The Risk of Oil and Gas investments – A Story of Declining Returns

Source: Kiplinger

19 July 2021 – by Eric Koons

In the three years after the ratification of the Paris Agreement, the five largest oil and gas companies invested over USD 1 billion into lobbying against climate-related issues. Despite this spending, investments in renewables have been steadily increasing. As of 2017, investments in renewables doubled those of fossil fuels, and this trend has been maintained since then.

This trend has occurred for several reasons, yet one of the most obvious is performance. A report released by the Center of Climate Finance and International Energy Agency found that over the last 10 years, renewables have seen an investment return of 426%, compared to 59% for fossil fuels. Additionally, oil and gas stocks have placed last in the S&P 500s’ sector rankings for five of the last seven years.

![]()

Risks in Oil and Gas Investments

Poor financial performance for oil and gas companies is attributed to a combination of factors.

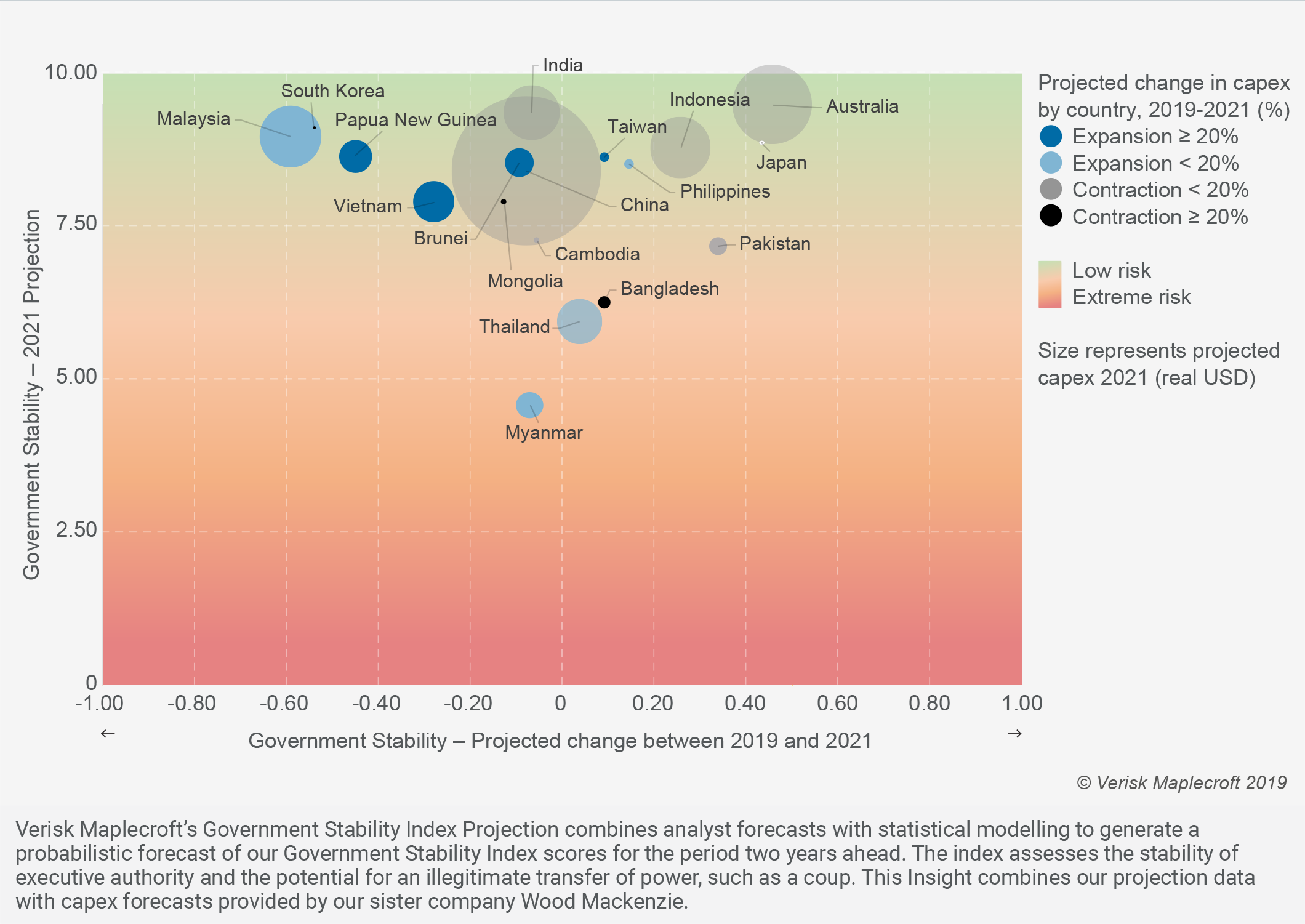

Political Instability

Major changes in the political landscape can significantly impact pricing and returns for the oil and gas sector. Many oil states are already politically uncertain and volatile, and with the declining use of fossil fuels, these countries risk falling into further turmoil. While analysts have predicted that Asia will remain relatively stable, the largest risk for political turmoil is in Thailand, Myanmar, Malaysia, and Papua New Guinea. This government instability will likely impact oil and gas investment throughout the region.

Shocks in Supply and Demand

Oil and gas projects have significant lead times. On the short end, a standard oil well can take several years to go from pre-drilling activities to production, and offshore oil projects can take upwards of five years.

By the time a project is operational and yielding product, supply and demand dynamics may have changed significantly. These projects are long-term bets that the price of oil will at least remain stable. Yet, based on recent trends we have seen, this is not the case, and prices have been tanking.

Locational Risk

Oil exploration projects involve substantial risks, as it is difficult to predict where oil reserves are located accurately. Decades of exploration have focused on the more obvious areas, so finding oil and gas has become more complex. Many oil and gas wells worldwide will never produce.

Volatility of Oil and Gas Industry Prices

Oil is known for dramatic price fluctuations. This is primarily driven by shifts in supply or demand, which is challenging to predict. Furthermore, oil and gas is a global industry. If a country dumps large quantities on the market, it can have significant impacts across the industry.

Predicting future oil prices is challenging already, but with throwing in political events and pandemics, it becomes nearly impossible. A great example is the COVID-19 pandemic – in March 2020, the price of oil dropped to its lowest point in 18 years. This was over a 50% drop in value in the span of a few months.

![]()

Stranded Assets in Oil and Gas Companies – their Effects on Oil and Gas Investments

Beyond the volatility of oil and gas prices, another real consideration is the risk of stranded assets. This risk is already happening. In Australia, the Bluewater coal-fired power plant was written off to the tune of $1.2 billion due to renewable energy and market forces. And this is only one example. As regulatory frameworks on emissions change, there is a real risk that oil and gas companies will simply not be able to sell their product.

The Rise of Renewables

Finally, as mentioned previously, investment in renewable energy is now about double that in fossil fuels. The falling cost of renewables is driving this, and the public sentiment is swaying heavily towards clean technologies. We expect this trend to continue as prices drop further and more and more governments and corporations go ‘green.’

![]()

Will the Investment Trend in Renewables Continue?

The traditional safe-haven investments in oil and gas are no more. Investment in fossil fuels is now a precarious business. The combination of traditional risks and modern issues, like the global pandemic, have wreaked havoc on the oil and gas sector. It’s no wonder that investments in renewable energy are now over double that of fossil fuels – renewables are fast shaping up as the new safe haven for investors.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more