2024 Trends in the Asian Solar Market: Growth and Opportunities

17 July 2024 – by Viktor Tachev

China aside, Asia’s solar market remains widely untapped. This is a huge missed opportunity, considering that the region faces unique circumstances. On the one hand, it is home to around 60% of the world’s population and will see massive energy demand growth in the upcoming years. The reliance on fossil fuels has made it accountable for around half of the global emissions. At the same time, led by China, the region is the leading global hub of clean energy innovation and has the biggest installed solar power capacity. As a result, Asia’s energy transition progress isn’t just a regional priority but a global imperative.

Overview of Solar Market Trends in Asia

The past year has become the 19th consecutive year in which solar power has been the fastest-growing source of electricity generation. In 2023 alone, the world added over 500 GW of new capacity. This marked a 23% solar power growth, according to Ember data.

Asia was among the engines behind this. The continent has witnessed a significant uptick in solar power capacity in recent years, becoming the fastest-growing market globally. According to data from Global Energy Monitor, between 2007 and 2024, Asian countries held four of the top seven positions in the biggest solar markets in the world. Regarding operational solar power capacity, China is the undisputed leader, while India, Japan, and Vietnam rank third, sixth, and seventh, respectively.

The growth in those markets was driven by factors like policy incentives, the increasing cost-competitiveness of solar technology, technology efficiency improvements and increased manufacturing capabilities.

In 2023, Asia had over 840 GW of solar energy capacity. According to Ember, three of the top five countries with the biggest solar-powered electricity generation are in Asia. China holds the first place, while India and Japan rank third and fourth, respectively. Experts believe 2024 is set for an even more significant increase in solar generation.

“Solar, in particular, is accelerating faster than anyone thought possible,” explains Dave Jones, Global Insights program director at Ember.

China Leads the Way

China installed more solar panels in 2023 than any other nation has ever built. It was responsible for 60% of the added solar capacity. For reference, the figure for Europe was 14%.

Furthermore, this year, the country announced a project for the world’s biggest solar farm. The 8 GW power plant will produce enough energy to meet the needs of 6 million households.

According to Climate Action Tracker, the country is about to surpass its 2030 NDC target of 1,200 GW in solar and wind capacity five years earlier.

Throughout 2023, China continued to demonstrate leadership in developing accompanying clean energy technologies, including solar cells, lithium batteries and EVs. Currently, China is responsible for 80-85% of global solar module production.

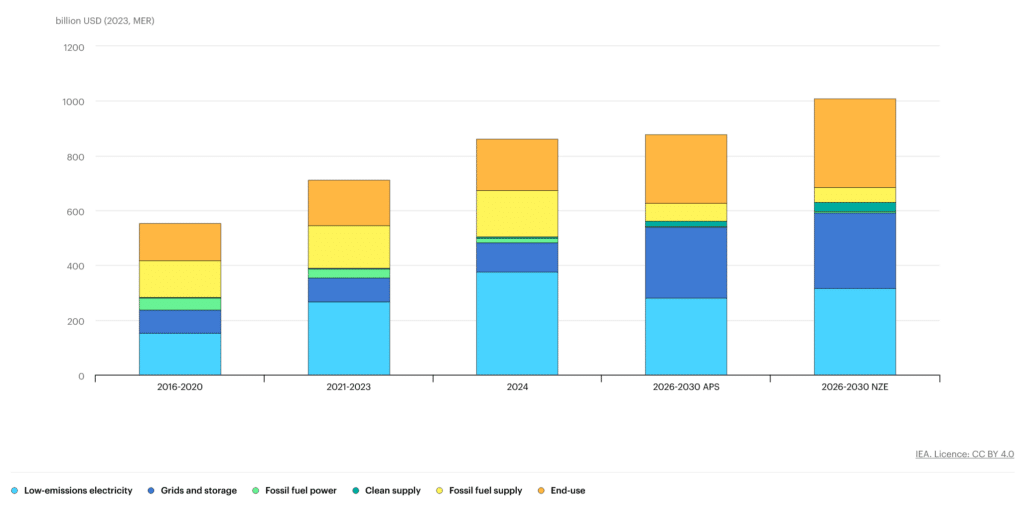

The IEA’s World Energy Investment 2024 report reveals that China is the only country globally that has reached the levels of clean energy investment needed in a net-zero-aligned world. Throughout 2023, it was responsible for a third of global clean energy investments. The country is set to account for the largest share of clean energy investment in 2024, topping USD 675 billion.

