How Carbon Pricing Can Catapult Energy Transition in Asia

09 June 2021 – by Ankush Kumar Comments (0)

The pace of energy transition is accelerating despite the on-going Covid-19 catastrophe. The recent Dutch ruling on the mineral oil giant Shell to cut its CO2 emissions by 45% by 2030 shows the urgency to counter even bigger catastrophes arising from climate change. Southeast Asia still depends heavily on fossil fuels and considers LNG as a transitional energy source. Though there are many tools to minimize fossil fuel emissions, experts believe carbon pricing can be a key policy instrument to keep the global temperature rise below 2°C and prevent irreversible global warming.

Carbon pricing at the global scale

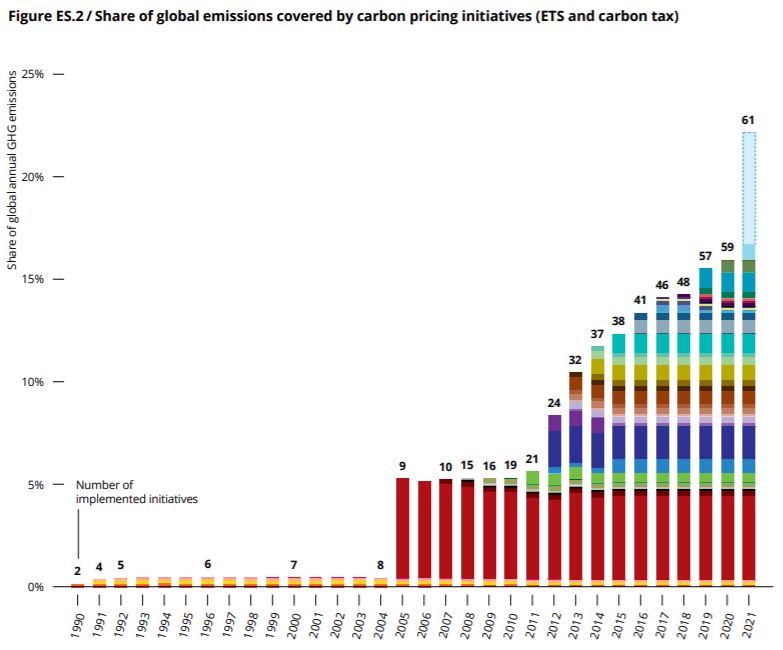

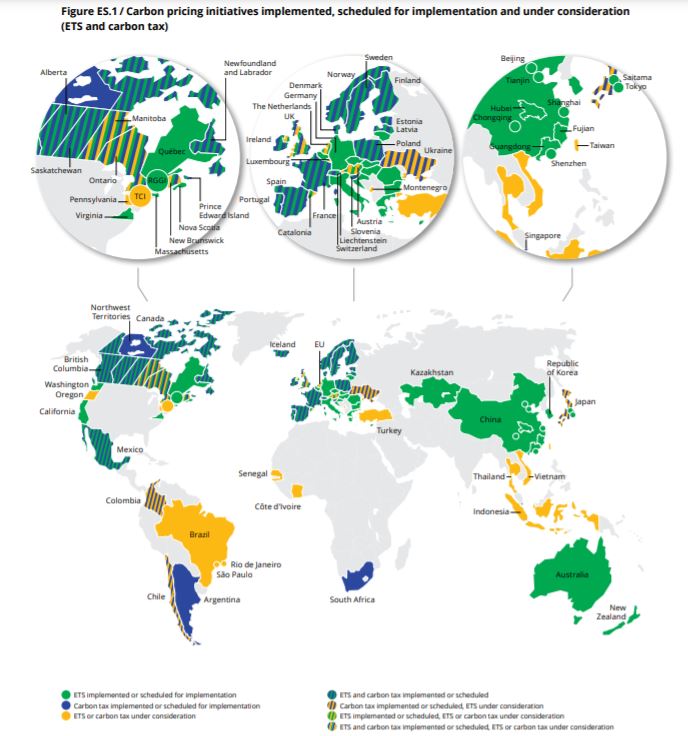

There are currently 64 carbon pricing initiatives implemented across the globe, according to the latest World Bank data. “In 2019 these initiatives raised USD $45bn in revenues for the environment and broader development projects”, World Bank’s Managing Director of Development Policy and Partnerships, Mari Elka Pangestu, said at last year’s CLPC dialogue. “But obviously much more can be done.” She added that carbon pricing was most effective when it was part of an integrated and coordinated policy package.

Carbon tax

Carbon pricing pushes consumers towards less carbon-intensive goods. It is implemented through an Emissions Trading System (ETS) or a carbon tax. Carbon tax accelerates the decarbonization of economies: A study in the OECD countries showed that a carbon tax of EUR 10 per tonne of CO2 can reduce emissions by around 7.3%.

