Natural Gas in Bangladesh – Record High Prices and Imminent Climate Impacts

Source: UNICEF

23 March 2022 – by Eric Koons

Natural gas in Bangladesh hit record highs in 2021. This is a similar story around the world, where rising gas demand has created an unstable market for importing LNG. This is due partly to the world’s goal of moving towards being cleaner energy consumers. We are collectively trying to push the days of hydrocarbons behind us and embrace the power of clean, sustainable energy. This won’t happen overnight, but the process is well underway.

As an intermediate between coal and zero-emission energy sources, liquefied natural gas (LNG) is a transition fuel. It’s cleaner than traditional fossil fuels but not as clean as renewables.

Bangladesh’s Natural Gas Reserves and Gas Exploration

While LNG can be an adequate transition fuel, that is all it is. Natural gas is not a solution to climate change. And for Bangladesh, there has never been a more critical time to build renewable energy capacity because Bangladesh is losing fast its remaining gas reserve and its gas exploration efforts are not up to the mark. The recent February 2022 IPCC report predicts dire climate change related economic and social impacts by the end of the century.

How many Natural Gas Fields are there in Bangladesh?

There are 28 natural gas fields in Bangladesh. The country’s largest natural gas field is Titas gas field. It was discovered in 1962 by the Pakistan Shell Oil Company, and it is also a crude oil producer.

A Look at the LNG Market and Natural Gas Prices in 2021

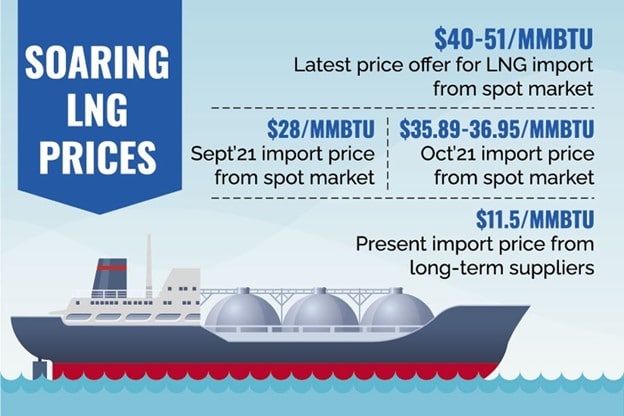

A surge in demand was met with a surge in natural gas prices. Spot LNG prices were as high as $56/MMBtu in October before settling down to around $35/MMBtu.

Bangladesh paid $35.89/MMBtu and $36.95/MMBtu in October 2021 for spot LNG cargoes. Instability in the LNG market creates a lot of uncertainty for LNG importers.

Bangladesh has fixed Liquified natural gas contracts that come at a lower rate, but they use spot pricing to account for 6% of its natural gas imports. With the wild swings of the 2021 LNG spot market, budgeting for imports to reach domestic energy demand becomes a near impossible task.

A low gas inventory in Europe created a lot of competition in the Asian LNG market as countries competed to secure their energy sources.

As a result, this led Bangladesh, along with other Asian countries, to explore the possibility of increasing local liquefied natural gas production to not succumb to the spot market.

Bangladesh is Aiming to Ramp Up Local Natural Gas Production

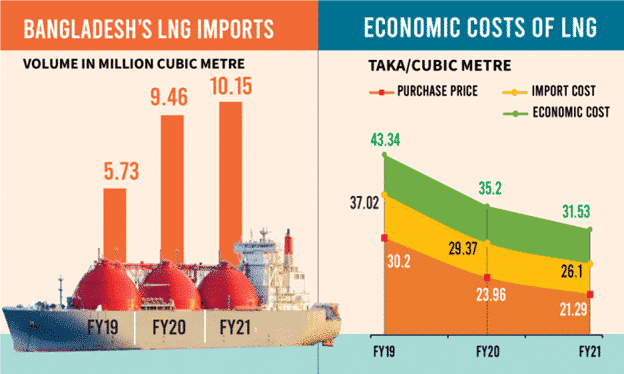

The Bangladesh government has been exploring contracts to build its first permanent liquified natural gas terminal. Having its own LNG terminal would bring down transport costs and double the country’s capacity for LNG imports. This proposal would still make Bangladesh susceptible to the severe swings in prices in the spot LNG market.

According to a study by the Center for Policy Dialogue (CPD), the price of LNG in the fiscal year 2021-2022 is expected to be 24 times more expensive than local Bangladesh gas production. Bangladesh has to find significant new gas reserves to meet its energy needs.

