Renewable Energy in Asia – The Landscape for Investments

Photo Credit: Shutterstock

20 May 2021 – by Eric Koons Comments (0)

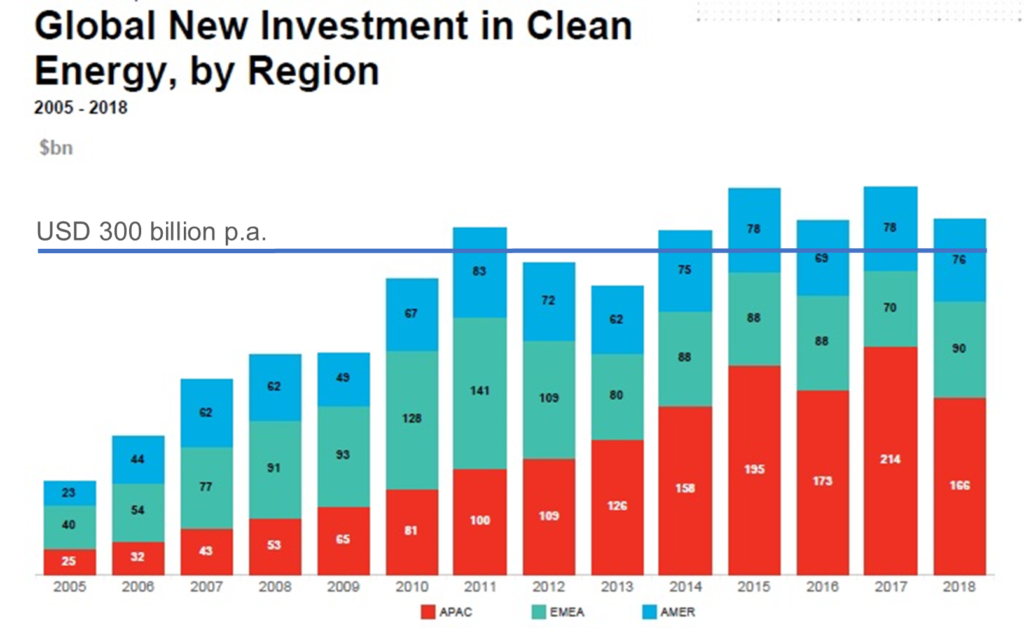

Renewable energy investment is booming. Since 2015, global investments have totalled over $300 billion annually. In the last few years this has been about three times the investment in fossil fuels. A new technology replacing an old one. No longer just an environmental play, clean energy investment is now firmly about making money.

Asia is a big part of the boom. In 2017, about USD $150 billion was invested in Asia alone, more than 40% of the global total. So, are there still opportunities to invest in the energy sector in Asia? And what are the challenges?

Renewable energy Investment in Asia

From 2011 to 2015, the major clean and green energy investment region shifted from Europe to Asia. With the two most populous countries in the world, and a host of other nations, this isn’t going to change anytime soon.

