LNG Prices in 2022 Bring Stability after 2021’s Volatility

Source: HDR

11 March 2022 – by Eric Koons

After record-breaking prices in 2021, Liquefied Natural Gas (LNG) prices may see more stability in 2022. Already, LNG is shaping up to be one of the world’s most essential and most significant energy sources of the decade as countries shift away from petrol-based power. LNG exports are also rising. Singapore LNG hub is the new sensation in Asian. While LNG is still a fossil fuel with high carbon emissions, it is also a bridge fuel for many nations unable to transition to renewable energy due to lack of capacity or infrastructure.

Natural Gas Futures

As a result, natural gas’ futures exploded, with demand for LNG expected to double by 2040. In 2021, natural gas prices rose significantly. While it is still more economically viable than other fossil fuels, it has raised questions about what the market will look like in the coming years.

What is LNG Price per Metric Million British Thermal Units??

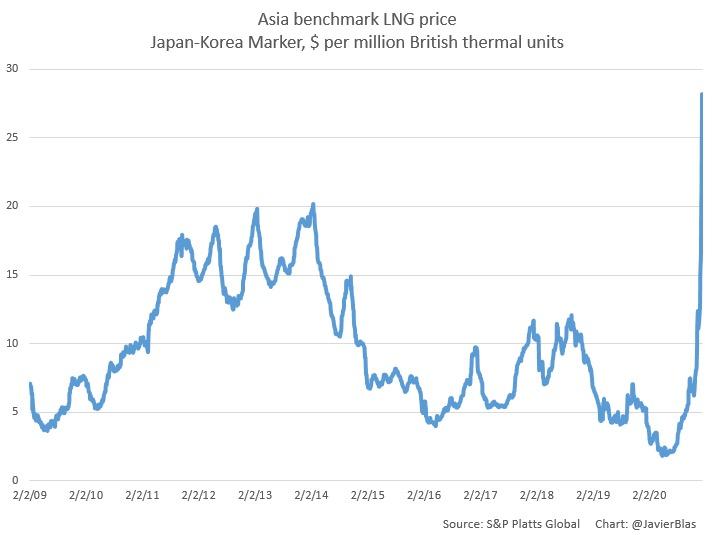

The factors affecting natural gas prices are similar to those regulating other forms of power—namely supply, demand, weather and the costs of different energy sources. For example, cold winters and high prices of other energy sources can drive up demand for LNG, increasing its price. This was what happened in Europe in 2021 when prices rose to USD 38.03 per million British Thermal Units (MMBTU). Previous peaks in 2020 and 2019 were USD 5.85 per MMBTU and USD 7.26 MMBTU, respectively. In Asia, spot prices hit a high of USD 48.30 per MMBTU in late December, partially resulting from rising prices in Europe.

How Much Does LNG Cost per Tonne?

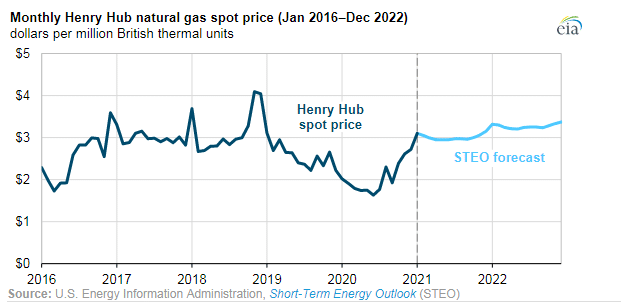

The current prices represent historic highs for LNG production. The highs, as mentioned above, were unprecedented and represented price increases of over 300% compared to the previous year. The United States, which has its own domestic LNG operations, also saw peaks early in the year. This propelled prices to over USD 10.00 per MMBTU from its usual hovering price of around USD 3.00 per MMBTU. While this is high, it’s still below the historical peak of USD 20.81 per MMBTU in 2005.

Why Are Liquefied Natural Gas Prices High?

In 2022, prices of LNG look to remain relatively stable as the year progresses. However, these LNG prices will likely be at higher levels than before and are due to several factors, including:

- Changing consumption habits linked to the COVID-19 pandemic

- Rising demand for LNG and lower demand for coal as the world moves away from other fossil fuels

- Growing electrification rates in Asia

- Europe and Asia’s reliance on Russian gas

- Political instability involving Russia and Eastern Europe

Will Natural Gas Prices Go Up in 2022?

Although prices have been dropping throughout January and February, some market speculators forecast high LNG prices for 2022. This results from weather uncertainties and tensions with Russia—one of the world’s largest LNG providers.

This has reinforced calls for local LNG supply chains across Asia and Europe, which currently rely on Russia for their natural gas. Several LNG projects are in the works, but they won’t come online before 2023. These projects should help reduce LNG prices across the board and reduce reliance on Russia.

LNG Price Will Eventually Fall

Forecasters are bullish on natural gas futures. Global demand for LNG is set to double by 2040, and new LNG projects are underway to ensure that Europe and Asia become less reliant on Russian gas. This will help ensure LNG prices are lower than their current rates and stabilise the market to reduce volatility. We expect these changes to happen from 2023 onwards, which other projections reflect.

While many still see LNG as a controversial choice for energy due to its carbon emissions, it may be the go-to source of power in the coming decade. This will continue to drive up the price until it starts to be replaced by renewable energy as the world’s primary power source.

Go further with LNG

This article is part of our biggest take on the rise of Liquefied Nation Gas.

We will discuss more related topics in the following articles, such as Singapore LNG hub for Asia.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more