The Lessons Other Asian Countries Can Learn From China

China has given strategic prioritisation to three industries: solar power, EVs and batteries. The nation’s commitment is part of a broader strategy to ensure more affordable electricity, improve energy security, build its export markets and decrease carbon intensity by pivoting away from fossil fuels. The execution of this strategy is largely based on pursuing national and local goals.

According to Ember, in 2023, the clean energy industry was the top driver of China’s economic growth. Targeted policies incentivising the green industries, including feed-in tariffs, subsidies, tax incentives and offtake from solar power producers, have fostered increased investment and faster adoption.

Furthermore, the country has explicitly focused on building its grid infrastructure, including long-distance transmission lines. Over the past decade, China has accounted for over a third of the global grid expansion. As a result, it has managed to reduce curtailment despite the tremendous amounts of new capacity added every year.

This is a particularly important blueprint for Southeast Asian countries to follow, considering the grid issues they face and their impact on the pace of the region’s clean energy transition.

Decreasing Solar Costs Make it the Most Viable Energy Source for Asia

According to IRENA, the global weighted average cost of electricity from utility-scale solar PV has fallen by 85% between 2010 and 2020, followed by concentrating solar power by 68%.

Today, solar power is one of the cheapest forms of electricity, according to the IEA, and is significantly more affordable than generating electricity from fossil fuels in most countries. Furthermore, these costs are expected to continue dropping further due to ambitious policy support. This is a significant factor for consideration across countries highly dependent on fuel imports. This trend is mirrored in Asia, where increased production capacity and technological advancements continue to drive down costs. The key to this trend is in Wright’s law, according to which a technology gets cheaper the more it is deployed, and it is deployed more as it becomes cheaper.

These lower costs make solar energy an increasingly viable option compared to traditional fossil fuels, even without government subsidies. According to Ember, given the excess supply and the rapid drop in battery storage costs, solar is limited only by how fast it can be connected to the grid.

In fact, according to Ember, solar module prices are now significantly lower than what Wright’s law of technology learning curves mandates.

Regulators’ Role Crucial to Bring Existing Barriers Down

The IEA notes that, globally, solar is on track with its Net Zero Emissions by 2050 Scenario. However, the disproportionate progress across markets means that there are clear leaders and laggards. Southeast Asia, except Vietnam, falls in the latter category. The region needs to address existing barriers through more ambitious policies to get on track with a net-zero-aligned trajectory.

According to the IEA, Japan and South Korea must double their clean energy spending by 2030 to meet the COP28 targets of tripling renewables by 2030. India must triple its green investments, while Southeast Asian nations must quadruple them.

Unlocking the needed capital requires complementing national targets with supportive policies to lure investors, ease and incentivise project developers and accelerate the development of grids and clean energy supply chains. Crucial in this would be introducing incentives such as tax rebates, subsidies and low-interest loans to ease the financial burden of solar project development. Other necessary measures include facilitating regional cooperation and investments in cross-border grids and energy storage systems to mitigate the variability of solar power and improve its integration into the existing grid infrastructure.

Redesigning electricity market rules and encouraging demand-side participation are other crucial steps, according to Ember.

Asia Has the Blueprint. Now It Has to Follow It

As per the stated policies, Southeast Asia will experience the second-highest energy demand growth globally after India by 2050. The countries will meet it primarily through fossil fuels. As a result, the region will see the largest absolute growth of CO2 emissions – 46% by 2050. Such a move will lock them into a future of high power costs, energy dependence, complicated decarbonisation pathways and environmental and health consequences.

Solar power can provide a viable way out. China, which has made strides in solar power deployment, is already reaping the rewards. The environmental and climate benefits aside, the ambitious clean energy policies have unlocked economic growth, more affordable power costs, and a more sustainable and self-sufficient energy system. Vietnam, with its exponential solar power deployment in 2020, adds another chapter to the blueprint that other Asian countries can follow in their energy transitions. With that said, Asia’s path toward a solar-powered future is clear. Now countries should follow it.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more