Upcoming LNG Projects in Asia: The Outlook for 2023 and Beyond

Photo by Juozas Baltiejus

26 December 2022 – by Viktor Tachev

Asian countries are leading the global plans for LNG terminal import infrastructure buildout. However, due to the high gas prices, these upcoming LNG projects in 2023 are facing the risk of delays or cancellations. Even if completed, considering the global gas supply crunch, the terminals might struggle to ensure deliveries.

The Upcoming LNG Projects 2023 in Asia

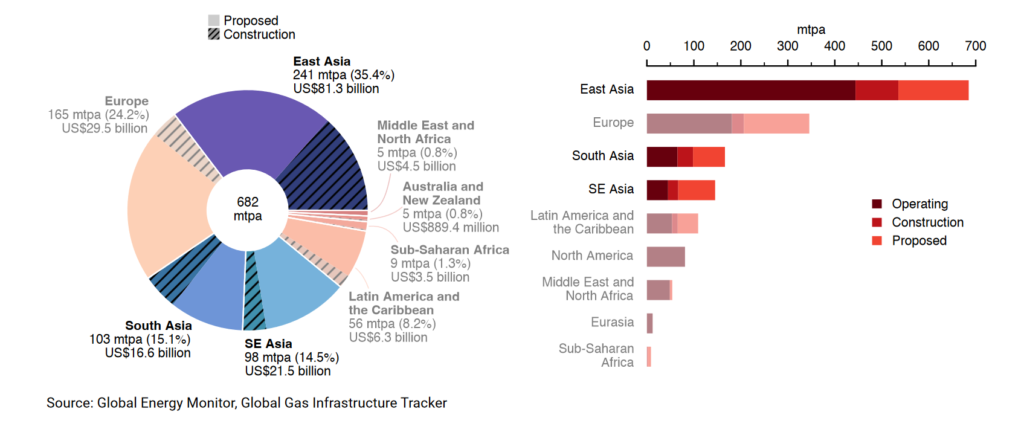

Global Energy Monitor’s December 2022 briefing reveals that Asia will build the majority of the new global LNG terminal import infrastructure next year.

Currently, the new LNG import capacity at various stages of development in Asia totals 442 million tonnes per annum (mtpa). According to Global Energy Monitor, this is enough to cover the entire 2021 global LNG trade.

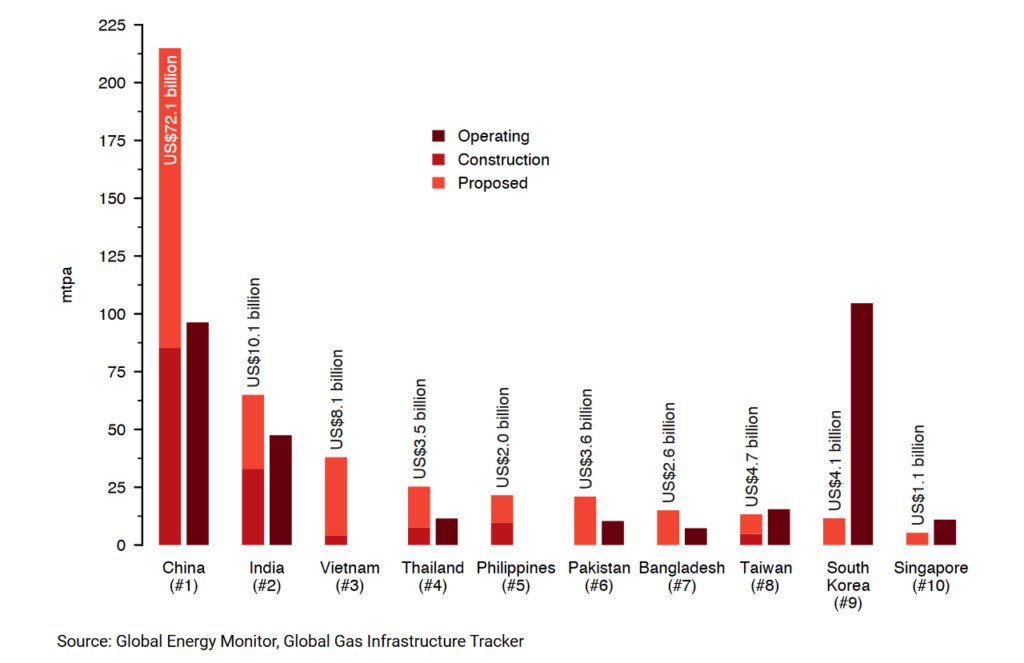

On a country level, the largest LNG terminal buildout is planned in China. Other Asian countries planning for notable expansion include India, Vietnam, Thailand, the Philippines and Pakistan.

In total, the upcoming LNG projects in Asia require an investment of USD 119 billion.

However, Global Energy Monitor warns that this investment could lock Asian economies into relying on a volatile, insecure energy commodity. Furthermore, it risks challenging global efforts to address the climate crisis.

