The Boom of Green Investments in Asia and the Reasons for the Investors’ Interest

20 July 2021 – by Viktor Tachev

As the next renewable energy powerhouse, Asia is a primary point of interest for many green investors. The reasoning is sound – the continent aims to dominate the global renewable energy stage in terms of new capacity addition, technology development, energy demand, and more. As a result, project developers, renewable energy companies, and financiers are increasingly looking to capitalize on the tremendous opportunities for green investments in Asia.

The Rise of Green Investing

Green investing is a subsection of the global socially responsible investing (SRI) trend that has taken the world by storm. In a nutshell, SRI is the process of investing in projects or companies dedicated to conscious business activities. SRI is often considered through the lens of environmental, social, and governance (ESG) investments. While SRI has been widely popular for more than a century, green investing is just picking up pace.

ESG and sustainable investments are on the rise

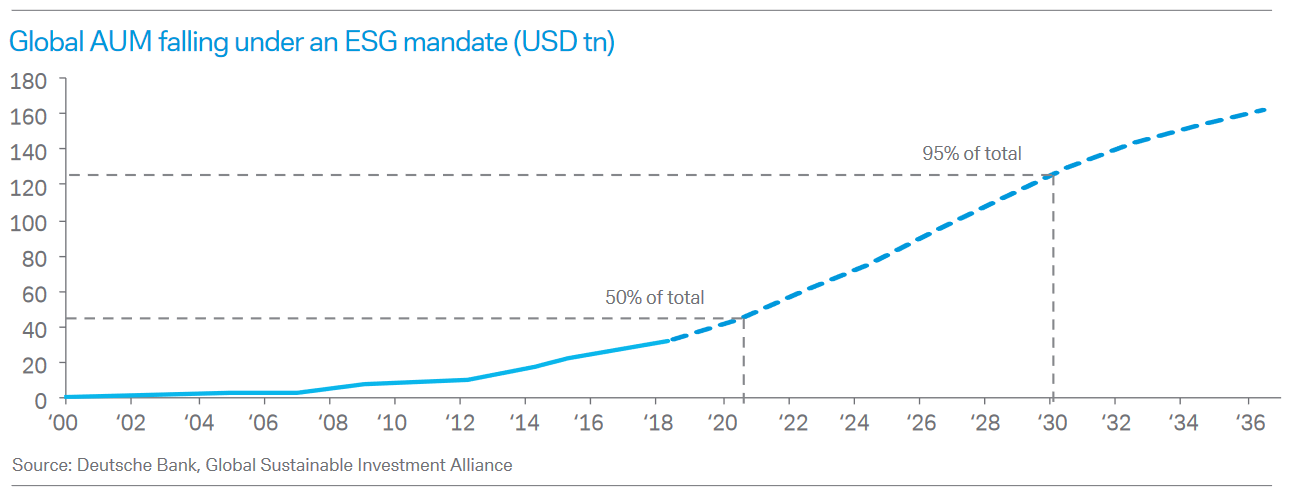

Currently, more than USD 30 trillion of assets globally are managed in ESG investments, up 34% from 2016.

In 2020 alone, sustainable fund assets hit a record USD 1.7 trillion. Global ESG assets are projected to exceed USD 53 trillion by 2025 and USD 100 trillion by 2030.

The trend is evident also on a local scale in Asia. A recent survey by the Economist Intelligence Unit (EIU) studying Asian investors’ preferences found that 27% of respondents expect to have up to 50% of their assets under management (AUM) in sustainable investments by 2023. Furthermore, over 35% of the wealth will be in the hands of millennials in the next five to seven years – a generation twice as likely as the overall investor to invest in companies targeting social or environmental goals.

The financial reasoning behind the growth

A study by Imperial College London and IEA, analyzing stock market data, concludes that renewables have a superior risk/return profile to fossil fuel investments in both ordinary market conditions and tail risk events. In some scenarios, green energy investments achieved over 7 times the return of fossils. The report also concludes that the cost of capital remains lower for renewable energy companies than their fossil fuel peers.

A study by RBC Global Asset Management concludes that socially responsible investing doesn’t result in lower investment returns. Just the opposite, Asian companies operating within the renewable energy niche are renowned for their growth potential.

In the first three quarters of 2020, clean energy investments outperformed the market and are expected to retain their growth in the upcoming years.

The Pros and Cons of Green Investments

Green investments will undoubtedly play a significant role in the global economy as we advance. Yet, despite the plethora of benefits, like any investment opportunity, they also have some drawbacks.

Pros of green investments

The most significant advantage is that green investments don’t sacrifice returns. They often outperform other market sectors, which means they offer a good blend between financial performance and the “feel-good-do-good” factor. And the best thing – they retain reasonable levels of risk, effectively serving as a hedging instrument for your portfolio.

