What is Carbon Credit Fraud? How Does It Impact Climate Action?

Source: Harvard Business Review

29 October 2024 – by Eric Koons

The voluntary carbon credit market was valued at over USD 700 million last year, yet is marred with instances of carbon credit fraud. So why is the market’s value so high and continues to grow? Simply put, carbon credits offer companies an easy way to show progress in reducing their carbon dioxide emissions.

The carbon offset market has become a cornerstone of corporate decarbonisation strategies by allowing companies to offset their own carbon emissions and reduce their carbon footprint by purchasing credits. This provides a near-term solution while companies slowly reduce their actual emissions. It can be a promising strategy to tackle greenhouse gas emissions immediately and provide a stopgap as sustainability programs grow throughout a business’ processes.

However, despite its potential, the voluntary market has significant challenges, including a lack of oversight and inefficiencies. These issues raise questions about the validity of credits and the emissions they claim to offset.

What Is the Problem with Carbon Credits?

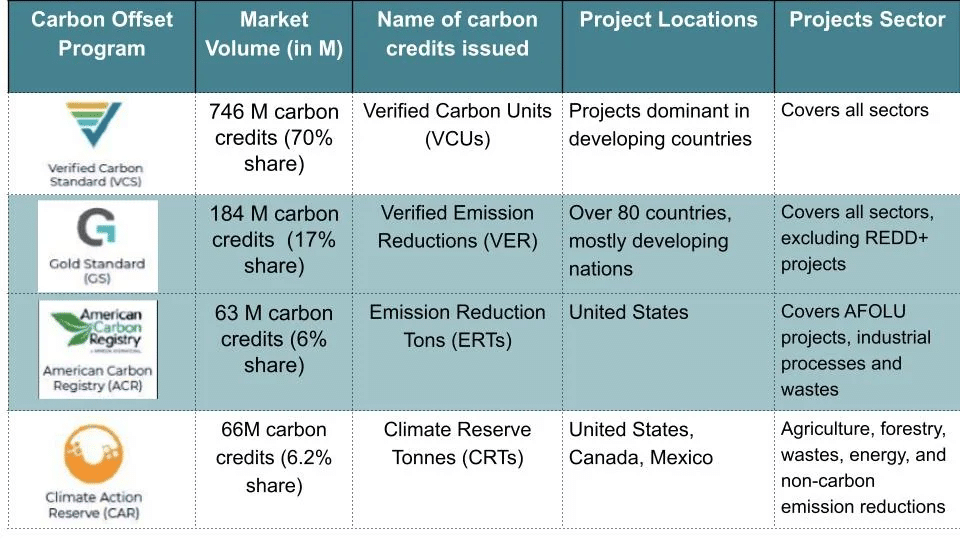

Carbon credits face several critical issues, primarily stemming from a lack of standardised regulations. There is no single standard that governs voluntary carbon offsets. Instead, there are several different standards, protocols and marketplaces to choose from.

While they all have similar guidelines, they have differences and varying levels of scrutiny of offsets. This allows projects to choose how to pursue offset validation and sell their credits. Ultimately, it creates opportunities for exploitation, making it challenging to ensure the integrity of credits issued and traded.

As a result, carbon credits fraud is prevalent. Some of the world’s largest companies, like Volkswagen, ExxonMobil and Disney, have been accused of fraudulent credit purchases. While it is unlikely they knowingly purchased fraudulent credits, it highlights how opaque the voluntary carbon credits market is.

What Is Carbon Credit Fraud?

Carbon credit fraud is the deliberate misrepresentation of emissions reductions from carbon offset projects and the issuance of fraudulent credits. Fraudulent credits do not correspond to their stated environmental benefits and do not provide the promised greenhouse gas reductions. This means that companies that purchase these fraudulent credits are not actually offsetting their emissions.

Carbon offset fraud undermines market trust, discourages genuine sustainability efforts and allows companies to falsely (knowingly or unknowingly) claim emissions reductions. Ultimately, it reduces the effectiveness of the carbon credit system in mitigating climate change and hinders global efforts to achieve decarbonisation goals.