If Bangladesh raises local gas production by 5-7%, they may be able to avoid the volatile spot market. A joint operation with India’s ONGC Videsh was executed in September 2021 for an exploratory well offshore in Bangladesh with the hopes of being able to produce more LNG locally.

Ensuring Effective Distribution

Another issue for Bangladesh is that a large portion of its LNG disappears as systems loss. The global average for LNG systems loss is 0.5-1.0%. In Bangladesh, that number is alarmingly high at 7-10%.

Bangladesh Gas Theft

Some loss of natural gas is normal in a nation’s energy grid. Bangladesh, however, has a big problem with thieves siphoning gas off the main lines through illegal gas connections. Cracking down on gas theft is an important measure to take. And it is even more critical when relying on expensive LNG imports to meet domestic energy demand.

Should Bangladesh Focus on Renewables?

The best long-term solution for Bangladesh is to begin shifting its focus to renewable energies. As of 2020, only 3% of Bangladesh’s energy mix came from renewables like solar and wind.

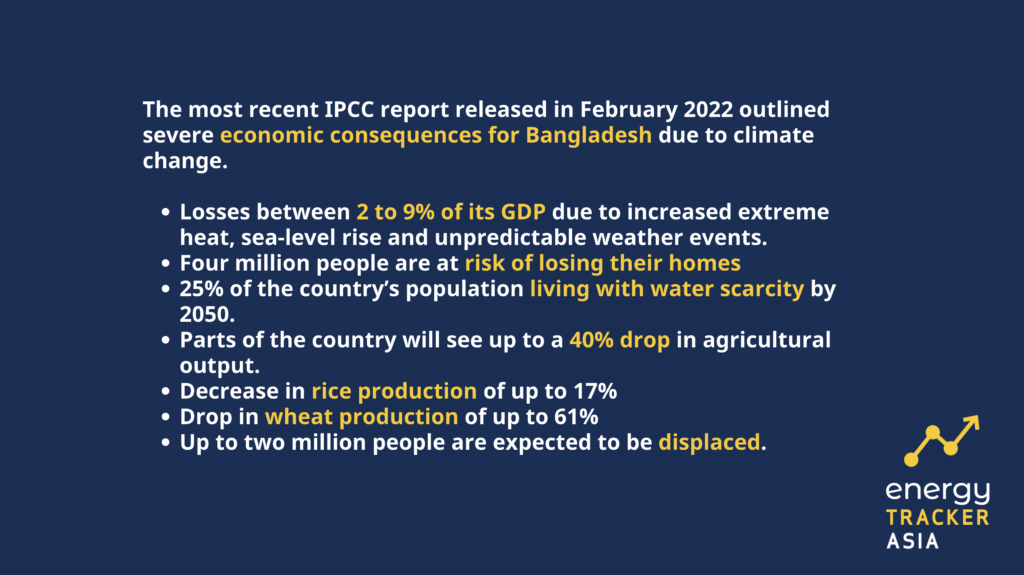

IPCC Report and Bangladesh

This is underscored by the most recent IPCC report released in February of 2022. The report outlined severe economic consequences for Bangladesh directly resulting from climate change. The report found that climate change may lead Bangladesh to lose between 2% to 9% of its GDP by midcentury. This results from increased extreme heat, sea-level rise, and unpredictable weather events.

Even more alarming, the report predicts that 4 million people are at risk of losing their homes, and 25% of the country’s population will be living in water scarcity by 2050.

In terms of agriculture, parts of the country will see up to a 40% drop in agricultural output. More specifically, this will take the form of a decrease in rice production up to 17% and wheat production up to 61% in the southern parts of the country. This is where 2 million people are dependent on these staples for food.

The Future of Bangladesh’s Natural Gas and Energy Mix

The volatility in the spot LNG market is a sign that Bangladesh should move away from fossil fuels, including natural gas. Furthermore, these natural gas prices, coupled with the world distancing itself from fossil fuel energy, makes it more challenging to secure affordable LNG. Recognized as a short-term solution to energy demand in Bangladesh and Asia more broadly, the focus should be shifted to growing renewable energy capacity in the region.

Already feeling the effects of climate change more than most countries, Bangladesh should be looking to develop its renewable energy grid to prevent recurring complications with fossil fuel availability down the road and limit further climate impacts.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more