Who Buys Russian Oil and Gas? – The Case for Renewables in Asia

17 August 2022 – by Viktor Tachev Comments (0)

The ongoing war in the heart of Europe raises the fundamental question about who buys Russian oil and gas. Or in other words: which countries and companies are indirectly funding Russia’s brutal aggression in Ukraine? The latest report by the Centre for Research on Energy and Clean Air (CREA) gives the answer. The detailed data set reveals that leading Asian economies are among the biggest consumers of Russian fossil fuels.

Who Buys Russian Oil and Gas? A Focus on Asia

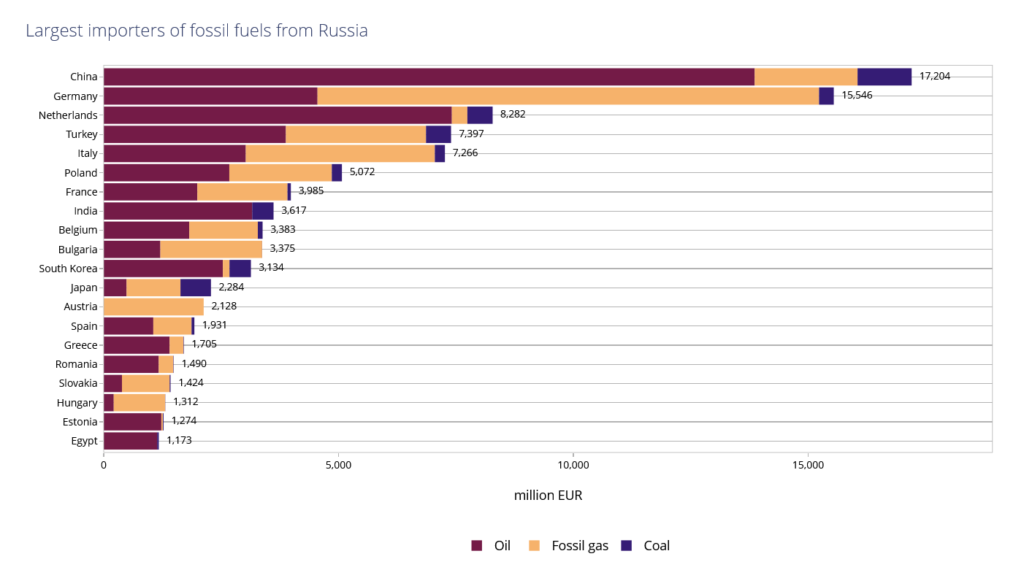

While Europe remains the biggest consumer of Russian crude oil and gas, CREA’s report reveals that Asian countries aren’t exempt from blame. Just the opposite – China, India, Japan, and South Korea currently receive significant fossil fuel exports.