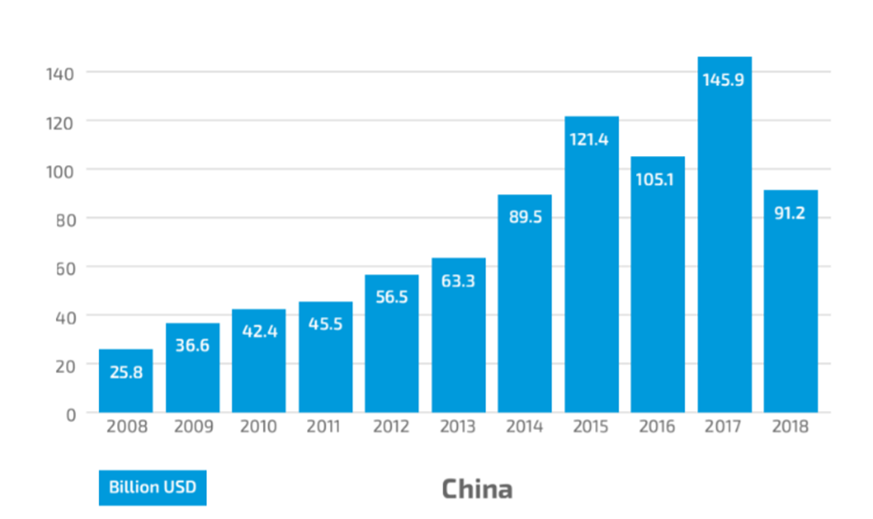

China: Clean Energy Financing

China is the undisputed global leader in clean energy and the champion of renewable energy in Asia. In 2017, 45% of global renewable energy investment was in China: USD $145.9 billion. This dropped to a still-impressive USD $91.5 billion in 2018 (32% of global) due to a change in feed-in tariff policy, falling costs of solar energy and different timing of investments.

With its recent announcement of a 2060 target for net-zero emissions, China’s investment in renewable energy fossil fuel based power plants is only going to continue. For China to reach 26% renewable energy in 2030, it has been estimated that ~ USD $145 billion investment each year will be required.

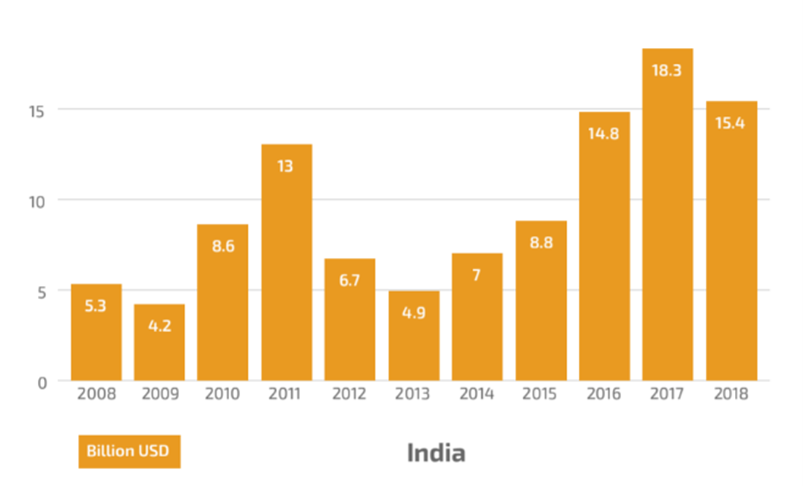

India: Clean Energy Investments

India remained the fifth-largest investment market for renewable energy in 2018, with USD $15.4 billion invested, down slightly from USD $18.3 billion in 2017.

But India has big plans for their renewable power and energy sources. The government announced last year that their energy sector would need USD $330 billion in renewable energy investment over the next decade to achieve its renewable energy targets.

South-East Asia (ASEAN) & Renewable Energy

ASEAN countries have been dragging their heels on renewable energy. However, this is changing, with a recently announced ambitious goal of 23% renewable energy by 2025.

Vietnam is leading the ASEAN sector in clean energy investment (34% of ASEAN investment) and will continue to do so into the future. It has plans to install more than 13 GW of new renewable energy from projects. They won’t stop there, with 50 GW capacity from wind and solar planned for 2030.

Singapore obviously has less land than other nations and has less internal investment. However, the huge Sun Cable project in Australia plans to send about 13 GW of renewable energy, from a giant solar farm in the Australian desert, underground and undersea to Singapore.

