The LNG Outlook of the Philippines and Its Impact on the Country’s Future

07 March 2022 – by Viktor Tachev Comments (0)

The Philippines faces a growing energy crisis and is looking towards liquefied natural gas (LNG) to save the day. Yet, its LNG expansion plans are not the answer—despite pressure from major companies supporting expansion plans. Experience from other Southeast Asian neighbours and their gas adventures show that the route is often costly and risky.

The LNG Philippines Market

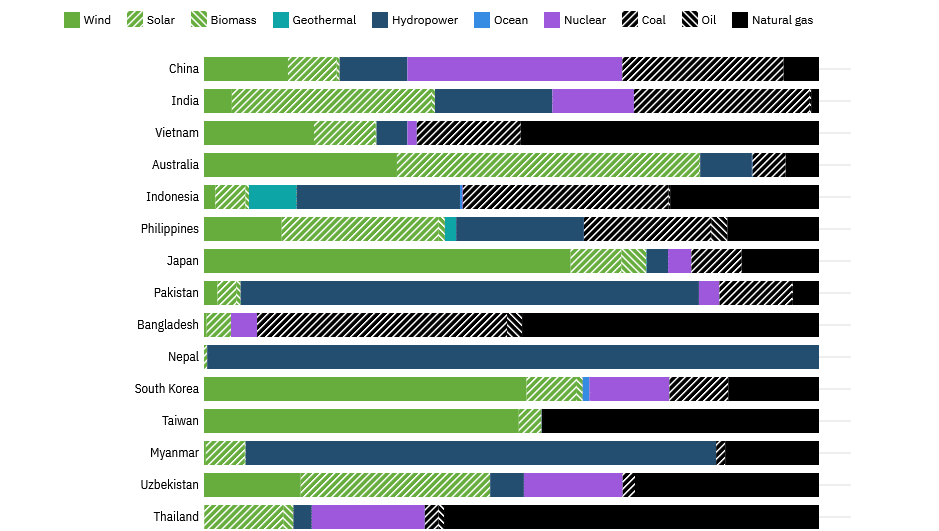

As the Philippines continues to develop, its appetite for energy continues to soar. By 2040, estimates show that the country will additionally need 43 gigawatts (GW) on top of its current supply. Today, coal makes up 47% of the energy mix, with natural gas accounting for 22% and oil at 6.2%. Renewables like hydropower, geothermal, wind and solar collectively totalling 24%.

LNG Terminals and Power Plants

As per the Philippines government plans, new energy will come from expanding LNG and natural gas supply. There are already six projects in the pipeline totalling 8.6 GW. Six companies aim to invest up to USD 1.61 billion to put up LNG terminal projects across the country to fulfil the natural gas requirements of gas-fired power plants. If plans go forward without hiccups, the country will launch its first LNG terminal by the end of 2022.

Additionally, with the Philippines seeing its main gas fields at Malampaya rapidly depleting, it hopes to make up the shortfall with LNG imports. The first, of which, are coming later this year.

Some pundits suggest that the Philippines is bullish on its LNG plans due to pressure from US gas companies looking for new markets. With net-zero pledges, climate change, and developing countries’ needs for more energy, gas companies are looking to capitalise by suggesting LNG is either clean fuel, transitionary, or reliable. However, such claims are questionable and deceiving at best.

The Risks Following the Liquefied Natural Gas Path for the Philippines

For the Philippines, an over-reliance on LNG imports puts its energy independence at risk. Moreover, a reliance on US-dominated LNG contracts could expose the country to wild price swings in global gas markets. This would place immense pressure on the government and companies that bet big on gas’s role in Asia’s energy mix.

According to the Institute of Energy Economics and Financial Analysis (IEEFA) report, LNG in the Philippines should be a fuel of last resort. Like other countries in the region, choosing LNG would lock the Philippines into decades of fossil fuel import dependency. For example, this year and a first for the Philippines, the local utility First Gen Corporation and its partner Tokyo Gas announced a five-year contract for LNG imports between 2023 and 2027.

