Fossil Fuel: Rising Concerns On Vanguard’s Investments

30 June 2021 – by Ankush Kumar Comments (0)

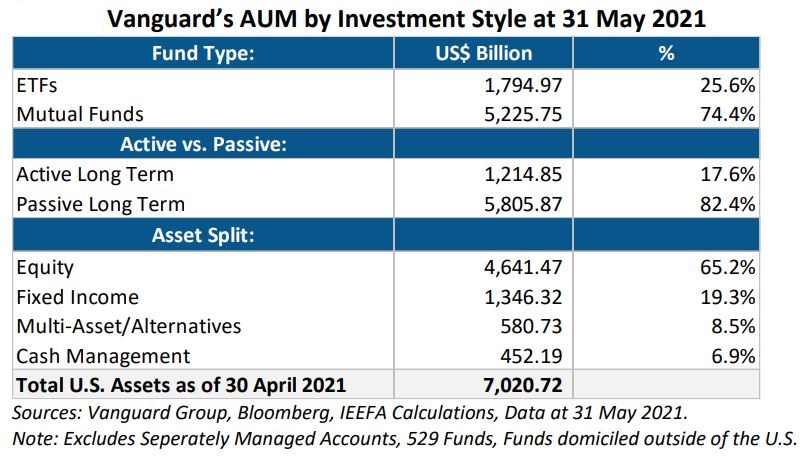

Vanguard Group, the world’s second-largest asset manager, currently holds around USD $300 billion in fossil fuel funds. With over USD $7.2 trillion in assets under management (AuM) including USD $90 billion in coal, it has not yet declared any phase-out plan. This finds harsh criticism in a new report : The US-based Institute for Energy Economics and Financial Analysis (IEEFA) rebukes Vanguard over its passive approach towards climate change.

Presence in Asian geographies

Although Vanguard has pledged to reduce its emissions by 2030 and attain net-zero by 2050, the report pin-points a laid-back attitude towards climate. The finance giant not only has a majority stake in most of the US listed companies but also a strong say in their management decisions. In Asia, Vanguard mainly focuses its business in Shanghai, China, as it will scale down its Hong Kong activities. Although the company had closed its office in Singapore and Japan, it still plans to grow in the Asian markets overall.

With index funds to world’s number two

Vanguard majorly deals in index funds, also called passive funds. Contrary to active funds, they are usually not overseen by an investment manager. Therefore, they are cheaper to invest in. Since the creation of the world’s first index mutual fund 45 years back, the investment group has grown to the industry’s number two after Blackrock.

Funds exposed to the fossil fuels industry

Capturing 80% of Vanguard’s business and valuing around USD $5.5 trillion, these index funds comprise Exchange Traded Funds (ETFs) as well as mutual funds. But they are largely exposed to fossil fuels, the study titled “Vanguard Group: Passive About Climate Change” found.

Fossil fuels include natural gas, coal, and heavy oils. Fossil fuels extraction and usage as natural gas increase carbon dioxide into our atmosphere.

Are fossil fuels more efficient than renewable energy?

One study proves that renewable energy sources generally account for roughly 50g or less of carbon dioxide emissions per kWh over their lifetime. This is a stark difference when compared to about 1000 g carbon dioxide/kWh generated for coal and generated 475 g carbon dioxide/kWh for natural gas. Most greenhouse gas emissions generated from fossil fuels are the product of fuel combustion, but fossil fuels plant operations and the decommissioning of their facilities are also noxious to the atmosphere.

