Ammonia Coal Co-firing: Solution Or Distraction?

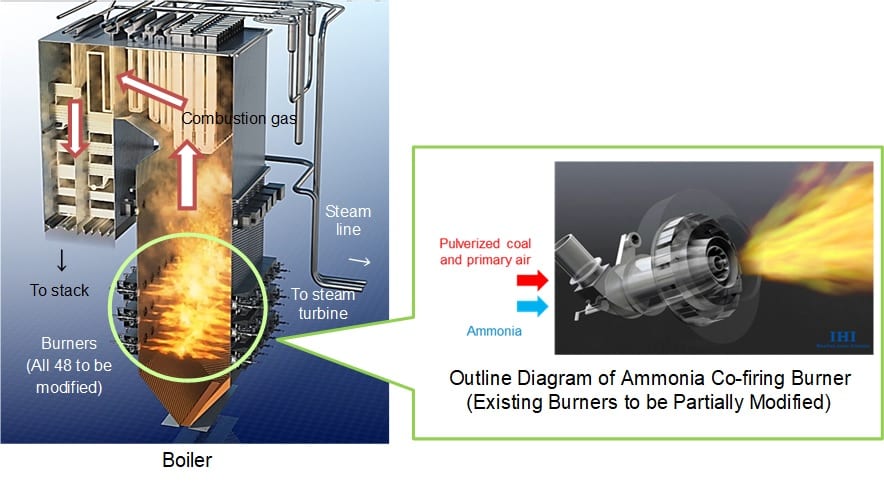

The Hekinan ammonia coal co-fired power plant. Source: JERA

12 June 2024 – by Eric Koons Comments (0)

Green ammonia fuel is a potential decarbonisation option for several industries, yet other use cases for ammonia, like ammonia coal co-firing, may hinder the energy transition. Green ammonia is made with renewable energy and produces zero carbon emissions. As an energy carrier and raw material for heavy industries, it is an excellent alternative to fossil fuels.

However, it requires new infrastructure and fuel cells to harness effectively. Ammonia-coal co-firing is a less infrastructure-intensive strategy that several nations are looking at as an alternative to burning ammonia alone.

What Is Ammonia Co-firing?

Ammonia-coal co-firing is the process of blending ammonia with coal during combustion in conventional coal-fired power plants. By incorporating ammonia into the fuel mix, less coal is needed to produce the same amount of energy. For example, if a power plant uses a 40% “coal-firing ratio”, ammonia replaces 40% of the coal by energy content.

Using green ammonia, the carbon dioxide emissions associated with coal combustion decline. Furthermore, retrofitting existing coal thermal power infrastructure with ammonia combustion to become a co-firing plant is feasible. As of 2020, 37% of global electricity came from coal-fired power plants. Some see co-firing ammonia with coal as a practical solution that leverages existing coal power infrastructure to reduce power sector emissions in the near term.

What is the Process of Co-firing?

Co-firing is a new method of energy production that involves simultaneously burning different fuels in the same combustion system.

The Financial Viability of an Ammonia-Coal Power Plant and Japan’s Strategy

However, ammonia coal co-firing is still a nascent technology and is not proven at commercial scale.