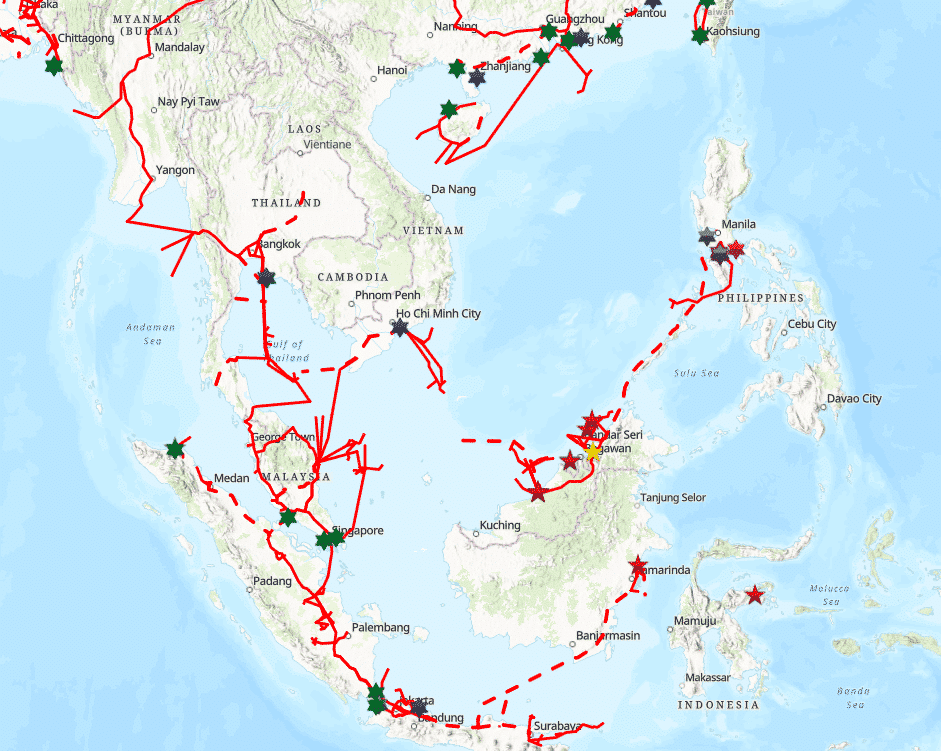

Furthermore, with the Philippines being an island country, it lacks the infrastructure for such ambitions. This has not only, so far, blocked imports but would need significant investment to scale.

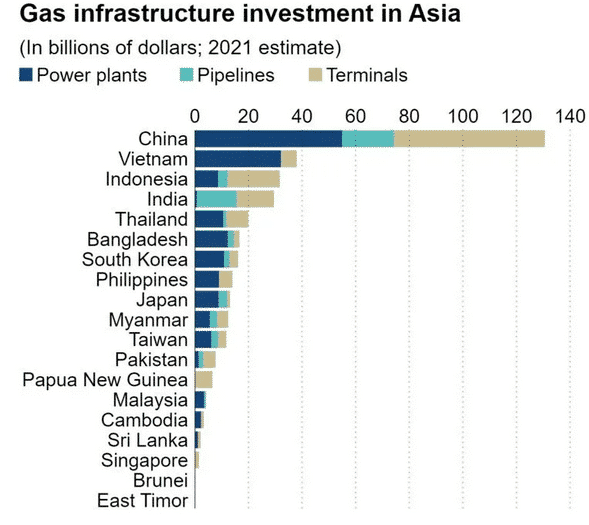

For these reasons, the IEEFA estimates that LNG-to-Power investors in the Philippines risk USD 14 billion in stranded assets. For Southeast Asia, planned gas projects culminate in USD 358 billion worth of potentially stranded risk assets. Financiers already recognise the magnitude of the problem. As a result, they are limiting lending for gas projects for the same reasons they moved away from coal.

Lastly, the expansion of the Philippines’ LNG fleet would ultimately slow the transition to cleaner, cheaper and more secure domestic renewables.

