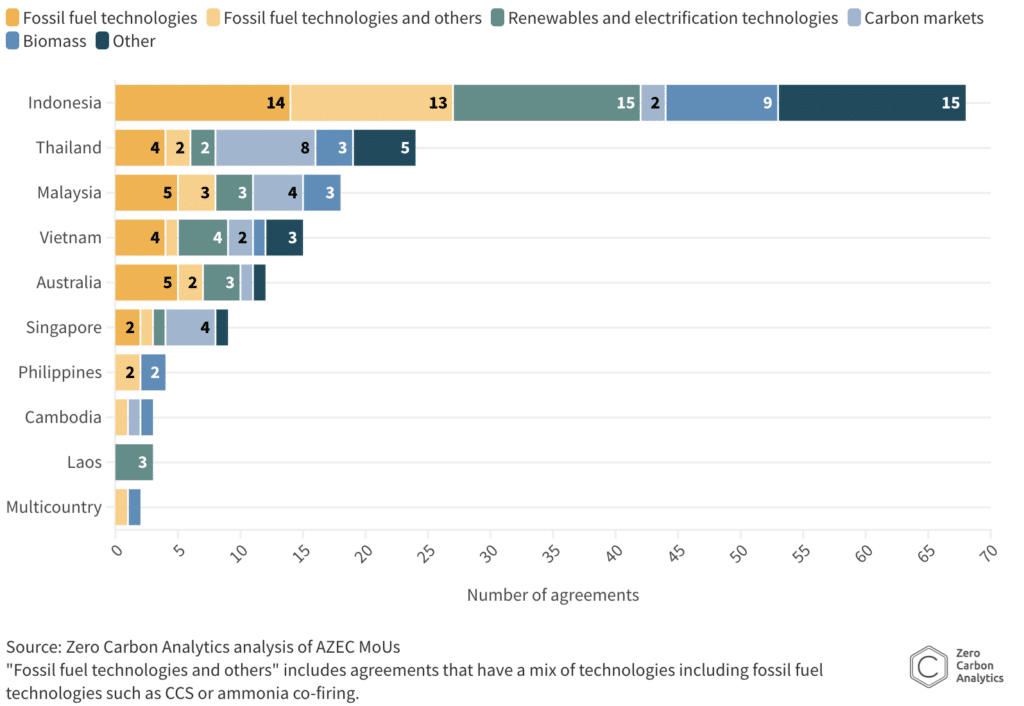

Among the AZEC member countries, Japan signed the most deals (43%) with Indonesia, followed by Thailand (15%) and Malaysia (11%).

Historically, Japan has been the top source of infrastructure investment in Southeast Asia and spearheaded the creation of an Asian LNG market since the 1960s. Japan’s public financial institutions, such as the Japan Bank for International Cooperation, have spent a total of USD 93 billion in overseas oil and gas projects between 2013 and 2023. About USD 41 billion of that was in fossil fuels projects in Asia, almost five times more than investments in clean energy over the same period.

Japan’s heavy focus on Indonesia in the AZEC is also consistent with the two country’s close bilateral relationship and Japan’s historical energy and infrastructure investments in that country. Wicaksono Gitawan, Energy Transition Associate and Project Manager at CERAH, an Indonesian energy nonprofit, told Energy Tracker Asia that “Indonesia’s reliance on Japan for energy and infrastructure finance has been going on for decades because Japan has been a key investor for Indonesia.”

Referring to Indonesia’s CCS agreements with Japan, Bhima Yudhistira Adhinegara, Executive Director of Center of Economic and Law Studies, an Indonesia-based research institution, told Energy Tracker Asia that “the Indonesian government thinks that as long as there is some money on the table, [it can] transport the CO2 overseas to Indonesia through shipping, pipelines and so on.”

AZEC Investments Must Shift to Renewables

On October 1, Shigeru Ishiba became Japan’s new prime minister. Rare among his Liberal Democratic Party colleagues, he argues for maximizing renewable energy capacity and reducing Japan’s dependence on nuclear energy in the long run. On Japan’s overseas energy finance or AZEC, however, Ishiba hasn’t made his views known.

“We hope he makes a difference and he should make a difference,” says Fukakusa. “He must listen to civil society’s concerns over AZEC initiatives and stop promoting ‘false solutions’.”

Hakko is optimistic about the idea of regional cooperation in energy, but says the focus needs to be on renewables: “Asian cooperation toward decarbonisation is necessary and important, but Japan’s support would serve the region far better by enabling the growth of renewable energy to improve energy security, strengthen clean economic growth, and alleviate climate risks.”