LNG Investments Expand Gas Fleets in Japan, China and South Korea

Photo: Wikimedia Commons

16 June 2025 – by Nithin Coca

Billions in LNG investments are flowing into the building of ever-more liquefied natural gas (LNG) carriers, to transport fossil gas from producing countries like Malaysia and Qatar to consuming markets in East Asia. This is worrying, as fossil gas is one of the leading contributors to climate change, a major source of CO2 and methane emissions. Many scientists see a reduction in consumption of fossil gas as essential to meeting climate and net-zero targets.

“It’s time to phase out fossil fuels,” said Manish Bapna, president of Natural Resources Defense Council. “That’s what the science demands. Vast industrial projects to export these dirty and dangerous fuels far into the future have no place in a climate-safe world.”

Despite this, an astounding 324 more LNG vessels are under construction, increasing the global LNG fleet. Expansion like this comes right as the world should be shifting away from fossil gas and to cleaner renewables.

“Emissions from existing gas projects are already too great for the world to have at least a 50% chance of limiting global warming to 1.5°C,” said Ted Nace, executive director of Global Energy Monitor. “If built, these new Asian gas projects would lock in emissions for decades, and worsen the long-term effects of climate change.”

Most of the fleet is for companies or state-linked enterprises in some of the world’s largest importers of LNG — China, Japan, and South Korea. Together, these countries accounted for a significant proportion of LNG consumption globally.

China’s Liquefied Natural Gas (LNG) Portfolio

China, in 2023, was the world’s largest LNG importer, consuming around 71 million tonnes, nearly half of all of Asia’s LNG.

That figure is likely to rise, as Chinese companies continue to sign new long-term contracts. Just this year has seen the state-owned China National Offshore Oil Corporation (CNOOC) sign a five-year deal with the United Arab Emirates’ Abu Dhabi National Oil Corp. ENN signed a 15-year deal with another Emirati oil company, and Australia’s Woodside Energy signed a 15-year deal with China Resources. In fact, Rystad Energy expects Chinese LNG imports to grow to 83 million tonnes this year.

Chinese oil and gas companies are doing more than just buying more LNG. They’re leading in expanding LNG fleets as well. China has carrier fleets on order by companies like CNOOC Gas, PetroChina and Power Group. China’s Bank of Communications and China Development Bank are playing a key role as financiers.

“Building more LNG carriers isn’t just climate-destructive — it’s economically senseless,” said Rachel Eunbi Shin, a gas team consultant at Solutions for Our Climate (SFOC), a South Korean NGO.

Japan and South Korean LNG Companies

Japan, which has the current largest fleet in Asia, has new ships being built in South Korea by Hyundai LNG Shipping, H-Line Shipping and the H-Line, Pan Ocean and SK group, some of the world’s largest shipbuilding companies. Korea itself has over 20 ships on order. Financing these orders are Japan’s MUFG, Mizuho, Sumitomo Mitsui, Korea’s Export-Import Bank of Korea, Korea Trade Insurance Corporation and Korea Development Bank, all of which have climate commitments.

“There’s a clear contradiction… spending billions to finance LNG carriers while simultaneously pledging to reach net-zero by 2050,” said Shin.

It’s particularly remarkable because both Japan and South Korea are experiencing declining LNG consumption. A big factor is the expansion of renewables, something that is expected to grow as both countries expand offshore wind and rooftop solar.

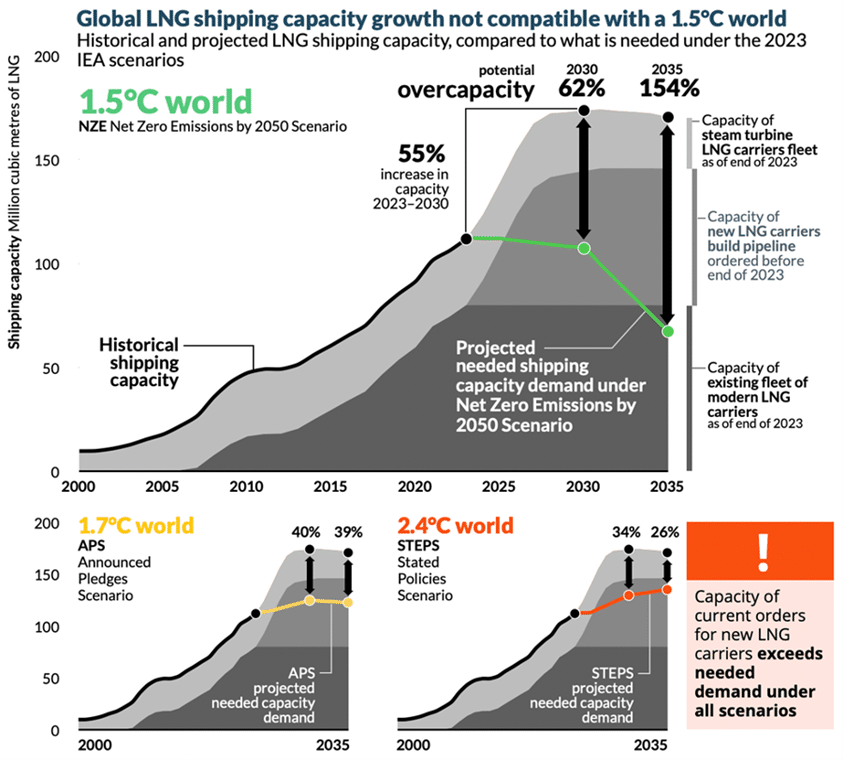

“The LNG shipping industry is approaching a cliff edge of overcapacity, with the widespread looming issue of stranded assets,” said Dongjae Oh, head of gas at SFOC. “Every new carrier order pushes the industry closer to unsustainable oversupply. Stakeholders must act now to halt new orders or face severe economic consequences as the global shift away from fossil fuels renders these assets obsolete.”

Ending Natural Gas Production

Building hundreds of new ships is exactly what we shouldn’t be doing at this moment, if we’re to have any chance of meeting science-based climate and net-zero targets, said Climate Analytics energy analyst Thomas Houlie.

“No new LNG carriers are needed in any scenario, including both the IEA’s 2023 Net Zero Emissions pathway, which aligns with the globally agreed goal of limiting temperature increase to 1.5°C,” said Houlie.

Many point the blame at the financiers — China Development Bank, MUFG and Export-Import Bank of Korea — which are investing, in total, billions into these ships. It’s a risky bet, as LNG is not only bad for the climate, it doesn’t make sense economically, either, at a time when renewables are getting cheaper.

“As the energy transition accelerates at an unprecedented pace, investing in fossil fuel transport capacity represents not just a risky and shortsighted gamble for investors, shipbuilders and shipowners, but an imminent threat to their financial stability,” said Oh.

It’s time for financiers, shipbuilders and oil and gas companies to stop LNG investments and shift to renewables, before it’s too late.

by Nithin Coca

Nithin Coca covers climate, environment, and supply chains across Asia. He has been awarded fellowships from the Solutions Journalism Network, the Pulitzer Center, and the International Center for Journalists. His features have appeared in outlets like the Washington Post, Financial Times, Foreign Policy, The Diplomat, Foreign Affairs and more.

Read more