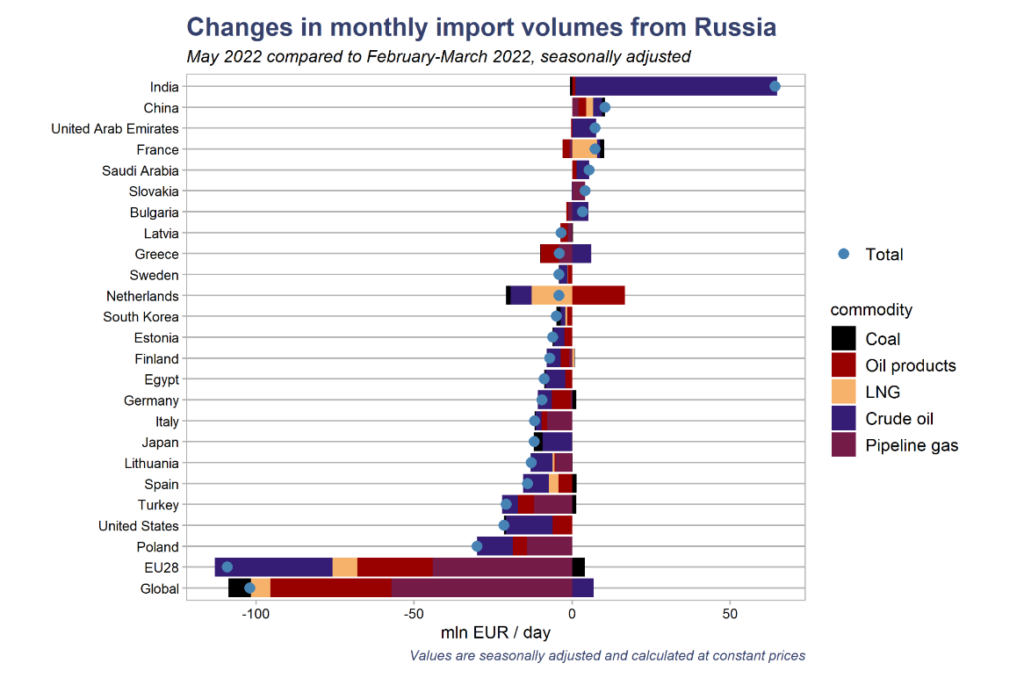

While European countries dominate, the underlying dynamics reveal that they are already reducing most of their Russian oil imports. Furthermore, the European Union is also planning for a ban on oil imports by the end of 2022. This ban on Russian oil purchases is the result of the Russia-Ukraine war.

On the other hand, Asia’s share of fossil fuel imports, especially crude oil from Russia, is on an upward trajectory. When comparing the first three weeks of April to the January-February period before the war, statistics reveal that:

- China imports 80% more coal and 210% more gas and oil products from Russia,

- South Korea imports 50% more coal, crude oil and gas,

- and India imports 130% more coal and 340% more refined Russian crude oil.

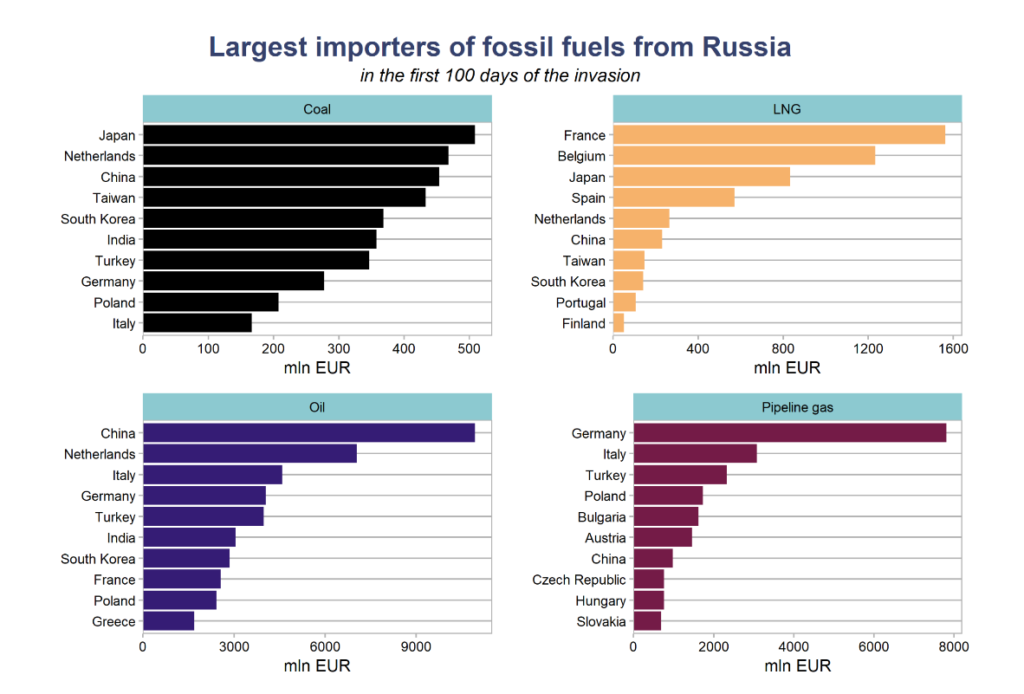

Furthermore, CREA’s report reveals that Japan has imported the most coal and the third-most LNG from Russia. China is the biggest oil and the third-biggest coal importer.

