How Trump’s Tariffs Are Rewriting Asia’s Clean Energy Future

Photo: Shutterstock / Andrew Angelov

18 September 2025 – by Heba Hashem

US President Donald Trump’s tariffs on imports from Asia are rippling across the region, disrupting solar supply chains, reshaping energy policies and redrawing trade maps.

A 19% tariff now applies to imports from Thailand, Malaysia, Cambodia, Pakistan, Indonesia and the Philippines. Vietnam and China face higher rates — 20% and 30% respectively.

Lowest Tariff on Singapore While Highest on India Due to Russian Oil Imports

Singapore secured the lowest among ASEAN nations at 10%. India, however, was hit hardest, with tariffs reaching 50%.

On solar panels, the duties are even steeper. US imports from Cambodia, Malaysia, Thailand and Vietnam now carry tariffs ranging from 14% to more than 3,000%, threatening to unravel years of cost reductions in renewable energy.

The blow is especially severe for India, where 90% of solar module exports head to the US. With tariffs cutting off that lifeline, analysts warn the country could see a supply glut as early as 2026.

Compounding the problem is cost. According to a Reuters report referencing Mercom data, Indian modules made with Chinese cells are 48% more expensive than Chinese-made products, and those built entirely with Indian cells are 143% more expensive.

Donald Trump’s Tariff are Shutting Down Factories in Thailand and Vietnam

Factories in Thailand and Vietnam — once major suppliers to the US — are already shutting down, relocating supply chains and laying off workers. Many producers are now looking to move to other regions where production costs and tariffs are relatively lower, such as the Middle East.

Pressure To Buy American Natural Gas

As part of its tariff strategy, the Trump administration has pushed Asian nations to buy more US fossil fuels, particularly liquefied natural gas (LNG). Japan, Taiwan, South Korea, Indonesia and India have all been pressed to sign long-term deals.

Indonesia, despite pledging to retire fossil fuel plants by 2040, agreed to import USD 15 billion worth of US oil and gas. Thailand, too, has committed to an additional USD 600 million in American LNG over the next five years, even as it pursues net-zero targets.

Japan’s largest power generator, JERA, signed 20-year contracts for up to 5.5 million metric tonnes annually starting around 2030. Vietnam, meanwhile, cut tariffs on US LNG from 5% to 2% to encourage imports. Both nations have pledged to reach net-zero emissions by 2050.

But critics warn the strategy risks locking Asia into costly, outdated infrastructure. “Trump has put pressure on a seeming plethora of Asian trading partners to buy more US LNG,” Tim Daiss, founder of the APAC Energy Consultancy, told Euronews.

Japan, he noted, had already bought so much gas that it was cancelling projects and offloading the excess. “Not good for Southeast Asia’s sustainability goals,” he added.

Are Fossil Fuels Really Cheap in Asia?

Fossil fuels often appear cheap in Asia thanks to government subsidies. Indonesia and Malaysia keep gasoline and diesel prices low, while India subsidises cooking gas. China also supports coal and oil production.

But the real price tag is far higher. The International Monetary Fund estimates Asia accounts for the largest share of global fossil fuel subsidies — both explicit and hidden — meaning taxpayers ultimately pay for the health costs of air pollution, environmental degradation and climate impacts.

Volatility adds another layer of risk. Countries like Japan, South Korea and much of Southeast Asia import nearly all their oil and gas, leaving them vulnerable to global price swings.

Renewable Energy Seeks Growth at Home

For policymakers, LNG offers short-term energy security, but long-term economics are shaky. According to Zero Carbon Analytics, LNG dependence exposes countries to price shocks and currency risks.

Still, analysts see opportunity. With US tariffs shutting Southeast Asian solar firms out of their biggest market, excess capacity may be redirected into local renewable energy projects. Lower-cost Chinese cleantech equipment could also flood the region, speeding up adoption.

“The tariffs and trade war are likely to accelerate the energy transition in Southeast Asia,” Ben McCarron, managing director at Asia Research & Engagement, told Japan Times.

Moreover, climate activists argue that US tariffs won’t meaningfully dent China’s clean tech dominance. Instead, they warn, the move will isolate Washington and raise costs for American consumers.

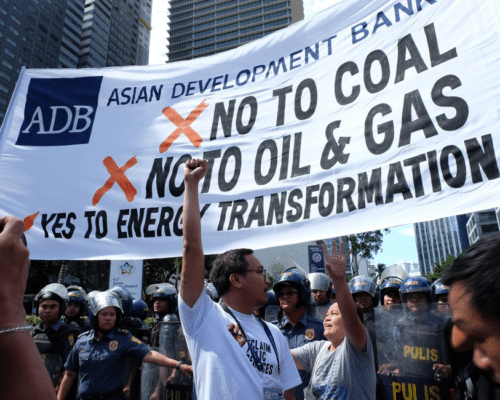

“The renewables trade had already significantly shifted away from the United States, even before Trump’s tariffs, with most wind and solar equipment manufactured in China,” global climate justice group 350.org said in a statement.

“Only 4% of Chinese clean tech exports actually go to the US — in a trade sector where sales volume grew by about 30% last year, this makes the US merely a footnote, not a global player.”

Regional Realignments – China, India and ASEAN

The fallout is also nudging countries toward closer cooperation. India and China are showing signs of warming ties, with Prime Minister Narendra Modi visiting Beijing for the first time in seven years after Washington doubled tariffs on Indian goods.

Some experts believe ASEAN nations must seize this moment to strengthen collective resilience.

“While there are no quick fixes, a couple of reasonable pathways would be to deepen intra-ASEAN trade and investment and expand ASEAN-GCC cooperation,” said William J. Jones, assistant professor of international relations at Thailand’s Mahidol University International College.

He cautioned, however, that “ASEAN leaders need to get their collective acts together quickly or face being taken advantage of individually again.”