Another advantage is that the niche is becoming more accessible by the day, even for retail investors. Investment opportunities come in many forms, be it an ESG fund, shares in a renewable energy company, a large-scale project for new net-zero capacity, or just installing a solar panel on your residential roof.

Besides, the market is still at its early age, meaning there is a significant growth potential ahead as it matures and attracts more public interest.

For more information about the advantages of renewable energy investments, check out our dedicated report on “5 Reasons that Define the Increased Investment Interest in Renewable Energy”.

Cons of green investments

First comes the lack of regulatory clarity in some jurisdictions. The result is a complicated project development process. It can lead to delays, project cancellation, lack of investment interest, and other barriers to the renewable energy progress in the particular region.

A significant drawback for ESG stock market investments is the inefficiency of rating models in their current form. This may deceive the investor that the company he invests in is more ethical or sustainability-dedicated than it really is.

The relatively young age of the green industry means it is learning on the go. While this opens the room for significant growth potential, it might also be volatile at times.

We should also mention the problem with greenwashing. The practice aims to create a false impression or provide misleading information by companies about how environmentally sound their products or whole business is.

The Success Stories and Green Investment Opportunities in Asia

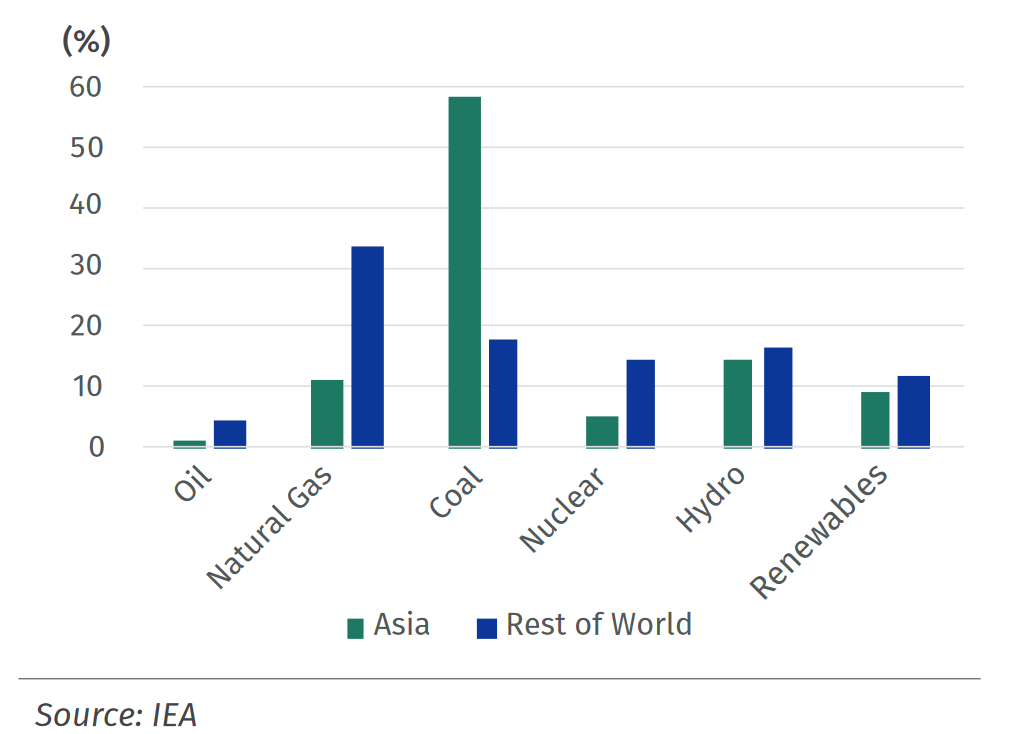

While the continent’s renewable energy progress still lacks behind the rest of the world, things are starting to take a different direction.

If we take the map of Asia, we will see that there is a major green investment success story in basically every country.

