The Power Sector in Bangladesh Is Slowing Its Economic Growth

Source: Reuters

23 March 2023 – by Eric Koons Comments (0)

The power sector in Bangladesh suffered a significant blow in October 2022. The country experienced unprecedented power shortages, resulting in rolling blackouts affecting 80% of the population. As utilities rushed to bring the grid back online, domestic and international issues turned the blackout into an energy crisis.

Bangladesh’s Energy Crisis

The rising price of oil, gas and coal skyrocketed in 2022 and brought into question the reliability of electricity for the 169 million residents of Bangladesh. Additionally, the blackouts and other planned energy shut-offs impacted the country’s manufacturing industry and caused the country to suffer economic consequences on multiple fronts.

Renewable Energy in Bangladesh

This is happening amid Bangladesh’s lacklustre renewable energy development and failure to meet successive renewable energy goals. The country aimed to produce 5% of its power from renewables by 2015 and 10% by 2020. As of 2021, renewables have only accounted for around 2% of power generation.

These failures raise the question: Could the energy crisis have been minimised with renewables?

Simply put – yes. Leading international organisations, such as the International Energy Association (IEA) and the United Nations (UN), continually cite improved energy security and resilience as significant benefits of renewables. This is even more apparent as nations worldwide release and meet progressive renewable energy targets. Bangladesh needs to do the same to prevent future power generation and energy issues.

However, Bangladesh is in a challenging position where it needs to maintain relations with the fossil fuel giants Russia and China, which finance most of the country’s energy infrastructure. This creates two opposing forces and makes the ideal stable economic growth supported by low energy prices appear further out of reach with the country’s existing energy infrastructure.

Bangladesh’s Energy Mix

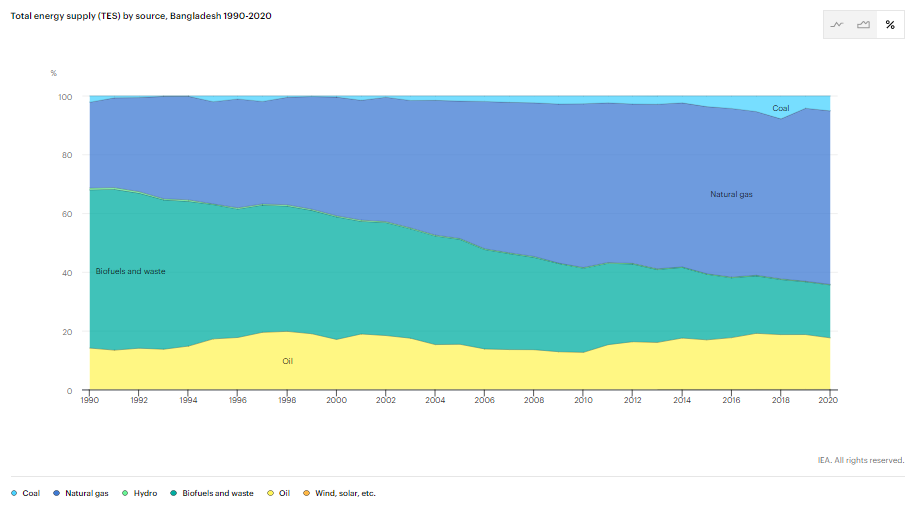

Meanwhile, fossil fuels dominate Bangladesh’s power sector. In 2021, its energy mix was around 68% natural gas, 23% oil, 8% coal and the rest from renewable energy plants. Hydropower was the largest renewable energy source at 0.39%, with solar being the runner-up at 0.26%.

A clear pattern emerges when the country’s energy mix is viewed over time. For example, natural gas use is increasing at a staggering rate, up from around 27% in 1971. Interestingly, renewable power generation capacity has been declining over the same period. The decline of renewables juxtaposes Bangladesh’s Rural Electrification and Renewable Energy Development (RERED) Project, one of the world’s largest off-grid solar power plants programs. However, utility-scale solar is largely untapped.