Renewables as the Way to Go

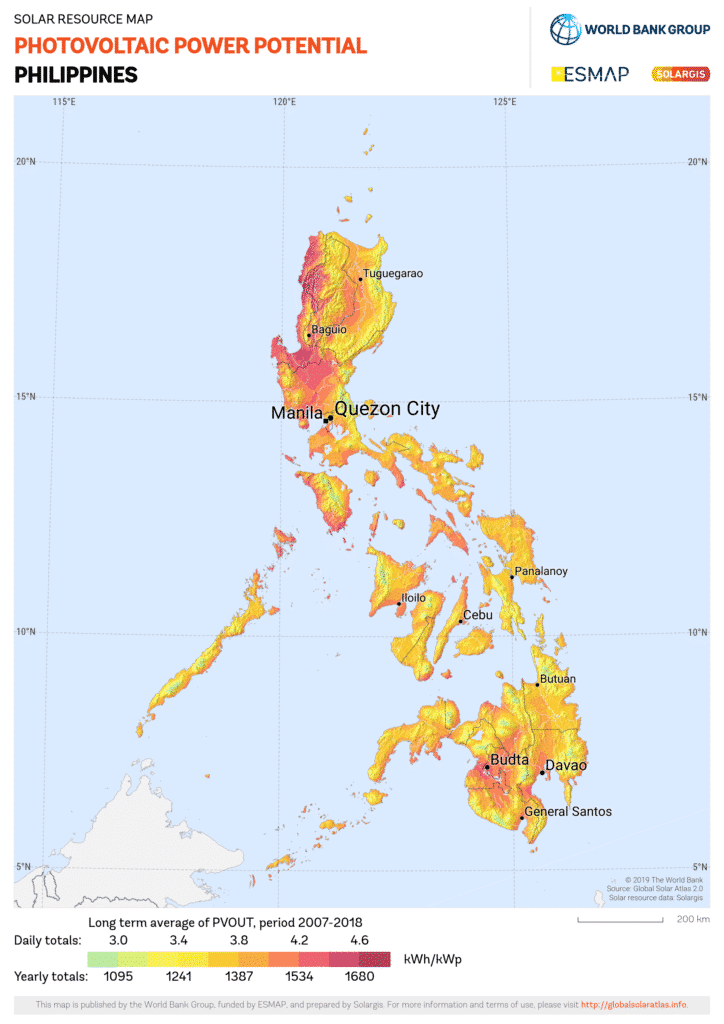

Like many countries in Southeast Asia, the answer for adding energy capacity and speeding up the energy transition is renewables. Importantly, the Philippines already has ideal prerequisites and massive potential for clean energy.

For starters, with wind speeds ranging between 6.4 to 10.1 metres per second, wind energy has vast potential. Additionally, geothermal resources exist, too, with the government already planning for it to contribute to 40% of all renewables by 2030.

Fortunately, the Philippines is beginning to move in that direction through various initiatives, including public-private dialogues and policy support. Fiscal and non-fiscal incentives to accelerate renewable energy generation are also in play, with an additional 19 GW of solar and 16 GW of hydropower on the way.

Government policy contributes to the proposed National Renewable Energy Programme (NREP) that targets a 35% share of renewable energy in the power generation mix by 2030.

LNG vs. Renewables – A Choice for the Philippines

The Philippines, like other developing countries, need to move away from coal but still lack the technical capacity to roll out renewables en masse. Yet, this hardly justifies a decision to lock the country into a decades-long LNG journey, with gas projects typically a three-decade endeavour. The Philippines even has an example of this in its backyard. The Pagbilao LNG facility was expected to be online in 2011 but now targets commercial operation by 2024.

Today, there is a growing threat of gas projects becoming “un-bankable” after the COP26, with the finance industry jumping ship when it senses reputation risks too. As a result, the Philippines has too much at stake if it starts building infrastructure from the ground up. Regarding energy costs related to LNG, the Philippines should look to Europe and its ongoing energy crisis to gauge its future.

Choosing the LNG path may lead to a conundrum difficult to escape from. On the other hand, renewables present an opportune moment for the country to capitalise on energy independence. This would also place it in line with global net-zero goals. Ultimately, it would move the Philippines away from an energy import-reliant model dictated by outside forces.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more