Would Pakistan’s Long-term Power Purchase Agreements Become Roadblocks to its Solar Energy Revolution?

Bilal Hafeez3249 / Shutterstock.com

28 February 2023 – by Haneea Isaad Comments (0)

A recent public hearing held by the National Electric Power Regulatory Authority (NEPRA) on a proposed 600 megawatt (MW) solar power plant in Muzaffargarh has brought to light a host of concerns on the right incentives needed to promote an expedient uptake of solar power in Pakistan.

This is the first large-scale 600 MW solar project offered under the new Fast Track Solar Initiative that aims to substitute solar PV in the place of expensive fossil fuel power generation. Like many countries in Asia, which have been priced out of liquefied natural gas (LNG) markets after Europe’s ‘buy-at-any cost strategy’ to avoid reliance on Russian gas, Pakistan too has been on the lookout for alternatives that offer economically priced and reliable energy supply. A request for proposal was hence released in September 2022, inviting bids on a Government to Government (G2G) or private basis.

The framework intends to provide an attractive package to renewable energy developers to up investments in solar PV in three phases: large-scale projects in multiples of 600 MW up to a total of 6,000 MW, 200 MW of small-scale installations on 11 KV feeders, and 2000 MW worth rooftop PV to solarise government buildings.

The package prepared by the Alternative Energy Development Board (AEDB) offers land on lease, a 70% foreign exchange-linked tariff indexation on a quarterly basis, a guaranteed off-take by the state-owned Central Power Purchase Authority, and a 25-year power purchase agreement (PPA).

While AEDB’s proposal aggressively addresses the acute cost of the supply problem, structurally, it risks being unsustainable.

Rather than incentivising developers to innovate on price and contract terms, this package is highly reminiscent of the deal offered to thermal Independent Power Producers (IPPs) in the 1990s, when Pakistan was new to overseas private investments in energy and was signing deals for plant financings at ten times the proposed investment cost.

More pointedly, those terms have landed the country in the contractually bound economic mess it is in right now.

Concerned stakeholders have already taken up some of these issues, ensuing in a technical debate during the NEPRA public hearing, but some sticking points remain.

AEDB’s proposed 25-year project term is particularly troubling and could potentially lead to an unsustainable lock-in of dollar-indexed tariffs. Should the cost of generation from solar power go down in future, the 2023-era solar projects would look prohibitively expensive.

Examining Project Term and Tariff Structure

At first sight, long-term contracts seem favourable to the government because they result in lower tariffs, as the costs are spread out over a longer horizon.

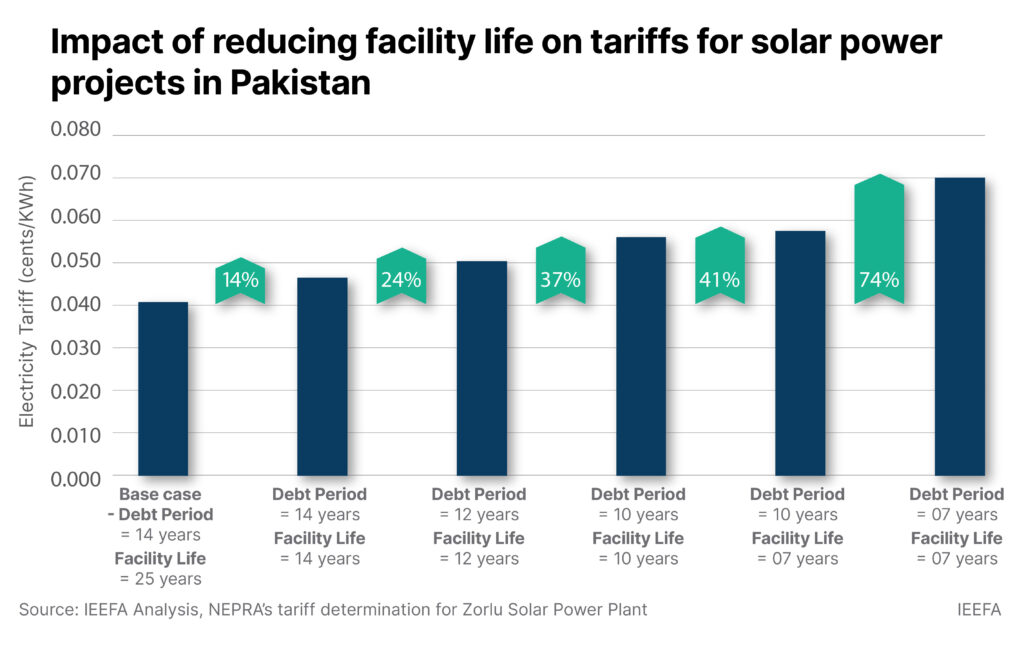

Solar-based power generation has been benchmarked at around 4 cents/KiloWatt hour (c/KWh) in Pakistan, assuming a 25-year project lifetime and a 14-year debt period, as in the recent case of Zorlu Solar Pakistan.

However, the Institute for Energy Economics and Analysis’ (IEEFA) evaluation reveals that reducing the project term from 25 to 14 years would raise the total tariff to 4.6 c/KWh, or a 14% increase. Reducing the debt servicing schedule to ten years and ending the project within the same timeframe further raises it to 5.5 c/KWh.

In contrast, some thermal power plants running on fuel oil or high-speed diesel now have fuel costs of 16-22 c/KWh, while fuel costs for imported coal and re-gasified liquefied natural gas (RLNG) are 9.5-13 c/KWh and 12 c/KWh respectively.

Solar-based power generation would still be the cheapest power generation by a wide margin. Granted that at 4 c/KWh, Pakistan has one of the cheapest regional tariffs awarded to solar power, especially considering the limited capacity installed at present, it can be argued that even with a shorter PPA term, the resultant tariff would still be comparable regionally.

Consider Vietnam, for instance, an established solar power market with an installed capacity of over 17 GW where the government has recently capped prices for ground-mounted solar at 5.02 c/kWh.

With vastly depleted forex reserves and the Pakistani rupee in freefall, dollar-indexed tariffs could mean an ever-increasing tariff in Rupee terms over the proposed project span of 25 years — an undue economic burden in such strenuous circumstances.

Policymakers should be wary as PPAs that are long-term or linked to foreign currency could limit the fiscal and planning flexibility of the government and utility.

Opportunities for Reform

As Pakistan moves towards a more liberalised power sector by introducing a Competitive Trading Bilateral Contract Market (CTBCM) in the coming years, competition and innovation should be encouraged instead.

Promoting solar PV projects, with one-time upfront capital investment and negligible variable cost creates an opportunity for a domestically financed, rupee-denominated energy supply system. As such, the government should prioritise rupee-dominated term lending to match currency liability with rupee utility revenues.

Meanwhile, multilateral development banks (MDBs), such as the World Bank or Asian Development Bank, could introduce a mechanism to break the cycle of reliance on foreign currency-denominated debt. Together with the GOP, the MDBs can lower the cost of capital for domestic green lending banks to co-finance renewable energy projects alongside domestic banks. The MDBs can also create a partial risk guarantee facility that might absorb any first loss.

One thing is certain: there is a dire need for some out-of-the-box thinking in Pakistan’s energy sector to resolve its power crisis. Offering the same incentives in the name of fuel substitution to solar power developers as legacy thermal IPPs received is neither a replicable nor sustainable solution for low-cost power generation.

Only new policies based on rigorous data modelling and research would allow Pakistan to tap into the new energy market’s innovation and economy, provide the right incentives for developers, and minimise economic risk to the country.

About IEEFA

The IEEFA conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.