Cost and Viability Plague Carbon Capture and Storage in the Power Sector

Boundary Dam Power Station and Carbon Capture Facility. Source: CCS Knowledge Centre

11 April 2023 – by Eric Koons Comments (0)

Carbon capture and storage (CCS) is gaining popularity with governments and policy-makers as a sustainable way to decarbonise the power sector. The United States just launched a USD 2.5 billion CCS funding program. ASEAN nations formed the Asia CCUS Network, and Australia announced a carbon credit system for CCS projects. However, this outlook on CCS’ role in power sector decarbonisation is highly optimistic. Carbon capture and storage is still a nascent technology, and its associated viability, effectiveness and costs still need to be investigated.

A recent report by the International Institute of Energy Economics and Financial Analysis (IEEFA) found that CCS paired with fossil fuels will significantly increase energy prices and surface various associated environmental issues. The International Panel on Climate Change (IPCC) ranks fossil fuel CCS as the least preferable decarbonisation option, with both wind and solar as better alternatives.

“Not only is it [CCS] unable to consistently deliver on performance claims, expensive to build and fraught with failures, but the impact on electricity prices if the cost is passed through to consumers would be unsustainable.”

Christina Ng and Michael Salt, IEEFA

However, governments continue to support the development of CCS, as it, in theory, allows the power sector to remain relatively unchanged. The fossil fuel industry can continue to develop with existing fossil fuel plants retrofitted with CCS technology. Ultimately, the costs and potential failures of CCS will fall on consumers.

CCS for Power Sector Decarbonisation Is Unproven

CCS with fossil fuel power generation remains an unproven technology at scale. This makes it challenging to estimate project cost and viability.

First, no successful commercial-scale new projects use CCS technology with thermal power generation. The Kemper CCS facility in the United States is an example of a failed project and is a warning to overly optimistic CCS proponents.

The Kemper facility was supposed to be a flagship “clean coal” project that integrated coal power with combined cycle gasification and carbon capture. However, challenges during construction led to a 250% increase in project cost and a three-year delay. Ultimately, the project’s carbon capture and gasification portions were scrapped, and it now runs as a standard thermal power plant.

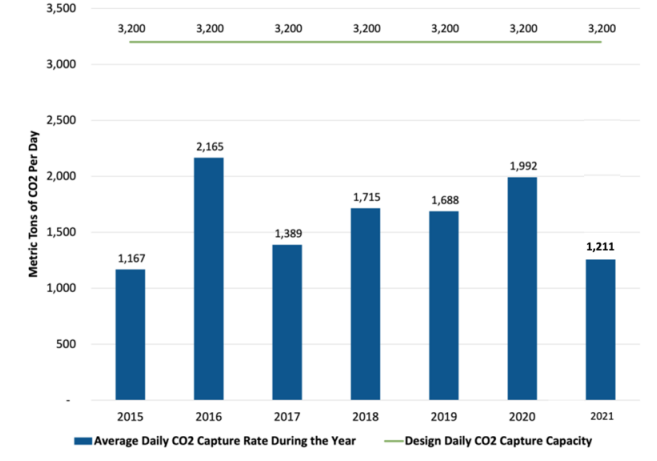

Second, the only two existing commercial-scale CCS retrofits are significantly underperforming. The Boundary Dam post-combustion CCS project’s carbon capture rate is around 50%, well under the targeted 90%. The Petra Nova post-combustion CCS project missed its carbon sequestration goal by 17%. This cost investors USD 23 million, and the plant shut down after only three years.

Unsolved Environmental Concerns

Beyond the questions about the ability of CCS to perform at projected rates, there are several other environmental concerns.

Implementing CCS promotes fossil fuel use and reduces the incentive to invest in alternative decarbonisation technologies. Additionally, long-term storage of carbon dioxide remains uncertain, and CCS power plants require additional resource inputs, like water and energy.

Why Is CCS So Expensive?

