ADB’s Double Standard On Fossil Fuel Investments

25 May 2021 – by Ankush Kumar

Owing to the decline in coal demand and strong criticism by climate institutions, global financers across the world have started distancing themselves from fossil fuel investments. In its recent draft energy policy, the Asian Development Bank (ADB) declared that it will not indulge in coal financing. However, the Philippines-based global bank stated that it may support natural gas projects based on certain criteria.

“ADB will not participate in investments to modernize, upgrade, or renovate coal facilities that will extend the life of existing coal-fired power and heating capacity,” it states in its draft energy policy. The only exception is “to re-engineer such plants for use of cleaner fuels, such as natural gas or renewable energy sources”.

NGOs demand total exit from fossil fuel funding

ADB’s energy policy announcement could increase pressure on other lenders to withdraw funding from coal power and fossil fuel companies. However, critics believe that many such financial institutions have moved their portfolios to finance gas as a transitional fuel. Fossil Free ADB had been particularly vocal in urging ADB to stop investing in fossil fuels. Also, Lidy Nacpil of the Asian Peoples’ Movement on Debt and Development (APMDD) told Energy Tracker Asia, “It is urgent that ADB also declare the withdrawal from expanding gas and oil projects”. She also said that “The new ADB energy policy must state categorically an all-encompassing end to the bank’s involvement in coal, gas, and oil projects.”

APMDD also raised strong concerns on the rising debts of Asian economies from ADB’s fossil fuel investments. In 2019 around 16 developing member countries including lower to middle income paid more than $6.4 billion as debts owed to ADB.

The NGO also increases pressure on the Beijing-based Asian Infrastructure Investment Bank (AIIB): “Its management has publicly declared several times that the bank would not finance coal-fired power plants. But its energy policy remains open to coal-related projects”, said Nacpil. “AIIB must also desist from financing fossil gas projects.”

Just transition to renewable energy systems

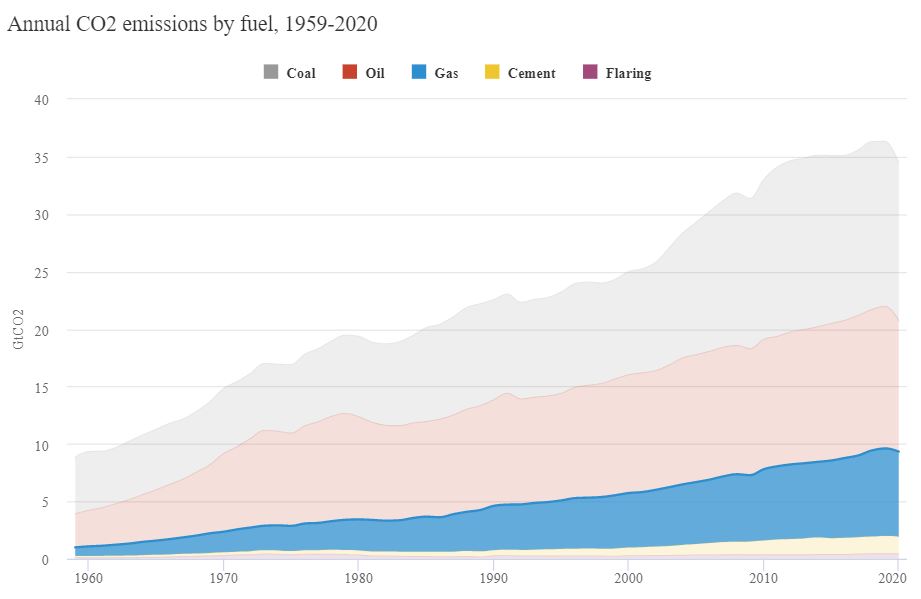

In 2019 emissions from carbon dioxide across the world comprising coal, oil, and natural gas amounted to 36.4 gigatons. This represented 68% of the total greenhouse gas emissions, which has implications on climate change, as ADB acknowledges in its draft policy. In Asia banks and insurers exit coal investments, but not yet oil and gas, wrote Ian Rivera of the Philippine Movement for Climate Justice. “The move away from coal is also driven by its overcapacity, as well as the costs of procurement.” Therefore, there is a rapid shift towards importing Liquefied Natural Gas (LNG) in countries like Vietnam, Bangladesh, Pakistan, and the Philippines.