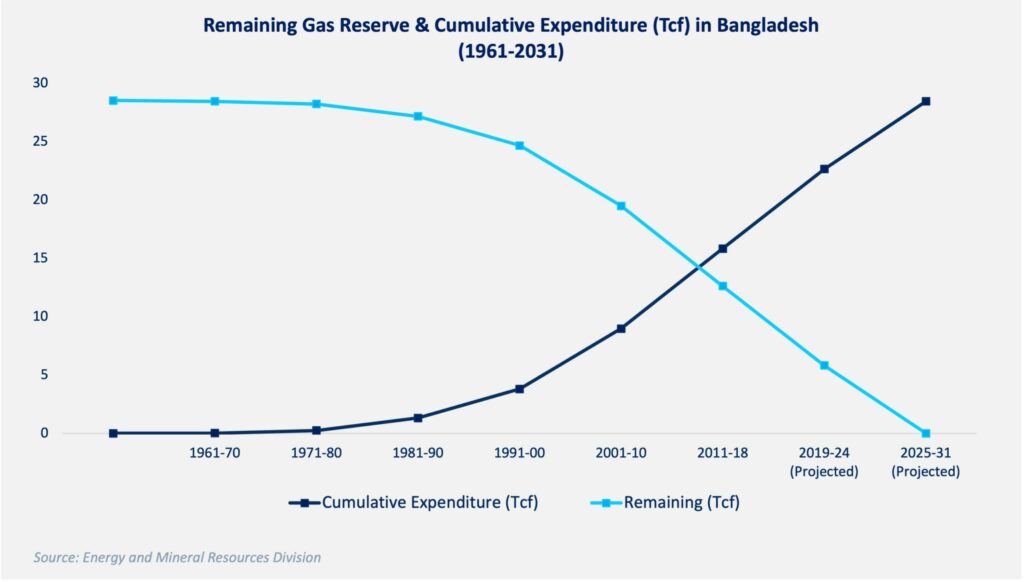

Now, more than ever, the country’s reliance on natural gas is becoming a liability instead of an asset. The country increasingly relies on foreign energy imports along with declining domestic oil and gas reserves. This puts Bangladesh and its energy sector at the mercy of global fossil fuel suppliers and limits the country’s autonomy.

Bangladesh’s Power Sector and Its Main Consumers

The Bangladeshi power sector’s reliance on natural gas came to a head in late 2022 as LNG reached record-high spot prices throughout Asia. This forced the Bangladeshi government to halt LNG purchases, creating an energy crisis.

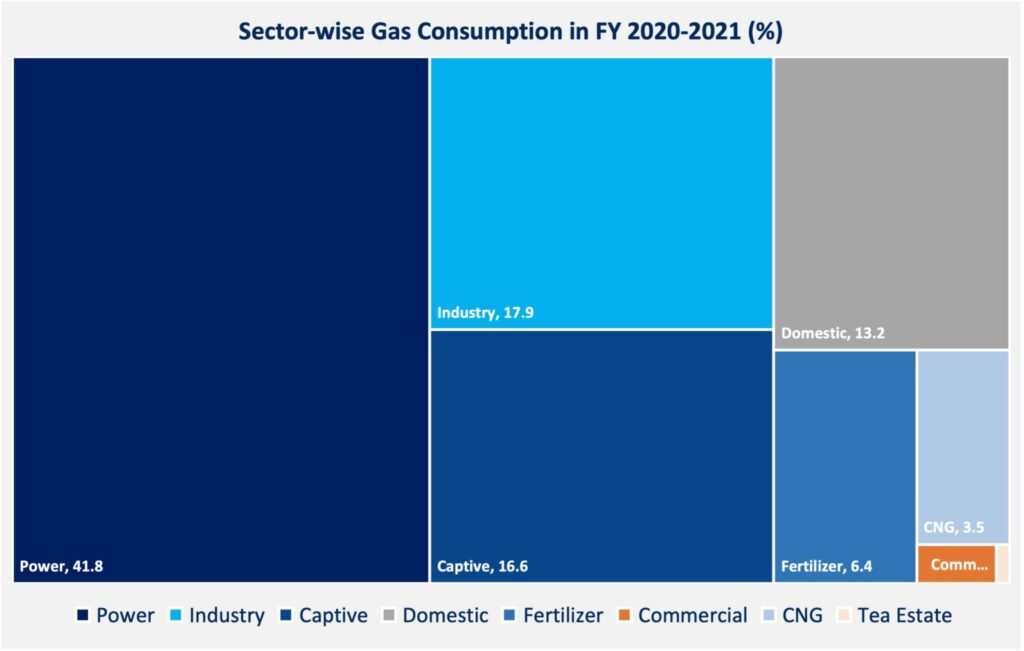

This lack of energy security amid planned and unplanned load-shedding has hit the country’s manufacturing industry hard. For example, the ready-made garment industry (RMG) accounts for over 10% of the country’s GDP. However, production facilities have been forced to close due to the lack of power, or they have been made to use costly alternatives.

Other large, energy-intensive industries in Bangladesh susceptible to energy shortages include the fertiliser industry, cement industry, IT industry, paper production industry and shipbuilding industry.

As these industries struggle through the energy crisis, some, especially the RMG industry, rely on diesel power generators to keep their machines running. This increases the built-in energy cost by as much as 300%, which may compromise these companies’ current ranking in the world market.

Government subsidies would be welcome, but the country’s dwindling foreign exchange reserves and growing financing deficit will make it challenging. In November 2022, the IMF issued Bangladesh a USD 4.5 billion precautionary loan to help shore up its accounts. Providing energy to the industry is necessary but not at the cost of unsustainable growth.

The Effect of Energy Shortages on GDP

Amid energy insecurity and a sluggish pandemic recovery, Bangladesh’s economy is slowing down. Initial annual forecasts predicted an economic slowdown from 7.1% growth in 2021/2022 to 5.5% in 2022/2023. This is partially attributed to higher energy costs, which increase production costs. However, global inflation and slower international consumer spending also play a part.

The Future of the Electricity Sector in Bangladesh

As with countries worldwide, Bangladesh needs to take a stronger stance on its energy transition. It should invest more in electricity generation through solar and wind power plants. While initial infrastructure and grid modernisation is expensive, long-term energy stability will be a boon for the rapidly developing country. As one of the countries most at risk from climate change impacts, adaptation and mitigation are critical components of its future energy policy.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more