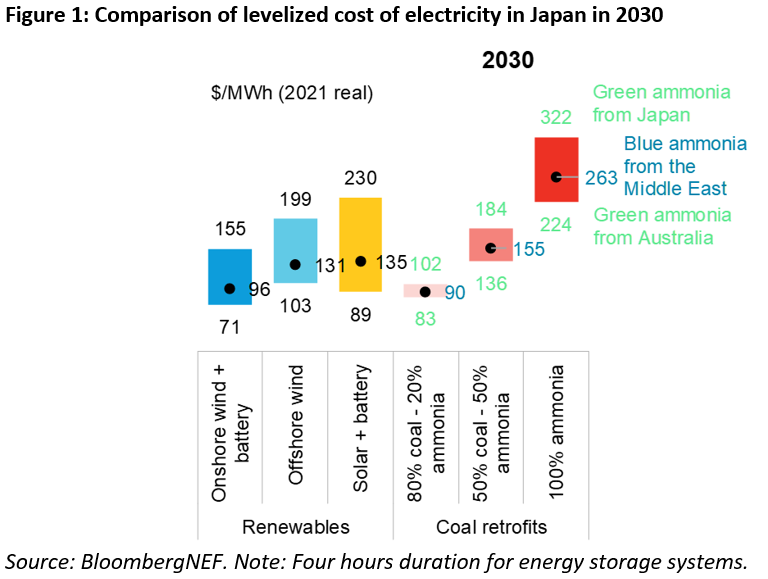

Japan is leading the charge for ammonia co-firing technology and has begun exploring the possibility of retrofitting coal plants. Initial estimates predict the levelised cost of energy (LCOE) of a retrofitted coal power plant with a 50% coal-firing ratio to be at least USD 136 per MWh in 2030.

Other renewable energy options, like onshore wind (USD 71), offshore wind (USD 103) and solar (USD 89), will have significantly lower LCOEs. These LCOEs include the substantial infrastructure costs for the deployment of the technologies.

With this comparison, it doesn’t appear ammonia coal co-firing will be cost-competitive in the near term.

Is Ammonia Co-firing Technology a Realistic Decarbonisation Strategy?

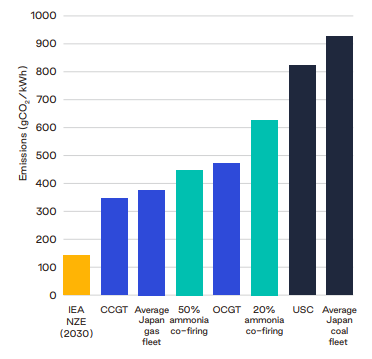

Beyond cost concerns, there are questions about whether co-firing can effectively support the energy transition. While it inherently reduces emissions from coal power plants, the associated emissions reductions depend on the ammonia production process.

Ammonia is an energy carrier, so it has the embodied emissions of the input energy source. Using blue ammonia instead of green ammonia causes the emissions reduction to decline significantly. Furthermore, grey ammonia’s overall emissions are double that of a standard coal-fired power plant.

Retrofitted Coal-Fired Power Plants

Another concern is that retrofitting existing coal-fired power plants will reduce their phase-out rate. Once a plant is retrofitted, it will have to stay online longer to cover the cost of investment. Leading organisations like the International Energy Agency (IEA), United Nations and International Renewable Energy Agency all state that the world must phase out coal as rapidly as possible.

An analysis by TransitionZero found that coal co-firing plants with a 20% coal-firing ratio will produce five times more emissions per unit of energy than required for IEA’s 2030 net-zero roadmap. Even a co-firing plant running a 50% high co-firing ratio will produce over three times more emissions than the IEA requires.

Ultimately, there are questions about the scalability of co-firing, and its adoption may hinder the transition to proven renewable energy options.