The Companies Still Importing Russian Fossil Fuels

On the corporate side, leading power utilities and industrial companies from Japan, South Korea and Taiwan have been among the biggest consumers of Russian fossil fuels in the first two months of the war. These include:

- KEPCO, Hyundai Steel and POSCO from South Korea,

- JFE Steel, Chubu Electric Power, TEPCO, Tokyo Gas, Mitsubishi, Nippon Steel, Sumitomo, Kyushu Electric Power and Tohoku Electric Power from Japan,

- and Taiwan International Ports Corporation, Formosa Petrochemical Corporation, and Taipower from Taiwan.

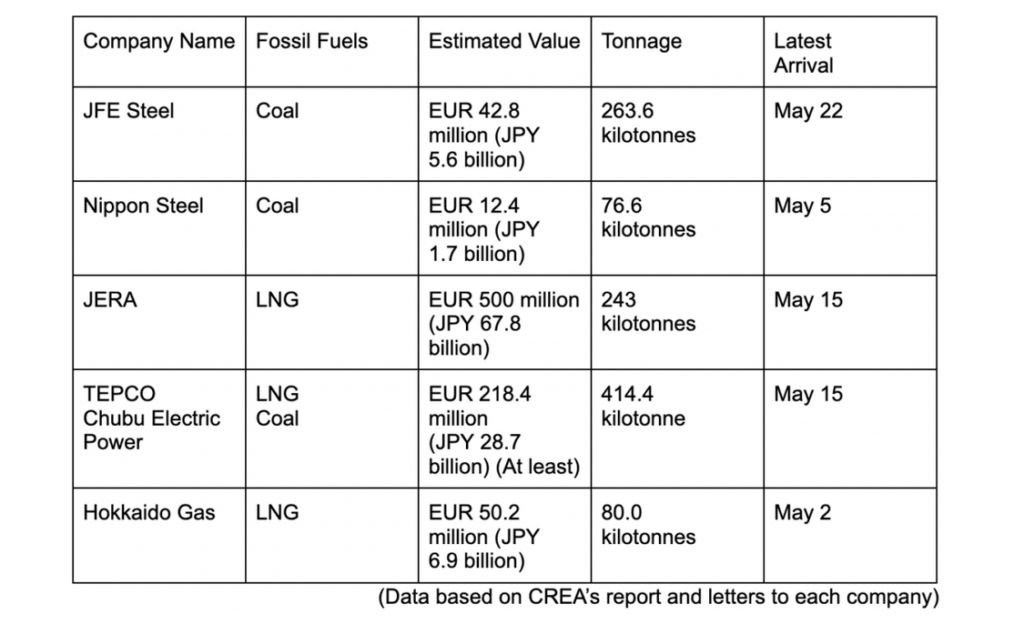

In an updated version of the report from June, CREA finds that while some companies haven’t received any Russian oil imports in May, others have continued purchasing Russian fossil fuels. Among them are Taipower, Chubu Electric Power, TEPCO, Nippon Steel, POSCO, Formosa Petrochemical Corporation and JFE Steel.

There were new additions to the list as well. Malaysiaʼs national electricity company TNB, alongside Indian refiners Reliance, Nayara Energy, BPCL and IOCL, received Russian fossil fuel imports in May.

The Reaction of the Guilty Companies

Some Japanese companies like Kyushu Electric Power were proactive and stopped importing Russian coal in March. Other enterprises stopped once Japan imposed a ban on imports. Eneos and Idemitsu, the country’s top refiners, halted crude oil imports and stopped buying crude oil from Russia in March. Tohoku Electric also suspended coal imports and said it is “studying” alternatives to Russian LNG.