Increasing risks for Vanguard investors

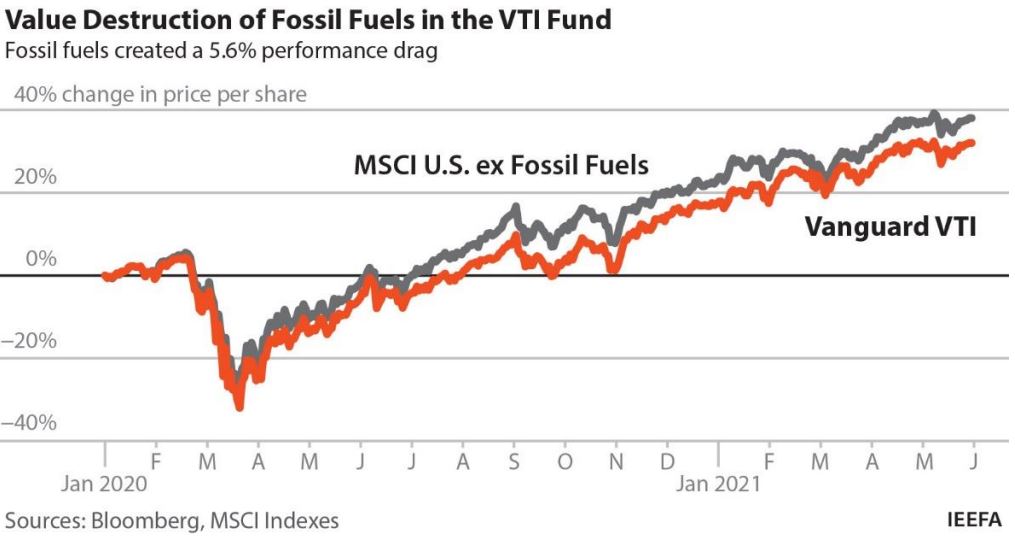

Consequently, Vanguard’s investors face an increasing risk. Around 15% of Vanguard’s total assets are part of the so-called Total Market Index Fund (VTI). With USD $1.2 trillion, it is also the world’s largest fund. However, according to the report, the VTI underperformed versus a comparable benchmark which excludes oil, natural gas and coal. Since January 2020, the MSCI USA ex Fossil Fuels has been 5.6% stronger.

This may be “the beginning of profound wealth destruction”, the IEEFA warns. More frequent extreme weather conditions could lead to intensified financial losses of the VTI related to damages and insurance.

Lack of Environmental, Social, and Governance labeled funds

Worse, the authors highlight that Vanguard markets only five Environmental, Social, and Governance (ESG) labeled funds to investors in the United States. As of 30 April 2021, its ESG products had USD $18 billion AuM. This was 0.26% of Vanguard’s total, the report calculates.

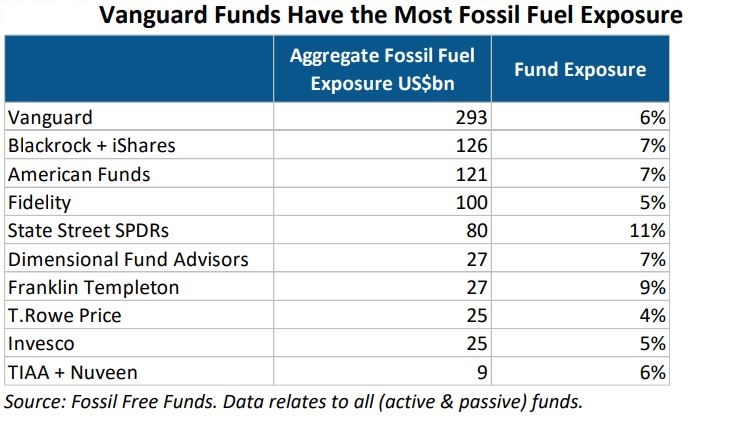

Vanguard’s fossil fuel exposure and carbon dioxide emissions

Referring to the data from Fossil Free Funds and Morningstar, IEEFA states that Vanguard’s passive equity funds contain between USD $227-265 billion of fossil fuel exposure. This takes the index giant’s overall fossil fuels, oil, natural gas and coal investments to around 6% of its total assets.

The aggregate fossil fuel data of Vanguard’s top three funds alone surpass USD $130 billion. Out of its 62 passive equity funds, only up to 15% have a low climate risk, the report highlights.

Scope of disinvestment in fossil fuels business

The other major funds in Vanguard’s portfolio are its actively managed assets totaling around USD $1.2 trillion in the US. IEEFA estimates that over half of its estimated USD $540 billion are equity funds and comprise high fossil fuel investments. The aggregate fossil fuel exposure in Vanguard’s actively managed funds stands at around USD $14 billion. The positive side of these funds are that they provide flexibility to divest or invest in companies or bonds.

Blackrock and it’s commitment to greenhouse gas emissions

For instance, the world’s biggest investment group Blackrock divested coal companies from its actively managed funds in 2020. Indeed, Vanguard’s biggest competitors are slightly ahead on the climate path. This April, State Street announced it would join the USD $37 trillion Net Zero Asset Managers initiative. The group is committed to support the goal of net-zero greenhouse gas emissions by 2050. The initiative currently has 87 signatories and bolsters the efforts of its members to limit global warming to 1.5 degrees Celsius.