Types of Carbon Credit Fraud

Carbon credit fraud comes in many forms. However, several of the most common types of carbon credit scams are as follows.

Ghost Credits and False Carbon Emissions Reductions

Ghost credits come from projects that either do not exist at all or fail to deliver the claimed carbon emissions reductions. They do not represent real emissions reductions. It’s called carbon emission fraud.

They often take the form of projects overestimating the emissions reductions they actually achieve and issuing credits for the overestimated amount. While some credits from the carbon offset project are legitimate, not all of them are. This misleads buyers and reduces the overall impact of carbon credit programs.

Double Counting – Undermines the integrity of Voluntary Carbon Markets

Double counting occurs when the same carbon credit is sold or used more than once. This is carbon credit trading fraud. This practice undermines the integrity of the carbon credit market by inflating the actual impact of emissions reduction efforts.

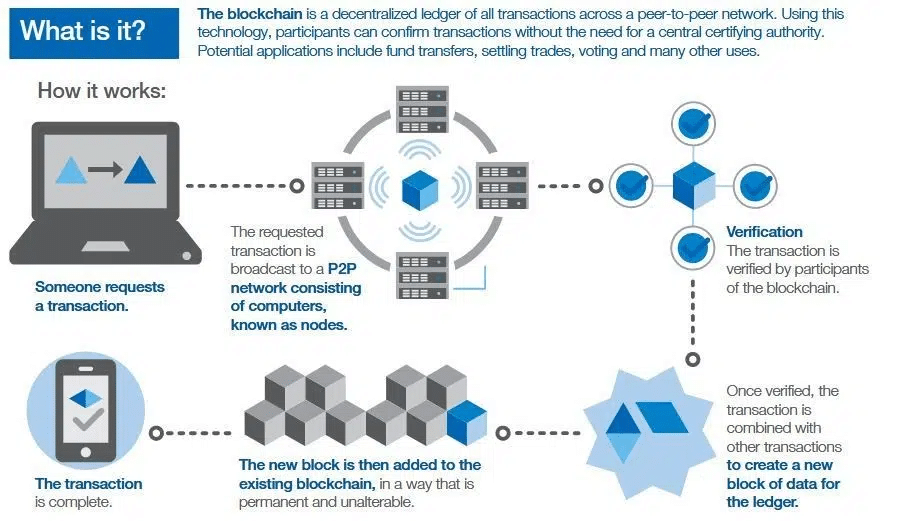

Combatting double counting is an ongoing process that centres around improving transparency and verification processes. A recent technological approach entering the market is using blockchain technology to create a public record of carbon credit issuance and use.

Fraudulent Project Claims

Projects may make false claims to secure carbon credits or make their credits more desirable without delivering the stated benefits. These claims can range from the quality of credits to additionality and co-benefits.

Co-benefits can make credits significantly more desirable and command higher market prices. For example, credits from projects with at least one co-benefit sell on average at a 78% higher price than ones with no co-benefits.

Wash Trading

Wash trading is a concern for every market that relies on supply and demand. In the voluntary carbon market, it involves the simultaneous buying and selling of carbon credits by the same entity to create artificial market activity and inflate prices. This practice can mislead investors and distort market values.

Verra Carbon Credit Scandal

One of the highest-profile cases of carbon credit fraud is the Verra carbon credit scandal. Verra is the world’s largest carbon credit certification program and in 2023, it was accused of selling ghost credits.

A team of scientists found that more than 90% of credits issued from its rainforest offset program did not represent actual emission reductions. Furthermore, the credits largely hinged on conserving rainforests that would otherwise be cut down. However, the researchers found that, on average, the threat to those forests was overstated by around 400%, raising questions about the additionality of the projects.

Ensuring Integrity in Carbon Offsets

Addressing carbon credit fraud is essential to maintain the market’s credibility and effectiveness. Stricter regulations, improved verification processes and greater transparency are all critical steps to take. Improving the integrity of credits will enhance trust and encourage genuine sustainability efforts, making carbon credits a more effective tool in the fight against climate change.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more