Korea Electric Power Corp said it began diversifying coal import sources away from Russia in February.

However, many other power utilities and industrial companies in Japan, South Korea and Taiwan remain silent on whether they plan to halt fossil fuel imports from Russia. Others, like Tokyo Gas, publicly admitted that they had no plans to stop buying Russian LNG voluntarily.

The Implications for the Companies Buying Russian Crude Oil and Gas

Senior management at the companies still buying Russian crude oil and gas should consider the substantial reputational risk they are exposed to.

First, they are subject to public scrutiny and increased pressure, as their funds contribute significantly to Russia’s federal budget. As a result, they empower Russia to continue its invasion of Ukraine, raising the toll of civilian casualties and prolonging the destruction.

Ukrainian environmental NGOs have already launched a campaign urging Japanese companies to stop fossil fuel imports and buying crude oil from Russia. Energy Transition Coalition, a Ukrainian Environmental NGO coalition, sent letters to 6 Japanese companies that have been buying Russian fossil fuels since the war started. Among them are JFE Steel, Nippon Steel, JERA, TEPCO, Chubu Electric Power and Hokkaido Gas. The letters follow CREA’s report, which finds that Japan was the largest coal importer and the third-largest LNG importer in the world in the first 100 days of the invasion. The coalition of NGOs demanded that these companies stop all fossil fuel imports from Russia or Russian companies and promote renewable energy.

The reputational risk also stems from the fact that buying oil, gas and coal continues to fuel an already devastating climate crisis. Furthermore, considering Asia is among the most vulnerable regions to climate change impacts, companies are directly funding the devastation in their backyard.

Renewables as the Alternative

CREA’s report urges countries and companies to embrace renewable energy as an alternative to fossil fuels and as a way to impact Russia’s military budget. The switch to renewables makes sense on all fronts.

First, it will boost the decarbonisation efforts of both companies and countries.

Furthermore, according to Carbon Tracker, new solar and onshore wind power developments in Japan, South Korea and Vietnam are either already cheaper or will become cheaper investments than new gas units by 2025. Additionally, fossil fuel prices are becoming more volatile due to the war, causing substantial financial losses for companies depending on them.

Estimates reveal that addressing the climate crisis will help the Southeast Asian region ensure a 3.5% average GDP growth per year to 2070. The economic benefits of renewable energy will hit USD 12.5 trillion by 2070. Similarly, decisive climate action could deliver USD 47 trillion to Asia-Pacific economies by 2070. Decarbonising the oil and gas sector alone can bring Southeast Asian countries economic opportunities of up to 20% of GDP.

On the corporate side, a switch to renewables will unleash massive opportunities for Asia’s energy industry, according to McKinsey. In Asia, investment activity in green energy and related heavy industries has doubled over the last decade. What’s more, the consultancy concludes that energy sector incumbents will soon find themselves defending their positions and competing against ambitious startups. Regional energy players should commit to new, climate-friendly business models to avoid the loss of market share.

Economic reasoning aside, a renewable energy transition will also lead to long-term energy security by reducing reliance on imports.

The reputational risk already discussed shouldn’t be underestimated as well. In a world where businesses are decarbonising en masse, the last companies to act will be jeopardising their reputations.

Now We Know Who the Buyers Are, Let’s See Who Stops Buying Russian Oil and Gas

According to IEA, 45% of Russia’s federal budget in 2021 came from oil and gas revenues. At the end of May 2022, Russia’s minister of finance announced that a part of its 1 trillion ruble budget from additional oil and gas exports revenue this year would be used to “conduct a special operation” – a term the country uses on state media to hide its war.

Europe has started to shift away from Russian fossil fuels and has started to speed up renewable energy adoption. Asia must follow suit and stop importing from Russia. It doesn’t make sense from both an economic and reputational standpoint.

Asian nations and companies should be aware that the money spent on fossil fuels is money spent on war. This is the moment for countries to demonstrate leadership and for companies to showcase their corporate responsibility.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more