Wind Energy vs Fossil Fuels: Cost, Efficiency, and Market Trends

Source: Orsted

27 February 2025 – by Eric Koons

Choosing between wind energy and fossil fuels is no longer a question: wind and renewables are clearly the future. Rapidly increasing climate change impacts drive home the urgency of moving away from high-emission energy sources, while businesses increasingly demand stable, profitable power solutions. Fossil fuel plants continue to release vast quantities of greenhouse gases and experience volatile pricing, underscoring the need for cleaner, more predictable alternatives like solar and wind. We can better understand why modern energy strategies must embrace sustainable options by directly comparing wind energy to fossil fuels.

Why Is Wind Energy Better Than Fossil Fuels?

The debate of wind energy vs fossil fuels hinges on two primary considerations: climate impact and long-term financial viability. Fossil fuels account for over 80% of the world’s primary energy supply, 75% of the world’s total greenhouse gas emissions and severe price volatility.

By contrast, wind energy costs have rapidly declined over the last decade, with a 68% reduction in onshore wind and a 59% reduction in offshore wind. This makes wind energy a compelling option for countries seeking stable energy at a predictable price.

Lower Carbon Footprint

Wind energy’s primary appeal lies in its near-zero emissions during operation, which vastly reduces its greenhouse gases compared to those from fossil fuels. Fossil fuel energy generation is responsible for the vast majority of carbon dioxide emissions. Coal alone still accounts for roughly 35% of global electricity generation, producing 66% of the energy sector’s annual emissions.

With governments and businesses striving for interim 2030 and net-zero 2050 targets, wind power provides a direct path to drastically cut emissions, offering cleaner air and a more sustainable energy source.

Long-term Cost Savings

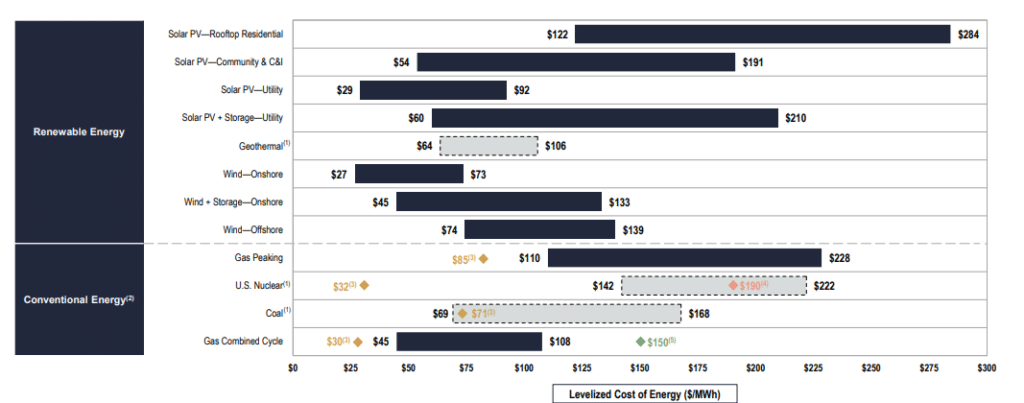

While setting up a utility-scale wind farm involves substantial upfront costs, operational and maintenance expenses remain comparatively low over the system’s lifetime. In some regions, the unsubsidised levelised cost of electricity (LCOE) for onshore wind has declined to as little as USD 27 per megawatt-hour (MWh). In contrast, the low end of coal sits at USD 69 per MWh, with natural gas peaking at USD 110 per MWh. Fossil fuels are plagued by volatile fuel prices and growing costs linked to carbon regulations.

Additionally, mechanisms like Power Purchase Agreements (PPAs) for wind often lock in rates for 15–25 years, helping investors and local utilities avoid the financial uncertainty associated with fluctuating oil, coal, or natural gas prices.

Energy Security and Stability

Having uninterrupted availability of energy sources at an affordable price is an essential factor for any nation’s economic stability and independence. When countries rely on imported fossil fuels to meet electricity demand, they become vulnerable to supply disruptions, sudden price hikes and geopolitical pressures that can undermine growth and stability. Wind power lowers these vulnerabilities by tapping into a domestic energy source that reduces the need for foreign fossil fuel imports.

