The Japan Transition Bonds Programme and the Transition Washing Concerns

02 March 2022 – by Viktor Tachev Comments (0)

The latest move by leading Japanese companies risks staining transition bonds to finance a green future. As a rich and industrialised nation, there is an expectation that Japan will be a forerunner in the energy transition. However, recent decisions point to the country’s hesitance to pursue a renewable-led future. The latest example is the transition bonds fiasco, led by JERA and Tokyo Gas. It risks setting a dangerous “transition washing” precedent for Japan and Asia.

JERA and Tokyo Gas‘ Transition Bonds Plan

JERA is a joint-venture between Japan’s first and third largest energy companies. Collectively it is also the leading corporate CO2 emitter in the country. On the other hand, Tokyo Gas is Japan’s largest natural gas utility, and both have plans for transition bonds.

JERA’s emissions have a ten-year term and total ¥25 billion (USD 217 million), with Mizuho Securities and Mitsubishi UFJ Morgan Stanley Securities leading the process. Tokyo Gas will issue seven-year and ten-year bonds worth ¥20 billion (USD 174 million), with Mizuho Securities and Nomura Securities acting as lead managers. Both organisations aim to issue their bonds in March 2022.

The Transition Washing Concerns

Uniquely, transition bonds intend to help companies attract capital to fund decarbonisation efforts. They are also used to garner investor support for the transition to greener operations. However, in JERA and Tokyo Gas’ case, the companies’ direction is questionable and arguably controversial.

For example, JERA plans to use the funds to remove existing liquefied natural gas (LNG) power generation equipment and build on its ammonia-hydrogen co-firing plans. However, due to its fossil fuel connections, the latter has attracted greenwashing accusations.

On the other hand, Tokyo Gas plans to use raised funds to support three projects: the Niihama LNG Project, a Smart Energy Network Project, and the Harumi Hydrogen Project—using grey hydrogen. Like JERA, two of these projects heavily link back to fossil fuels. This seemingly contradicts Tokyo Gas’s goal to “Lead the transition toward carbon neutrality.”

Is Japan to Blame for Transition Washing Practices?

What’s next if transition bonds, a core pillar of green finance, are yet another tool for fossil fuel support?

Currently, Japan’s transition finance scheme structure allows companies to make such moves. Japan’s Ministry of Economy, Trade and Industry (METI) states that both companies’ transition bond emissions will be “model projects.” Furthermore, the ministry envisions companies referring to its roadmap to shape their transition finance efforts. However, METI does not consider the risk of transition finance “a subject of evaluation” and says that it is the responsibility of the investors instead.

Worryingly, this is not an isolated case. Recently, Japan’s green innovation fund said it would back JERA’s plans for mixing blue ammonia with coal. Hydrogen industry experts described the plans as a “distraction” and raised concerns about dishonesty in the country’s decarbonisation efforts.

Whether intentional or a loophole, Japan has created an environment where transition bonds now support fossil fuels. It is no surprise then that Japan ranks at 37 on the World Economic Forum’s (WEF) Energy Transition Index. It especially ranks poorly on the “Capital and Investments” benchmark. Japan must avoid transition washing accusations to convince the financial industry of its decarbonisation effort and efforts for greenhouse gas emission reduction. For starters, it could ensure that transition bonds live up to their name and that they are used to limit or phase out fossil fuels—not prop them up.

How Can Transition Washing Impact Other Asian Countries?

For now, country-specific climate commitments remain primarily on paper. Without being held accountable, countries can delay their decarbonisation efforts and engage in transition washing practices without real consequences.

To date, fossil fuel projects continue to thrive in emerging and developing economies across Asia. Due to the lack of political stability, clean energy supporting policies, scarce investments or unsuitable infrastructure, many continue to rely on coal, oil and gas. However, backing the status quo at the expense of long-term goals has proven costly across the board.

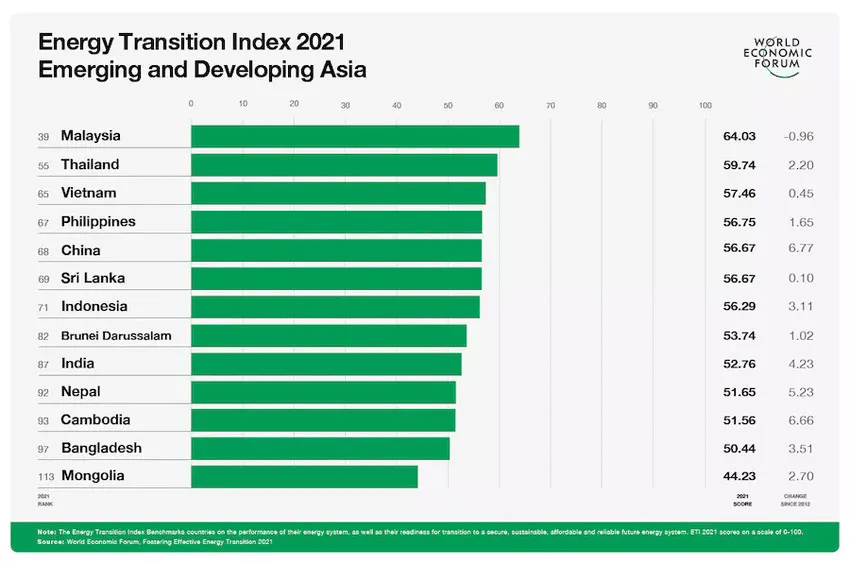

Japan’s lateral moves also send signals to less developed economies already struggling with ensuring economic resilience and transitioning their energy systems. Placing the energy transition at the bottom of their priority lists worsens the outcome. Currently, all developing Asian countries, bar Malaysia, rank between 50 and 100 on the Energy Transition Index 2021.

Japan Should Capitalise on the Potential of Transition Finance Tools

Transition bonds are potent tools for decarbonising an economy. In Japan, some estimates show that the annual issuance of transition bonds could soon reach ¥1 trillion (USD 8.7 billion).

However, for transition finance tools to make a difference, as expected, Japan needs to ensure that there are limited transition washing possibilities. Until then, firms can continue to hide behind pretences that their transition bond programmes will help decarbonisation or low-carbon efforts. In reality, without changes, they now risk funding fossil fuel-related projects.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more