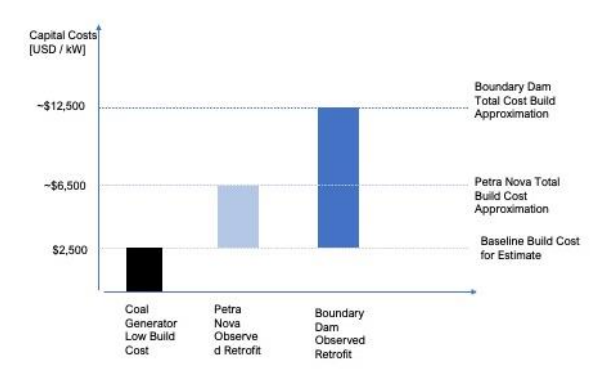

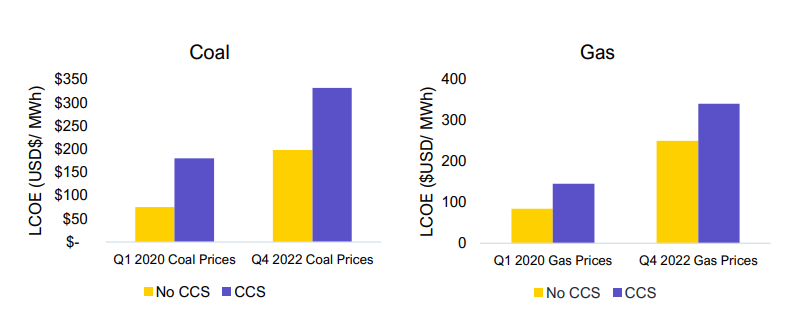

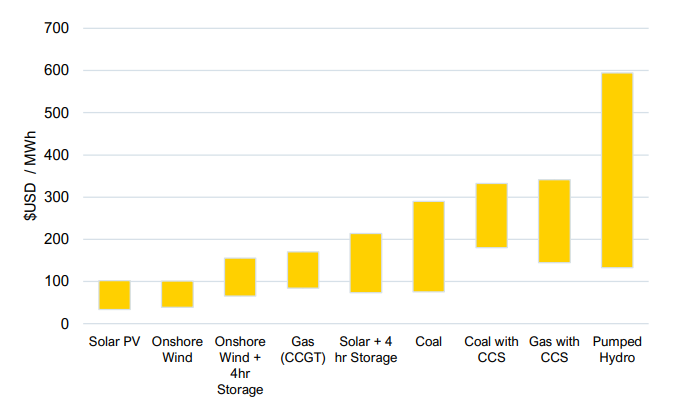

Cost is the second area of concern. The IEEFA estimates the levelised cost of energy (LCOE) of thermal power generation with CCS is 1.5 to 2 times higher than wind and solar paired with battery storage. There are several reasons for this trend.

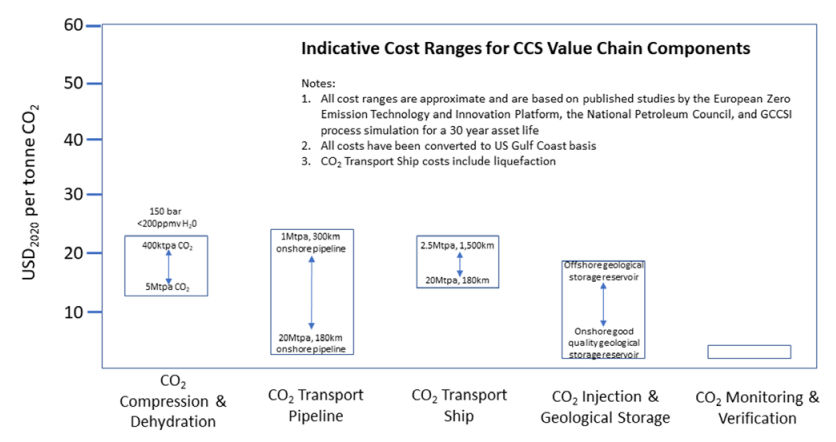

Firstly, CCS facilities are expensive, even before considering the additional CO2 transport and storage costs. It increases the ongoing operating costs for both fixed and variable operations and maintenance, and it requires additional energy input to run. Estimates put this at 20% to 30% of a paired thermal power plant’s generation, reducing overall plant efficiency by between 6% and 12%

The cost-effectiveness of power sector CCS is directly dependent on fossil fuel prices. Fossil fuel markets are notoriously volatile, making it challenging to predict long-term costs. For example, low oil prices were the cited reason for the shutdown of the Petra Nova CCS facility in 2020. Meanwhile, beyond the direct carbon capture operations, there are additional carbon dioxide transport, storage, monitoring and compliance costs.

Consumers Will Shoulder the Costs of CCS

Ultimately, the cost of applying CCS in the power sector is high and arguably prohibitive to wide-scale adoption. Furthermore, as companies look to recover the cost of CCS, they have two alternatives: pass the costs on to consumers through higher energy prices or seek government support.

The IEEFA examines how this can affect retail energy prices through a case study in Australia. The IEEFA estimates CCS would increase electricity prices from coal generation by around 65% and from natural gas by 35%.

This comes when energy prices are already increasing and are expected to rise by 56% over the next two years. It is challenging to believe that consumers would support technology that exacerbates this issue.

Alternatively, CCS projects reliant on government subsidies or support will lead to a similar issue. Consumers will ultimately cover the costs through higher taxes or other public-facing financing mechanisms.

The Proven, Cost-Effective Alternative: Renewable Energy

In summary, CCS in the power sector remains unproven at scale, has consistently underperformed, is expensive and disincentivises investment in proven renewable energy technologies. Yet, CCS is still marketed and discussed as a viable and crucial decarbonisation technology. This is not true in its current state, and it is unclear if it will ever reach viability.

Alternatively, renewable energy, like wind and solar, are proven technologies with thousands of existing commercial-scale projects. Furthermore, these technologies are free from the common issues of fossil fuel dependence, namely price volatility and energy security. Renewables are part of developing a resilient energy grid that promotes domestic energy generation and does not rely on finite fossil fuel resources.

Furthermore, while the LCOE of coal and natural gas has remained relatively stable over the last 10 years, solar has declined by 90% and wind by 72%. Solar and wind already have lower costs than thermal power with CCS, and we expect this trend to continue.

It does not make sense for investors and policy-makers to support an unproven, expensive technology when better alternatives are available. Support for CCS in power generation utilises capital to build robust renewable energy grids that experts agree we need.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more