As LNG is considered a clean alternative to coal, imports are currently ramped up across Asia. “We are alarmed by this development”, said Rivera. “At this stage in the global climate action, the move that we urgently need is a just transition to renewable energy systems.”

Natural gas no alternative to coal

The declaration by ADB is very similar to the stance taken recently by many financial institutions. On the one hand, they proclaim themselves as clean energy financers. On the other hand, they leave some room to continue with their fossil fuel investments. This double standard of posing as carbon neutral but still financing fossil fuels have led to accusations of greenwashing against several banks.

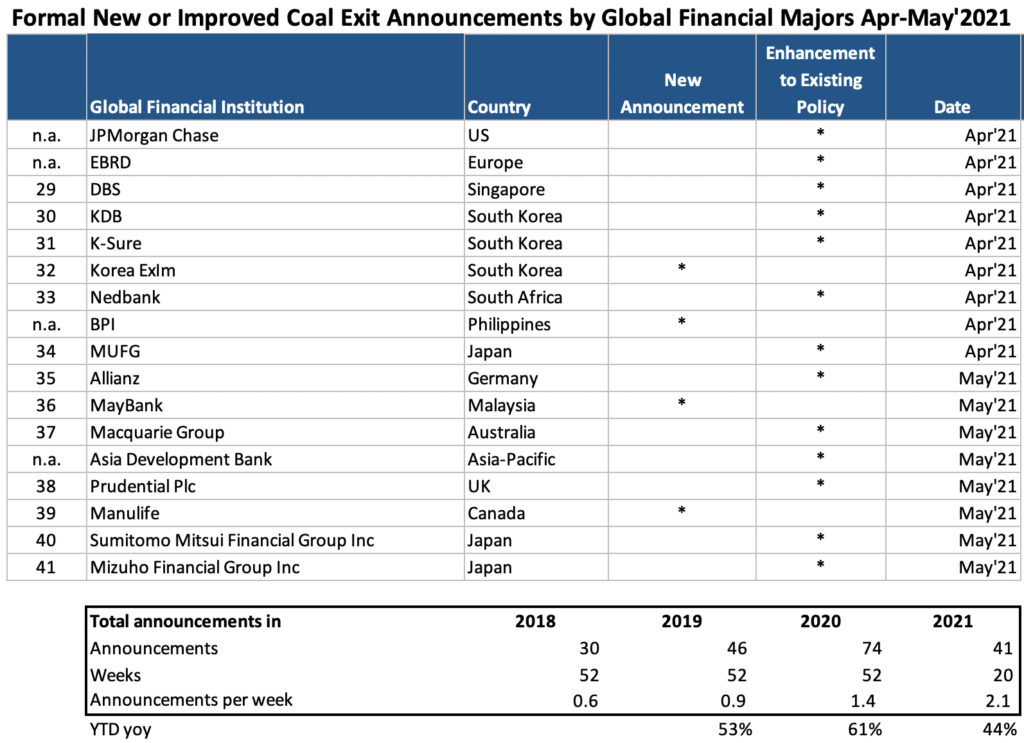

Financial institutions like JBIC, K-Sure, KDB, KEXIM, DBS, CIMB, Prudential Plc, MHFG, and SMFG have already declared their coal exit intentions. The latest to pledge against coal investments are the Australian investment bank Macquarie and the Singapore-based DBS Bank.

Joining the league, Malaysia’s Maybank also declared not to finance coal as part of its five-year strategy. It has committed to achieving net-zero carbon emissions by 2050. “This transition will take two to three decades at least. The best time to start transitioning is now by building up the viability of new technology alternatives, and avoiding more fossil fuel investments,” says Tim Buckley, Director Energy Finance Studies, Australia/South Asia, IEEFA.