Japan Is Looking Towards Co-firing Ammonia for Decarbonisation

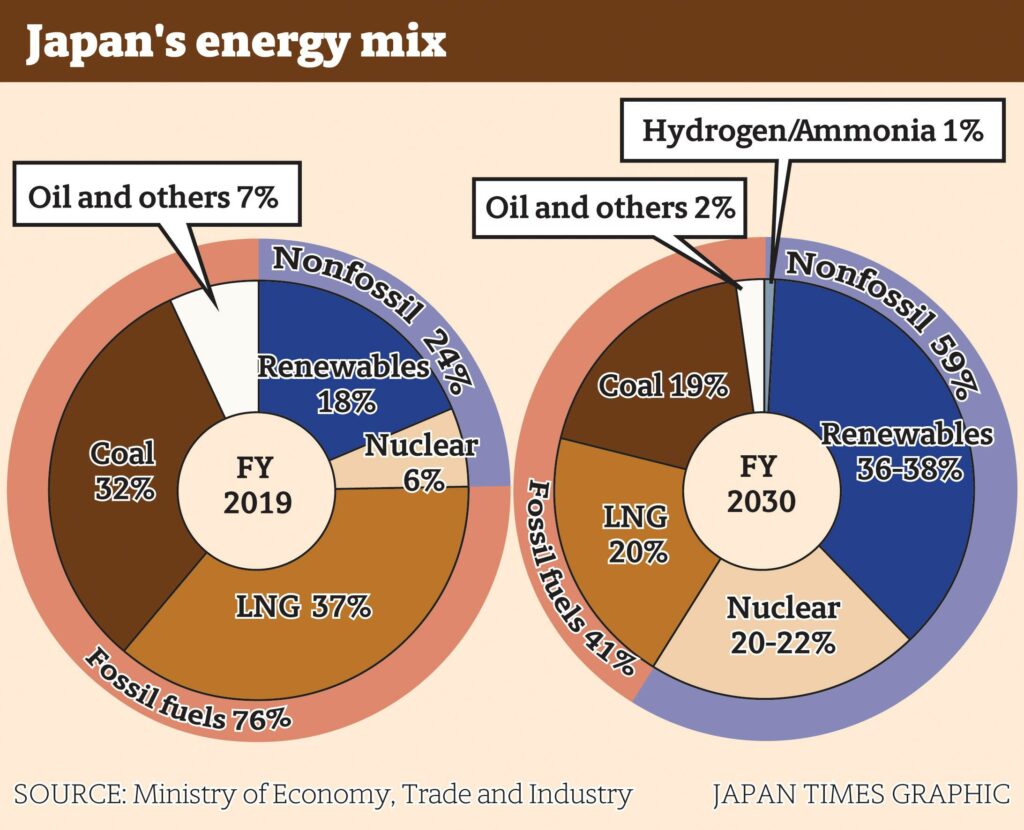

Even with questions surrounding cost and viability, Japan is seriously considering to co-fire ammonia to achieve its decarbonisation goals. This primarily stems from the country’s large share of existing coal-fired power plants and space constraints for on-land wind and solar.

The Japanese government has set aside USD 482 million for research and development in ammonia coal co-firing as part of its Green Innovation Fund, and several utility companies have received subsidies to set up demonstration plants.

Additionally, Japan is considering allowing ammonia co-firing projects to apply for its new capacity payment mechanism for low and zero-carbon technologies. This will provide set sale prices for the electricity that projects produce and will incentivise investment into the technology.

The Japanese utility company JERA is the first company with a demonstration plant in use. It is testing a 20% co-firing ratio at its 1-GW Hekinan coal-fired power plant. This project will be a major test for the technology, as it is the world’s first demonstration at a commercial-scale plant.

However, Japan’s optimism towards co-firing is raising questions worldwide, and many experts see it as delaying the adoption of direct policy action to phase out coal plants. For example, if co-firing cannot be made economically and environmentally feasible, the country’s goals of reducing coal’s share of electricity generation to 19% by 2030 and achieving net zero by 2050 may slip further out of reach.

Green Ammonia: Co-firing Versus Hard-to-abate Sectors

While Japan is the testing ground for commercial-scale ammonia production from coal, the technology is far from proven. It will require significant investment and research in the coming decades. Furthermore, the current production of green ammonia is minimal and needs to be a priority to support co-firing plants. Using fossil fuel-based ammonia would undermine decarbonisation efforts and lead to emissions of other greenhouse gases.

Another contentious issue is whether co-firing is the best use of green ammonia. Green ammonia has significant potential in other high-polluting “hard-to-abate” sectors with minimal other decarbonisation options. Adopting co-firing facilities will pull green ammonia away from these high-value decarbonisation targets, like the cement and shipping industries.

With several other proven low-carbon energy technologies in existence, ammonia coal co-firing should not be a significant priority or seen as a decarbonisation pathway.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more