Low climate related engagements

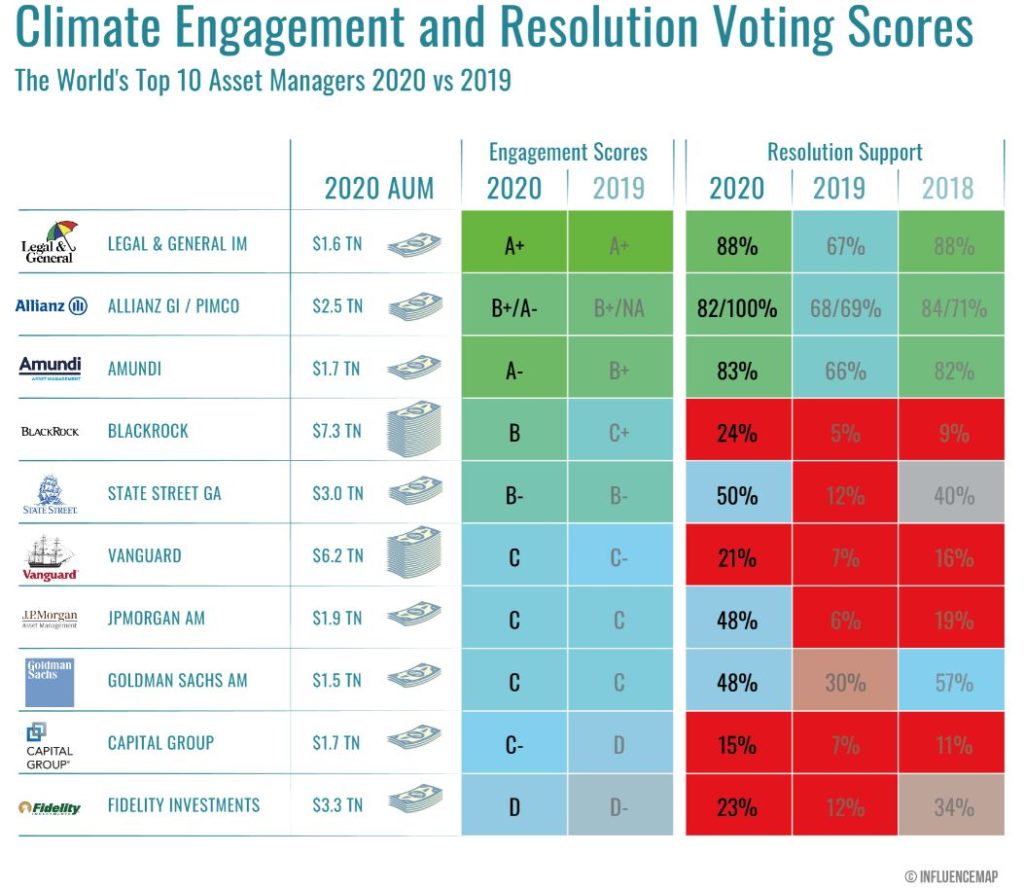

Blackrock claims to have completed 1,260 climate-related engagements in 2020. State Street reported 376 whereas Vanguard did not report having any, IEEFA states. The group itself declared to have “engaged with 219 companies in carbon intensive industries, or 33% of all companies engaged.”

Vanguard justifies its climate actions and fossil fuel investments

Especially in Asia, Vanguard is involved in highly questionable coal investments, as a 2020 study of the German NGO Urgewald found. This includes coal and natural gas consumption in Bangladesh’s Payra Hub, new coal power plants in China and India. “We would demand to divest from all companies that are still expanding their coal assets, which is important in particular in Asia,” says Katrin Ganswindt, finance campaigner of Urgewald.

Net-Zero goals: Is this the answer to fossil fuel divestments?

With regard to Vanguard, she regrets that the company is not at least part of the Net-Zero Asset Managers initiative. However, there were several problems with net-zero. For Urgewald, the timeline of emission reduction is too long. “Net-Zero is a mere accounting trick and too often a distraction of fossil fuel to avoid absolute emission reductions,” Ganswindt stated. “Real Zero is the only alternative.”

Lack of divestment from fossil fuel and natural gas industries

Energy Tracker Asia reached out to Vanguard for comment. “Vanguard regularly engages with the boards of carbon-intensive companies on climate risk.” It stressed that investment stewardship remained a core capability. It was committed to continued attention to climate risk. “Our index funds do not divest from specific securities in their benchmarks, including those in fossil fuel intensive industries.”

Asset managers and their responsibility to lower fossil fuels investments

This statement of climate NGO As You Sow raises eyebrows. “Vanguard uses the excuse that it cannot divest from fossil fuels. This is because it specializes in low-cost index funds that are not actively managed,” President & Chief Council of As You Sow, Danielle Fugere said.

But as the creator of index funds, the group had the ability to choose the entities that make up its funds. “Given the impact of climate change, asset managers must begin to provide low carbon index funds as a baseline,” Fugere demanded.

Fossil Fuels recommendations from IEEFA

Several global organizations are distancing themselves from fossil fuel investments. Experts say that big players like Vanguard must fully commit to climate initiatives. Likewise, IEEFA recommends Vanguard to have a coal exit policy in place which progressively encompasses all portfolios. To start with, it should first concentrate on companies still expanding their coal business.

IEEFA’s take on fossil fuel investments

Another important recommendation was to prioritize addressing climate risks by adopting investment stewardship guidelines. Lastly, IEEFA advises that Vanguard ensures transparency around company engagements related to climate change.