Challenges Facing Green Energy Investments in Asia

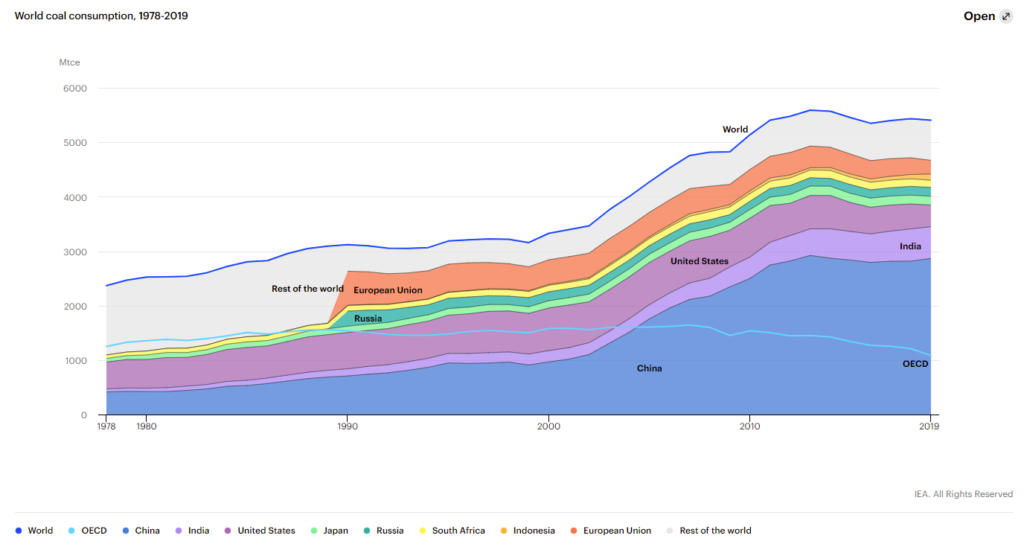

The abundance of cheap coal is still a major barrier to clean energy investment in Asia. In 2019 Asia accounted for 68% of world coal use, with China accounting for 53% alone. Asia has plenty of cheap coal, particularly in Indonesia. The challenge for renewables is to bring generation capacity online fast enough to cater to an increasing Asian population with increasing energy needs. Some countries still believe coal is the best option to solve this burgeoning energy demand.

ASEAN countries are lagging China and India in terms of clean energy investment, in part due to unique challenges. Finance has been identified as the most important challenge, but there are other issues holding things back. These include a lack of regulatory frameworks, a lack of coordination between government and private sector, and a lack of policy to regulate land use. In Indonesia and the Philippines, limited electricity transmission infrastructure and associated energy access is a major barrier. Indonesia has additional problems with its complex bureaucracy.

For the ASEAN region to achieve its publicized goal of 23% renewables by 2025 it will need to get moving and sort out these issues.

Financing Opportunities.

There is a wide range of sources for clean energy financing in Asia.

Private sources are the major financiers, providing about 87% of finance for renewable projects between 2013 and 2016. Most renewable energy investment is sourced in the same country in which it is spent.

Thus, if you are looking to fund a renewable project or get co-investors involved, local private sources are your best bet. These include private sector banks and other private financiers (e.g., pension funds), green bonds, private equity and capital markets, and even power utilities.

The World Bank and the Asian Development Bank (ADB) are two of the top international institutions for investing in energy projects in Asia. In South Asia, development banks invested about USD $6 billion between 2009 and 2016, with the World Bank, ADB and the Japan Bank for International Cooperation putting in more than USD $1 billion each. While this may seem like a substantial investment, it accounts for well below 1% of the total renewable energy investments made in Asia during this time. Asian development banks, particularly ADB, need to have a stronger stance on supporting renewable energy projects in the region.

There are also several global assistance programs specifically focused on renewable energy. These include the Green Climate Fund, the Global Environment Fund, the Global Climate Partnership Fund and the Global Green Growth Initiative.

Sustainable Energy in the Future

Over the last few years, annual investments upwards of USD $150 billion have been ploughed into renewable energy in projects in Asia, but this is not enough. Aggressive climate-related targets announced by nearly all Asian nations guarantee investments will need to increase in the future.

Opportunities abound across the entire Asia-Pacific region. While some challenges remain, the push towards clean energy appears unstoppable, and there are plenty of options for finance to make it happen.