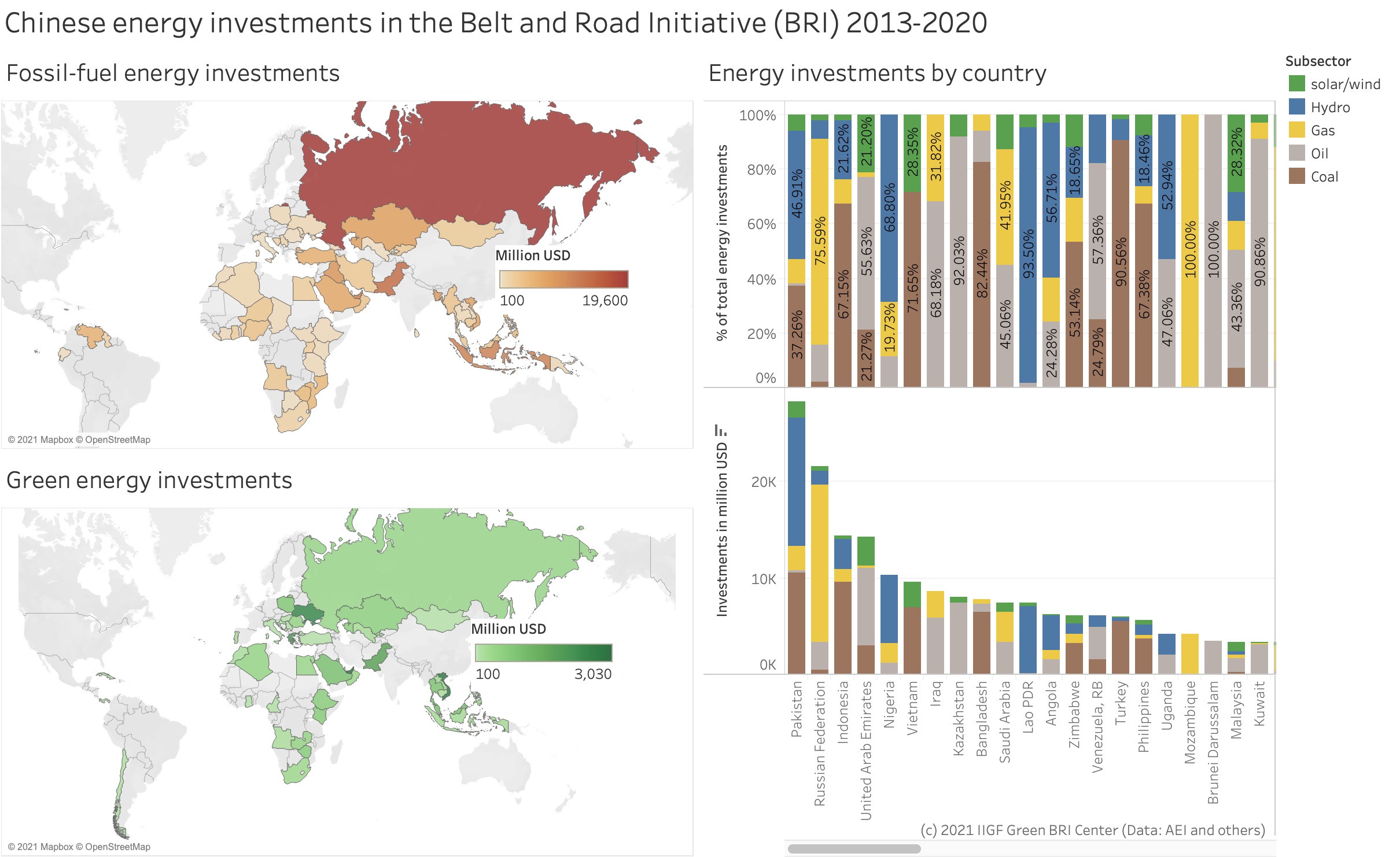

China, for example, owns 9 out of the 13 largest solar module manufacturing companies in the world. The country is also home to some green businesses with the best long-term prospects, making it the central point of interest for many retail and institutional investors globally.

Vietnam is also worth a mention as it managed to become a top 10 solar power market globally for just a couple of months. Countries like Thailand, the Philippines, Malaysia, and Indonesia are also making significant progress and have ambitious plans.

In Q3 2020, Taiwanese investors held more ESG assets as a total share of assets under management than any Asian economy. Furthermore, the local financial regulator, the Financial Supervisory Commission, is among the most vocal proponents of green investments.

Countries in Central Asia like Kazakhstan and Uzbekistan are also determined to make green energy a more substantial part of their power mix.

The continent, as a whole, now leads sales of low-carbon goods and services as a share of GDP. It also accounts for close to 50% of global renewable energy investments.

Asia holds three of the top five places for the countries that have attracted the most clean energy investments in 2019, with China, Japan, and India holding first, third and fourth places, respectively.

Experts project the APAC region to lead renewable investments by 2030.

What the Future Holds for Green Investments in Asia

McKinsey & Company sees significant growth potential in various green sectors, including renewable power generation, electrification of infrastructure, bioenergy, hydrogen, carbon capture, utilization, and storage (CCUS), negative emissions technologies, and more.

Furthermore, the Climate Action 100+ investors initiative has so far collected over 570 signatories, which, combined, account for more than USD 50 trillion in assets under management.

Governments, policymakers, investors, and the corporate sector all recognize the importance of the net-zero transition. As a result, the growth in the industry is inevitable, as is the investment interest.

The question for most investors now is not if but when they will become a part of the green revolution. As years of market history had shown, the sooner, the better.

![]()

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more