Examples of how the carbon price affects carbon emissions

Further observations in the West came to similar results. In 2012, the United Kingdom increased carbon rates from EUR 7 per tonne of CO2 to more than EUR 36 by 2018. In this period, the country witnessed a 73% fall in emissions in the electricity sector. Similarly, the overall pollution in the European Union Emissions Trading System (EU ETS) fell by 8.9%. Previously, permit prices had been increased by EUR 8.90 per tonne of CO2 to about EUR 25.

Many Canadian territories have initiated schemes to align with the federal government’s carbon pricing system. Several US states and provinces are also considering adopting ETS for the building sector. In Latin America; Colombia, Mexico, and Chile have established carbon pricing as part of a wider strategy to decarbonize their economies and reduce greenhouse gas emissions.

Significance of Carbon Pricing in Asia

With energy demand estimated to advance by 70% by 2040 compared to 2015, Southeast Asia is at the center stage for the global energy transition. The region has witnessed drastic changes from the closure of several power plants, banks declaring carbon neutrality, and the falling prices of renewable energy. However, the pace of energy transition is relatively low in the region. Reasons are high political, regulatory, and economic barriers. In Asia, Singapore became the first country to introduce a carbon tax. Indonesia is also looking to implement a domestic ETS to achieve its climate goals. Elsewhere, China has incorporated its electricity sector in its ETS and aims to cover industrial infrastructure in the near future.

Asia moving away from fossil fuels & towards carbon pricing

The World Bank also wants to accelerate this process. In the next five years, the institution would support ten new countries to put in place carbon pricing programs, Pangestu promised in her speech. The bank would also provide technical assistance to a further 20 countries. Pangestu did not specify countries’ names. But as Asian economies are largely dependent on fossil fuels, it can be a huge opportunity for them to hasten their energy transition through this program.

“Carbon-pricing is not the silver bullet”, said William Acworth, head of Programme Carbon Markets and Pricing of the German thinktank Adelphi. “It must fit within a broader package of policies that provide a comprehensive and credible framework for emission reductions.” Speaking to ETA, Acworth added that in Asia particularly, policies to spur renewable energies and reduce the barriers to the electrification of transport and industry were essential.

Assessing carbon pricing impact

Though carbon taxes have helped in lowering emissions, experts also suggest that carbon pricing alone is not enough to attain net neutrality. Despite adopting a carbon tax, Canada for example is far away from achieving its 2030 carbon emission targets. The country levies CAN $40 per tonne. Scientists estimate it would require a carbon price of $210 per tonne to meet the goals.

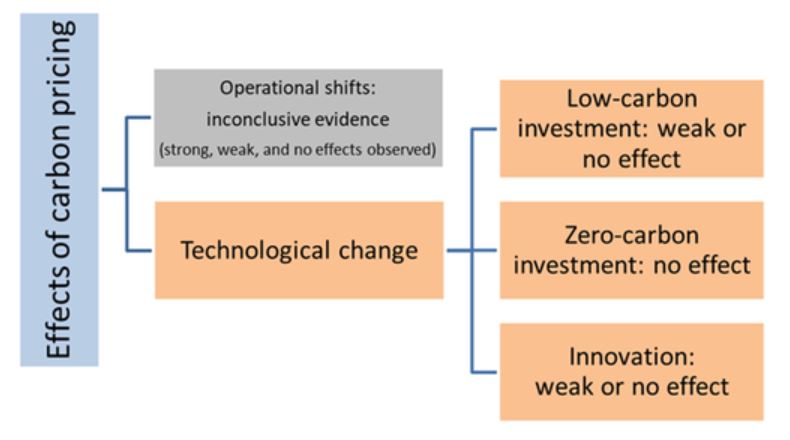

A study released last autumn analyzed carbon pricing mechanisms in the European Union, New Zealand, British Columbia, and the Nordic countries. It found that the impact of carbon pricing in fostering innovation and green investments was debatable. One key reason the scientists identified was an overallocation of certificates in many emission trading systems. With too many certificates in the market, carbon prices fall. In consequence, it is cheaper for fossil fuel plants and energy-intensive companies to pollute than to invest in cleaner technologies.

The study acknowledged certain changes in operational shifts. For example, companies moved from coal to gas power. However, no profound technological changes to reach full decarbonization were observed.

Key takeaways for Asian economies

Hence for Asian governments, an important takeaway is the design of emission trading systems. Too many certificates or – in a taxation system, too low prices – can be inefficient and even counter-productive.

The study also suggested that the effectiveness of carbon pricing could be enhanced. Examples are the increase of investments in renewable energies, low carbon assets as well as more research and development. Governments should therefore also consider a climate-oriented instrument mix: from direct subsidies for green energies to regulative law penalizing excessive fossil fuel use.

Policymakers also have to consider the social implications. An increase in oil or coal prices threatens the most vulnerable that are already struggling with the Covid situation. Therefore funds from carbon pricing systems should be well invested: They could play a crucial role in post-Covid support to low-income economies. Also, carbon pricing can help in making renewable energy sources more competitive.