The New LNG Projects 2023 at Risk of Underutilisation, Delays and Cancellations

In 2022, many countries in Asia dropped or delayed LNG infrastructure development plans due to poor economics or lack of demand.

India

All six new terminals anticipated this year in India are offline at the time of this writing. Most of them are postponed to 2023.

China

In China, just two of the eight new terminals planned for this year have started operation.

Vietnam and Philippines

Vietnam and the Philippines postponed the launch of their first LNG terminals for 2023. San Miguel Corp., the leading gas infrastructure developer in the region, is at risk of delays for eight power projects.

Bangladesh

The Bangladeshi government cancelled an LNG-fired power plant project, citing high gas prices on global markets as the main reason.

Across Asia, just two 1-mtpa LNG import projects have been commissioned in 2022. The new import capacity commissioned in 2021 was only 17.1 mtpa.

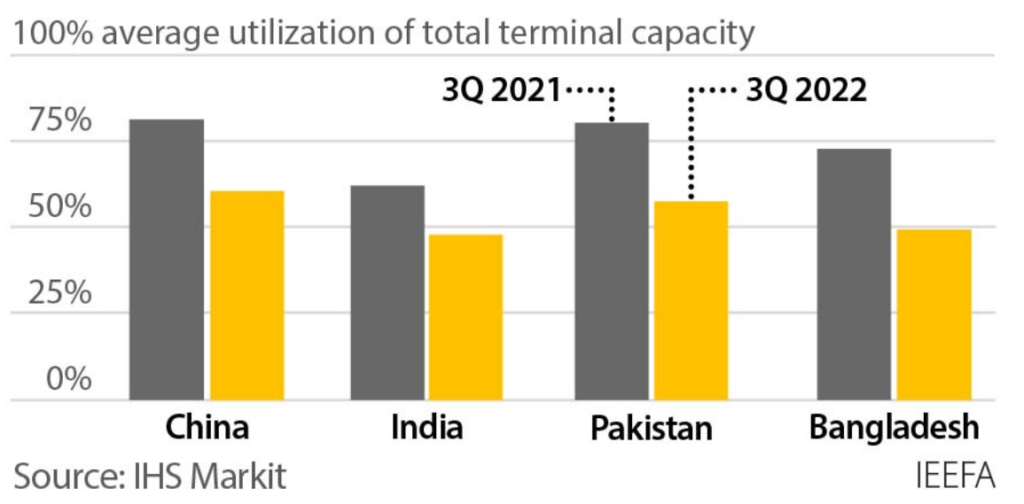

Existing gas plants are also struggling to fulfil their entire LNG production capacity. According to the IEEFA, in 2022, three of India’s six operational LNG terminals were running at below 20% capacity. The think tank sees a real risk for similar underutilisation rates to continue through 2025.

The IEEFA warns that the underutilisation of existing import terminals can also negatively affect new projects. As a result, they might face an increased risk of further delays and cancellations.

Looking Beyond 2023: What is the future of Liquefied Natural Gas (LNG)?

Most analysts share pessimistic views about the 2023 outlook of the gas market. The reasons for the potential uncertainty ahead are the gas supply crunch and the persistently high prices, which have already created economic hardships or completely priced Asian countries out of the market.

LNG markets are expected to remain tight until significant new supply capacity comes online, which is unlikely before 2026. Furthermore, long-term global LNG export projects contracts starting before that are sold out already. Those who can find available deliveries face competition from European countries. And entering a bidding war isn’t viable for emerging Asian nations. Furthermore, as the recent experience of India and some South Asian countries shows, the risk of LNG suppliers cancelling their already agreed deliveries in favour of better yields elsewhere is real.

As a result of the tight market and the energy crisis, gas prices are likely to remain high for all of 2023. Goldman Sachs even warns that they might remain twice as high as normal until 2025. As net energy importers, Southeast Asian nations would be among the most affected.

The Asian Development Bank even warns that some Asian countries can experience energy price hikes of up to 27% over the next three years.

Renewables as a Way to Preserve Economic Stability

Asia is already the leading LNG-importing region globally. On top of that, it is home to 65% of the LNG import terminals under development globally. The LNG terminal buildout plans come despite spot prices for LNG in Asia reaching their highest levels ever in August 2022. They were 300% higher in October than in the same month in 2021. Sam Reynolds, an energy finance analyst with the IEEFA, notes that the high gas prices are among the leading causes of potential project delays across Asia.

Paired with the gas supply crunch, the prices are likely to strengthen the case for renewables, leading to a lower gas demand across Asia. As a result, the future for LNG projects would remain uncertain, with the economic logic for their construction and operation eroding even further.

Meanwhile, the cost of renewable energy continues to fall. It is now cheaper than fossil fuel alternatives in China, India, Thailand and Vietnam. On top of that, in the first half of 2022, it saved USD 34 billion in avoided fossil fuel costs in seven Asian countries — China, India, Japan, South Korea, Vietnam, the Philippines and Thailand.

The financial, climate and energy security benefits of clean energy make leapfrogging new gas infrastructure for Asian countries more tempting than ever.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more