Technological Advancements and Scalability

Over the past decade, rapid innovations in turbine design have driven up energy output while cutting costs, making wind installations competitive and cheaper than fossil fuel facilities. This trend is expected to continue in the coming decades.

This scalability accelerates the shift to wind power, as developers can build large-scale, multi-turbine projects far faster than the traditional timeline for constructing coal or gas facilities. Meanwhile, fossil fuel technologies, though mature, have seen comparatively slower innovation and face increasing scrutiny over environmental and public health impacts.

Market Trends and Financial Outlook in Asia

The accelerating pace of renewable energy adoption in Asia makes wind an especially attractive choice for companies and governments focused on profits and sustainability. New investments in clean energy across Asia reached nearly USD 345 billion in 2022, with wind power playing a pivotal role in these growth figures. By leveraging cost, health and climate benefits of wind energy generation, many Asian economies are positioning themselves as leaders in the global energy transition.

Renewable Energy Policy Made China Largest Installer of Wind Turbines

Strong policies and incentives have catalysed wind power development in countries like China and Japan. China’s feed-in tariffs and renewable energy quotas have attracted massive private investment, positioning the nation as the world’s largest installer of wind turbines. Similarly, Japan has massive offshore wind energy potential. Its goal is to bring 45 GW of capacity online by 2040, and there are at least nine offshore wind projects in development. These supportive frameworks spur domestic production and attract international businesses eager to tap into Asia’s evolving renewable market.

Growth of Wind Energy in Emerging Markets

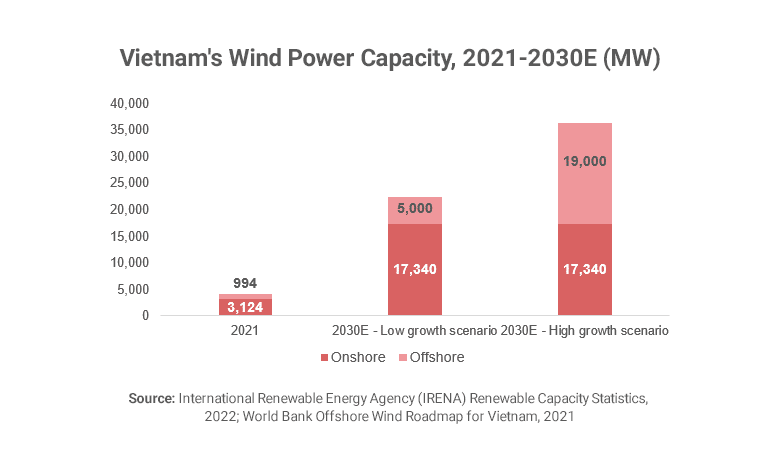

Emerging economies across Southeast Asia are embracing wind power as a means to diversify their energy mix and reduce carbon emissions. For example, Vietnam reached its 2025 wind energy capacity goal five years early and is aiming for 18 GW of capacity by 2030. This will create thousands of jobs in manufacturing, installation and maintenance.

These growing markets demonstrate how a combination of favourable policy, natural wind resources and private capital can drive large-scale adoption and spark regional economic benefits.

Investment and ROI for Stakeholders

For investors, wind energy offers notable returns backed by stable revenue streams. Payback periods for onshore projects typically range from seven to 12 years, depending on location, turbine costs and financing structures. Large-scale wind farms in India have attracted some of the country’s largest energy companies seeking reliable yields, while smaller community-based projects have allowed local cooperatives to generate revenue and share financial benefits across entire towns. With fossil fuel markets prone to dramatic swings, wind’s predictable ROI increasingly appeals to private and public sectors alike.

Forging a Wind-powered Tomorrow

Wind energy stands out as a compelling investment, merging strong financial returns with meaningful environmental benefits. Asia alone is on track to add over 1,000 GW of new wind capacity by 2030, an essential boost for net-zero commitments. This rapid expansion creates stable revenue streams, fosters local supply chains and cuts reliance on carbon-heavy fuel sources. By prioritising wind, both companies and governments can accelerate sustainability milestones while cultivating long-term economic stability.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more