Southeast Asia Economy: Waiting for Green Investments

Photo: Shutterstock / Miha Creative

11 June 2024 – by Nithin Coca Comments (1)

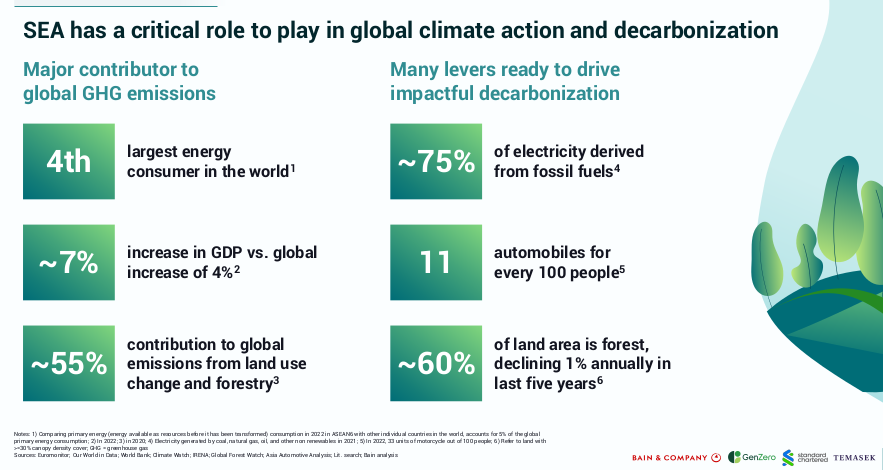

A new report from Bain & Company, GenZero, Standard Chartered and Temasek highlights the need for huge investments to support the green energy transition for the Southeast Asian economy. It notes that, so far, there isn’t nearly enough action being taken.

“There is a reality gap between what many believe is happening and true progress on the ground. Despite Southeast Asia’s structural challenges, immense potential exists to accelerate the energy transition and build the green economy,” said Dale Hardcastle, director of global sustainability innovation at Bain & Company, in a press release.

Biggest Challenge for Southeast Asian Countries

According to the report, the main challenge for the Southeast Asia economy and region is to fulfil decarbonisation targets while meeting soaring energy domestic demand. Although Southeast Asian economies have a lot of potential, resources and capacity for renewables and other low-carbon or resilient solutions, stakeholders need to accelerate progress to meet energy goals.

“We need to start with what we can do here and now and not miss the opportunity at hand,” said Hardcastle.

The Green Economy and Southeast Asia Economic Growth

Southeast Asia’s economy is growing rapidly, as this region, which has a greater population than the United States, plays a larger role globally. With economic growth and investment growth, however, comes increased energy usage and more greenhouse gas emissions. The region is currently highly dependent on coal, fossil gas and petroleum, all of which are costly and polluting.

While the region has set net-zero targets and has pledged to reduce greenhouse gas emissions in line with the Paris Agreement, so far, action has been mostly lacking and fossil fuel consumption is rising.

“The projected increase in energy demand across the region threatens to make Southeast Asia’s current decarbonisation targets unachievable, as current policies do not address how countries can balance the competing priorities of development and decarbonisation,” said Danielle Fallin, program manager for the Southeast Asia program at the US-based nonprofit Center for Strategic and International Studies, in an analysis.

One way to do that is to expand the use of renewable energy, incentivise energy efficiency and invest in more sustainable infrastructure. That, however, will be costly and requires most Southeast Asian countries in the region to push policies that promote and incentivise green investments.

“Countries, which take the lead in charting out their decarbonization roadmap through clear policy frameworks, supportive regulations and concrete financing plans, will be better positioned to attract private investment and accelerate their transition,” said Kimberly Tan, head of investments at GenZero.

Investing in Southeast Asian Economy

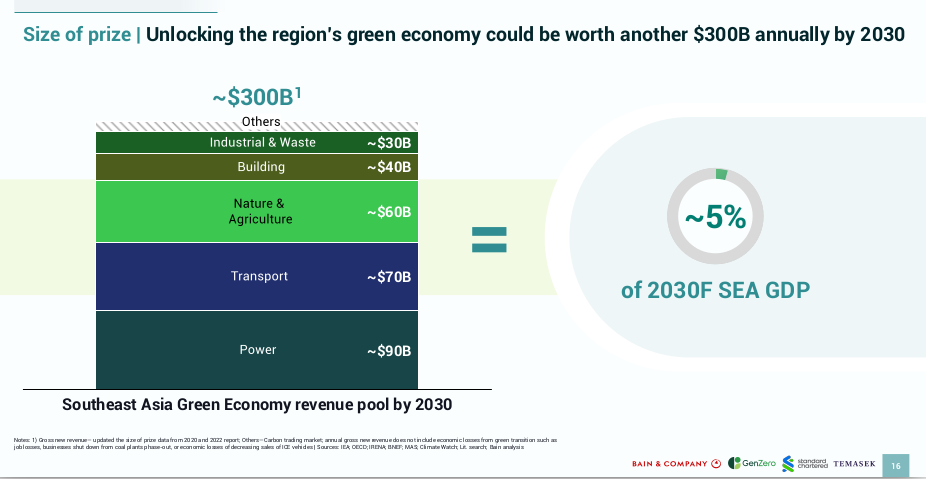

The report urges governments to push further on what they call foundational policies, like setting aside more funds for green incentives or setting up carbon markets. They identified 13 investment ideas across four themes that could generate USD 150 billion in revenue by 2030.

“Focusing on proven solutions to decarbonise and accelerators, such as blended finance or other incentives, can catalyse investment while governments figure out the more complex changes,” said Hardcastle.

These areas range from future-focused solutions, like regenerative agriculture and low-carbon transition fuels, to nature-based solutions, like forest conservation, mangrove restoration and peatlands protection. The report noted that some countries, like Malaysia and Laos, are leading the way, seeing triple-digit growth in green investments, while other Southeast Asian countries, like the Philippines and Indonesia, are lagging.

When it comes to cutting emissions, though, making the energy system more green will be essential. The good news is that according to a report from the Indonesia-based Institute for Essential Services Reform, Southeast Asia already has sufficient renewable energy sources to reach decarbonisation targets. But to mobilise and scale investments, there needs to be structural reform in the power market that incentivises investors.

While policy-makers are key, companies have a key role to play as well. In fact, investing in green mechanisms can increase revenue, cut capital costs and diversify a company’s portfolio. There’s also potential for innovative schemes, like cluster and pilot developments, the promotion of green industrial clusters and regional partnerships.

“We need radical collaboration across the public and private sectors, as well as harness the breadth of financial toolkits, to catalyze investment flows for sustainable infrastructure and collectively raise the bankability of such projects,” said Kyung-ah Park, head of ESG Investment at Temasek.

The bottom line is that Southeast Asia’s economy and region have massive potential but need leaders to deploy and rapidly scale investments and proper policy if they’re to meet decarbonisation targets. The time for action is now.

by Nithin Coca

Nithin Coca covers climate, environment, and supply chains across Asia. He has been awarded fellowships from the Solutions Journalism Network, the Pulitzer Center, and the International Center for Journalists. His features have appeared in outlets like the Washington Post, Financial Times, Foreign Policy, The Diplomat, Foreign Affairs and more.

Read more