Despite these announcements, experts believe that the world needs to expedite the pace of transition. “Emissions evaluations show that imported LNG on a 20-30-year time frame is actually often worse than domestic coal,” asserts Buckley.

Scientists consider methane (the main component of natural gas) far more potent than CO2. Over a timeframe of 20 years, methane is around 90 times more effective at trapping heat in the atmosphere as compared to CO2.

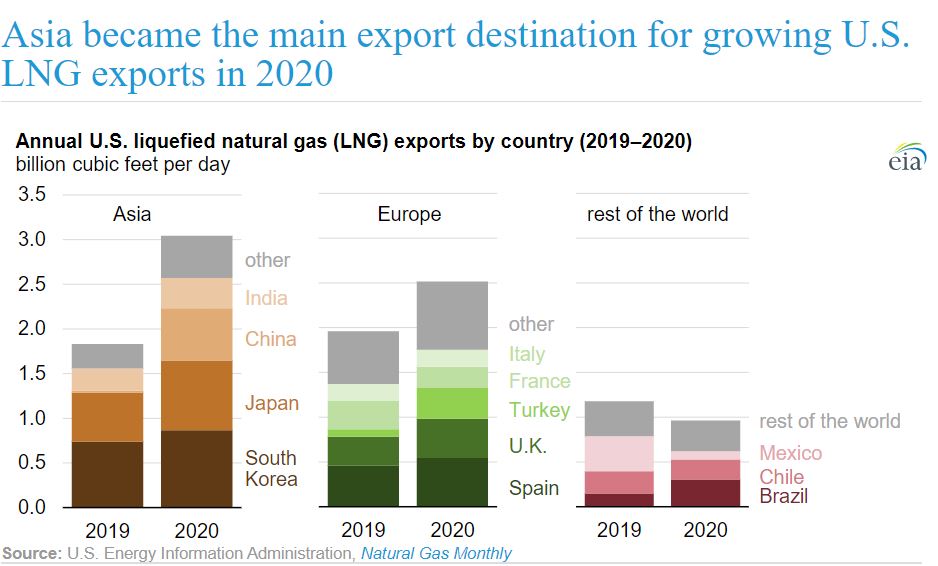

Asia attracts LNG investments

Natural gas is largely consumed in buildings, power generation, and industries across Asia and the Pacific economies. Asia turned out to be the top destination for LNG exports from the United States. Shipments to Asia increased 67% in 2020 compared with 2019, accounting for almost half of the US overall LNG exports.

Even the ADB acknowledges the risks of natural gas regarding climate change. The Paris Climate Agreements’ call for deep decarbonization “has raised questions about whether continued investment in gas is aligned” with the net-zero objectives. Moreover, replacing coal with natural gas would not eliminate greenhouse gas emissions.

The Asian Development Bank also points to the oil and gas trend to justify its ongoing investments. In its policy, it expects natural gas to “increase in the region during the next decade”.

In contrast, the European Investment Bank (EIB) was not only one and a half years faster than the ADB to come up with a climate strategy. It also ruled out financing all fossil fuel energy projects, including natural gas, from the end of 2021 onwards.

Distant goal of net-zero emissions

In contrast, even the International Energy Agency (IEA) calls for a phase-out of LNG. “No new oil and natural gas fields are needed in our pathway,” states a report released on 18th May. Accordingly, by 2050, the global energy demand will shrink by eight percent, but serve an economy more than twice as big as today. “Almost 90 percent of electricity generation comes from renewable sources”, it predicts.

The IEA report further raises serious concerns about the world falling short to bring global energy-related carbon dioxide emissions to net-zero by 2050. Climate campaigners believe that efforts towards more renewable energy till 2030 are most critical. It will determine whether the world can keep the global temperature rise below 1.5 degrees Celsius from pre-industrial levels.